What is the Best & Free Cap Table Management Software for Startups?

Table of contents

The two best cap table management software providers right now are Carta and Pulley Carta now has a free version called “Carta Launch” for companies with less than 25 shareholders/stakeholders or less than $1 million in funding raised. This competes directly with Pulley’s free ‘seed’ plan for companies with less than 25 stakeholders. Together, these two providers have close to 95% of the market for cap table management software in the US!

Other capitalization table software providers

AngelList now has a new cap table management product called AngelList Equity. It’s got a free plan for companies that have raised less than $1 million in funding. Shareworks used to have a free version, but now it starts at $3 per month. Shoobx, now owned by Fidelity, also offers a free plan for lightly funded companies, but we only have a couple of companies using it so it’s tough to draw conclusions from their experiences. Another player, Figure, used to be called Adnales until Figure acquired it. We haven’t actually used their cap table management software, so can’t speak to it’s quality, and we are a little worried that it’s now just a feature of a startup trying to do something tangental (they have a lot of different product lines on their site!). We’ve had a heard good things from outsourced CFOs about two12.co, but also haven’t used it yet - their pricing is quite low, so that’s appealing. We’ve heard of another new provider named Cake Equity, but haven’t really seen them in action yet. Finally, Captable.io is now owned by the LTSE; it has a pretty good UX.

For many reasons, it’s very important for a young company to keep careful track of equity ownership and stock options. Most importantly, it’s very likely that the majority of your employees (and founders!) are working hard to try to make their ownership and options worth something - so you owe it to them to keep careful track of each and every share. Your cap table matters, so pick a good software vendor to help you get it right and keep it straight.

How to Choose the Best Cap Table Software for Your Startup

Here are several key items to look for as you try to choose the best cap table software.

- Will your lawyer use it? Most early-early companies have their law firm help manage the capitalization table, and typically 100% of Series A startups enlist their law firms to do the actual cap table management. So ask your law firm which tools they are willing to use - note all will say Carta, so you’ll have to push them if you want to use an alternative like Pulley.

- Cost. Super early-stage companies are usually cost-conscious, so choosing an option that starts out low-cost is a good idea.

- Ease of Use. If you are DIYing cap table management, the system has to be easy to use. And some systems are set up to make it easy for boards to do option grant approvals, so the UX needs to be good enough for a VC to use on their phone while they are drinking a coffee driving down 101 on the way to your board meeting.

- Support for common securities. You’ll need to choose a vendor who handles preferred stock, restricted stock, warrants, SAFEs, converts and options. The newest vendors may not be able to handle pre and post money notes, so make sure the vendor can deal with the types of securities you are likely to issue.

Features You Probably Don’t Need in your Cap Table Management Software

The sales teams at the cap table vendors have some great features that they’ll tell you about - that you may never use. Don’t obsess over the differences between the vendors on these features:

- Scenario modeling. Startups shouldn’t really be focused on financial engineering. Sure, once or twice a year one or two of our hundreds of clients has some complicated cap table issue they want modeled, but to pay extra for a feature that less than 1% of our client need isn’t worth it. Focus on the basics.

- Exit modeling. This is even a sillier feature, especially if you are the type of a person subject to day-dreaming instead of working. While it might be gratifying to model out what it looks like if Google buys your startup for $10 billion, no $11 billion, no, $2 billion, it doesn’t actually help you all that much. If you are selling your company, you’ll have expensive lawyers who will give you the actual result of your negotiations. But we’ll give you a tip for free - your shareholders probably make more money if you sell your company for a bigger $$ value.

- 409As. Pretty much all of the cap table vendors throw in 409A’s as part of their package. You can purchase a 409A for just a couple of thousand dollars, so while it’s nice to get one from your cap table provider for “free,” don’t obsess over it, as you can likely find a low cost way to get one.

Carta vs Pulley

Let’s compare pricing and features between the two most popular cap table management software providers, Carta vs Pulley.

| Carta | Pulley | |

|---|---|---|

| Free Plan | Yes - up to 25 stakeholders | Yes - up to 25 stakeholders |

| Priced Plans Starting At | $1,500 per year | $1,200 per year |

| Scenario Modeling | In paid plans | In free plan |

| Law Firm Penetration | Used by all law firms | Used by most law firms |

| UX | Good | Very Good |

| Works for public companies | Yes | Not Yet |

Pricing

What does Carta or Pulley cost? Both Carta and Pulley have free plans designed for companies with less than 25 stakeholders (basically, 25 shareholders/option holders). The cost scales up from there differently for both cap table vendors. Let’s dive in.

Carta Pricing

We’ve been able to back into Carta’s pricing from our accounting data, looking at a number of our clients who use the plan. Carta’s pricing seems to scale with headcount.

- Free plan: free for up to 25 employees/investors/stakeholders; no 409a included

- Build plan: $50 per stakeholder; no 409a

- Grow and Scale plans: seem to be about $120, $130 per head; has a 409a

Pulley’s pricing

- Free plan: up to 25 stakeholders

- Startup plan: $1,200 a year, up to 25 stakeholders, no 409a

- Growth plan: $3,500 a year, up to 40 stakeholders, comes with a 409a

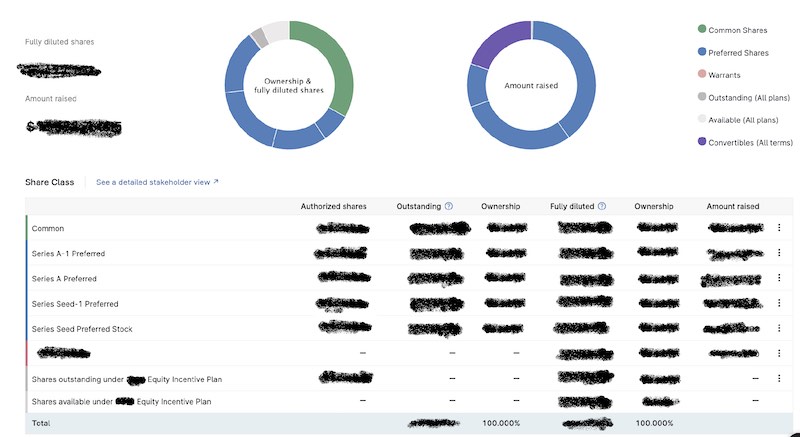

Carta Cap Table

Wondering what a Carta Cap table looks like? Wonder no more, here is what the view looks like from inside the Carta software:

As you can see, Carta lets you manage multiple kinds of investor stocks alongside of your employee options. You can manage:

- SAFES

- Convertibles notes

- Preferred Stock

- Options

- Warrants

- RSUs

- Profits interests

- and some other securities you aren’t likely to encounter as a VC backed startups.

Carta Alternatives

Carta is clearly the leading cap table management solution in the VC backed startup scene. However, there are some legitimate Carta alternatives:

- AngelList Equity - has a free plan for companies that have raised less than $1 million in equity

- Pulley - best alternative for very early-stage companies, Pulley made big marketshare gains in 2022

- Shoobx - owned by Fidelity, also has a free plan for companies that have raised less than $1 million in equity; the run rate expense for a modestly sized startup seems to be about $3,000 a year.

- Shareworks - the biggest enterprise alternative to Carta, great for companies that are rapidly scaling

- Capbase - currently only for pre-valuation companies (i.e. super early-stage)

- Figure (formerly Adnales) - a new player with attractive pricing, but we have yet to actually get our hands on it / see any clients use it; now owned by a crypto company.

- two12 - only a couple of our clients have used it. Super low cost, so that’s appealing, but too early for us to have a judgement.

- Captable.io - owned by the LTSE, has a good UX.

Carta vs AngelList Equity

We haven’t seen a lot of startups using AngelList’s cap table management tool yet -but they have a free plan and good brand recognition, so we expect to see it soon.

| Carta | AngelList Equity | |

|---|---|---|

| Free Plan | Yes - up to 25 stakeholders | Yes - up to 20 stakeholders |

| Priced Plans Starting At | $1,500 per year | $1,560 per year |

| Scenario Modeling | In paid plans | Don’t think they have it yet |

| Law Firm Penetration | Used by all law firms | Not widely adopted yet |

| UX | Good | Not sure |

| Works for public companies | Yes | Not yet |

Cap Table Software - what is it?

Capitalization table management software, or cap table software, is a software tool that helps companies manage their equity ownership structures. A capitalization table, or cap table, is a document (really a spreadsheet) that provides a detailed record of a company’s total capitalization, including all its securities (such as shares, options, warrants, etc.) and the respective ownership percentages. Basically, who owns what.

Understanding and correctly recording ownership is critical

A cap table clearly lays out who owns what in a company, specifying the ownership stakes of founders, investors, employees, and any other equity holders. This helps prevent misunderstandings and conflicts over ownership stakes and can serve as an official record of these allocations. Imagine your startup gets a huge acquisition offer - but you don’t know which employees own what. Or if you exit and then an investor disputes their ownership, saying they purchased more shares than you think they did. These situations can be legally fraught, and litigating this is a disaster. And think of it from an acquirer’s perspective - they don’t want to buy a company that’s going to drive an immediate lawsuit!

Thankfully, it’s not as hard to manage a startup’s ownership as it used to be. And the best, startup lawyers know how to set up software to make this much, much easier.

What cap table software does

Cap table management software assists with various tasks related to maintaining and updating a company’s ownership structure.

- Record Keeping: The software keeps track of all changes in the company’s equity structure, such as share issuance, options granted, transfers, and equity transactions. Critically important, and as accountants, we need this to be done right.

- Compliance: Beyond securities laws, many tax jurisdictions want an accurate breakdown of a startup’s ownership, or want to know what percentage of investors are outside the US, etc.

- Reporting: They often come with the ability to generate a range of reports, such as ownership percentages, dilution impact, vesting schedules, and more.

- Vesting management: Employee stock options typically vest monthly (after a cliff vesting period is over). Keeping track of startups with dozens, if not hundreds of employees, all vesting different amounts of stock monthly is painful, and mistakes can lead to upset employees and litigation. Software makes it much easier.

- Communication: The best solutions let employees know when their equity is vesting, and handle a lot of the communication around exercising stock options. Plus, at a fund raise, you’ll need to explain your current ownership and projected ownership after the close, and having a well managed cap table is VERY important to a clean fund raise.

Overall, cap table management software simplifies complex equity management tasks, reduces the risk of errors, ensures regulatory compliance, and provides a transparent view of the company’s equity structure for all stakeholders.

5 Reasons Your Startup Needs Cap Table Software

Your capitalization table is a fundamental part of running a startup, and by using specific cap table management software you can make your life a whole lot easier. There are different ways to create and manage your cap table, ranging from spreadsheets to an equity management platform. While it’s fine to start out with a spreadsheet, as your startup moves through rounds of funding, you’re going to want cap table software that automatically updates as you issue employee stock options, get new 409A valuations, and reach other financial milestones.

What is a Cap Table?

Your capitalization table is one of the most important documents that your startup has. A cap table shows you who owns what in your company. It acts as a record of your investors and shows how much capital you’ve raised. As well as those crucial things, the cap table also helps your employees manage their own stock options.

5 Reasons you Need Cap Table Software at your Startup

1. Accessibility

The first reason your startup should start using cap table software is for accessibility. Your cap table shows the ownership structure of your company, which prevents misunderstandings or disputes. Having software in which you manage that structure makes it easier for employees, investors, and founders to see how much they own. It also makes it easy for people to click on, select, or prove actions that are being taken that will affect their ownership.

2. Illustrates Voting Power

Secondly, cap table software clearly illustrates the voting power of your shareholders. This software makes it very easy for you to look and see who owns which type of shares in your startup. It therefore also shows who has control over the business, or the business decisions, when shareholders come to vote.

3. Assists in Equity Grant Planning

The third reason for using cap table management software at your startup is how it can help you plan for future equity grants. You can look at it and see how much of the option pool you have available, and therefore how much equity you can grant to future employees.

4. Useful for Fundraising

Cap table software is incredibly useful when you are fundraising, because it shows the ownership structure of your startup to potential investors. You can produce an up-to-date cap table easily, which you can then share with potential investors and their lawyers at the push of a button.

5. Simplifies Issuing New Shares

Finally, not only do cap table management tools make it easy for you to understand the impact on your ownership when new shares are issued, but they also means there can be a lot less legal paperwork. This means fewer billable hours required from your lawyer to issue new shares, since the back and forth of paperwork, assisted by an expensive attorney, is drastically reduced.

Instead, with cap table software, all you have to do is push a button, send an equity agreement directly to the impacted individual or investor for them to sign, and it will all be recorded. The cap table software will keep all cap table information organized and easily accessible.

Why do CPAs and Lawyers Like Cap Table Software?

Now, CPAs (Certified Public Accountants), like us at Kruze Consulting, are big advocates of using cap table software but, in addition to this, lawyers also like cap table software for some pretty important reasons. If you’re working with professional, experienced advisors, you’ll find that we all advocate for you to choose a software to manage your employee equity grants, equity plans, financing etc.!

Why do Lawyers Like Cap Table Software?

- Cap table software automates the calculations and tracking of equity ownership. This reduces errors as well as the time attorneys would require to figure all of the calculations out, keep track of it and manage it.

- Since cap table software also provides a lot of transparency, lawyers like the fact that it makes it easy to demonstrate or share the ownership structure of the startup with other stakeholders. And that’s not only important for the lawyers whilst they work with a company, it also makes it a lot easier if you’re trying to sell the company or attract investors. They will want to know where the money’s going when they’re making an acquisition and who owns the business when they’re making an investment.

- Due to this transparency, cap table software can also help ensure compliance with certain regulatory requirements related to equity ownership. And compliance is a big tick for lawyers!

- As a startup grows and hires more employees or issues more equity, managing the cap table can become more and more complex. Cap table software can help manage this complexity, making the lawyer’s life easier once again.

Why do CPAs Like Cap Table Software?

Here at Kruze Consulting, we are a CPA firm that serves venture capital backed startups and as an accountant serving startups, we like cap table software for a few very important reasons:

- Software helps to catch errors early on by helping us reconcile the cap table. To put this into context, we track every dollar that comes into a startup to make sure that is then used to purchase equity and then is actually matched with the individual or investor who is, in theory, the owner of those shares.

Believe it or not, every year (with one or two clients) we see someone has signed some sort of investment agreement, generally at the seed stage, and agreed to wire money into the startup but failed to do so. This is most likely because their wire hasn’t gone through or they forgot to send the money.

But what does that mean? Do they still own that piece of equity? Who owns it? Do they own those shares or do they not because they didn’t send the money? Well, reconciling the cap table can help you catch those things early on and avoid future issues down the line. For example, when someone is acquiring your company for a ton of money and you don’t know who actually owns what. Software makes reconciliation way easier.

- Secondly, accounting firms really like cap table software because having easy access to the cap table helps tax accountants prepare tax returns. This is because some tax authorities need to know who the startup’s major owners are and a cap table provides that information.

Software also helps with calculating share count - ownership percentages that are required by some state tax agencies. For example, if you’re filing your Delaware franchise tax, they will require your startup’s share count.

Cap Table Management Software Market share

Carta has maintained a lockhold on the capitalization table software market for quite a while. Pulley is the major player who has been able to take marketshare, and Shareworks - which used to be our 2nd most-liked Carta alternative, has really dropped in usage to basically nothing. But, the overall market share changes have been SLOW. We believe this is because capitalization software purchasing decisions are typically made by the law firms that assist startups in their earliest fundraises - and attorneys are notoriously slow to make technology changes.

| Q1 2020 | Q2 2020 | Q3 2020 | Q4 2020 | Q1 2021 | Q1 2022 | Q2 2022 | Q3 2022 | Q4 2022 | Q1 2023 | Q2 2023 | Q3 2023 | Q4 2023 | Q1 2024 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Carta | 89% | 90% | 91% | 94% | 95% | 93% | 93% | 92% | 92% | 92% | 92% | 92% | 93% | 93% |

| Shareworks | 11% | 10% | 8% | 4% | 4% | 1% | 1% | 0% | 0% | 0% | 0% | 0% | 0% | 0% |

| Pulley | na | na | na | na | na | 5% | 6% | 6% | 6% | 6% | 6% | 6% | 6% | 6% |

| Other Software | 0% | 0% | 2% | 1% | 2% | 1% | 1% | 2% | 2% | 2% | 2% | 2% | 1% | 1% |

Getting the Most Out of Your Cap Table Management Software

Using cap table management software is essential for startups, but to truly maximize its value - and to preserve ownership - founders should follow these key practices:

1. Always Work with a Qualified Attorney

Cap table management software simplifies equity tracking, but it’s not a replacement for legal expertise. Stock options and investor equity have a lot of regulations, and mistakes can not only become expensive, they can upset your most important supporters. Always consult with a qualified attorney to ensure compliance with securities laws and proper documentation for stock issuances. An attorney can:

- Verify exemptions for securities registration.

- Ensure proper issuance of shares.

- Assist in drafting agreements for convertible securities and other instruments.

This collaboration safeguards your cap table’s integrity, helps you keep as much ownership as possible in your company, and helps avoid costly errors during due diligence.

2. Implement Vesting Schedules for Service Providers

Create and stick to vesting schedules for all founders, employees, advisors, and contractors. This ensures long-term commitment and protects the company from losing equity to early departures. While it may seem impossible, we see dozens of founder departures a year in our client base, so having a vesting schedule can help preserve the company’s ownership for people actually working on the business.

3. Grant Equity Within Industry Standards

Use standard benchmarks when granting equity to employees and advisors to avoid oversized grants that could dilute ownership and signal poor management to investors. We’ve published data on typical, very-early stage startup compensation that includes what the first employees get in terms of equity grants. Scroll down to see the equity grant data; for example the first hire: 0.5% to 4% equity (median 1.49%).

4. Regularly Review and Update Your Cap Table

Stay on top of cap table updates by integrating a regular review process. This is especially critical before fundraising or granting new equity. The best cap table management software companies make it easy to keep your records accurate and ready for investor scrutiny. Stay on top of who owns what.

5. Negotiate Convertible Securities Carefully

When issuing convertible notes or SAFEs, avoid overly generous valuation caps or discounts that can result in significant dilution. Another major cap table management mistake we see is when a startup has a number of SAFEs with different discounts/caps - these can add up to massive dilution if you aren’t careful. Work with qualified legal and financial advisors to ensure these instruments align with your long-term goals, and keep them updated in your cap table software.

6. Ensure Compliance with 83(b) Elections

If you’re issuing restricted stock, file 83(b) elections within 30 days to lock in a low-cost basis and minimize future tax liabilities. Cap table software often includes tools to streamline this process, but always consult with a tax advisor to confirm compliance. Get this done promptly!

7. Leverage Cap Table Management Platforms

Choose a cap table software vendor like Carta or Pulley to manage your ownership. Using robust cap table software reduces administrative burdens and ensures your equity structure is transparent and well-documented.

8. Model your option pool

Founders should have a plan on how they grant options, just as they have an operating model on how they will spend their cash. We have a free option pool model template - grab it now, and regularly update it to make sure you are not giving away too much of the company too quickly.

How to structure Ownership in the Cap Table Between Founders

How startups initially set up their ownership split between founders is a question that we get a lot! Here are some important things to think about as you set up your capitalization table.

Tips for setting up your cap table

- Founders always take Common Stock

- Include vesting period to protect founders that stay with the company

- VCs want to know that founders are emotionally and financially invested in company

- Not all founders will have equal ownership - have this conversation early to avoid resentment

- PRO TIP: File your 83B within 30 days of founding and buying your stock

Founders should always take common stock, everyone on the management team should get common stock. You don’t want to have one of the founders having preferred and a liquidation preference over everyone. That’s just weird, it can lead to misaligned incentives down the road and VCs will probably not like it.

The second thing is you really need to have is a vesting period on everyone’s shares. What this does is that it protects the founders that end up staying with the company for many years from some of the other founders who might leave after a year or two. By having a vesting period, (typically it’s a four-year or a five-year vesting period) where your ownership vests, if it’s a five-year vesting period you vest 20% of your stock every year and usually there’s a one-year cliff, so you vest 20% after the first year and then you do the rest of it on a monthly basis.

But what that does is if someone decides they need to leave because they don’t believe in the vision anymore, they can leave and their remaining unvested equity can be used in the stock option pool to attract other senior-level, really strong talent to help the company be successful. What you don’t want is to have everyone vest everything on day one and then one of the two founders decides they’re going to go live in Hawaii and take off and not actually do any work for the startup and not advance the cause. Because then a big piece of your cap table is owned by someone who isn’t helping the business.

So vesting periods are really, really important. It’s very friendly to the founders that are gonna stay there, it’s also something that VCs want. When they invest in a company, they’re really investing in the founders; there may be some great technology, maybe it’s a great vision, but venture capitalists know that the founders and the executive team are the ones that are going to make it happen and bring the company to success. So they want to make sure the founders are emotionally and financially vested in the company.

Now there’s another thing that gets discussed, it’s kind of a tough topic, but sometimes you do not want equal ownership between the founders. Not everyone should have the same percent of the cap table. Now this is the case when one of the founders is going to make a more significant contribution than the others. A typical founding pair might be one kind of business or sales or strategy person and a technical founder. That’s kind of the combo we see quite a bit at Kruze Consulting, but maybe the technical person was recruited late to the idea and they weren’t the person that really took the germ of the idea and really built it out. Or maybe everyone knows that the CEO’s is going to do a lot of product stuff while also raising money and doing a lot more work or maybe a lot more important to the company’s future.

It’s much, much better to have that conversation early in the startup. You don’t want a lot of resentment building over the years where someone feels like they didn’t get their fair share or someone feels like maybe the cap table being equally split wasn’t the right amount because they’re doing so much more. This is a really tough conversation to have, we really recommend having it on day one or day two instead of day 365, where tensions could be much higher. Do it right away, before you and your co founders really start working on the project.

Feel free to lean on your angel investors for advice here or even your CFO firm like Kruze. We have helped hundreds of companies manage their cap tables (using software of course!) and see this a lot - our basic advice is to align the ownership amounts with the expected contribution amounts.

The vesting period and these ownership splits are really all about doing the right thing for the company and making sure everybody is aligned. These honest conversations between founders really sets the stage for you to have many more honest conversations down the road. There’s is going to be a lot of tough stuff that comes up over the years and having just this first one around the ownership split will really help you and be beneficial going forward.

We have one other pro tip for all the founders out there. This isn’t about the ownership split but instead is for your taxes - file your 83b filing with the IRS within 30 days of founding the company and buying your founder shares, it is so important. Make sure that it is certified mail, keep that receipt for the rest of your life. You do not want to screw up the 83b. This happens occasionally, it is really hard to reverse. The 83b basically gives you a really low cost basis and you can get capital gains on all your appreciation after that. It should save you a ton in taxes.

So have the tough conversation with the ownership split, have the tough conversation around the vesting period, and then after you have that conversation shake hands, hug, and then fill out that 83b form and walk over to the post office and mail it together.

Once you go beyond the founders, it’s time to get a cap table management software to help you keep careful track of everyone’s ownership and vesting. Again, Carta and Shareworks are the two biggest players in the space.

What is a Vesting Period?

No discussion about cap table management would be complete without going over what a vesting period is. For a typical stock option plan, a vesting period is the amount of months/years that a startup employee must stay employed at that startup in order to be allowed to exercise their stock options.

A vesting period or schedule prevents a startup employee from leaving the company early-on and taking a large piece of the company’s equity, leaving no room on the capitalization table or options pool to hire another employee.

In Silicon Valley, the typical vesting schedule is over four years, with a one year cliff. More notes on stock vesting:

- Startup employees who receive stock options do not receive the stock in one lump sum

- The stock options are vested over a certain period

- The purpose of the vesting period is to retain employees

- Vesting Period is typically 4 or 5 years

- Vest on a monthly basis after the 1 year cliff

How do you read a cap table?

The typical capitalization table is a spreadsheet with a list of the investors and equity-holders on the left. The columns across the top will list the type of security/equity (i.e. common stock, preferred by round or class, etc.). The corresponding cells will show which equity owner has what number of that particular share type. There is usually an ungranted option pool amount, and finally, a sum total of the shares outstanding given conversion. There should be calculation of the percentage owned by each entity, which sums up all of their share types, on the far right of the table.

What does a cap table look like?

The output of a typical, detailed capitalization table will be a spreadsheet tab with names of stockholders/investors in the left most column, one listed in each row. The next column(s) will contain the number of shares held of the specific share classes by each investor; common shares, Seed shares, Series A Shares, etc. Don’t forget option holders granted, vested and exercised shares (exercised are usually listed in the “common” column). The next columns will have total shares owned on an undiluted and diluted basis. Then there are ownership columns which show the percent of the company owned for diluted and undiluted ownership. Finally, at the bottom, the last row will summarize the totals for each column.

What is included in a cap table?

You’ll need to include the total shares outstanding, by class, plus information on your investors, founders and other stock holders.

- Names of shareholders

- Number of shares outstanding and authorized (both common and preferred)

- For option and warrant holders, vesting schedule and shares vested

- Percent ownership

- Stock class

- Price per share

- Value

- Date the shares were acquired and cash paid

How do you add a Series A, B or C to the Cap Table?

The right cap table software, like the ones we mention in this article, will make it easy to add VC investors to your cap table after you raise a Series A (or later round). Hopefully you are working with an experienced law firm that has put you into a solid software system for managing your company’s investors, shares, options, etc. If not - the Series A is the time to do it!!!! Don’t delay; mistakes could cost millions of dollars at a successful exit.

Pros and Cons of Cap Table Management Software

Pros

-

Accurate Record Keeping:

- Ensures all changes in equity structure are tracked accurately.

- Reduces the risk of errors and disputes over equity ownership.

-

Compliance:

- Helps meet regulatory compliance related to equity ownership.

- Provides necessary documentation for tax filings and legal documents.

-

Ease of Use:

- User-friendly interfaces make cap table management platforms easy to navigate.

- Many tools offer automated updates and alerts for vesting schedules and other important events.

-

Efficiency:

- Streamlines the process of issuing new shares and managing employee stock options.

- Saves time and reduces the need for extensive legal paperwork and legal fees.

-

Transparency:

- Provides clear visibility into the ownership structure for all stakeholders.

- Facilitates better decision-making and communication with investors and employees.

-

Support for Multiple Securities:

- Handles a wide range of equity instruments, including preferred stock, warrants, SAFEs, convertible securities, and options.

- Ensures compatibility with various types of funding rounds and compensation structures.

-

Investor Relations:

- Simplifies investor reporting and improves transparency in investor relations.

- Assists in planning for equity grants and equity compensation, aligning with business objectives.

-

Fundraising:

- Enhances the fundraising process by providing potential investors with clear and accurate ownership information.

- Supports various financing rounds, making it easier to manage the complexities of raising capital.

Cons

-

Cost:

- Can become expensive, especially as the company grows and the number of stakeholders increases.

- Higher-tier plans with advanced features may be cost-prohibitive for early-stage private companies.

-

Complexity:

- Some software may have a steep learning curve, especially for those unfamiliar with equity management.

- Advanced features like scenario and exit modeling can be overwhelming and unnecessary for many startups.

-

Dependence on External Providers:

- May require coordination with law firms and other external advisors who are familiar with the software.

- Limited compatibility or preference for specific software by legal advisors can restrict choice.

-

Vendor Lock-in:

- Switching providers can be challenging and time-consuming due to the complexity of migrating data.

- Long-term contracts and reliance on a single provider can limit flexibility.

-

Limited Utility for Very Early-Stage Startups:

- Basic needs can often be met with simpler tools like spreadsheets in the initial stages, although the leading providers’ free plans make this less of a con.

- Advanced features may not provide significant value until the company reaches a larger scale.

Conclusion

Choosing the best cap table management software is critical for managing your startup’s equity structure. A robust equity management platform helps streamline the process of issuing equity, managing employee stock option plans, and preparing for liquidity events. By weighing the pros and cons, startup founders can make an informed decision that aligns with their business objectives and supports their growth through various funding rounds.

Why do CPA firms want access to the capitalization table?

Your cap table management software isn’t just for keeping your investors and option holders happy - it also helps your accountants. Here are the reasons that your CPA firm has been requesting access to your cap table:

- To reconcile it - see below, this can be a huge issue if a wire bounced or if an investor sent an incorrect amount of money!

- On tax returns - tax agencies want to know who owns your startup. Your accountant usually needs to provide a list of the largest owners, such as the founders and major investors, on tax returns.

- For other tax calculations - (this is really reason 2a) lots of state tax agencies need to know things like share count (think of the Delaware franchise tax calculation, for example), or ownership percentages.

If you don’t provide access to your cap table software to your accountant, a December 31 download will usually suffice. However, having direct access to the cap table management system is very nice for the accountants, so that they can easily look up information that tax authorities may require on forms, such as investor addresses, etc.

Don’t forget to reconcile your cap table!

This is a pro-tip for companies that are raising venture capital (and especially raising seed financing) - don’t forget to reconcile your cap table! Your cap table software won’t do this for you, ask your accountant to do this (if they don’t do it automatically after you’ve raised). This is a service that we regularly provide for our clients after they’ve raised a funding round, and it matters because if you don’t it’s possible that an investor’s wire may have not come through, meaning you don’t actually raise as much capital as you sold! Basically, your accountant will review your cap table line by line and match them the stock purchase agreements and the bank account wires to make sure all the money you are supposed to have raised has arrived. We have a blog post on how to reconcile a cap table, check it out.

Do you really need a cap table and expensive cap table management software?

Startups 1) really, really need a cap table and 2) ought to be using software once they’ve raised real money from outside investors or issued stock options to employees. A capitalization table is one of the most important legal and accounting files that a startup has - manage it diligently!

Why a Capitalization Table is Important:

Defines Ownership and Equity: A capitalization table provides a clear visual representation of the ownership structure of a company. It shows the percentage of ownership for each person or investor involved in the company. This is especially useful in cases where there are multiple stakeholders, such as multiple founders or a large number of investors. Having a clear understanding of ownership can help prevent misunderstandings or disputes about who owns what portion of the company. Keeping track of it in a software system that your lawyers can easily access and update is a major way to reduce the changes of a dispute!

Aids in Decision-Making: A capitalization table also determines the voting power of each shareholder, which can be critical in making important decisions about the direction of the company. Most preferred stock - the kind of stock VCs own - has voting rights that are important to track. This includes the preferred stock voting as classes, with the ability to accept or reject mergers, fundraises, debt, even CEO pay. You need to know who owns what.

Plans for Equity Grants: A capitalization table is a useful tool for planning future equity grants to employees or new investors. It allows a company to see how much equity is available and how it should be distributed. This information is critical in making informed decisions about how to allocate equity, which can have a significant impact on the company’s future. And options pools are a secret way that VCs negotiate down valuations with founders (read about the option pool shuffle).

Useful for Fundraising: Startups often use a capitalization table to showcase their ownership structure to potential investors. The best cap table software providers offer fundraising scenario planning, which can help founders understand the dilution they will have from various financing strategies. However, these scenario analysis tools are usually only available on the more expensive pricing plans.

Simplifies Share Issuance: When a startup issues new stock to investors or to employees via stock options, a capitalization table makes it easier to determine the impact on the ownership stakes of existing shareholders. This information can be critical in ensuring that founders is aware of how the issuance of new shares will affect their ownership percentage.

In summary, a capitalization table is a critical resource for any company, as it provides a clear understanding of ownership, aids in decision-making, assists with planning for equity grants, is useful for fundraising, and simplifies the process of issuing new shares. It helps ensure that all stakeholders are on the same page when it comes to ownership and equity.

Avoid giving away too much of your company at a fundraise - One tip

When it comes to your startup’s equity, ignorance is far from bliss. One often misunderstood element that can drastically alter your ownership stake is the Option Pool Shuffle. This dance between founders and investors during fundraising can lead to unexpected dilution of your hard-earned equity. That’s why having an organized cap table is not just a convenience—it’s a necessity. Understand how the Option Pool Shuffle impacts your stake and how you can tackle it effectively. The “option pool shuffle” and can reduce founders ownership, and drive a lower effective valuation on the next round.

We’ve created a spreadsheet that you can use to size your option pool here: free option pool sizing spreadsheet.

Here’s how you can add your accounting firm to your Carta account

Carta is a tech firm that specializes in software that manages your startup’s capitalization table and valuation. Most startups that we work with at Kruze Consulting use Carta. But startups need to give their accountants access to their Carta accounts so the accountants can access the information for your tax filings. The steps are:

- Log into your Carta account.

- Navigate to the company tab.

- Click permissions and roles.

- Click on the law firms button (this is important).

- Click add law firm.

- Type in your accounting firm (Kruze Consulting if you work with us).

Your accounting firm will now have read-only access to your capitalization table. Clients often ask us “Why click on law firms?” The reason is that lawyers normally control the cap table for companies, so the software is set up that way.

Now Carta helps founders file 83(b) elections

An 83(b) election tells the IRS that a founder is buying a startup’s stock immediately, locking in the cost basis now rather than later, when it may be worth more money and generate more taxes. The 83(b) election has to be physically mailed to the IRS, and Carta now lets you print out the notification with a cover letter. Founders can specify how much stock they want to buy before printing the notification, and should consult their tax professionals before filing the notification. Carta will provide a tracking number to help you follow the status of your notification with the IRS, and you should make sure you send it via certified mail, so it won’t be lost.

Categories:

Startup Financial SystemsRecent questions

Top viewed questions

- What happens if the IRS audits me and I do not have the receipt for an expense (assuming it was a legitimate expense)?

- How should convertible note financing be handled on the balance sheet?

- How do startups account for equity and fundraising on the Balance Sheet?

- For startups incorporating in Delaware, what firms are good registered agents to use?

- 2025 Founder Salaries by Stage