Guides, tips, and systems advice from the leader in cloud accounting services.

Cloud accounting offers benefits to startups

Adopting cloud accounting solutions to streamline your business — including human resources, payroll, customer service, sales, and accounting — can position you for efficiency and success in your daily operations.

For early-stage businesses, cloud accounting services offer distinct advantages over traditional accounting software:

- Remote access. A cloud accounting system is hosted on a remote server, from which you can access your data and information anywhere with an internet connection, at any time, from various mobile devices.

- Collaboration. Smaller companies can work with remote teams on the same platform without investing in IT infrastructure.

- Integrations. The best cloud-based software integrates with other systems; cloud accounting software is no exception. For most growing startups, automated bank feeds, payroll integrations, and more make cloud solutions a better option than traditional accounting software.

- Data security. Storing financial information on remote servers allows for strengthened security measures such as encryption, secure data storage on offsite servers, and access controls with multi-factor authentication.

- Automatic software updates and backup. Your software is in a data center, which provides seamless updates and better security and will automatically back up your company’s financial data.

- A wide range of functions. Cloud-based accounting software provides more than just basic accounting functions, including invoicing, bank interfaces, payroll systems, real-time financial data (dashboards and reporting), and integration with a wide range of software systems.

- Savings. Most cloud accounting systems are offered on a subscription basis, making them an affordable option for startups that don’t want to spend money on expensive hardware and software. Additionally, cloud accounting software add-on features are usually purchasable in extensible increments, so you can keep costs lower until you need more advanced features.

- Unlocks outsourced virtual accounting services. Cloud accounting systems allow for remote access, which means they’re easy to use with outsourced cloud accounting service providers. You can get lower-cost accounting experts at a fraction of the cost of full-time staff.

- Lower lock-in. A cloud accounting system from one of the major providers, such as Intuit, is a highly-adopted solution connected to millions of qualified accountants and bookkeepers worldwide. By choosing a widely used cloud-based accounting system, you make your data and system highly portable to many different providers of cloud accounting services.

- Diligence. Funding rounds and acquisitions can occur quickly, and startups need to be ready to present their financial data for due diligence quickly. A cloud accounting solution provides you and your accounting team with real-time access to your financial information.

Almost every early-stage, VC-backed startup in the U.S. is using cloud accounting solutions, from bookkeeping software to virtual accountants and tax teams. Cloud accounting services can optimize your tax planning, financial projections, cash management, and board reporting, giving you more time to focus on what’s important to your business.

Cloud Accounting Services

Kruze serves VC-backed startups that have raised over $15B in funding and know what it takes to be prepared for financial due diligence.

We’re a pioneer in cloud accounting services — and as a CPA firm, we can produce reliable, GAAP-compliant monthly financial statements, file your tax returns, and represent you before the IRS (and other taxation authorities).

Why did Kruze shift to the cloud?

In an interview with the Cloud Accounting Podcast (the leading podcast covering cloud accounting software and services), Kruze Consulting illustrates the significance of Kruze investing in technology and embracing virtual accounting solutions:

“What it really comes down to is you either need to make a choice: you’re gonna be a high hourly-rate person, conceptually, and just charge a lot for your services, and be kind of a lone wolf, or a small firm/small headcount, or you need to really standardize, drive adoption, drive process, driving improvements, become a bigger firm. We’ve chosen the process-centric approach in scalability, and investments in software to make ourselves big…”

What are cloud accounting services?

Cloud accounting services are remote accounting, tax, and bookkeeping services delivered using SaaS cloud accounting software like QuickBooks Online. With cloud accounting, accounting data is stored in the cloud, leading to better reliability, lower costs, and improved quality.

Companies choose cloud accounting service providers like Kruze to lower their costs, improve financial reporting quality, and prepare for complex accounting and tax due diligence.

Get a cloud accounting system

We recommend QuickBooks Online (QBO) as the best cloud provider for startups and high-growth small businesses. As the leading cloud accounting software for small business owners in the US, it interfaces with a wide variety of other automated cloud-based systems like payroll.

Out of the cloud accounting providers available, QBO is considered an industry standard, so finding remote bookkeepers or accountants who can work with this system is easy. As a proud partner of QBO, we highly recommend their system to most US-based startups.*

Cloud accounting is effective at any stage of growth, but its importance increases as companies scale. Even if your business is 100% co-located in a single office, a cloud application service provider remains supreme. Cloud providers allow for better backup, easier access, superior workflows, and much, much more. At scale, additional solutions are often a good fit. We frequently see startups switching to Netsuite and SageIntact as they approach an IPO.

We’re also tracking various AI-enabled cloud accounting software vendors — but, in our opinion, none have yet crossed the chasm. Although we’re certain that AI accounting softwares will become pivotal solutions for startups, we can’t recommend them just yet. While the promise of AI is great, the current products aren’t quite there yet, and relying on a more traditional cloud-based accounting system like QBO is a better choice for startups (for now).

*As a QuickBooks Online partner, we can receive a commission if you sign up through our link.

What can cloud accounting experts bring to your startup?

The top reason startup companies fail is running out of cash. Hiring a cloud accounting expert can help you track and manage your cash flow, review your expenses, file state and local tax returns, and much more. Routine cloud bookkeeping tasks include:

- Categorizing and posting all your transactions to your accounting software

- Reconciling your bank accounts

- Sending, tracking, and reviewing invoices

- Paying vendors, contractors, and other bills

Online accounting software can surpass the hurdles presented by traditional accounting systems. By using a cloud system, you’ll get access to first-class accounting systems that can help you, or your remote bookkeeper or accountant, optimize ongoing tasks.

The best cloud accounting experts provide your business with actionable information you can use to make informed decisions, such as your runway and burn rate. These are two crucial metrics to remember — your burn rate measures the rate at which you spend your funds and your runway is the number of months you have until you run out of money (or reach your zero cash date).

Early-stage startup accounting is frequently done by founders, but it’s never too early to consult an accountant. It’s important to have answers on hand, like the accounting method you should use (accrual accounting is the right choice), and other details like the financial records you’ll need to file taxes. We’ve provided some startup tips that can help you handle budgeting, financial model templates, recordkeeping, and more.

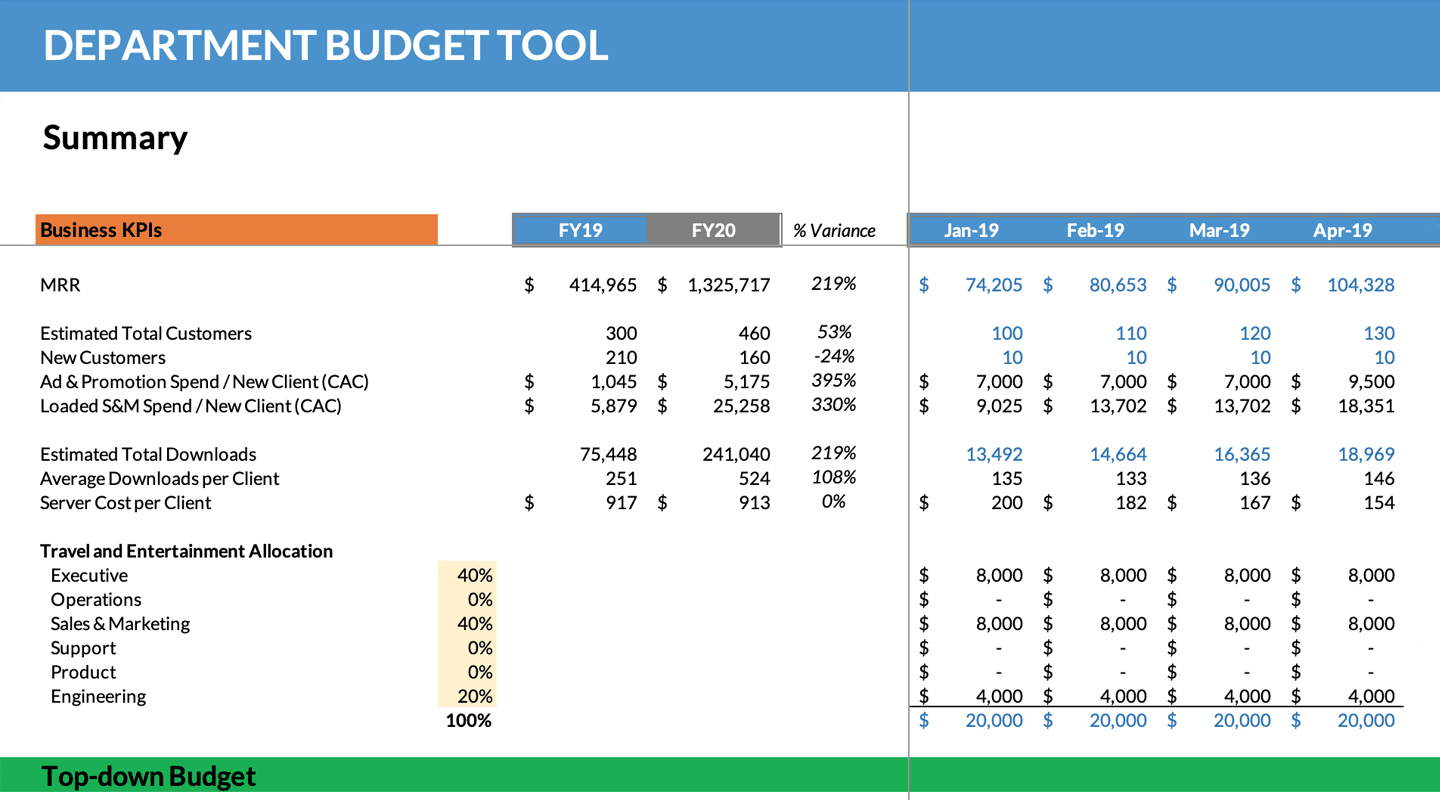

Budgeting is the first step in accounting

A budget, which is an estimate of your expenditures and income (if any), is an essential tool for startups. Moreso than traditional accounting software, cloud accounting systems help you structure and monitor your budget, which will only become more complicated as your company grows.

Tips for your budget:

- Your biggest expense in most cases will be employees. You’ll need to assess what team members you need to reach your milestones, and how much each will cost you.

- Cash burn is a key metric that you should track carefully. It’s of the utmost importance you understand your monthly spending so you can gauge the buffer between your current finances and needing additional funding.

- Think carefully about your potential market and how much revenue you eventually expect to earn. Smaller companies with lower revenue expectations don’t require as much capital as larger ones.

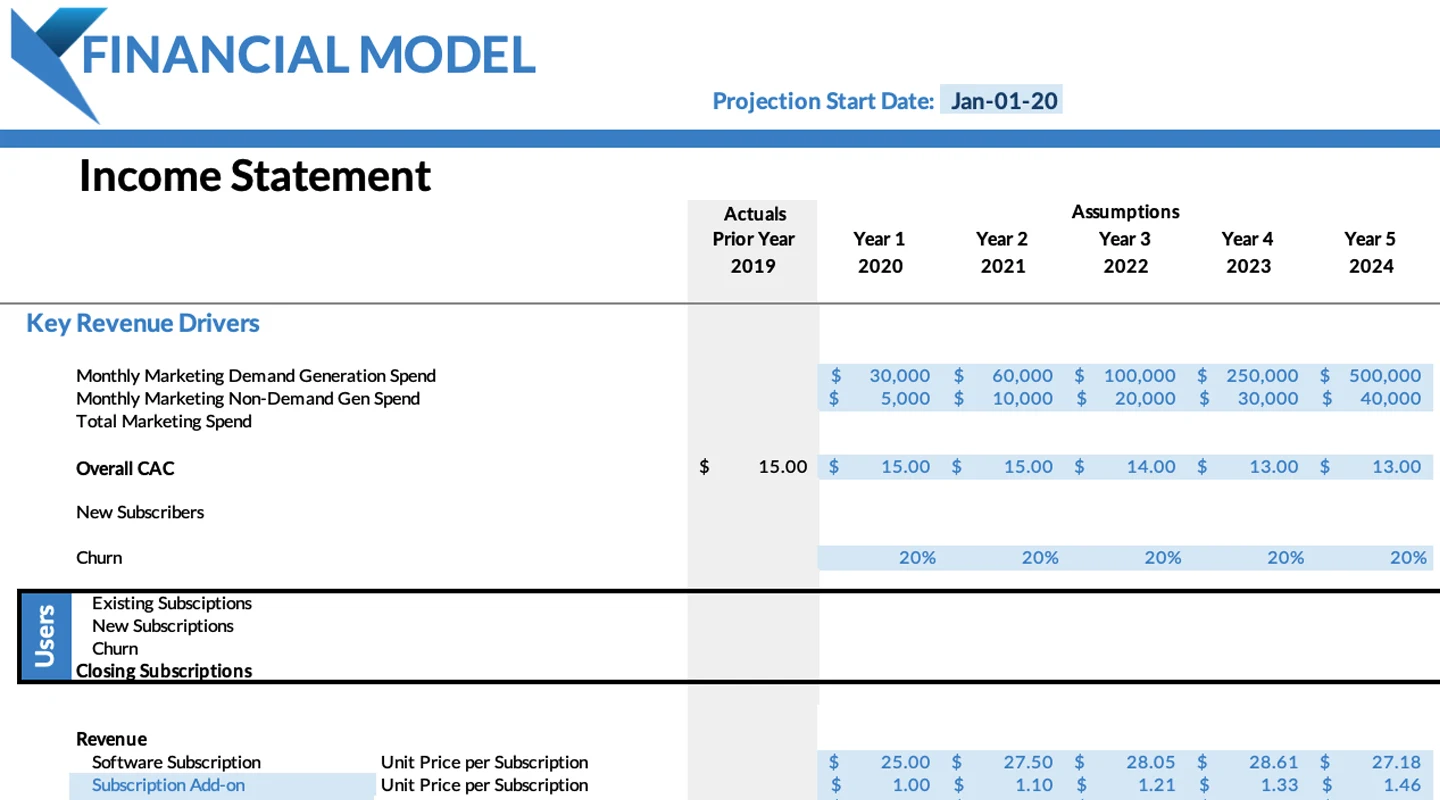

How do you create a financial model?

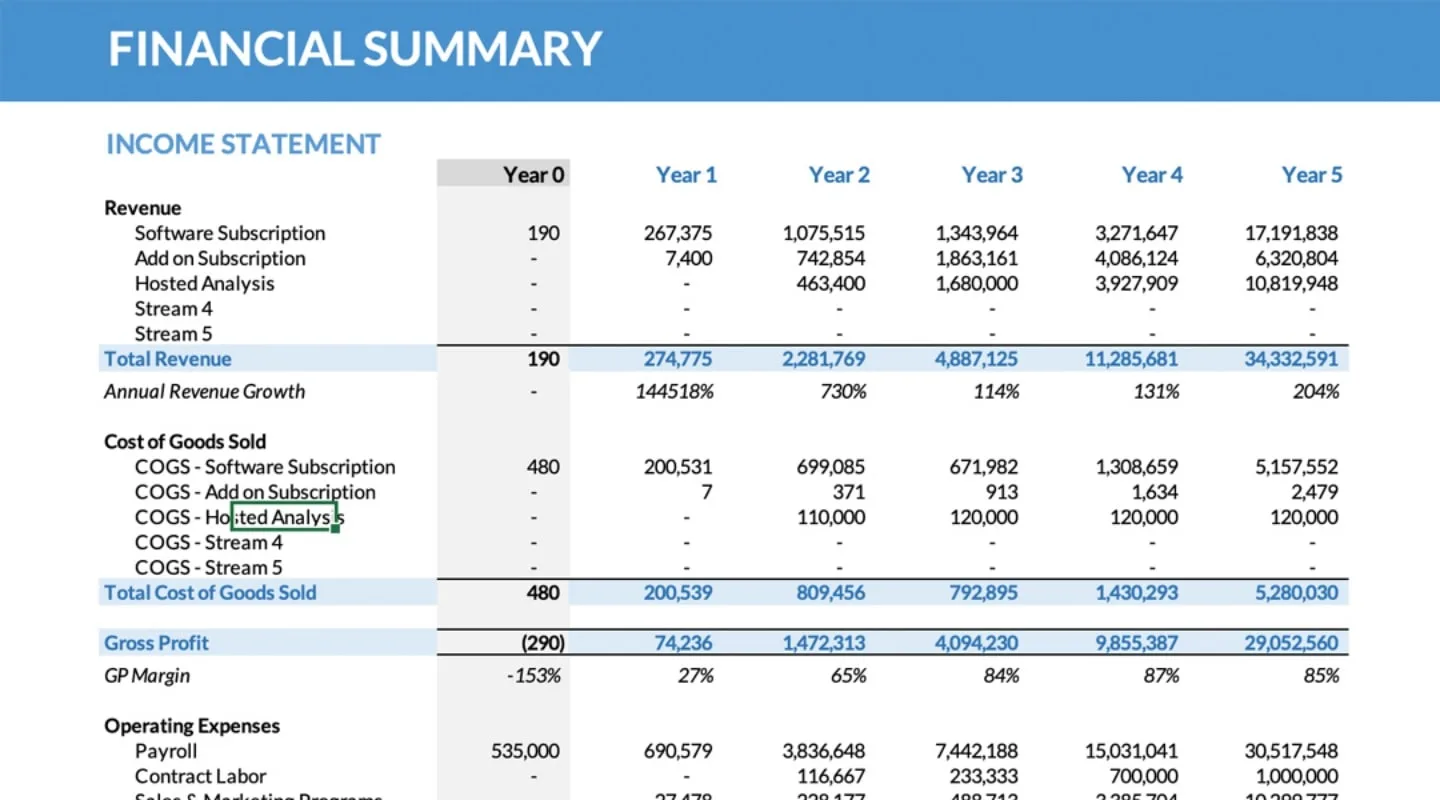

Almost all companies engage in financial planning, but a financial model is a necessity for startups. A realistic assessment of your business idea helps you determine your probability of success. Other reasons for financial models include:

- You need to look at scenarios. What happens if your business doesn’t go as planned? How will you adjust? That’s true of the best-case scenarios as well. If things go better than expected, will you require the same amount of funding?

- Fundraising requires a financial plan. Angel investors, venture capitalists, banks, and other sources of funding are going to want to see the details of your business to determine if it’s an opportunity they want to pursue.

- Investors will need updates. Once you have investors and shareholders, they’re going to expect regular updates on how you’re spending the funds they provided.

Cloud accounting systems provide financial modules for financial planning, budgeting, and more — so you can work with a templated solution. In the meantime, you can find helpful tips, instructions, and videos for financial modeling here.

Do you need to review your budget vs. actual numbers?

We highly recommend using your financial models and projections to compare with your actual business activities every month. Your company’s financial health depends on how well your actual sales and/or expense numbers stack up against your financial projections. Good accounting software can help you create dashboards and other tools to quickly match your budget against your actual results.

What information do you need for due diligence?

Every startup needs three traditional financial statements as part of its financial models. The statements need to be prepared using generally accepted accounting principles (GAAP) and your cloud accounting system can help you get the information you need to handle due diligence. If you’re seeking funding or being acquired, investors and buyers will want to see GAAP financials as part of due diligence. For more information, you’ll find our downloadable VC checklist here.

What accounting statements do you need?

Cloud accounting software can help you adhere to GAAP standards as you develop your:

-

Income statement. Your income statement reports your startup’s income through a particular time period, using this formula:

- Net Income = Total Revenue - Total Expenses.

-

Balance sheet. A balance sheet is a snapshot of your company’s financial position on a specific date, using this formula:

- Assets = Liabilities + Shareholders’ Equity.

- Cash flow statement. Your cash flow statement summarizes all cash inflows your startup receives from ongoing operations and external investments and deducts all the cash outflows as your company pays various expenses and obligations.

Key Financial Metrics That Matter

There are a few important metrics that entrepreneurs should know about accounting for early-stage businesses.

The burn rate is how much money you’re spending every month. The cash-out date is the estimated date you’ll run out of cash, given your monthly spending and the remainder of the investment you have sitting in your bank account.

Deferred revenue is when a client pays you before receiving a service. For example, if you charge a client’s credit card for a 12-month subscription, you receive 12 months of cash from that client. Since you owe them the subscription, deferred revenue gets added to your balance sheet as a liability. Cash offsets liability on your balance sheet, so you’ll have more cash flow than your income statement would “predict.” All in all, deferred revenue is not a bad problem to have.

Accounts receivable (AR) refers to the amount that your customers owe to you for the goods or services sold to them on credit. This lives on your balance sheet under liability because you haven’t yet received the cash for the item or service provided.

Accounts payable (AP) is the money your business owes to its vendors for providing goods or services on credit. These are bills that you haven’t yet paid. Different vendors have different payment terms, so you should use this to your advantage. But remember, in accrual accounting, if you use a service/get invoiced by a vendor, you’ll see it on your income statement even if you haven’t paid them yet; your operating loss is different from your cash burn.

How can a cloud accounting system help you get ready for your tax return?

Getting through tax season can be stressful, but organization and a cloud accounting system can help. Remember that even unprofitable startups need to file federal and state tax returns.

You’ll need the following documents to complete your tax return:

- EIN Letter from the IRS (this is the Employer Identification Number letter that the IRS created for you when you requested your EIN for your company.)

- Vital Business Statistics

- Business Address

- Shareholder SSN/Address info

- Prior Year Tax Returns (Federal and States)

- Local Tax Returns (if any)

- Financials

- Full-year Balance Sheet

- Profit & Loss Statement

- General Ledger

- Capitalization Table

If you prefer to hand off your returns to a CPA, Kruze Consulting can help.

Consider the Research and Development (R&D) tax credit

This government-sponsored tax incentive rewards companies for conducting R&D activities in the United States, and even pre-revenue startups can use the R&D tax credit to reduce their burn rates. Kruze has helped our clients get millions of dollars in tax savings through our work with this tax credit.

You can your expenses by up to $250,000 a year (note that the maximum amount will double for the tax year 2023 due to the Inflation Reduction Act of 2022). Visit our R&D Tax Credit Calculator to estimate how much your company can save, or contact us now to see how we can help your early-stage business.

Combining cloud accounting automation and experienced accountants

At Kruze Consulting, we’ve developed a refined process to manage bookkeeping for startups and provide a multi-level review of all the accounting.

Step 1. Our process relies on a cloud accounting system like QuickBooks Online and Kruze’s own software, which interfaces with QBO, and categorizes and labels transactions.

Step 2. After the initial step, a staff accountant verifies that all the transactions are labeled and in the correct accounts, and then reconciles the accounts against statements.

Step 3. The controller, who is an accountant with at least 10 years of experience, checks the transactions to make sure there are no errors.

Step 4. An account manager or CFO reviews the financials before they are provided to the client. Since they are familiar with the individual clients, they can make sure clients’ specific procedures are followed correctly.

Why don’t I see my contracted revenue on my Profit & Loss Statement?

If your startup is selling a service and starts earning revenue, it’s important to account for that revenue correctly. If the service is contracted over a period of time, you can only recognize part of the revenue each month. For example, if your startup sells a 12-month contract for services, you can only recognize one-twelfth of your contracted revenue each month.

The remainder of the revenue stays on your balance sheet under “deferred revenue,” and that total will come down over time as your startup recognizes the contracted revenue each month. This is all part of accrual accounting, which is the best way for startups to handle their accounting. It’s also what venture capital firms want to see as part of the due diligence process.

Kruze Cares More!

Ready to Work With The Best Accountant?

HOW ARE WE DIFFERENT?

We know you’re busy. Our automated systems can get the job done quickly, and we don’t stop there. We go above and beyond automation with a team of certified public accountants (CPA) experts ready to provide you with white-glove service. This is the Kruze way!

Don’t take our word for it. Check out our client reviews and testimonials.