Cash flow statements are one of the three major financial statements that startups should produce regularly (the other two are the balance sheet and income statement).

The cash flow statement shows if a startup is managing its cash wisely, and summarizes the total amount of cash that goes into and eventually leaves a startup company.

Since VC backed startups should be using accrual accounting, the cash flow statement becomes quite important. It lets founders (and investors) know which activities are generating cash, which are using cash and how the company’s cash balance has trended historically. And for companies that have put together 3 statement financial models, it explains how the company will use cash and produce cash, plus where it will get investment dollars.

Since careful cash management is crucial to any startup’s success, you can see why a cash flow statement is important to founders and CEOs. In addition, we recommend founders have all three financial statements if they’re seeking venture capital or securing debt funding, at least beyond the pre-seed or seed stage.

What’s included in a cash flow statement?

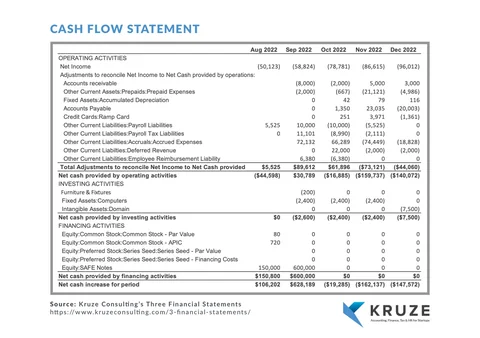

The cash flow statement follows the movement of cash and cash equivalents in and out of a startup. The statement includes three areas of the company that generate cash:

- Operating Activities. Cash from operations is the amount of money that a startup generates or uses by carrying out its business activities over a period of time. This includes things like accounts receivable and payable, accrued revenue and expenses, deferred revenue, and tax liabilities, all of which increase or decrease the amount of cash a startup has on hand.

- Investing Activities. Any cash that comes from buying or selling long-term assets and other investments is included in cash from investing activities. Buying or selling property or equipment to build a product falls into this category, as do any payments related to mergers or acquisitions.

- Financing Activities. Cash from financing activities includes venture capital financing or debt financing. Basically, it’s the money you get from securing venture financing, and the money you’ve spent to pay off any of that financing.

What are the formulas on the Cash Flow Statement?

The statement starts with the company’s net income, from the income statement. It then adds/subtracts the operating activities section to arrive at net cash flow from operations. Next, movement in cash from the investing activities section is added and subtracted to produce the cash provided by investing activities. Then the cash flow from financing activities is calculated. Finally, this arrives at the next increase or decrease in cash for the period.

- Operating calculations: Net Income + Non-Cash Expenses - Changes in Working Capital = Net Cash Flow from Operating Activities

- Investing calculations: Cash Inflows from Investing Activities - Cash Outflows from Investing Activities = Net Cash Flow from Investing Activities

- Financing calculations: Cash Inflows from Financing Activities - Cash Outflows from Financing Activities = Net Cash Flow from Financing Activities

- Net cash flow calculator: Net Cash Flow from Operating Activities + Net Cash Flow from Investing Activities + Net Cash Flow from Financing Activities = Net Increase/Decrease in Cash

Some statements will also show the ending cash position. This calculation takes the prior period’s ending cash balance and adds the Net Increase/Decrease in Cash to arrive at the new, ending balance.

How do startups calculate cash flow?

There are two methods for calculating cash flow – direct and indirect.

- Direct method. The direct method uses actual cash inflows and outflows to determine the changes in cash over the period. It’s a summary of the cash a startup pays or receives. Receipts and payments are netted to arrive at the actual cash a startup has on hand at a given time. This is also known as the income statement method. We do not recommend this method, as VC-backed startups should follow accrual accounting. The next method uses accrual accounting:

- Indirect method. The indirect method relies on accrual accounting, which recognizes revenue when transactions for goods or services are made, and records expenses as they occur, regardless of when money changes hands. With the indirect method, you start with net income (from the company’s income statement) and then add or subtract non-cash items to reconcile actual cash flows from your operating activities. Items like depreciation, which cuts into earnings but doesn’t use up cash, are added to the cash flow. Items like accounts receivable, which gets booked as revenue but doesn’t provide actual cash, are taken out of the cash flow.

Since most businesses already use accrual accounting (and Kruze recommends that you do, too), it’s easier to prepare an indirect cash flow statement than a direct cash flow statement.

Why is a cash flow statement important?

A cash flow statement shows how your company is spending money and where that money is coming from. Planning for cash flow is critical for startups, and your cash flow statement can help you manage the complex task of tracking expenses, invoices, and sales.

How to use the statement to project cash-zero date

Experienced founders use this statement to understand their burn rate and projected cash-zero date. To calculate a startup’s burn rate and cash out date, start by calculating the burn rate on either a three- or six-month basis. The burn rate can be calculated on an accrual basis or a cash basis. The cash basis burn rate is typically operating cash flow minus investment cash flow. Once you have the burn rate, take the cash balance and divide it by the burn rate. The resulting number is how many months of cash you have left, and the last day of that month is your cash out date.

We have a startup cash burn rate calculator that you can use to estimate this without constructing an entire cash flow statement (although you should still have a CF statement!!!) It’s nested in our startup cash management articles.

Why investors think this is an important financial statement

Cash flow statements are also important for raising venture capital. A potential VC investor will want to know how capital intensive your startup is (how much money you need before your startup becomes profitable). The VCs will also look at things like seasonality of revenue, collection periods, and growth in accounts receivable (to see if customers are actually paying you), which affect how much capital a startup will need to fund its growth.

Don’t neglect your cash flow statement

Knowing how to create and interpret a cash flow statement is essential for startup founders and CEOs. According to CB Insights, running out of cash is the number one reason startups fail. A cash flow statement helps you make important decisions about how you’re spending your venture capital and investing in your startup’s growth, and you need to review it every month. If you have questions about your financial statements, startup accounting, or venture capital, please contact us.