How do you account for payroll Expense (Wages) and payroll Taxes in QuickBooks?

Table of contents

This is one of my favorite dead giveaways that a company has been working with a subpar bookkeeper, and it’s so easy to spot.

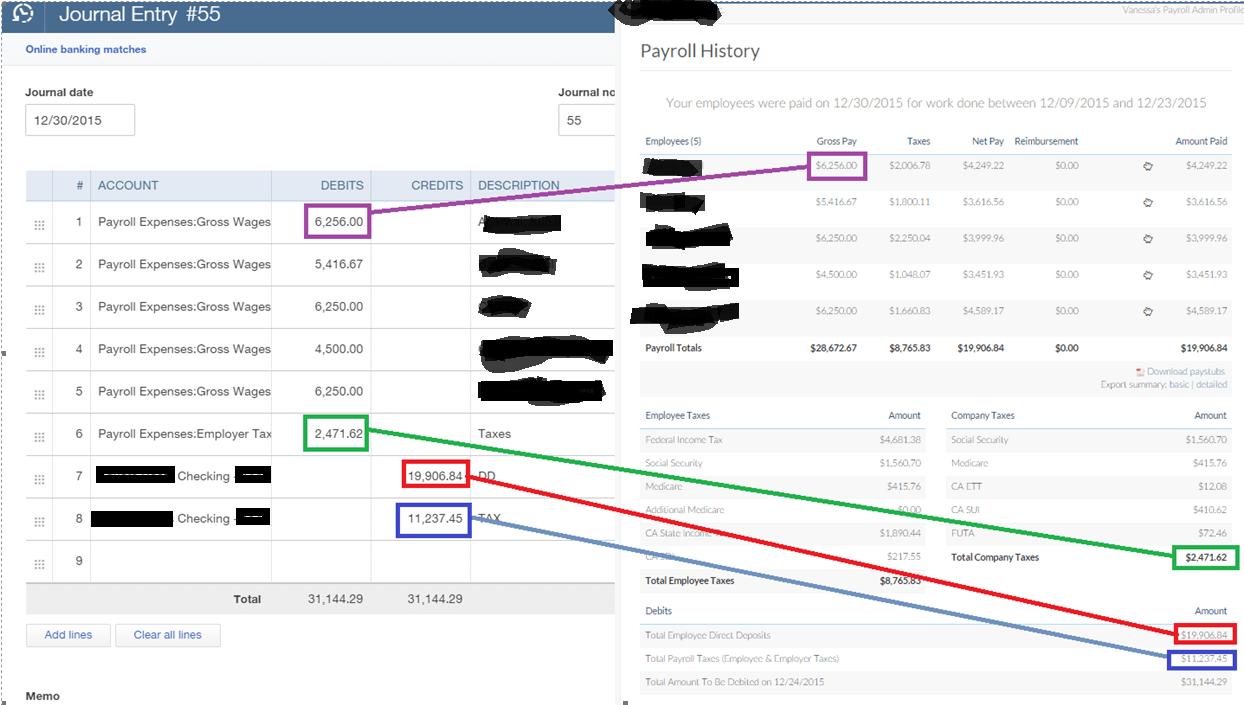

On the P&L, Payroll is shown as “Payroll/Wage Expense” and “Payroll Taxes.” If the ratio of these two number is 9:1, it’s been booked correctly. If the ratio is 6:4, it been booked incorrectly. The reason that this happens is because payroll processors debit the bank account for two amounts, wages and taxes, and they do so in the 6:4 ratio. However, the taxes amount is for both the employer and employees, and the company should report the Gross Wages of the employee and the Company Taxes, as opposed to the Net Wages and sum of Employer and Employee Taxes. If you want to learn more, visit our article on typical startup payroll costs.

QuickBooks Online - Accounting for Payroll Taxes Example

This requires a “Journal Entry” as shown below.

And hopefully you are using what we consider the best accounting software for startups, QuickBooks Online. You can read about why we think this is the right choice for early-stage companies.

Categories:

Startup BookkeepingTable of contents

Recent questions

- Are You Missing Hidden Tax Deductions Because Your Bookkeeping Isn’t Up-to-Date or Detailed Enough?

- How Does Modern Bookkeeping Automation Improve Cash Flow Visibility and Support Smarter Business Decisions?

- What Bookkeeping Strategies Can Help a Fast-Growing Startup Maintain Accurate Financials Without Slowing Down Innovation?

- What Is Net Working Capital in M&A, and Why Does It Matter for Deal Value?

- How Can Startups Identify and Track Sales Tax Nexus Across Multiple States to Ensure Full Compliance?

Top viewed questions

- What happens if the IRS audits me and I do not have the receipt for an expense (assuming it was a legitimate expense)?

- How should convertible note financing be handled on the balance sheet?

- How do startups account for equity and fundraising on the Balance Sheet?

- For startups incorporating in Delaware, what firms are good registered agents to use?

- 2025 Founder Salaries by Stage