Why Does Good Accounting Matter For Ecommerce Companies?

Of all the online business models, eCommerce is perhaps the most complicated. From inventory management to understanding the relationship between marketing spend and shopping cart size, eCommerce business founders have a ton on their plates.

And the numbers behind the business are critically important, helping founders avoid cash crunches, unwanted excess inventory, unexpected return ratios and more.

Here are some of the reasons an eCommerce business needs great accounting:

- The right numbers help founders understand how the business is doing financially

- Executives make better decisions when they use credible data

- Projecting working capital changes helps keep the business from going “upside down” - even profitable companies can go bankrupt if the timing of their cash flows are incorrectly managed!

- Sales taxes and state and federal taxes require correct numbers

When Does A Funded Startup Need To Start Worrying About Doing Bookkeeping?

If you haven’t been keeping track of your books by the time you raise your first outside money, you need to get your books in order.

We generally recommend that businesses move away from spreadsheets and into an accounting software as soon as possible.

- Day one you start the company and start a bank account.

- Connect that bank account to QuickBooks.

- Start getting the bank feed going into QuickBooks and actually characterize the transactions inside of QuickBooks.

What Financial Statements Do Ecommerce Companies Need?

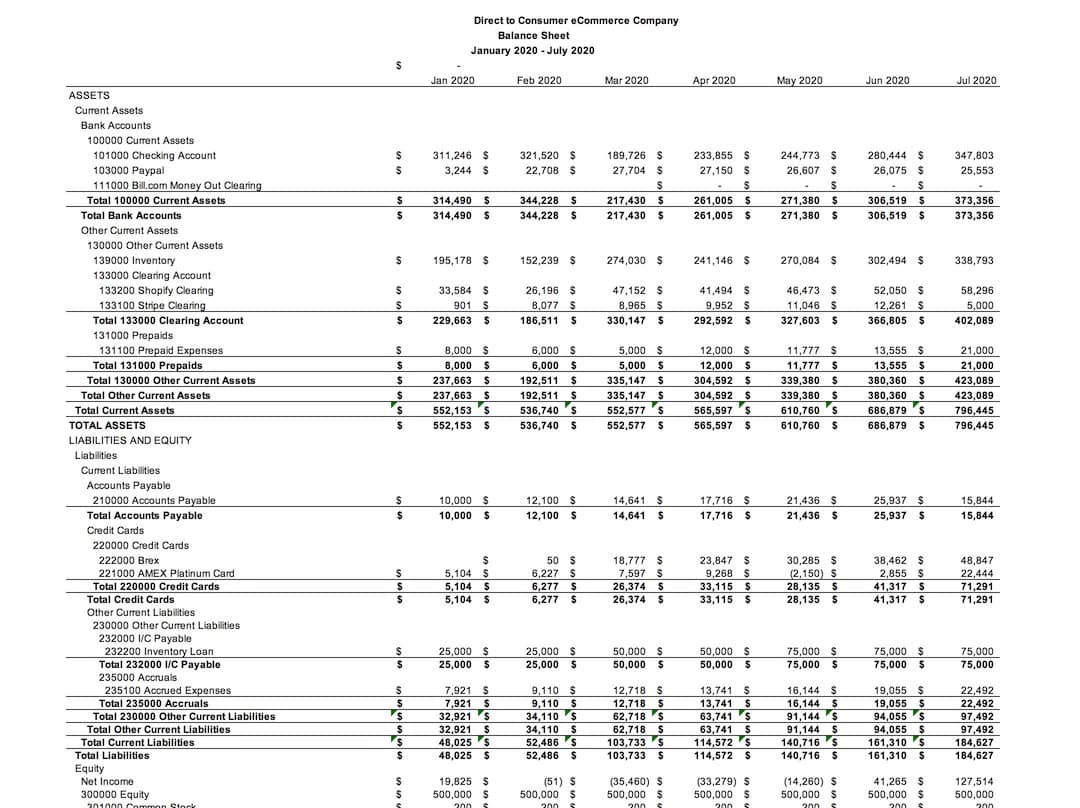

We recommend that eCommerce companies produce three major financial statements - every month. These are the Income Statement, Cash Flow Statement and Balance Sheet.

And the numbers behind the business are critically important, helping founders avoid cash crunches, unwanted excess inventory, unexpected return ratios and more.

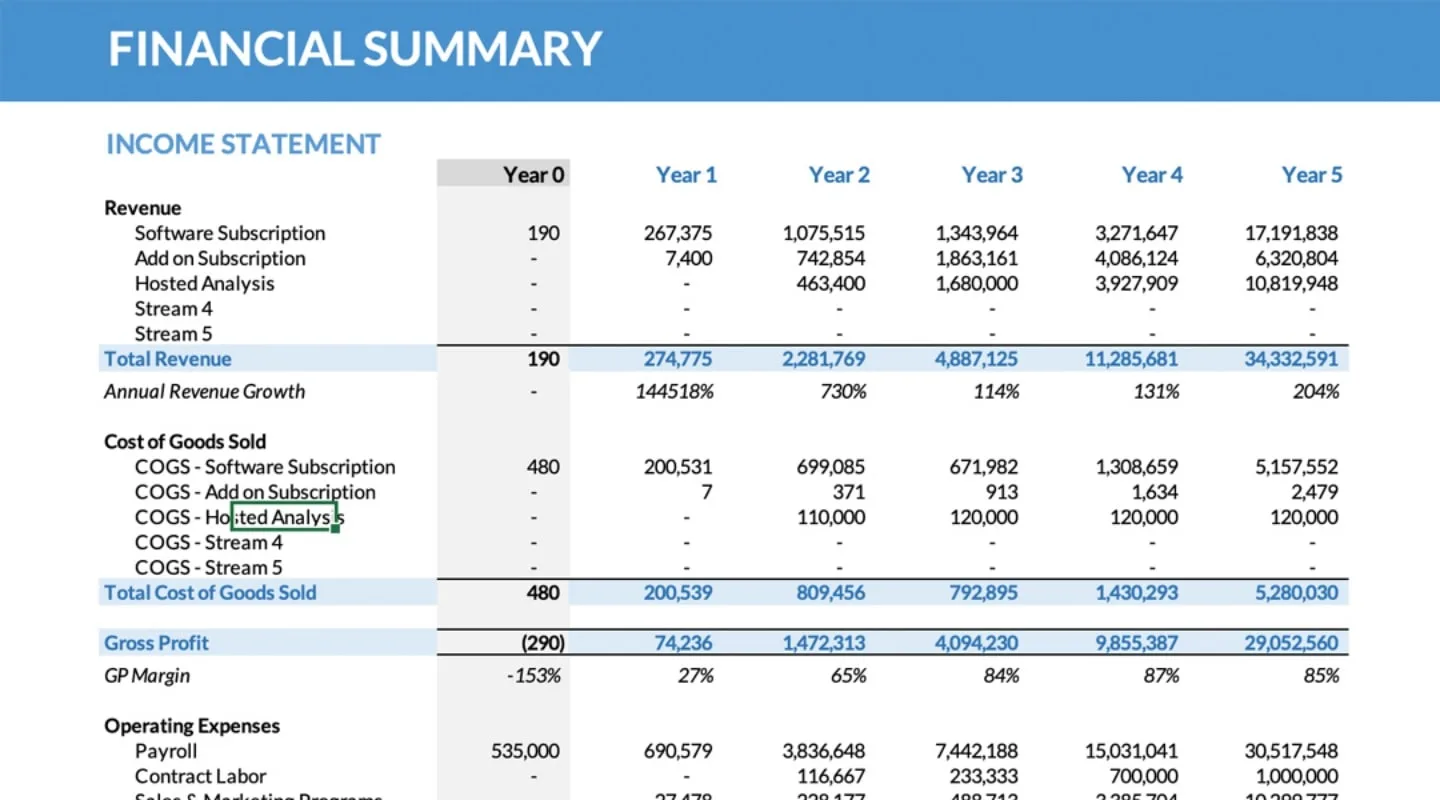

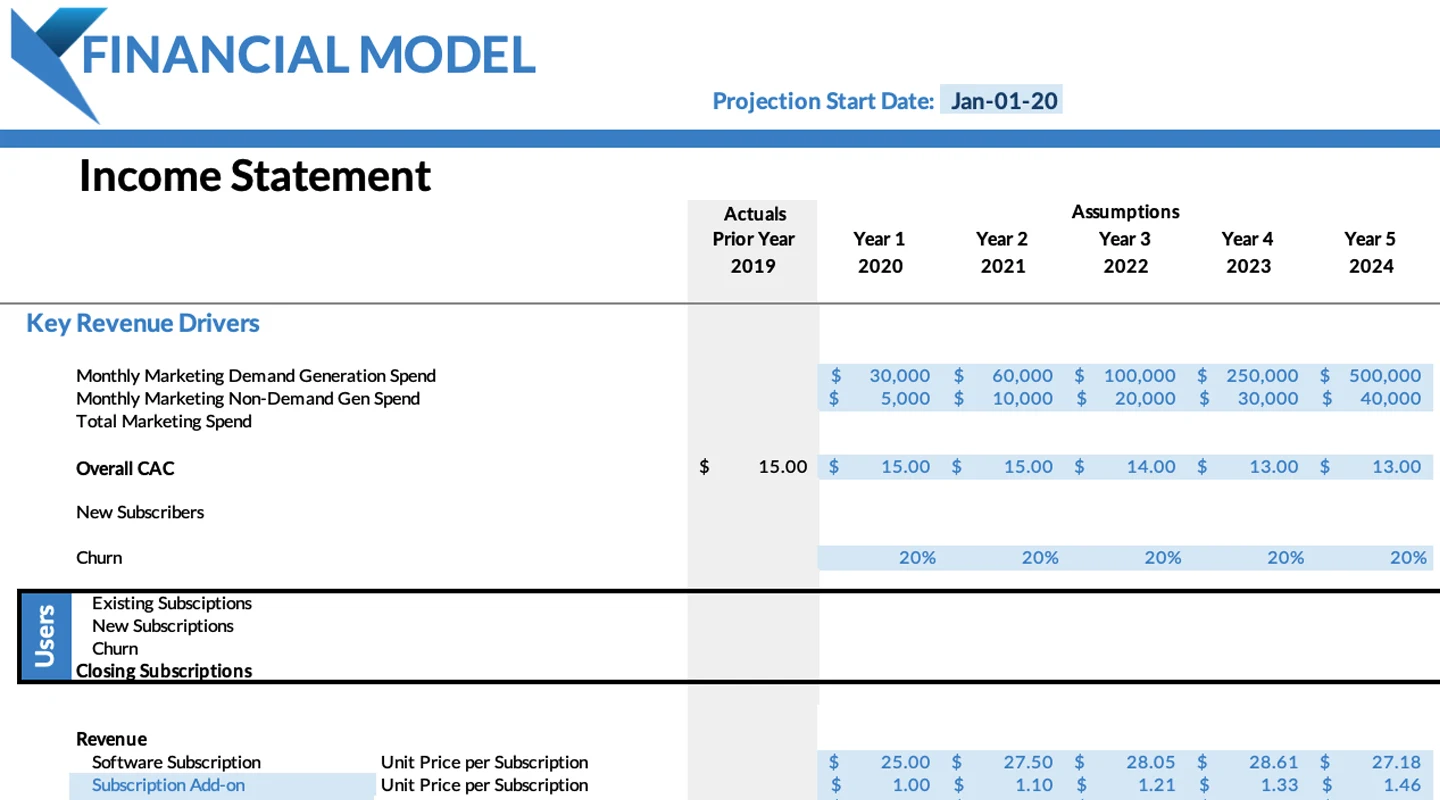

The income statement shows the company’s:

- Revenue

- Cost of Goods Sold (COGS or COS)

- Gross Profit (Revenue - COGS)

- Operating Expenses

- Net Profit

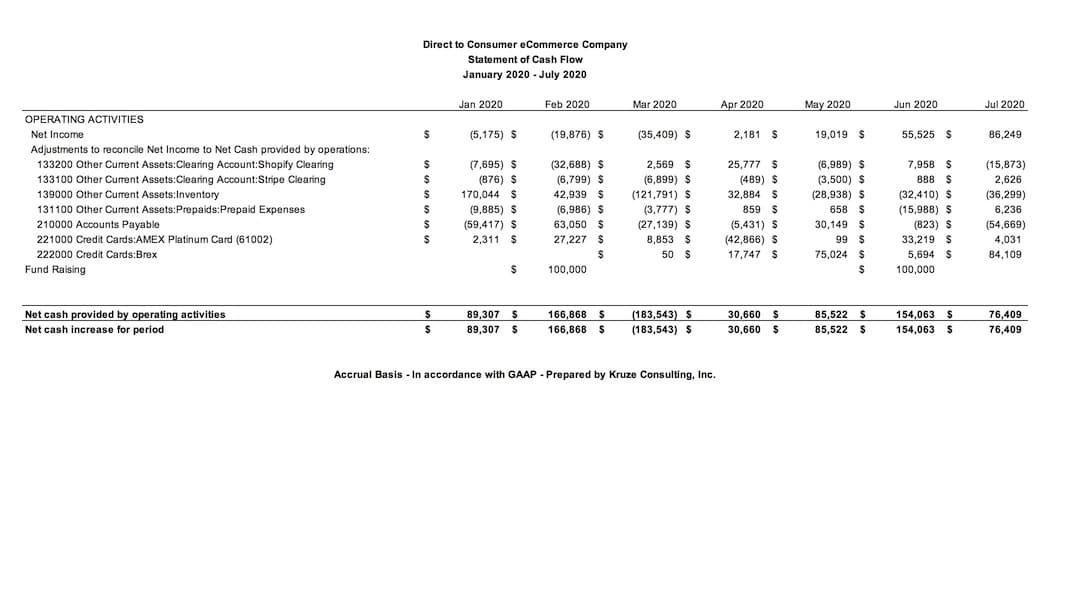

The cash flow statement shows the company’s:

- Changes in Inventory

- Other working capital changes (like changes in payables)

- Operating income

- Investments in equipment

- Capital raises and loan paydowns

- Net cash flow / change in cash position

The balance sheet shows:

- Assets

- Cash

- Inventory

- Accounts Receivable

- Other assets like equipment, buildings, etc.

- Liabilities

- Accounts Payable

- Sales Tax

- Credit Card liabilities

- Loans

- Equity

- Invested equity

- Retained earnings

5 Things That Make Ecommerce Accounting Difficult

- Sales tax

- Inventory

- Start Gross vs net revenue and accounting for returns

- Start Understanding gross profit - fulfillment, shipping costs; other costs by 3rd party manufactures or fulfillment; tying inventory to sales to understand COGS; customer service costs

- Start High transaction volume can make doing accounting difficult and complex

- Start BONUS: Advertising costs and ROI on investments

What To Look For In An Ecommerce Accountant

Startup, early-stage and fast growth eCommerce businesses need more than just a “bot” bookkeeper - they need a real accountant who understands their working capital needs and growth plans. High-growth online retailers and DTC companies often have thousands of transactions. Little errors can grow into big problems if not caught early. And just because an accountant has experience with other tech business models like SaaS or Biotech does NOT mean that they are ready to handle eCommerce.

Kruze’s accounting and bookkeeping team combines experienced eCommerce accountants with industry leading - and custom built - accounting software. Kruze’s team automates everything that makes sense, but each of our clients gets an experienced, US-based accountant to look over the financials every month and catch any issues as they arise.

Kruze Consulting leads the way in technological innovation, offering clients the most advanced automated fintech and accounting tools. By leveraging artificial intelligence, we enhance processes and streamline financial analysis.

Our CPAs blend extensive tax expertise with state-of-the-art technology to deliver outstanding accounting, finance, and tax services tailored for startups. At Kruze, we don’t just use advanced tools like AI; we are pioneers in introducing and integrating these innovations to benefit our clients.

We believe that it’s our team’s job to help save our CEOs time and take care of the basic bookkeeping tasks that other services dump onto their clients. Unlike other startup bookkeeping services, our team deals with the complexities of online business’ financials, and sets you up with clean financials that you can use to make ROI decisions and raise outside venture capital.

Ready to work with experts?

Ecommerce Sales Tax

Sales tax has always been a really important revenue stream for states, but eCommerce companies were more or less exempt for the most part. However, a couple of years ago, the Supreme Court made a decision that changed all that - and today, many smaller ecommerce companies will now owe sales tax in multiple jurisdictions.

The big thing is to be aware, and in order to do that D2C companies will want to do what’s called a “nexus study” in each state, and typically, all that requires is again that asset, people, property test. But also, you want to break out your revenue by state and basically show your accountant so they can help you decide if your company will owe tax.

At Kruze we do this, at Kruze, we have a dedicated sales tax team that this is just what they do. So they’re pretty good at it. And they’ll look and see and look at the laws in different states and the thresholds and figure out if you have to file and pay taxes in those states.

Each jurisdiction has different thresholds to determine if any sales tax is owed. Because this can get pretty complicated quickly, we usually recommend choosing a sales tax software to help make the recordkeeping and threshold monitoring easier. Currently, the top sales tax software companies are Avalara and TaxJar.

Another important reason to work with a good ecommerce accounting service provider is that you want someone who knows your business (and taxes) well enough to alert you if the software is producing strange results. For example, Kruze recently noticed one of the software packages was understating what a company’s revenue was in a certain state - so the tax was going to be lower. But, because we know the client so well and because we know the books so well, we were actually able to figure that out and correct the amount.

And that’s one of those things that if it’s incorrect, it can come back and bite you a couple of years down the road because the states will actually audit your company and audit your records. And there are penalties for underpayment that you want to avoid.

Another thing you need to think about if you’re selling through Amazon, you’re an e-commerce provider and you’re doing the fulfillment by Amazon, Amazon actually will give the records of the states showing what they sold and who the vendors were, like your e-commerce company if you’re using Amazon fulfillment. Even though the sales tax will be withheld at the checkout level with Amazon. So Amazon is submitting these records and also submitting the sales tax. You as an e-commerce company fulfilling through Amazon should also let the states know about that revenue. You don’t actually make the payment because the payment has already been made, but you do need to just let the states know otherwise the states are going to see what Amazon reported and they’re going to see what you reported and see they’re different numbers and they will actually come after you, do an audit and try to get to the bottom of it. So that’s really important. A lot of companies think if they’re fulfilling via Amazon, they don’t have to submit anything but you actually do. Again, a good accounting partner can help your eCommerce company avoid these issues.

Accounting For Shopify Stores

Shopify is a force and the dominant software for the marketplace or for selling goods online - and it seems like new improvements are released every week. Many of our eCommerce clients are on Shopify. Because of this, and the desire to always guide our clients down the path of financial health, our team has come up with the best practices for accounting for Shopify stores.

Good accounting matters for startups. Here are additional helpful accounting tips for Shopify users, including payment methods, sales channel reporting, best accounting software, and more.

Payment Methods Accepted by Shopify

Here is a list of the major payment methods that work inside Shopify.

- Shopify (ShopPay) is the main gateway but is powered by Stripe. So whether you realize it or now, you’re using Stripe when buying through Shopify’s default payment.

- Paypal is a huge payment network and is nice for the end customer.

- Even though Amazon sort of competes against Shopify, Shopify accepts Amazon Pay because so many people have amazon payment accounts. It’s good for conversion.

- Stripe is usually offered in geographies that don’t have Shopify payments. Stripe has more global coverage.

- Affirm lets people pay over multiple payments. Affirm is pretty nice because it’s one of the first options that lets you delay paying everything upfront.

What is the Best Accounting Software for eCommerce Startups?

In our experience, we have found that QuickBooks online is the best accounting software for eCommerce businesses.

The best tech stack that we’ve seen is that clients use Shopify for payment processing/etc., then have QBO as the accounting software. Blue Onion is a nice addition to the eComm tech stack for revenue recognition (so you can get sales by SKU and cost of good sold by SKU). Subscription commerce companies may also benefit from Fathom for subscriber charting. Other payment processing that may be OK are Chargify or Chargebee, although these may lean a bit more SaaS vs. eCommerce. We haven’t seen as much customer happiness with Braintree/Paypal, although some clients do use it successfully.

Not only does QuickBooks online nicely integrate with Shopify, but it integrates with payment tools you may use, such as PayPal, Stripe, and other payment options you may be receiving.

Xero is an alternative to QuickBooks Online, but is nowhere near as powerful and is appropriate for a smaller, 1 to 5 person company.

If you are an eCommerce vendor that keeps inventory, you may want to consider QuickBooks Desktop. There are plugins to manage your inventory in QBO, but they aren’t perfect yet.

Shopify Sales Channel Reporting

Shopify can be used as a one-stop shop to hold all the sales information from your different ecommerce sales channels. It tracks each of the different channels and then puts together a report to give you visibility into how many products were sold via each channel. This can help you improve your ecommerce accounting forecasting, since the added channel visibility is information that may not naturally be captured by our accounting system.

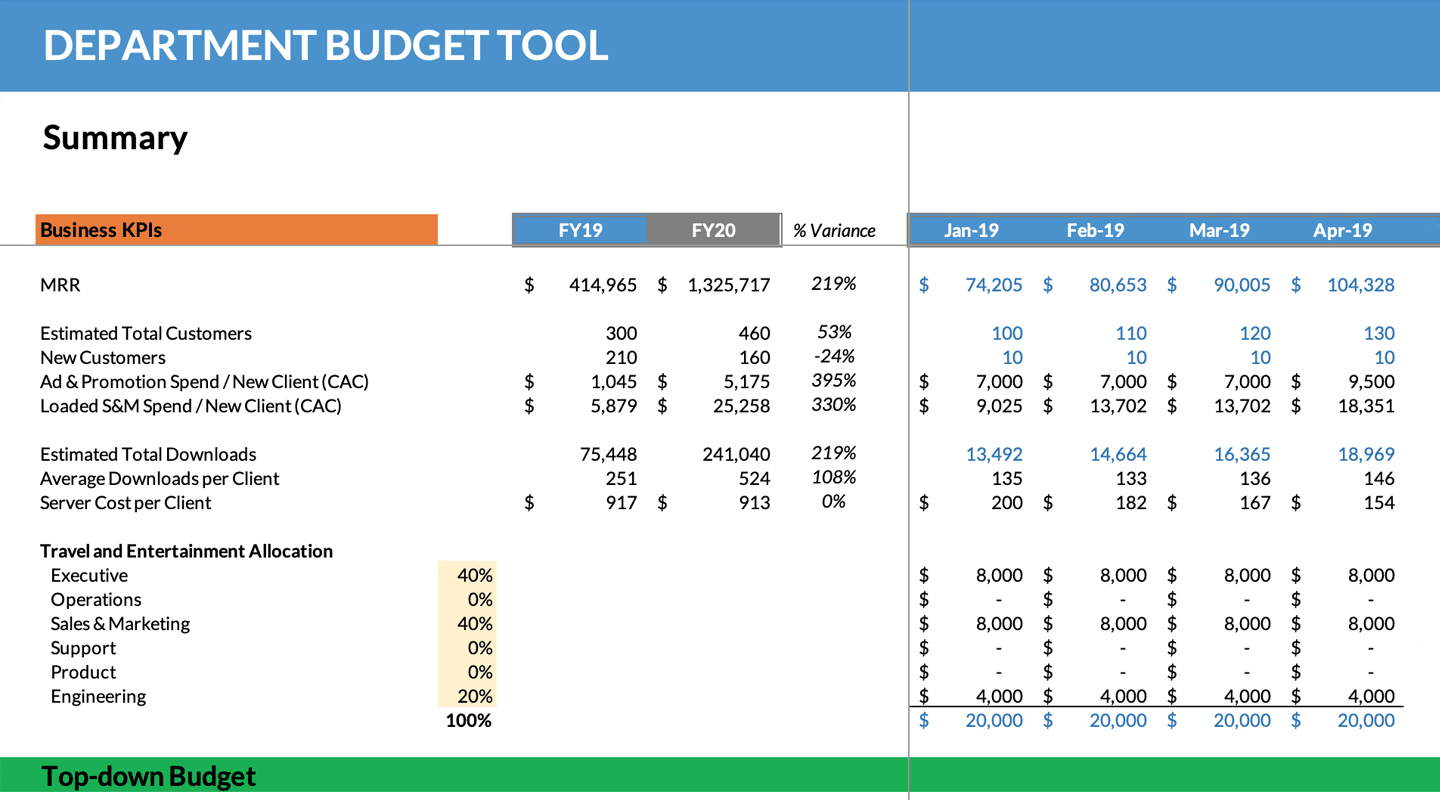

Knowing where your customers are coming from and what and how much they’re buying is important. This will cycle back into what you want to pay on a customer acquisition cost, and what you’re going to pay for advertising to get those customers to your site.

Here is a partial list of what can be connected with Shopify:

- Online Store

- Facebook Shop

- Amazon

- Walmart Marketplace

If you are interested in working with an eCommerce accountant who “speaks” Shopify, consider reaching out to Kruze!

How To Breakout Shopify Fees For Accurate Financials

Shopify is the e-commerce software platform of choice. Everyone’s flocking to Shopify to host their store and make all their transactions easy. In the past, you would have to hack together a website to try to sell products or would have to pay a million dollars for a piece of software to do e-commerce. Nowadays, because Shopify has an accessible price point, and it is really easy to use, there are hundreds of thousands of stores on Shopify. Perhaps, your business is one of them.

It makes a difference to know how to treat the information you are getting from Shopify in your accounting system.

And so let’s walk through it here.

For the vendor, the person that owns the e-commerce site, Shopify is amazing. However, there are a couple of fees businesses have to pay when they use Shopify:

- Platform Fee - It is just the cost of using Shopify.

- Shipping Fee - When you are doing e-commerce, this is the cost to ship your goods.

Both of these technically should be in cost of goods sold, but the way it automatically comes into QuickBooks, it is just like one big bundle of fees. You can’t split them out natively or easily in QuickBooks. You need some more information.

Luckily, Shopify provides an invoice, so you can see the itemized platform fees and shipping fees in your account for every month. What a good accountant would do, like us at Kruze, is we go into that invoice and we break out the platform fees. That is one line item in the cost of goods sold. It is like the software cost to host your store. And then we break out the second line item, which is shipping fees.

Now, those two different sets of fees are going to go in totally different ways. That is why you want to break them out.

This is important so you will have a better view of your gross margin. You will know if you should someday, start using a new shopping platform because it is cheaper, easier or if the shipping fees are just eating into your profits so badly that you are going to have to find another shipping option.

Having visibility on gross margin is important. And we are very thankful that Shopify does provide that invoice because it allows the Kruze Consulting accountants to deliver accurate financials for the e-commerce customers.

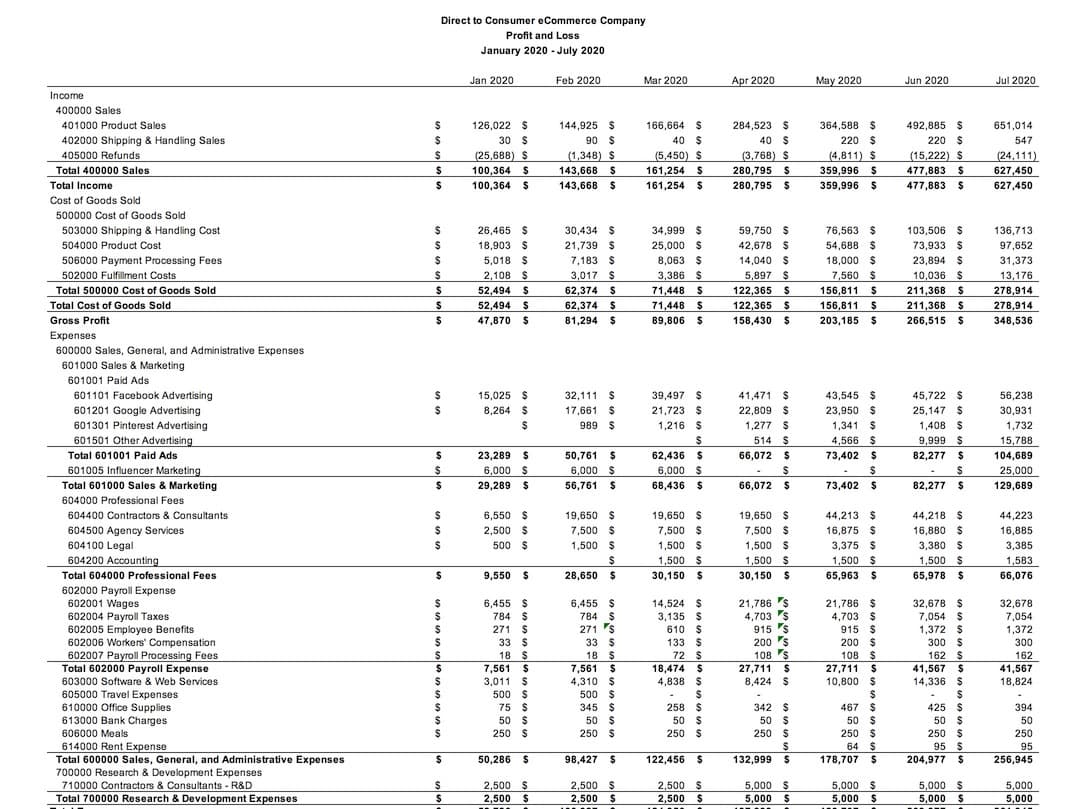

How to Read an Income Statement

Income statements are the barometer of your company. Knowing how to read an income statement is a must for every entrepreneur and startup founder. Your eCommerce accounting income statement will tell you how much revenue you’re generating. It will help you understand your costs. You’re going to need to report this to the board.

How to Read Your Income Statement

Looking at the top of your income statement and scrolling to the bottom— you first subtract from revenue your cost of goods sold. That gets you the gross margin or gross profit. Then you subtract operating expenses like research and development, sales and marketing, general administrative. You then get down to operating income and subtract interest and other costs. This will give you the net profit.

Your net profit is going to feed into both your balance sheet and your cash flow statement. Your net profit is the bottom line. It’s what your eCommerce company is producing.

Line Items on Your Income Statement:

- Revenue: Widgets x The price of the widgets

- Cost of Goods Sold (COGS): All costs associated with delivering your service

- Gross Margin = Revenue - COGS

- Operating Expenses:

- Research & Development (R&D)

- Sales & Marketing

- General & Administrative (G&A)

-

Operating Profit = Gross Margin - Operating Expenses

- Also called EBITDA, although technically it means something else - follow that link to learn more

- Other Expenses:

- Interest Income & Expenses

- Taxes

- Net Profit = Operating Profit - Other Expenses

- Net Profit is the bottom line, what the company is producing. It is used on other financial statements.

Set Up a Good Chart of Accounts

A well-structured ecommerce Chart of Accounts (COA) is essential for eCommerce startups as it serves as the foundation for the company’s financial record-keeping and reporting system. By categorizing transactions into distinct accounts, it ensures accuracy in financial statements, facilitates tax preparation, and enhances financial analysis and decision-making. For eCommerce businesses, which often deal with a high volume of transactions across diverse channels, a tailored COA helps in tracking revenue streams, managing inventory costs, and analyzing expenses effectively. This level of organization and clarity is crucial not only for internal management but also for presenting a transparent financial picture to investors and stakeholders, thereby supporting the startup’s growth and scalability.

How to Finance Your eCommerce Company

Founders often ask, “how should I finance my eCommerce business?” The good news for eCommerce entrepreneurs is that a few financing options are available to help them get up and running pretty quickly and produce a positive gross margin, positive net margin.

5 Ways to Finance Your eCommerce Company:

- Bootstrapping: Invest your savings into buying inventory and products, mark it up and sell to your customers and repeat.

- Venture Capital Investment - VCs especially like to invest in branded products.

- Banks Loans

- 2 Different Types of Bank Loans:

- If you have not raised VC money, your bank loan will require a personal guarantee.

- If you have raised VC money, you can raise Venture Debt with no personal guarantee.

- 2 Different Types of Bank Loans:

- More Aggressive Debt: From places like Shopify Capital, Stripe Capital, Fundbox

- Independent Fund or business development company lenders

Evaluate your eCommerce funding choices. Depending on the situation your eCommerce company is in, you may start off bootstrapping. Then you may turn to raise venture capital or bank debt.

Don’t be wedded to any one of these fundraising options. Your needs as a business are going to change as you grow. Be flexible and opportunistic.

How Do eCommerce Companies Manage Their Inventory?

If you have an eCommerce business and the inventory is too large for your personal space or small office, you should consider other ways to manage your inventory. There are two fundamental ways that eCommerce companies can manage their inventory. You can own or rent a warehouse and handle all the inventory responsibilities, or you can hire a third-party logistic provider to manage it all for you.

2 Ways to Manage Inventory:

- Own or Rent your warehouse

- Better for larger companies

- Requires more Logistics: Requires purchasing inventory management software, hiring staff, etc.

- Third-Party Logistics Providers

- Amazon is a significant player in this space

- There are also many other 3rd party Logistic Companies outside of Amazon

- Allows the founder to focus on business objectives - outsource the logistics!

Important Dates for eCommerce Startups

-

Claim Research & Development Tax Credits on Form 941, and file annual Federal Unemployment Tax Act (FUTA) return on Form 940. Use our handy calculator to estimate your possible research and development tax credit.

-

Founder startups should send 1099s to contractors. Send W2s to employees and e-file 1099-MISC for non-employee compensation with the IRS. Or file Form 8809 for a 30-day extension to file W2s and 1099-MISC for non-employee compensation.

-

Conduct annual employee performance reviews

-

Review key metrics and KPIs

-

Check progress on quarterly goals

-

Review and update company policies and procedures

-

Review monthly financial statements

-

Close January books