How recruiting costs change as a startup grows

Most of our startup clients are growing fast, raising capital, developing and shipping product and hiring. Lots and lots of hiring!

Top 5 and Top Boutique Startup Law Firms

A list of the top 5 startup law firms and top 10 boutique firms curated by Kruze Consulting, a leading CPA focused 100% on venture-funded startups.

Essential HR Tools for the scaling startup

Kruze Consulting has worked with over 1000+ startups and has helped set up numerous HR infrastructure systems.

Recent Startup Podcasts

Our COO, Scott Orn, has been busy talking with interesting players in the Startup space on Kruze Consulting’s Founders and Friends Podcast.

Spring Cleaning Cash Flow Management Tips for Startups

Kruze Consulting’s VP of FP&A, Healy Jones, gives three top tips on how to spring clean your startup’s cash flow management to help reduce your burn rate.

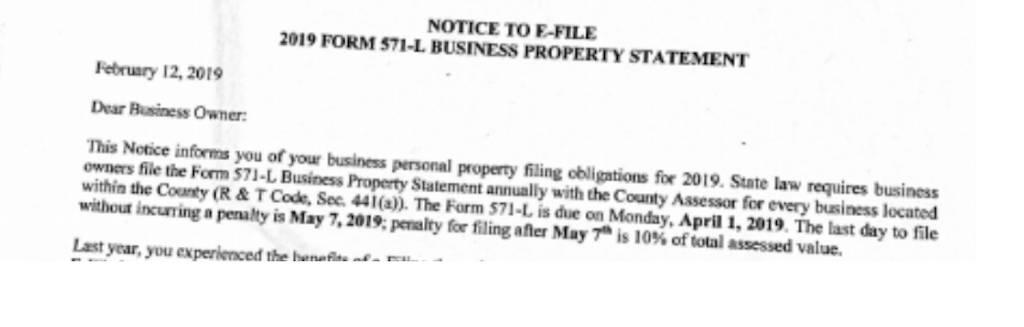

571-L SF Property Tax Statements for California Startups

If your startup has a location in California, then you likely have the pleasure of needing to file a 571-L SF Property Tax Statement. What is the Form 51-L?

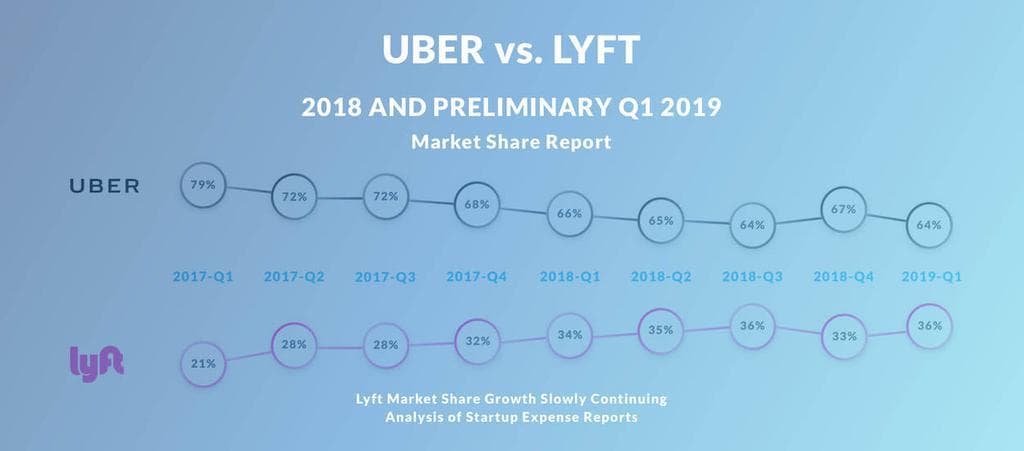

Uber Lyft - April 2019 Updated Analysis

We recently updated our Uber vs. Lyft Market Share Report. Check it out to see how these two competitors fought over the startup ridesharing market!

Featured Service - Embroker

Embroker is an intelligent insurance platform for startups and businesses.

What financial information do VCs want after an investment?

If you are a startup CEO who has just raised funding, this post will help you understand the financial information your VC’s will expect to see from you.

Featured Service - Decisely

Decisely is a benefits brokerage and HR services company that offers interconnected technology solutions to small businesses and startups.

Some of our newest Quora posts

We’ve been busy answering questions on Quora. Below are some of our most recent Answers that you might find interesting!

Free Resource for Startups Raising Venture Capital

Kruze Consulting has compiled the ultimate Finance, Tax and HR Due Diligence Checklist, free for Startups to download and use in their fundraising efforts.

Tax Time Smoothies

Continuing our tradition of focusing on employee wellness, we recently brought in some healthy smoothies to help our team deal with the stress of tax time.

Featured Service - Rippling

Rippling is a new, cloud-based system that makes managing your startup’s HR and IT systems easy.

Bad Bookkeeping: The Top 10 Ways your Financials are Messed Up

Vanessa Kruze, CPA, discusses bad bookkeeping, the top 10 ways your startup’s financials are messed up and what you should do to correct them.

Startup CEO Salary Calculator

US Based Companies that have raised under $125M

Top Articles

-

Pre-Seed Funding + Top 20 Funds

-

eCommerce Accounting

-

Accounts Receivable Loans

-

What is the 2% and 20% VC fee structure?

-

How much does a 409A valuation cost?

-

What are Your VC’s Return Expectations Depending on the Stage of Investment?

-

Fractional CFOS

How much can your startup save in payroll taxes?

Estimate your R&D tax credit using our free calculator.

r&d tax calculatorSignup for our newsletter

Popular pages