What is a Balance Sheet?

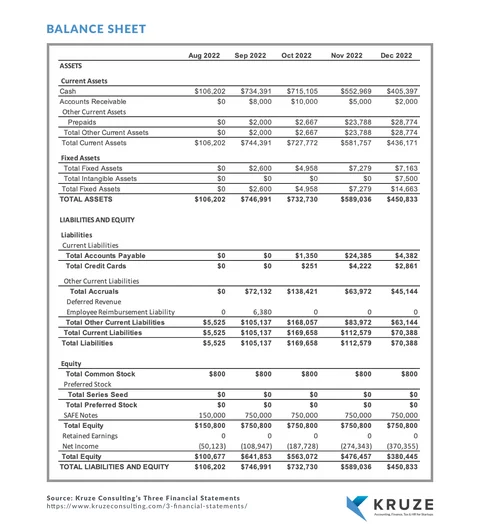

A balance sheet is one of the three core financial statements for a corporation, and it acts as a snapshot of all of your startup’s assets, liabilities, and shareholder equity at a single moment in time. The three statements are informative tools that founders, venture capitalists, investors, and lenders can use to analyze a startup’s financial health. The formula for a balance sheet is: assets = liabilities + equity. That’s why it is called a “balance sheet,” because it should be balanced! And that equation is called “the accounting equation.”

The accounting equation provides a snapshot of what a company owes and what it owns, as well as the amount invested by shareholders. You, and your investors, can see easily what your startup’s financial position is at a particular time.

What is the Accounting Equation?

This equation underpins the entirety of double entry accounting, which is the idea that for every credit there needs to be a corresponding debit (check out our video on double entry accounting to learn more on that topic).

The accounting equation is:

Assets = Liabilities + Equity

It’s that simple.

How do accountants use the accounting equation?

You will see the accounting equation at work on the balance sheet example below. When your startup gets its monthly financials you’ll see the company assets and the liabilities + equity. The accounting equation says those two must balance, and that’s the foundation of the balance sheet.

Here is a real world example of how the accounting equation works on a balance sheet. Say you own a software company and you sell a one year subscription to a service. You will collect all of the payments for this service in advance, meaning your cash on the asset side will go up and then, on the liability side, your deferred revenue will go up by an equal amount. It is a really simple example, but that’s how the accounting equation works.

What’s Included in a Balance Sheet?

A balance sheet includes the following information, and the items it reports should all correspond to the accounts listed in your chart of accounts.

Assets

The assets section of the balance sheet itemizes the things of value that your business owns. Generally, the items are listed in order of liquidity, so the first things you’ll see are the items that can easily be converted to cash. The assets portion can include:

Short-Term Assets

- Cash and Accounts Receivable. Cash and accounts receivable are your most liquid assets, your startup’s lifeblood. Cash is how you pay your employees and all of the vendors that work for you, so this is a very important category for any startup. Accounts receivable includes money that your clients and customers owe you, and can be converted into cash very quickly, because most companies collect on a certain schedule.

- Pre-paids, Deposits & Inventory. Other short term assets include pre-paid expenses, which are things you’ve already paid, like rent for offices or insurance. Sometimes startups have to pay deposits in advance when ordering inventory or other items. Inventory, for startups that sell physical goods, includes both finished products and raw materials. These items all have value, and it’s common for them to be paid for in advance. So they sit on the asset side of your balance sheet.

Long-Term Assets

Long-term assets are items that typically won’t be converted to cash within a year. Long-term assets can include:

- Fixed Assets. These are typically things like equipment, parts, or the machinery you use if your startup manufactures other products. Other fixed assets are things like computers, buildings, or property.

- Long-term securities. These are investments that can’t be sold within one year, like stocks or bonds.

- Intangible assets. Intangibles are non-physical items that have value, including licenses, copyrights, franchise agreements, patents, or intellectual property (IP).

Liabilities

The next part of the balance sheet lists liabilities, which are the money your startup owes to others. Some types of liabilities are:

- Accounts Payable. These are short-term obligations owned to creditors, suppliers, or other vendors, which you haven’t paid yet. For example, you would typically pay the vendors that work for you every month on a 30-day cycle – those are accounts payable.

- Deferred Revenue. Deferred revenue is a somewhat surprising liability shown on the balance sheet. SaaS companies typically collect cash from an annual deal upfront, but they can’t recognize all that revenue immediately. This means they have to offset that cash collection with deferred revenue, the liability of which goes down over time as the company delivers a service. It may seem a little counterintuitive that you would have a liability for that, but it makes sense when you talk it through with a good accountant, like Kruze Consulting.

- Short- and Long-Term Liabilities. Long-term liabilities are debts that extend beyond 12, and for startups specifically, it’s usually either venture debt or convertible notes. Long-term debt or convertible debt, that will convert into equity over time, is typically presented under long-term liabilities. Short-term liabilities are financial obligations that are expected to be paid off within one year. A common type is a short-term bank loan, which might have been used to fill a gap between financing rounds. Taxes can also be considered a short-term debt, particularly if a startup owes quarterly tax payments that haven’t been made yet.

Equity

Equity (also called shareholders’ or stakeholders’ equity) can include several components. Common ones are:

- Share Capital. These are amounts received by the startup from transactions with its shareholders. Corporations can issue either common stock or preferred stock. In the event the company is liquidated, common stockholders can only receive payments after preferred stockholders are paid.

- Retained Earnings. Retained earnings are any business profits that are invested back into the business. Retained earnings can be used to fund working capital, purchase fixed assets, or make debt payments, among other things. A lot of startups lose money every year, so retained earnings are typically negative and offset some of the equity that you have raised. However, some startups are profitable over time, so they have a positive entry in retained earnings.

- SAFE Notes. These are being a preferred way to invest in startups, and simple agreement for future equity (SAFE) notes allow investors to purchase equity in a startup at a negotiated price now, and the investor will receive the equity at some point in the future – normally when the startup next raises capital. They’re technically equity, not debt, and that’s how we account for SAFEs on the balance sheet.

Balance Sheets and your Chart of Accounts

The chart of accounts (COA) serves as the foundation of a company’s financial statements, including the balance sheet. It is essentially a categorization scheme that assigns a unique number to every financial transaction within the company’s ledger.

Understanding the Chart of Accounts

The chart of accounts is divided into several segments to cover the entirety of a business’s financial transactions. For a balance sheet, these segments primarily include Assets, Liabilities, and Equity. Each category within the COA is assigned a series of numbers, which helps in organizing financial information efficiently and effectively. Here’s how they typically break down:

- Assets (1000 - 1999): This range covers what the company owns. It includes both current assets (cash, accounts receivable, inventory) and fixed assets (property, plant, equipment).

- Liabilities (2000 - 2999): These numbers represent what the company owes. This category is broken down into current liabilities (accounts payable, short-term loans) and long-term liabilities (mortgages, long-term loans).

- Equity (3000 - 3999): This section covers the owners’ claims after liabilities have been settled. It includes retained earnings, common stock, preferred stock, and possibly more, depending on the company structure.

How Are Balance Sheets Used?

Since the balance sheet gives you an all-inclusive snapshot of data, there are multiple ways you can use it to analyze a startup’s financial position. Remember - startups are different than traditional businesses, so the metrics used are pretty different from what a ‘regular’ business might need to analyze. (We’ve included notes on those metrics as well below just in case your startup gets profitable and has debt financing!)

What VCs Look for on a Balance Sheet

What investors want to know on the balance sheet

- Cash and Change in Cash over Time as proxy for cash burn rate

- How the business has been financed

- Inventory (for certain industries)

- Are customers paying?

- Is Accounts Receivable building up?

- Are collections poor?

- Are there a lot of Liabilities – like unpaid vendors, etc.

- Does the company have too much debt?

Traditional Businesses Balance Sheet Metrics

Traditional businesses have balance sheet metrics related to 1) how the company can support its debt load; and 2) how the company produces financial returns for its equity. We’ve included these ratios here, even though they are not all that important for most VC backed startups.

Financial ratio analysis uses formulas to determine the financial health of a company and its operational efficiency. Common ratios include:

- Debt-to-Equity Ratio. This measures the degree to which a startup is financing its operations through debt and is calculated by dividing total liabilities by total shareholder’s equity.

- Debt-to-Total Asset Ratio. This shows how much of a startup is owned by creditors and how much is owned by shareholders. It’s calculated by dividing total debt by total assets.

- Current Ratio. This liquidity ratos shows how easily a startup can pay off its short-term debt, and is calcualste by dividing current assets by current liabilities.

- Quick Ratio. With a current ratio, you might not get a clear picture of liquidity since it includes any inventories, which may not be easily converted to cash. The quick ratio is calculated by subtracting inventories from current assets, and then dividing by current liabilities.

- Return on Assets. This measure profit per dollar of assets, and is calculated by dividing net income by total assets.

- Return on Equity. ROE measures the profit per dollar of equity, and is calculated by dividing net income by total equity.

Who Looks at Balance Sheets?

There are basically two situations where people need to see your financial statements: Pitch meetings for venture capital funding, and meetings with your board of directors. Of the two, board meetings will occur more often, usually quarterly or monthly. Your balance sheet helps you update your board on your startup’s financial position and growth potential. If you want to execute any plans, like expansion, budget changes, or fundraising, your board of directors will want to see the numbers that support your initiatives.

Accuracy is critical – you’ll need to have confidence in your numbers. Incorrect or inconsistent financial statements can ruin your fundraising plans and cause your board and investors to lose confidence in you. It’s best to hire an experienced startup accounting firm to make sure everything you’re showing to board members and VC investors is completely reliable.

Our final piece of advice is to never neglect your balance sheet. There are so many things you can do with the information it provides, and it is really important you review it on a monthly basis. Check it regularly and use it effectively.

If you have any questions on balance sheets, startup investing, startup accounting, taxes, or venture capital please contact us.

How do VCs evaluate a startup’s balance sheet?

The balance sheet is one of the most important financial statements that a company produces. So founders should understand which things in particular that a VC is looking at on their balance sheets.

In addition to the income statement and cash flow statement, the balance sheet is one of the three core financial statements a VC will ask a startup to produce. In general, VCs will interact with your balance sheet on one of two occasions:

-

If the VC is already an investor, then they will look at your financial statements prior to every board meeting.

-

When a VC is not yet invested in your startup but they are evaluating you as a potential investment opportunity. they will look at your balance sheet for a snapshot of how your company is doing.

What do VCs Look For on the Balance Sheet?

Here are the key things a venture capitalist will look for on a startup’s balance sheet and why:

Cash & Change in Cash

The first thing that a VC will look at is cash and change in cash over time. Change in cash is a rough proxy for burn rate, but it excludes any sort of financing activities that the company’s carrying out. The cash flow statement is just a moment in time, and is simply the cash a company had on a particular date. So, whatever that cash balance is, the difference between that and the amount before the previous period is how much money has been burned. If the company is financed, they have raised equity financing or, in some cases, debt, then the cash balance can go up. These are all things a potential investor is going to want to know about and will discover from the change in cash over time on the balance sheet.

Equity & Debt

The next place a VC will look is further down the sheet at the equity and debt sections of the balance sheet. This is to help them understand:

- If your startup has raised any equity recently

- If your startup has any debt, or other types of liabilities, that indicate financing

Remember, convertible notes are classified as debt meaning they will show up in the liability section of your balance sheet as debt.

Accounts Receivable

Another fundamental thing a VC will try to understand is if your clients are paying you. On your balance sheet you have what’s called accounts receivable. When you are delivering a service or a product to a client, and they haven’t paid you, you create an accounts receivable asset on your balance sheet. This can build up over time.

Accounts receivable is not an uncommon thing to have, but, as a potential investor, VCs want to check and make sure that customers are valuing the service or good that the startup is providing enough to pay for it in cash. Therefore, a VC will check the accounts receivable to see if they are building up.

Deferred Revenue

On the other end of the spectrum, the next thing a VC will look for is deferred revenue. Deferred revenue is a customer prepayment for your startup’s product or service. We see this happening a lot with SaaS businesses where a client has signed a 12-month contract and has paid upfront for it. That prepaid cash comes into the business and is known as deferred revenue.

A VC will see deferred revenue on the cash side of the balance sheet, but it balances down on the liability side, and VCs will love to see it. Having deferred revenue means that clients love the startup’s product enough to pre-pay for it. That is phenomenal.

Deferred revenue is a great way to finance a business, which makes it an exciting indicator of how a company is doing. VCs will definitely look at deferred revenue and, if you have it, that is something you want to gently brag about.

Inventory

Another thing VCs might look at is inventory. Some companies, such as hardware startups or e-commerce vendors, will most likely have inventory. Inventory uses up cash, which makes it a key thing for VCs to look at.

If you spend money to purchase inventory, a VC will want to understand how that cycle works if they are going to finance your business as an investor. The balance sheet is a great place to figure that cycle out.

Debt

Finally, a venture capitalist is going to look to see if your startup has a lot of debt. This is because a lot of VCs don’t like to come in and finance a company with equity when that money is just going to go straight back out of the door to pay off debt.

It is not necessarily a bad thing to have debt as an early stage company, but you want to be aware of what you are doing with your cash when you are in debt.