A well-structured startup budget is crucial for success, guiding decision-making, attracting investors, and ensuring long-term viability. To help you get started, we’ve created a comprehensive startup budget template that you can customize for your business needs.

Why your startup needs a budget template

A startup budget template is more than just a financial planning tool; it’s a roadmap for your company’s future and a sanity check when you are first getting started to make sure you can finance the business and develop a company with good unit economics. Here’s why it’s essential:

- Sanity Check: Before you start a new company, laying out the budgeted costs, expected revenue and cash needs lets you have a higher level of confidence in the company’s viability.

- Financial Health Management: A budget template helps you track and manage your startup’s financial health, ensuring you don’t run out of cash prematurely.

- Strategic Decision Making: It provides insights that guide important business decisions, from hiring to product development.

- Investor Communication: A well-prepared budget demonstrates fiscal responsibility to potential investors.

- Goal Setting and Tracking: It allows you to set financial goals and monitor your progress towards them.

Key components of a startup budget template

Always start with your corporate goals for the year, then focus on creating the budget. An effective startup budget template should include the following elements:

1. Revenue projections

Your startup budget template should start with a detailed forecast of your expected revenue. This might include:

- Sales projections

- Recurring revenue (for SaaS companies)

- Other income sources, such as consulting revenue

Remember, it’s crucial to be realistic in your revenue projections - especially at first when you are likely to be lightly funded. Overly optimistic estimates can lead to poor decision-making. However, if you need to grow 3x to be able to raise your next round, work backward from that at first to see how and if you can achieve that specific revenue metric.

2. Expense categories

A comprehensive startup budget will include various expense categories:

- Fixed Costs: Rent, salaries, insurance, etc.

- COGS: The costs to produce and deliver the service/product to customers.

- Variable Costs: Marketing expenses, sales commissions, etc.

- Capital Expenditures: Equipment purchases, software licenses, etc.

- R&D Expenses: Crucial for tech startups and product-based companies

- Operating Costs: Technology and equipment, professional services (legal, accounting, etc.).

3. Cash flow projections

Your startup budget template should include a cash flow projection. This can be pretty simple, although some founders like to use templates that have a full cash flow statement, it’s not really necessary. Simply getting the cash inflows, outflows and ending cash position is likely what most founders need in their first templates. Projecting cash helps you anticipate potential cash shortages and plan accordingly. It should cover:

- Cash inflows (revenue, investments, loans)

- Cash outflows (expenses, debt repayments)

- Monthly cash burn rate

- Net cash position

4. Profit and loss statement

A projected profit and loss statement is a crucial component of your startup budget template. It provides a snapshot of your expected financial performance over a specific period.

6. Hiring plans

Your template needs to include the largest part of any startup’s budget - hiring. Understanding who you’ll hire, when and at what cost is a core element to creating a solid budget. If you have division or department leaders, the budgeting process is a great moment to make sure they understand and can articulate how many people they’ll need to hit the company’s goals.

5. Funding sources

If you’re raising capital, your startup budget template should outline your funding sources:

- VC/Equity investments

- Loans

- Grants

- Personal investments

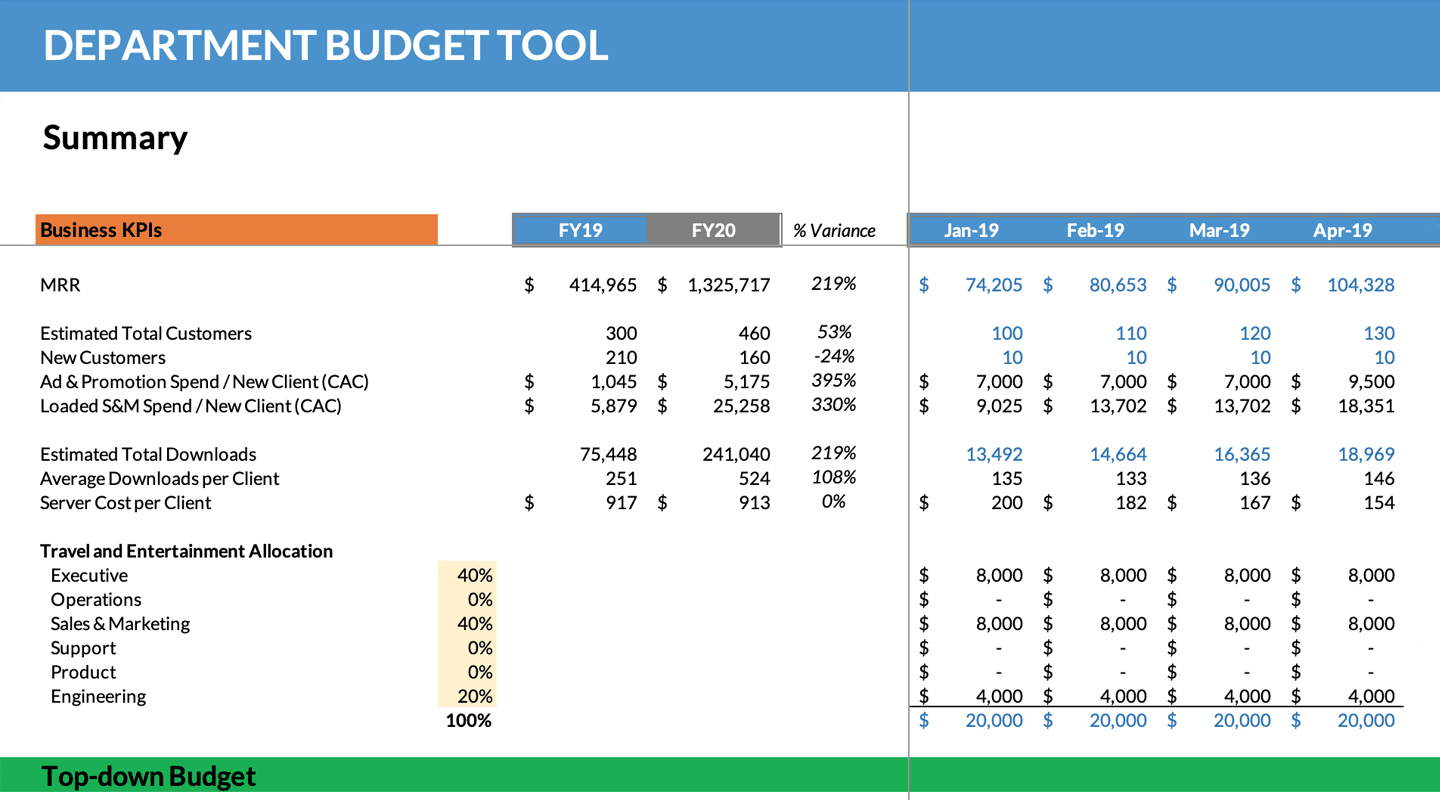

6. Key performance indicators (KPIs)

Include relevant KPIs in your startup budget template to track your financial and operational performance. These might include:

- Number of customers

- Customer Acquisition Cost (CAC)

- Lifetime Value (LTV)

- Burn Rate

- Runway

How to create a startup budget template

Now that we’ve covered the key components, let’s walk through the process of creating your startup budget template:

-

Choose Your Tool: While many startups use Excel, Google Sheets is becoming increasingly popular due to its collaborative features and accessibility.

- Set Up Your Timeline: Decide on your budgeting period. Most startups create monthly budgets for the first year, then quarterly or annual budgets for subsequent years.

- List Your Revenue Streams: Start by listing all potential sources of income.

- Detail Your Expenses: Break down your expenses into categories (fixed, variable, one-time).

- Create Your Projections: Based on your research and assumptions, project your revenue and expenses over your chosen timeline.

- Calculate Cash Flow: Use your revenue and expense projections to calculate your expected cash flow.

- Add KPIs: Include relevant KPIs to help you track your financial health.

- Review and Adjust: Regularly review your budget against actual performance and adjust as necessary.

Best practices for using a startup budget template

- Start with Goals: Set your goals for the year, or time period, and then make sure the budget reflects these. How much you’ll need to grow, how much you can burn, any product or other KPI metrics - set it up front; constraints make for a better process and will help you choose a better template.

- Be Realistic: It’s tempting to be overly optimistic, especially about revenue. Resist this urge and base your projections on solid data and realistic assumptions.

- Update Regularly: Your budget shouldn’t be a static document. Update it regularly based on actual performance and changing circumstances. Running regularly budget-vs-actual analysis can help keep you focused.

- Use Scenario Planning: Create multiple scenarios (best case, worst case, most likely) to prepare for different outcomes.

- Involve Your Team: Get input from different departments to ensure your budget reflects the entire organization’s needs and goals.

- Monitor Cash Burn: Pay close attention to your burn rate and runway. These metrics are crucial for startups.

- Align with Strategy: Your budget should reflect and support your overall business strategy.

Common pitfalls to avoid in startup budgeting

- Underestimating Expenses: Many startups underestimate their expenses, particularly hidden costs like taxes, insurance, and maintenance.

- Overestimating Revenue: Be conservative in your revenue projections, especially in the early stages.

- Ignoring Seasonality: If your business is affected by seasonal trends, make sure your budget reflects this.

- Neglecting Cash Flow: A profitable business can still fail if it runs out of cash. Always keep a close eye on your cash flow projections.

- Forgetting Cash Timing: Sometimes startups need to make purchases of inventory or other products well head of collecting payment; many larger customers take time to pay their bills - neglecting to account for this in your budget can result in serious shortfalls in cash.

- Failing to Budget for Growth: As you grow, your expenses will likely increase. Make sure your budget accounts for this.

Advanced tips for startup budget templates

- Use Startup Financial Models: Leverage more advanced financial modeling techniques to create more accurate and insightful projections.

- Integrate with Other Tools: Connect your budget template with your accounting software for real-time updates and more accurate forecasting.

- Include Non-Financial Metrics: While financials are crucial, including relevant non-financial metrics can provide a more holistic view of your startup’s performance.

- Plan for Contingencies: Set aside a portion of your budget for unexpected expenses or opportunities.

- Use Benchmarks: Compare your financial metrics with industry benchmarks to gauge your performance and identify areas for improvement.

Conclusion: The power of a well-crafted startup budget template

A well-designed startup budget template is more than just a financial tool—it’s a powerful asset that can guide your business towards success. By providing clear insights into your financial situation, it enables you to make informed decisions, allocate resources effectively, and communicate your financial strategy to stakeholders.

Remember, the goal isn’t to predict the future with perfect accuracy, but to create a flexible, data-driven framework that can adapt as your startup grows and evolves. Regular reviews and updates are key to maintaining the relevance and usefulness of your budget template.

At Kruze Consulting, we’ve seen firsthand how a solid budget can make the difference between a startup that thrives and one that struggles. That’s why we’re committed to helping founders create and maintain effective financial plans.

For more detailed guidance on creating financial projections for your startup, or if you need help developing a customized budget template for your unique needs, don’t hesitate to reach out to our team of startup finance experts. We’re here to help you navigate the financial complexities of startup life and set your business on the path to success.