Kruze Consulting has worked with numerous healthcare startup clients, that have collectively raised almost $1.5 billion in venture capital funding.

Our experienced CPAs and CFOs are sharing their insights on the most effective accounting practices for healthcare startups.

The Right Time for a Healthcare Startup to Begin Accounting

Keeping accurate financial records is crucial, especially when you’re about to raise money from your first investor. By this point, you should have your books in order.

As soon as possible, venture-backed healthcare startups should implement accounting software to maintain a record of their financial transactions. Ideally, this should be done when the company is in the process of closing its initial round of funding, or as soon as the founder begins to spend their own capital to get the business going. Here are some tips as you get the accounting started:

- Once you have a dedicated bank account for your startup, it’s time to start bookkeeping.

- Integrate your bank account with an accounting software like QuickBooks Online (QBO). Select a software that can accommodate your early-stage healthcare company’s unique requirements and scale alongside your growing business. Check out our comprehensive article on the top accounting systems for startups.

- Ensure that transactions from your bank account are properly categorized as they are imported into your accounting software. Healthcare startups often encounter distinct expenses, such as clinical trial costs, regulatory fees, and R&D expenses, which should be tracked separately. To guarantee accurate categorization, consult with an accountant who has experience working with healthcare companies.

- Think about obtaining a business credit card that isn’t linked to your personal credit (opt for cards that don’t necessitate a personal guarantee). Connect this card directly to your business bank account so that transactions are automatically imported into your accounting software. This simplifies your personal finances and ensures more accurate and streamlined bookkeeping for your startup.

- Closely monitor your research and development (R&D) expenses, as they typically constitute a significant portion of a healthcare startup’s budget. Make sure these expenses are properly accounted for, including accurate categorization and documentation for potential tax credits.

- If your healthcare startup works with contract research organizations (CROs) or multiple vendors, ensure your accounting system can efficiently handle purchase orders, invoicing, and payment terms to streamline your financial management.

- By implementing sound accounting practices from the start, healthcare startups can ensure precise financial reporting, informed decision-making, and seamless operations as the company expands.

Navigating the Unique Challenges of Healthcare Accounting

Accounting for healthcare startups presents several distinct aspects compared to accounting for businesses in other industries:

- Clinical trial expenses: Healthcare startups frequently invest substantial resources in conducting clinical trials to develop and test new drugs, devices, or treatments. Founders need to keep careful records of what is being spent, especially because even unprofitable startups may be able to take advantage of tax credits.

- Research and development (R&D) expenses: A significant portion of a healthcare startup’s budget is often allocated to R&D. Again, proper categorization and documentation of these expenses can help startups leverage R&D tax credits and other incentives.

- Inventory management: Healthcare startups, such as medical device or pharmaceutical companies, must effectively manage physical inventory. Accurate inventory tracking and valuation are vital for financial reporting and cash flow forecasting

- Revenue recognition: Healthcare startups must comply with revenue recognition principles, ensuring that revenue is recognized when earned and all associated costs are matched with the generated revenue. This can be particularly complex for startups with multiple revenue streams or subscription-based models.

- Grants and funding: Many healthcare startups depend on grants and other forms of funding to support their research and development efforts. Proper tracking and reporting of these funds are essential for maintaining compliance and securing future funding opportunities.

Accounting for healthcare startups requires a thorough understanding of the industry’s unique financial aspects and the flexibility to adapt to the evolving needs of a growing business.

Essential Financial Statements for Healthcare Startups

Healthcare startups should generate three primary financial statements: the Income Statement, Cash Flow Statement, and Balance Sheet. Additionally, they may need to monitor other financial and operational metrics to effectively manage the business and report to their board or investors. These metrics may include headcount, projected expenses, clinical trial progress, regulatory milestones, and key performance indicators (KPIs) specific to their business model.

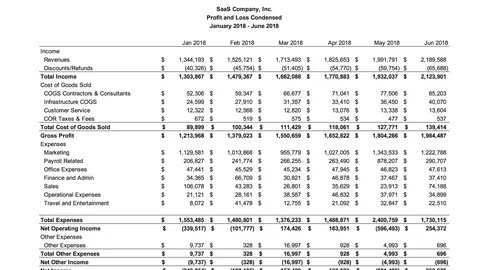

The income statement offers insights into the company’s:

- Revenue (vital for healthcare startups that have started generating revenue from products or services)

- Cost of Goods Sold (COGS) and Gross Profit (crucial for understanding profitability, especially for startups selling products)

- Operating Expenses (typically categorized into R&D, sales and marketing, general and administrative, and regulatory compliance expenses)

- Net Profit

As healthcare startups advance through clinical trials, obtain regulatory approvals, and start generating revenue, the income statement becomes increasingly critical for evaluating their financial performance. And many grants will show up as income, so they should be properly booked.

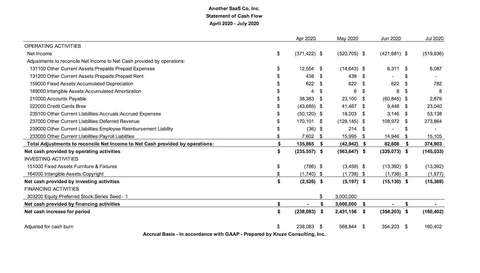

The cash flow statement reveals the startup’s:

- Changes in working capital (such as fluctuations in inventory, receivables, and payables)

- Operating cash flow

- Investments in R&D, clinical trials, and equipment

- Capital raises, grants, and loan repayments

- Net cash flow / change in cash position

Healthcare startups heavily depend on the cash flow statement to track their cash position and identify potential cash flow challenges related to R&D investments, clinical trial expenses, and regulatory compliance costs. And businesses that need inventory or disposables may need to rely on the cash flow statement as well.

The balance sheet presents:

- Assets

- Cash

- Inventory (for startups selling physical products)

- Equipment and other fixed assets

- Intangible assets (such as patents and trademarks)

- Liabilities

- Accounts Payable

- Credit Card liabilities

- Loans and other debt

- Equity

- Invested equity

- Retained earnings

The balance sheet of a healthcare startup may vary from that of startups in other industries, depending on the company’s specific focus (e.g., medical devices, pharmaceuticals, or digital health). Accurate tracking and reporting of these items on the balance sheet are crucial for founders to understand the company’s financial position and make informed decisions, and sophisticated investors will rely on the balance sheet to understand the company’s financial position.

Structuring Your Bookkeeping

We advise founders to implement a customized chart of accounts (COA) for their healthcare companies. A chart of accounts is a framework that organizes expenses, assets, liabilities, and other financial elements within your accounting software. By creating a COA tailored to the specific needs of healthcare startups, you can simplify the process of managing the sector’s unique accounting requirements, such as tracking costs associated with clinical trials, regulatory compliance, and R&D.

For instance, a well-designed COA for healthcare startups might include categories for:

- Clinical trial expenses

- Regulatory compliance costs

- Research and development (R&D) expenses

- Inventory costs (for startups selling physical products)

- Reimbursement and billing-related expenses

- Grants and other funding sources

Although it may not be necessary to implement a fully customized COA from the outset, investing in the development of a tailored framework as your startup grows will yield long-term benefits. A healthcare-specific COA will help you better understand your company’s financial performance, make informed decisions, and communicate effectively with investors and stakeholders. Moreover, when your company undergoes an audit, a well-structured COA will make it easier for auditors to track your transactions.

Advice for Healthcare Founders

Kruze only works with VC-backed startups, and we’ve created tailored advice for healthcare founders seeking outside investment from professional investors. Here are some tips to help you engage with VCs effectively.

- Ensure that you are engaging with investors who have a track record of investing in healthcare - many VCs focus solely on software, so target the right investors to save time and effort.

- Seek introductions to healthcare-focused VCs from founders they have previously backed. We recommend cold emailing or reaching out to these founders on LinkedIn to request advice. If you make a positive impression, consider asking for an introduction to their investors.

- Your clinical trial plans and regulatory strategy will be a critical component of due diligence. Be prepared to discuss your timeline, costs, and risk mitigation strategies in detail.

- Be transparent about the challenges, risks, and weaknesses your startup faces. Remain open to feedback and be willing to adapt your strategy based on investor input.

- Stay in touch and maintain engagement with potential investors. Provide concise updates highlighting your startup’s traction, clinical trial progress, and regulatory milestones. Request tips or advice to build trust and rapport.

- Present a clear understanding of the capital required to reach key milestones, such as completing a clinical trial or obtaining regulatory approval. We generally recommend aiming to raise at least 20% more than your initial estimate, as developing healthcare products is inherently challenging. So have a good financial model.

Kruze: A Trusted Accounting Partner for VC-backed Healthcare Startups

Through our extensive work with funded healthcare startups that have collectively raised $1.5 billion in venture funding, we recognize that founders need to accurately forecast their future expenses. To assist with this, we provide our bookkeeping services at a fixed, recurring monthly rate, enabling our clients to predict their basic accounting costs each month. Experienced startup founders understand the importance of forecasting expenses for the coming months, and having set accounting expenses is a vital step towards effective cash management. Additionally, Kruze has a dedicated in-house tax team focused on helping startups maximize tax credits, manage sales tax, and more.

Contact Kruze today to learn more!

Qualities to Look for in a Good Healthcare Startup Accountant

Your healthcare startup’s accounting partner should have a deep understanding of the unique challenges faced by businesses dealing with clinical trials, regulatory compliance, and R&D. This encompasses not only basic bookkeeping but also navigating the complex tax incentives available to healthcare businesses.

At Kruze, we combine cutting-edge automated software with the expertise of experienced controllers and CPAs. Our proprietary, highly automated bookkeeping software seamlessly integrates with QuickBooks Online, reducing your monthly accounting expenses while ensuring that your transactions and supporting details are securely stored in the industry-leading accounting software. Our accounting team boasts an average of over 11 years of experience.

Interested in learning more about our expertise?

Top Healthcare Startup Accountants Understand Tax Credits for Healthcare Companies

Various tax credits can help unprofitable, R&D-focused healthcare startups reduce their burn rate. Partner with an accountant who can provide both bookkeeping and tax services to maximize your government incentives.

Some of the most valuable tax credits for healthcare startups in the research stage include the R&D tax credit (calculate your credit here), and several state credits like the California Sales Tax Exemption, the Massachusetts Sales Tax Exemption, and the Maryland Biotechnology Investment Tax Credit. The R&D tax credit, which should apply to most healthcare startups conducting research in the USA, is typically the most significant of these incentives.

Major Dates for Healthcare Startups

-

Review key metrics and KPIs

-

Check progress on quarterly goals

-

Review and update company policies and procedures

-

Review monthly financial statements

-

Close January books

-

Update financial model with January results

-

Hold leadership team meetings