Kruze Consulting clients are twice as likely to be acquired as the average startup.

I say that with a ton of pride, a little bit of awe, and a profound sense of responsibility. Our commitment to not just meet, but exceed, the expectations of those we serve is what sets us apart. It’s not just about numbers for us; it’s about the people and dreams behind each startup (although we do really care about the numbers!).

I’ve always known that the team at Kruze cared more about our clients’ success—but to actually see data that supports the quality of the work that we do is truly heartwarming.

Talk with us now if you want to increase your chances of success

Accounting for the 2x better metric

We know that Kruze clients are twice as likely to be acquired because we can compare our clients’ metrics against data published by the cap table management vendor, Carta.

Carta regularly publishes data on trends in the startup ecosystem. From valuations to information on SAFE notes, they are a great source of information that we regularly cite when advising our clients. It’s such helpful information that we regularly compile it in ways that make it easy for our clients to digest, such as on our startup valuations page or on our startup statistics blog post.

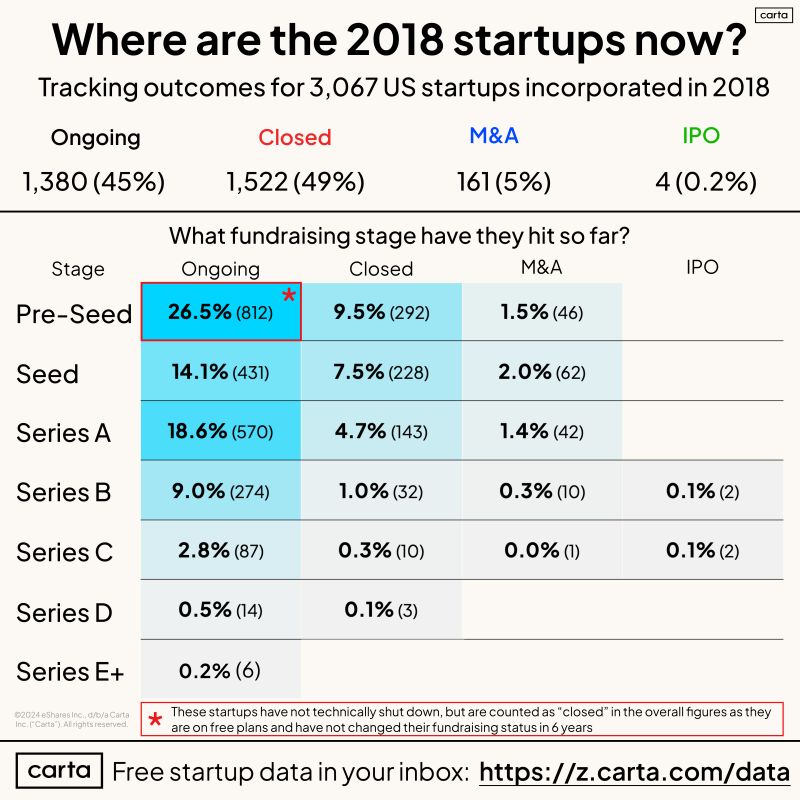

Carta published data on “Where are the 2018 startups now” that showed that 5.2% of startups incorporated in 2018 were acquired. You can see the original post on LinkedIn here. Of the 3,067 US startups in their data set, 161 were acquired (and another 4 went public). Since Carta serves such a large percentage of the VC-funded startup market, we think this is a valid average for how the average startup performs.

As an accounting firm, we know when our clients were incorporated - so we decided to take a look at our clients that were incorporated in 2018 to see how they fared.

We found that our clients were over two times more likely to be acquired, and were also much more likely to have raised subsequent rounds of capital as well!

We knew we were good, but wow!

Why do we think Kruze clients are 2x as likely to exit as the average startup?

2023 was our busiest year for M&A ever. More of our clients exited than we’d ever seen, despite the fact that it was a difficult year for the overall VC ecosystem, and that the total number of M&A exits was much lower than the recent historical trends.

We think our clients were more likely to exit for several key reasons - most of which we think we can provide to all of our clients. Here are five reasons why we think our clients are more likely to be acquired:

-

Solid, reliable metrics are the lifeblood of most startups that end up being successful. Our approach ensures that founders receive clear, comprehensible financial data that offers them actionable insights. This lets our founders make informed decisions swiftly—whether it’s deciding how many new hires to make, managing cash flow, or strategizing for growth. By providing metrics that matter, we set our clients up for better strategic planning and increased attractiveness to potential acquirers.

-

Our clients are diligence-ready, meaning they're prepared when potential acquirers (or VCs) start showing interest. We ensure that all financial records, compliance documents, and tax filings are properly filed and ready for inspection. This not only speeds up the acquisition process but also builds confidence with potential buyers, demonstrating a well-managed, stable business ready for a seamless transition. In our experience, many deals, both M&A and VC funding, come together quickly, and the best founders are ready to jump into diligence. That’s our job - to make sure financial diligence is ready to go asap. Looks like we are doing a good job!

-

Most companies that get acquired do so before the B, when they are still using an outsourced accountant like Kruze. According to the 2018 incorporated startup data from Carta, the majority of M&A exits occur before Series B funding rounds—150 out of 161, to be exact. Early in a startup’s lifecycle is where Kruze shines - our ICP is from the pre-seed to the Series C. Our specialized support in accounting, finance, and tax services during the early stages of a startup’s life cycle places our clients in an optimal position for an acquisition. You won’t believe how intense the tax diligence is when you sell your startup to a major tech company, even if it’s only a $50 million dollar exit! Having the right partner at the earliest stage matters.

-

Our clients were more likely to raise Series A and B - see the first two points. Our clients have a higher track record of securing Series A and B funding than the average startup company in Carta’s data set. So not only are they more likely to still be in business to get acquired, they are also more likely to have attractive operational metrics, which correlates with a greater likelihood of being operational and attractive for acquisition.

-

This one isn’t something we can “do” for our clients - we just happen to have VCs refer the companies they like in their portfolio to us. And founders who organically find us are the ones who are actively looking for an accounting partner who can give them better metrics. These combine to make our clients, well, better, than the average startup. And creates a self-selecting ecosystem of high-potential, driven startups primed for success.

If you’re ready to improve the likelihood of success