SAFE notes are one of the preferred investing instruments in the startup world. SAFE (simple agreement for future equity) notes are an alternative to convertible notes, and SAFE notes are less complex.

They are basically an agreement that allows investors to purchase equity in a startup at a negotiated price now, and the investor will receive the equity at some point in the future (called conversion). There’s no set time for conversion – it will happen when and if the company next raises capital.

With that in mind, how do startups account for a SAFE note investment? Let’s look at some important accounting points.

A SAFE is equity, not debt

SAFE notes are technically equity, not debt, and we account for them as equity on the balance sheet. This has important ramifications for investors who are trying to take advantage of the Qualified Small Business Stock (QSBS) exclusion. The exclusion can provide significant tax savings for qualified investments that are held for at least five years, based on when the stock was issued.

With SAFE notes, that clock starts on the date of conversion. Recently some SAFE notes have incorporated a debt-like term stating that investors get paid back first, making SAFE notes more of a hybrid security. However, we still classify it as equity.

How do you account for simple agreements for future equity? As equity.

Accounting entries for SAFE investment

When funds come in from a SAFE note, they are added to cash as a debit. We also credit the SAFE notes line item in your balance sheet. Since SAFE notes don’t have a maturity date, they don’t have to be paid back in 12 or 24 months.

Journal entires when a company receives a SAFE

- Debit: Cash (an asset account) to reflect the inflow of funds.

- Credit: SAFE Notes Outstanding (an equity account) to reflect the liability to issue future equity - you may also just call it SAFEs if you have sophisticated investors who know what they are looking at.

SAFE funds on the balance sheet

They sit on the balance sheet in the equity portion until the company:

- Is sold.

- Raises a follow-on round of capital.

Hopefully you don’t incur substantial fund raising costs, like legal fees. After all, that’s the whole idea behind a “simple” agreement for future equity!

However, should you have capital raising costs - the most likely of which will be a legal bill - you will want to capitalize it on the balance sheet instead of running it through the P&L.

This is an important part of the accounting treatment for SAFE agreements that many non-startup bookkeepers will miss.

How to account for a SAFE conversion?

If the company raises another round of capital, the SAFE notes will convert at a predetermined valuation cap or at a discount to the valuation, depending on the round terms and the details of the SAFE. At that point the SAFE note entry will be removed and the amount will be credited to preferred equity.

For example, a startup might have a SAFE note from an angel investor. A year later, the company may raise a Series A preferred round. To account for this event, the SAFE note entry will be removed and moved over to the preferred Series A line item in the equity portion of the balance sheet.

Journal entries for SAFE conversion

Upon the conversion of SAFE notes into equity, typically during a subsequent funding round, the following accounting treatment is applied:

- Remove SAFE Note Entry: The SAFE note entry is removed from the balance sheet.

- Credit Preferred Equity: The amount is credited to the preferred equity line item in the equity section of the balance sheet.

If you have questions about accounting for SAFE notes, please contact us.

SAFE vs Convertible Note

A lot of founders spend time trying to decide if they should use a SAFE or a convertible note for their seed or pre-seed round.

We don’t think accounting considerations should drive this decision - the primary reason for using a SAFE is the lower legal costs and reduced paperwork complexity.

However, a difference between these two instruments is that a convert is accounted for as a debt instrument, whereas a SAFE lives in the equity section of a balance sheet.

The primary reason for using a SAFE is the lower legal costs and reduced paperwork complexity.

Safe Accounting Faq

- Are SAFE Notes Equity?

- Are SAFE Notes Debt?

- Is a SAFE Note a Loan?

- Are Simple Agreements for Future Equity accounted for the same as SAFEs?

- Is accounting for a SAFE easier than accounting for a convertible note?

- What is 'Safe Preferred Stock' on a balance sheet or capitalization table?

- Are SAFE Notes on the Cap Table?

Are SAFE Notes Equity?

Yes. In Silicon Valley, experienced venture capitalists expect to see SAFE notes accounted for as equity on the balance sheet. The Financial Accounting Standards Board (FASB), has yet to address the GAAP issues associated with this early-stage financing instrument. Y Combinator introduced the SAFE note in late 2013 - it’s been long enough, so it’s frustrating that the group in charge of publishing and clarifying GAAP rules (that’s FASB!) has yet to formally address how to put it on the balance sheet.

Since pretty much every company that raises this kind of a financing round expects to go on to raise a traditional preferred stock round from a VC, it makes sense to account for it as the VCs expect, as equity.

Are SAFE Notes Debt?

No, SAFEs should not be accounted for as debt but instead as equity. Experienced venture capitalists expect to see SAFE notes in the equity section of a company’s balance sheet - therefore, they should be classified as equity, not debt. FASB has yet to formally explain how CPAs should account for these instruments under GAAP, so for now early-stage companies should record them as future VCs will expect to see them when the look at your startup’s financial statements.

Is a SAFE Note a Loan?

No, a SAFE note is not a loan or debt, it is accounted for an equity on the balance sheet. Unlike convertible debt - or pretty much any debt, it does not have an interest rate nor does it have a maturity date. VCs expect to see the instrument on the balance sheet in the equity section, so don’t account for it as a loan.

Are Simple Agreements for Future Equity accounted for the same as SAFEs?

Yes, Simple Agreements for Future Equity are SAFEs - the same instrument, just not abbreviated. They are accounted for as equity on the balance sheet. When the Simple Agreement for Future Equity converts to preferred stock, the accounting entries are that the SAFE entry is removed and the amount is credited to preferred equity (ignoring any APIC implications).

Is accounting for a SAFE easier than accounting for a convertible note?

Yes! SAFE note accounting is much easier than convertible note accounting, mainly because converts often have an interest rate which needs to be accrued and calculated for at conversion. Additionally, SAFE notes do not require the same level of paperwork and legal costs as convertible notes.

What is 'Safe Preferred Stock' on a balance sheet or capitalization table?

Occasionally startup attorneys will recommend recording the conversion of SAFEs into preferred equity as “Safe Preferred Stock.” This doesn’t impact the accounting treatment of the SAFE note, but it can add another line to the equity section of the balance sheet and another column to the cap table (to record the preferred shares issued to the SAFE holder upon conversion).

As accountants, we generally defer to the law firm’s opinion on if this is necessary, and we’ve seen lawyers recommend this when the preferred shares held by the SAFE investors have specific rights or preferences, such as specific liquidation preferences or dividend calculations.

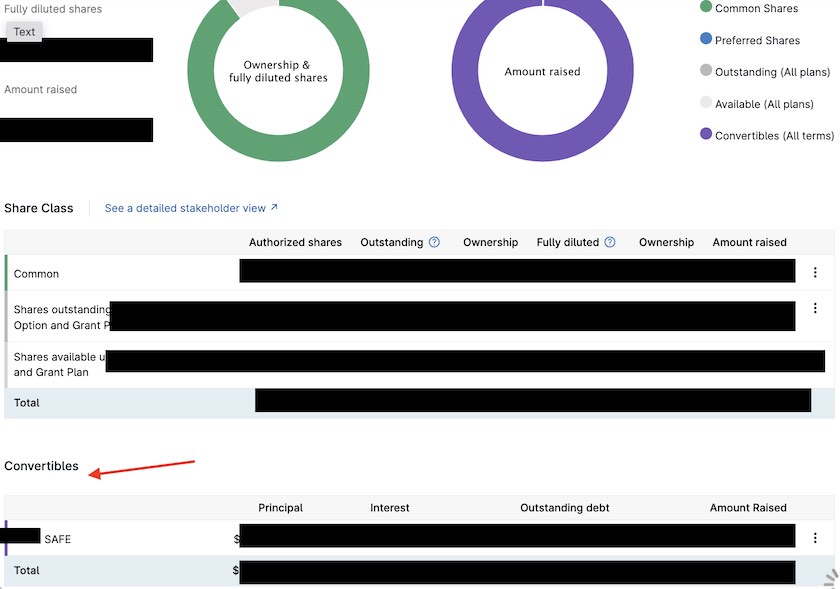

Are SAFE Notes on the Cap Table?

Yes, SAFE notes are shown on a company’s cap table, since they are part of the capitalization. However, they typically do not indicate specific ownership percentages since the price per share and the number of shares are not determined until the notes convert into equity. They are usually listed separately, indicating the investors, the invested amount, and the terms of the security, generally in a convertible instrument section of the table.

A cap table, short for capitalization table, is a detailed spreadsheet or software system that provides a clear visual representation of the ownership structure and the amount of capital that a company raised. It outlines the percentage of ownership, equity stakes, amount invested and shares for each investor or stakeholder involved in the company. Cap tables are particularly important for startups that have multiple stakeholders or have raised capital from outside investors. Companies with convertible instruments need to keep careful track of these on their cap table so that when they convert to equity there are no mistakes (which lead to costly legal bills!).

Important accounting dates for startups using SAFE notes

-

Review key metrics and KPIs

-

Check progress on quarterly goals

-

Begin planning next year’s budget

-

Review compensation and benefits plans

-

Review monthly financial statements

-

Close Q2 books

-

Review cash management strategy and investments