How to effectively track and calculate Customer Acquisition Costs:

Implement a Class System

- Enable the class-tracking feature.

- Assign classes to each transaction on the P&L [Ex. Engineering, Sales, Marketing (or Sales &Marketing), and G&A].

- QBO will auto-recognize and apply the appropriate class to recurring transactions andvendors on a go-forward basis.

- The chart of accounts, and format of the P&L will remain unchanged.

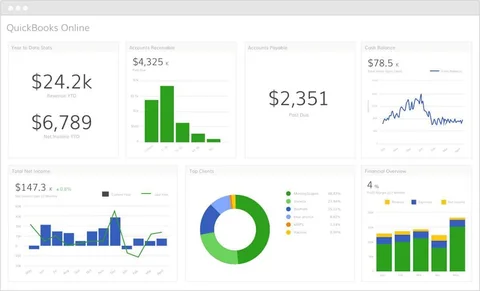

- Run the Profit & Loss report in QBO and filter by Class to pull the information needed for theCAC calculations.

Move to a Department-based COA

- Full overhaul of the Chart of Accounts and format of the P&L.

- Each Department [Ex. Engineering, Sales, Marketing, or (Sales & Marketing), and G&A] willcontain their own appropriate sub-accounts. Ex: each department would have their own Wages, Software accounts.

- This will provide increased visibility for internal analysis on department-based spend oInputs for CAC calculations can be easily extracted from the P&L, without running separate reports.

Which one is best for me?

• If you are content with your chart of accounts and current format of the P&L, you would be best suited implementing a class system. A class system is simplest, and most cost-effective option without materially changing your COA and financial statement presentation.

• If you would like to better analyze spending on a department level, then you’d be best suited to implement a department-based chart of accounts. This would entail a revamp of the chart of accounts, with the appropriate subaccounts created for each department.

Note: Both options require diligence on your part to instruct on which types of outlays (and vendors) should be allocated to each department and to properly categorize expenses on Expensify (either by class or the correct departmental account).

General template for assigning classes to transactions/vendors:

Sales & Marketing

- Sales Commissions

- Salesperson Wages, benefits, workers’ comp, etc.

- Sales Travel & M&E

- Sales subscription services

- Sales conferences

- Salesperson computers/equip <$2,500

OPS

- Website hosting expenses

- Website development and maintenance

- Contractors, consulting

- Professional development

- OPS Travel, M&E

- OPS personnel wages, workers’ comp, benefits, etc.

G&A

- Bank charges

- Accounting

- Employee computers and equipment <$2,500

- Executive personnel wages, benefits, workers’ comp, etc.

- Liability insurance

- Legal expenses

- Rent

- Utilities

- G&A software subscriptions and licenses

- Office food & entertainment

- Recruiting

- Payroll fees

- Office misc

- Office furniture

- Misc Travel

- Janitorial Services

Engineering

- R&D costs

- Engineering personnel wages, benefits, workers’ comp, etc

- Engineering personnel computers and equipment

- Internal engineering equipment

- Engineering software and subscriptions

- Travel and M&E for Engineering Team

COGS

- Hosting fees (Twilio, AWS, Heroku, etc.)

Kruze Consulting is a leading CPA firm only serving funded startups. If you are a funded startup, choose Kruze Consulting’s team of CPAs, bookkeepers, CFOs, former IRS tax auditors, and venture experts. Besides being expert QuickBooks accountants, our firm handles all things Accounting, Tax, Finance, & HR: interim CFO Consulting, financial modeling, annual taxes, R&D tax credit studies, venture debt consulting, 409A reporting, bookkeeping, AR/AP, and Seed/Series A/B Fundraising Preparation. Contact Kruze today!