What founders and investors need to know about the three financial statements.

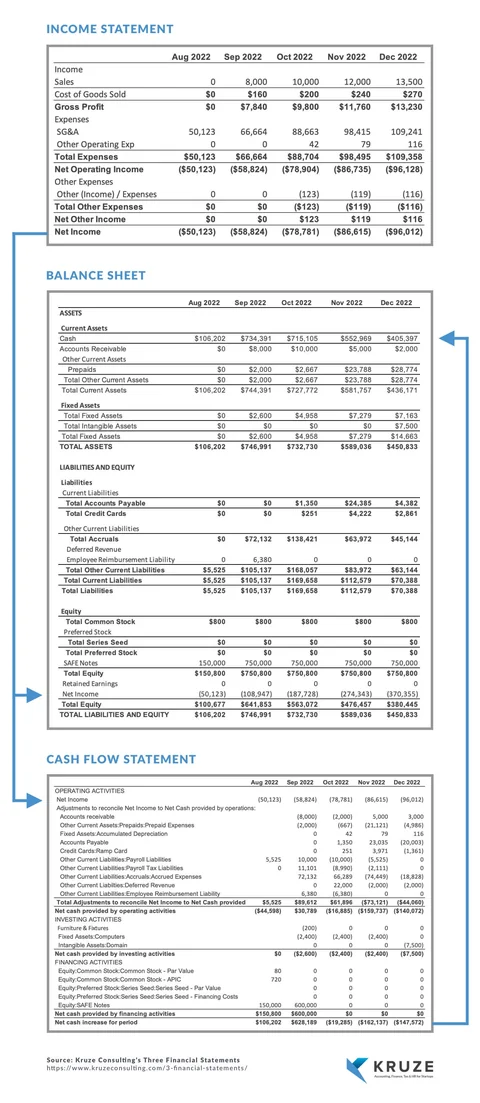

Early-stage companies and investors focus on three main financial statements - the income statement, the cash flow statement, and the balance sheet. VCs expect these financial statements to be produced on an accrual basis - the same basis that the SEC has publicly traded companies use.

As leading startup accountants, we have produced thousands upon thousands of financials for our clients. Feel free to contact us if your startup needs help producing these three statements for investors.

Let’s dive in and explain more about the 3 financial statements most startups need!

The Three Financial Statements

| Income Statement | Cash Flow Statement | Balance Sheet | |

|---|---|---|---|

| What is it? | Revenue and Expense netting to profit/loss | Summary of changes in cash | Record of assets, liabilities and equity |

| Most important formula | Revenue - expenses = net income (loss) | + Cash from operating activities + cash from investing activities + cash from financing = cash flow | Assets = liabilities + equity |

| Over a period or snapshot? | Over a period time | Over period of time | Snapshot |

The three financial statements make the most sense when analyzed together. However, the one that VCs are founders are most likely to use - and be familiar with - is the Income Statement.

Income Statement

The income statement, otherwise known as the Profit and Loss (P&L), shows whether a company has a profit or loss over a defined time period. P&L’s are contain information on how much a company is earning from customers - revenue, how much it is spending - expenses, and nets to the income or loss incurred over that period of time.

Basically, the income statement is how much you’ve earned over time and how much you’ve spent to generate those earnings.

Accrual P&L’s account for revenue and expenses as they are incurred, not when cash changes hand. (You can learn more about accrual vs cash accounting and its impact on the 3 financial statements here). Don’t worry - the cash flow statement will help make sense of the movement of cash in a company that’s producing accrual based financial reporting.

What are the formulas on an income statement?

The income statement can be broken down into a series of formulas:

- Revenue - Cost of Goods Sold = Gross Profit

- Gross Profit - Operating Expenses = Operating Income

- Operating Income - Interest Expense = Pre-Tax Income

- Pre-tax Income - Income Tax = Net Income (or Net Loss)

An even more simplified formula for the P&L is:

- Total Revenues - Total Expenses = Net Income (or Net Loss)

Where is EBITDA on an income statement?

EBITDA = Earnings Before Interest, Taxes, Depreciation and Amortization, and it sort-of appears on the income statement of most startups as Operating Income (which, as we mention above is Gross Profit - Operating Expenses. However, it is probable that Operating Income includes depreciation and amortization, therefore it is best practice to calculate it by adding those two items to Operating Income (once you have confirmed that they are included in those figures). Read our entire article on EBITDA here.

Cash Flow Statement

The cash flow statement shows how money (that’s cash!) is moving in and out of the company over a period of time. It’s not as well understood as the Income Statement, and calculating the numbers on it can be confusing for even experienced startup bookkeepers. But the cash flow statement is incredibly useful for investors analyzing companies using accrual based accounting, so all founders seeking professional VC funding should have their accountants produce one.

Before we get into the three main sections on a cash flow statement, let’s discuss how cash moves in a business doing accrual accounting.

Cash flow example

Let’s say a startup sells software to a client – and let’s say they sell a SaaS product for $10,000 a month to that client. The startup recognizes $10,000 in revenue the first month that product is live. However, if the end client takes a month to actually pay the startup, no cash exchanges hands in month 1. Therefore, the startup adds an asset to the balance sheet called Accounts Receivable. This hits the cash flow statement as a USE of cash (in the operating section, to be discussed in a moment). Therefore, at the end of the month, even though the startup recognizes the $10,000 in revenue, their cash position will be $10,000 lower than you’d predict just from looking at the income statement. That’s what the cash flow statement is for, to explain the flow of cash in an accrual based business.

3 Sections of the cash flow statement

The cash flow statement has three sections, the operating section, the investments section and the financing section. Here is what each section does:

- Cash from Operating Activities is cash produced (or consumed) by normal business operations, like selling products or services.

- Cash from Investing Activities is cash produced from the purchase or sale of long term assets, like the purchasing of computers or manufacturing equipment, and other investment activities that the startup undertakes.

- Cash from Financing Activities is cash created by equity or debt financing that funds the business’ balance sheet – and the payback or pay down of equity and debt. VC backed startups will see this section explode when they raise a round of financing.

This makes the cash flow statement one giant formula that shows the cash the company uses or creates:

Beginning Cash Balance + Cash from Operating Activities + Cash from Investing Activities + Cash from Financing Activities = Ending Cash Balance

The top/starting point of the cash flow statement is the net income from the company’s income statement. And the change in cash flows to the balance sheet (and many of the items in the three sections to this financial statement come from the balance sheet changes).

Balance Sheet

The balance sheet is the financial statement that provides a one-time snapshot of a company’s financial position at a specific point, unlike the income and cash flow statements which show financial information over time. It’s the place to look to understand how much cash a company has, or how it has been financed.

This financial statement balances the company’s assets against liabilities and equity. This equation is called the “accounting equation” and is:

Assets = Liabilities + Shareholders’ Equity.

Assets can include cash, accounts receivable, inventory, and fixed assets like buildings and equipment. Liabilities encompass what the company owes such as accounts payable, debt, deferred revenue and accrued liabilities. Shareholders’ equity encompasses stock and retained earnings. Note that SAFEs are considered equity, whereas convertible notes are considered debt on the balance sheet.

How the three financial statements flow together

The three financial statements are connected – together they represent the financial metrics of the business, and each has an impact on the numbers presented on the others. The item that is easiest to follow across the three statements is Net Income.

- Net Income from the income statement shows up at the top of the Cash From Operations section in the cash flow statement.

- The cash flow statement adjusts Net Income to reflect the actual cash collected through the operating activities section, the investments section, and then the financing section.

- Net Income from the income statement is incorporated into the Retained Earnings section of the balance sheet, causing the Equity amount to be adjusted up or down – this balances the balance sheet, if done correctly.

Cash also flows from the cash flow statement to the balance sheet. And non-cash items from the balance sheet flow from the balance sheet to the cash flow statement.

Wait, isn’t there a 4th financial statement?

Yes, you got us! If you read the SEC’s information on the main financial statements, you’ll see that they reference a fourth statement that public companies are required to report –the statement of shareholder equity. It shows the changes in equity ownership over time. Startup investors and founders use a cap table, produced out of specialized software, to manage this information.

Although, when a tech company is getting ready to go public it should start producing this report. There really is no need for an early-stage startup to produce a standalone statement of shareholder equity following GAAP rules.