How do startups account for equity and fundraising on the Balance Sheet?

Table of contents

Lately, we’ve had a lot of questions around How Startups Record Equity on the Balance Sheet. So let’s break it down. There are 2 ways that Startups Record Equity on the Balance Sheet.

- The Official GAAP accounting way (time consuming and costly).

- How Investors prefer to see it.

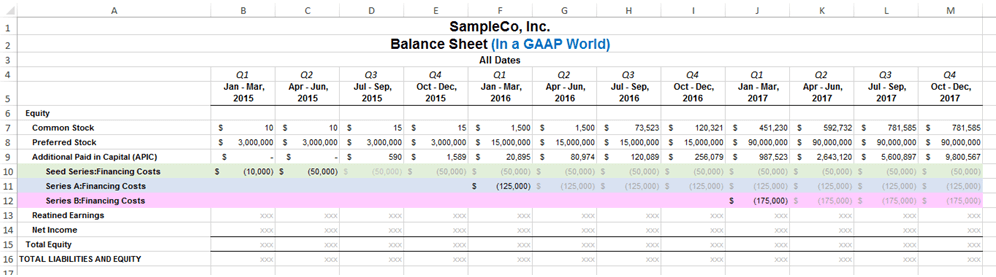

The Official GAAP accounting way:

a

a

So technically you’re supposed to report the Equity section in 3 accounts:

- Common Stock: most often this is employees and founders purchasing stock, then the general public once the company goes IPO

- Preferred Stock: most often this is the VCs and Angel Investors purchasing stock: should the company go belly up, their ownership is preferred and they’ll get their money back before Common Stockholders do

- Additional Paid in Capital (APIC): calculated as the (Issue Price – Par Value) * Basic Shares Outstanding. Financing Costs are netted against this account. For big public companies, calculating APIC is relatively easy to do: they have big accounting departments that can easily pull market/issue price, the par value and the Basic Shares Outstanding. But what about startups who are Seed, Series A-D? Calculating APIC is time consuming and costly… and has very little value to the management team or investors at this stage.

GAAP accounting for the cost of raising capital

A note on recording the legal fees associated with the fundraise (and heavens knows that it costs serious legal $ these days to raise VC funding): legal and other DIRECT costs associated with an equity fund raise should be capitalized and netted against APIC. There is no need to amortize this permanent equity cost. On the off chance that your startup raises debt, those costs would be amortized, generally based on the length of the loan.

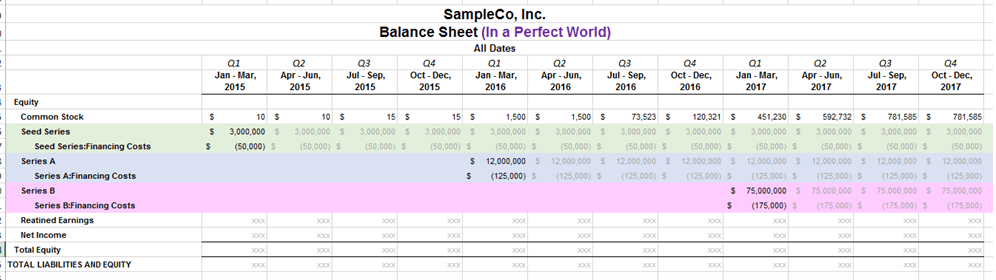

How investors prefer to see the equity section:

Record each fundraising round as a new Equity account and net the Financing Costs against it, as seen below.

- Common Stock: Common Stock purchases from the founders and employees still go against Common Stock, no matter which funding round you are in.

- Seed Series: Angel and VC funding (Less Seed Series Financing Costs)

- Series A: Angel and VC funding (Less Series A Financing Costs)

- Series B: Angel and VC funding (Less Series B Financing Costs)

- Et cetera….

If you haven’t really calculated APIC, don’t include it on your Balance Sheet because it give the impression that you’ve calculated the (Issue Price – Par Value) * Basic Shares Outstanding.

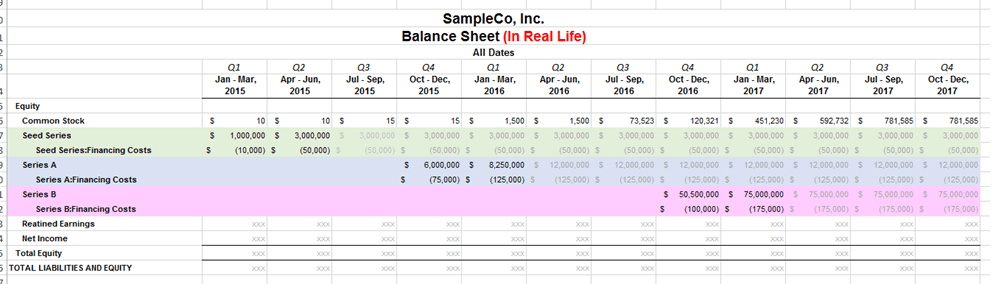

Notice that once fundraising round is closed, new funds aren’t added to it. New funds are placed in a new fundraising Equity account. I grayed out the numbers to show that the account essentially remains dormant once the round is closed. The picture above shows you what the Balance Sheet would look like in a Perfect World, ie all investors deposit their funds within a short window. But we all know that there are always some early jumpers and laggards, and some funding rounds that last many quarters and other instances where a Series B hits just 6 months after a Series A. So in Real Life, the Balance Sheet tends to look like the picture below. The lesson being is that you should check with your cap table, founders, lawyers and accountants about any potential overlap of funding and place the funds according to the prescribed funding rounds.

Why do investors prefer to see the Equity section this way?

Because it’s easily recognizable to them and is cost effective. Once you clear Series D, or your investors want to see APIC, or if your auditors demand it… then calculate APIC. It’ll take your accountants some time and will cost you $ (we’re happy to do the work if you’re happy to pay, but we also want to be hyper cognizant of cost/benefit relationships), but if it’s what the investors want, give the investors what they want.

Accounting for capital raising - Early-stage startup FAQ’s

How do you account for common stock on a startup’s balance sheet?

Ok, so we’ve referenced above on how VCs like to see the equity section of the balance sheet organized, but let’s focus on how the accounting works for a VC-backed startup’s common stock.

Recording Common Stock

- Initial Issuance: When common stock is issued, it should be recorded on the balance sheet. The entry involves debiting cash (or another asset if applicable) and crediting common stock for the par value of the shares issued. Any amount received above the par value is credited to Additional Paid-In Capital (APIC). More on APIC in a moment.

- Founder Shares: Founder shares are typically common shares (although we are seeing founder preferred these days as well). The accounting entry for founder shares involves debiting cash and crediting the common stock account for the amount paid by the founders.

- Subsequent Issuances: For any additional rounds of funding, it is advisable to create separate equity accounts for each funding round (e.g., Series Seed, Series A). This helps in reconciling the cap table and maintaining clarity in financial statements.

Additional Paid-In Capital (APIC)

- Definition: APIC represents the amount paid by investors over the par value of the stock. It is calculated as the difference between the issue price and the par value, multiplied by the number of shares issued. This is mainly an accounting item, and doesn’t have a huge impact on how anyone would analyze the company’s financials.

- Par Value: This is a non-intuitive accounting item. The par value of common stock is the nominal or face value assigned to a share when it is issued, as specified in the company’s charter documents. This value is largely symbolic and does not reflect the market value of the stock. It is often set at a very low amount, such as $0.01 or even $0.00001, to meet legal requirements in certain jurisdictions and to minimize potential liabilities for the company. The primary purpose of par value is to establish a minimum price at which shares can be issued. This serves as a legal safeguard to ensure that shares are not sold below this value, thus protecting the company’s creditors by maintaining a minimum level of capital. Warning: par value can impact your Delaware Franchise Tax.

Fundraising Costs

- Accounting for Costs: As we’ve already mentioned, legal and other direct costs associated with raising equity should be capitalized and netted against APIC. These costs are not amortized but are instead treated as a permanent reduction in equity

What is the accounting treatment for capital raising costs?

When raising equity funding, the legal and other direct costs associated with an equity fund raise should be capitalized and netted against the equity sections’ Additional Paid in Capital account. You do not amortize the costs of raising equity. For debt, the costs should be amortized against the length of the loan. The capital raising costs accounting treatment is crucial for accurate financial statements.

Capital raising costs accounting treatment

Capital raising costs, such as legal fees, underwriting fees, and registration fees, are accounted for differently depending on the type of capital being raised. These costs include legal fees, underwriting fees, and registration fees. When raising equity, these costs are capitalized and netted against the APIC account. For debt, they are amortized over the loan’s duration. Proper accounting for these costs ensures that financial statements reflect the true cost of raising capital. The Kruze team is experts at these accounting treatments; in general, depending on the type of financing raised:

Equity: These costs are capitalized and netted against the Additional Paid-in Capital (APIC) account in the equity section of the balance sheet. They are not amortized. Under ASC 505-10, equity issuance costs are also recorded as a reduction of the equity account’s proceeds.

Debt: These costs are amortized over the length of the loan. Capitalizing costs is an accounting treatment that follows the matching principle, which aims to record expenses in the same period as related revenues.

How do you account for fundraising expenses?

For early-stage, VC fund raises, the company that raised funding should capitalize the direct costs of the fund raising and net against the APIC account on the balance sheet. Small, recurring expenses may be run through the P&L (talk to your CPA) but major expenses like the legal bill, which will usually arrive a month or two after you’d close the financing, need to be capitalized. Legal fees and other expenses related to the fund raise should be carefully documented. Digging into different types of transaction costs that many startups may face:

Legal Fees

Legal fees are specific incremental costs incurred during the capital raising process. For equity securities, these fees are capitalized and netted against the APIC account. They are not amortized, which aligns with the equity classification guidelines under ASC 505-10. Legal fees paid in relation to debt issuance are amortized over the loan period, ensuring that expenses related to the debt are matched with the loan’s term. One item that Kruze accountants - and our startups clients - regularly face is how poorly law firms invoice their clients. Some law firms many not invoice a client until well after a transaction is completed - this is great from a cash flow perspective, but does create some havoc for managing your accounting. Additionally, some law firms may bill a retainer or may bill incrementally. In these cases it’s important to keep up to date with your law firm so you know how much of a bill you may get. In our accountants’ experience, when you let your attorney know that you are keeping track of the bill, even if you haven’t been invoiced, you are likely to end up with a lower bill. This can help reduce over billing and save your startup money! So pay attention.

Transaction Costs

Transaction costs, including underwriting and registration fees, vary based on the capital type. For equity transactions, these costs are capitalized and reduce the proceeds recorded in the equity account. Debt-related transaction costs are amortized over the life of the loan, ensuring they align with the period the debt benefits. Accurate tracking of these costs is essential for correct financial reporting under GAAP. Most startups that Kruze works with don’t have underwriting fees, since most VC deals don’t have an investment banker involved.

Financing Costs

Financing costs, which encompass all direct costs associated with raising capital, follow distinct accounting treatments. Equity financing costs are capitalized and netted against the APIC account, reducing the gross proceeds recorded. Debt financing costs are amortized over the loan period, ensuring that the costs are spread over the time the loan benefits the company. This approach ensures the financial statements reflect the true cost of capital over time. Many venture debt providers have fees that can be classified as transaction costs, so make sure you understand your venture debt term sheet when you agree to a debt financing.

How to account for a venture capital investment?

If your company has raised venture capital funding, you’ll need to record the fund raise on your balance sheet and capitalize any financing costs directly associated with the VC round. See our notes above for the GAAP methodology - plus the way most VCs like to see the accounting of their investment on the balance sheet.

What about SAFEs or Converts?

Great question. We’ve written entire articles on both of these. The punchline is that SAFEs are equity and Convertible Notes are debt. Follow those links to find out more about how to record them on your balance sheet.

How to Account for Venture Debt Costs

Venture debt costs, including fees paid to the debt provider and legal fees paid to get the transaction papered, should be capitalized and amortized over the term of the loan. These financing costs encompass origination fees, commitment fees, and other direct fees paid to secure the debt financing. By amortizing these costs over the loan period, companies ensure that the expense recognition aligns with the period during which the loan provides benefits. This approach ensures accurate financial reporting and compliance with accounting standards.

Categories:

Startup BookkeepingTable of contents

Recent questions

Top viewed questions

- What happens if the IRS audits me and I do not have the receipt for an expense (assuming it was a legitimate expense)?

- How should convertible note financing be handled on the balance sheet?

- How do startups account for equity and fundraising on the Balance Sheet?

- For startups incorporating in Delaware, what firms are good registered agents to use?

- 2025 Founder Salaries by Stage