If your startup has a location in California, then you likely have the pleasure of needing to file a 571-L SF Property Tax Statement. What is the Form 571-L? It’s a property tax form that business owners (like startups) need to file every year that reports business property. Basically, it is a tax on a business property such as supplies, computers, furniture, building improvements, etc. A common misconception is that you only need to report capitalized assets (read: Balance Sheet Assets) but that’s not the case: expensed supplies, expensed computers, and expensed furniture also counts for the 571-L report. The tax is usually managed/due through your county, so, for example, companies in Palo Alto will need to interact with Santa Clara County. For our clients, we will look to their Fixed Assets on their balance sheets, and also consult their P&L for a few specific items to figure out how to correctly calculate this tax. (We’ve listed out tax deadlines for San Francisco startups and for startups in Palo Alto and Santa Monica, in case you want to know other filing dates that you are subject to in those California locations.)

Who has to file a 571-L?

If you are a business with a location in San Francisco, you need to file if:

- SF sent you a notice to file.

- You have a taxable business property with a total cost of $100,000 or more, located in the City and County as of January 1st of each year, even if the Assessor’s Office did not send, or request you to file a Business Property Statement.

- It’s time to update your state regulated, direct billing update - probably not the case if you are a startup.

In other counties, like San Mateo County or Los Angeles County, the county likely sent you a notice to file.

What qualifies as “Business Personal Property”?

Per San Francisco Tax Collector*“Business Property is any tangible property owned, claimed, used, possessed, managed or controlled in the conduct of a trade or business. This includes all machinery, fixtures, office furniture, and equipment. In general, business personal property is all property owned or leased by a business except licensed vehicles, business inventory, intangible assets, and application software. Examples of business property that would be assessed as personal property include but are not limited to: *

- Operating Supplies

- Machinery & Equipment

- Office Furniture

- Copiers and Fax Machines

- Telephones

- Computers

- Restaurant Equipment

- Cameras

- Printing Equipment

- Leasehold Fixtures

- Leasehold Structures (Tenant Improvement)

In essence, Business Personal Property is all property used in the course of doing business that is not exempt.” Note that other cities may have different definitions as to what qualifies as Business Property.

What is the tax rate?

For our clients in San Francisco, the 2019 Tax rate is applied at 1.1743%. So, for every million dollars worth of fixed assets, your startup will likely pay $11,743. Note that one million dollars in fixed assets are a lot for a startup! You will need to fill out the form for the other counties in California to figure out the rate for your startup if you have locations in other counties.

What are the 571-L deadlines?

• Initial filing due date: April 1st.

• Final filing due date: May 7th.

• Pay the taxes due by Aug 31.

Where do you file?

We encourage our startup clients to e-file, which you can find here if you are in San Francisco: https://secure.go2gov.net/efile/sanfrancisco/main.jsp

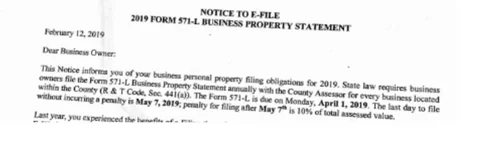

According to San Francisco, in order to e-file, you have to be eligible. The county of SF says, “You may participate in e-Filing your statement this year if you received one of the following documents in the mail: 1) a Notice of Requirement to File 2019 Form 571-L Business Property Statement, or 2) a Notice To e-File 2019 Form 571-L Business Property Statement, or 3) a Direct Bill Notice, or 4) a Low Value Exemption Notice. If you received one of those notices, your Account Number and PIN are located on the top right corner of your notice and you may proceed to the e-filing portal to submit your 571-L Business Property Statement.”

Here is the link to the Los Angeles County page where you can file, and here is one for Palo Alto, which is in Santa Clara County.

When do you get the tax bill?

If your form is filed on time, according to San Francisco County, you should receive your tax bill at the end of June. And your payment is due on or before August 31st. There are penalties for late payments.

We check with our clients to see if they have received a letter from the county. They are likely to have gotten something called a “2019 form 571-L Business property statement” from the San Francisco Assessor-Recorder’s Office, or your counties office. Hopefully, you are working with a CPA who is familiar with startups and the particulars of doing business in SF. If not, consider setting up a consultation with us today!

Should startup founders have to deal with this paperwork?

So, you are the founder of a fast-growing startup… should you really have to deal with paperwork like this? We don’t think so, and that’s why we offer tax compliance services to our clients. If you are working with a bookkeeper who doesn’t get startups, and who suggests that these kinds of government paperwork tasks are a good use of your time, why not consider upgrading to Kruze? Our accountants help San Francisco based startups deal with these kinds of issues. Contact us here.

And if your startup’s tax accountant hasn’t talked to you about research and development tax credits, reach out to us. The research and development tax credits enable early-stage, unprofitable companies to reduce their burn rate through payroll tax deductions. This can save your company up to $250,000 a year!