Every day we’re approached by a prospective client who’s interested in working with us. After hearing their story and telling them ours, it is time to get them a quote. This invariably involves getting access to their QuickBooks Online account or other proprietary software (Bench, inDinero, etc) so that we can check out the volume and complexity for monthly work going forward. We also need to assess if there’s a backlog of work that needs to be done when we onboard the client - since startups are different than the businesses that most bookkeepers are used to servicing, we’ve seen a lot of shoddy or incorrect accounting work! Here are my Top 10 Ways Your Financials are Wrong.

Top 10 Ways Your Startup’s Financials are Wrong

1. Accounts Aren’t Reconciled. Our first stop in the books is to take a look at the last time the Balance Sheets accounts were reconciled. We look at every account, not just the Bank and Credit Cards. For example, unreconciled Payroll Liability accounts can spell big tax trouble as this indicates that some tax agencies have not yet been paid. If the accounts haven’t been reconciled, we have to go back and do that. No, it’s not enough to just have the transactions added to QBO. If the accounts aren’t reconciled, it’s very likely that there are erroneous transactions or missing transactions. Checking to see if your accounts are reconciled is easy; just look at the register for the check marks in the right-hand column or pull the Reconciliation Reports:

How to view a reconciliation report in QuickBooks Online

- From the left menu, select Reports.

- Type Reconciliation Report in the Go to report search bar.

- Select Reconciliation Reports.

- Select the Account for the reconciliation report you want to view.

- From the Report period drop-down arrow, choose the reconcile period.

- Select View Report.

2. Lumpy Numbers. Our next stop is the Profit Loss to look for trends. If you’re working with a good bookkeeper, trends are readily apparent, such as growing payroll and steady income. If you’re working with a bad bookkeeper, the numbers will look like shotgun blast: there’s no rhyme or reason to placement and no way to analyze the financial health of the company.

3. Financials presented properly. If your bookkeeper has exported the financials for your review, it should be presented as such:

- Accrual Basis

- At least a year’s worth of history

- Month over Month

- Total in Descending Order

- No Pennies

There’s really no other way to analyze the financials.

4. Sub-accounts not properly nested under Major Accounts. No matter how many accounts you have, they should be able to roll up neat and tidy under just a few Master Accounts when you the “Condense” button in QBO. The idea here is that you should be able to fit your financials onto a PowerPoint slide, if necessary. This allows you to see how the company if performing from a high level without giving away any secrets.

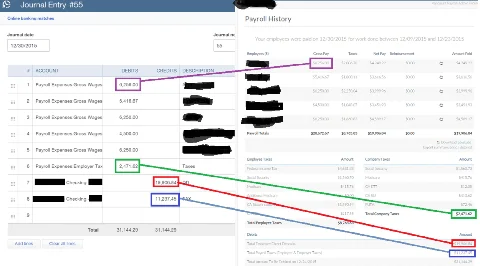

5. Payroll not booked correctly. This is one of my favorite dead giveaways that a company has been working with a subpar bookkeeper, and it’s so easy to spot. On the P&L, Payroll is shown as “Payroll/Wage Expense” and “Payroll Taxes.” If the ratio of these two number is 9:1, it’s been booked correctly. If the ratio is 6:4, it has been booked incorrectly. The reason that this happens is because payroll processors debit the bank account for two amounts, wages, and taxes, and they do so in the 6:4 ratio. However, the taxes amount is for both the employer and employees and the company should report the Gross Wages of the employee and the Company Taxes, as opposed to the Net Wages and sum of Employer and Employee Taxes. This requires a “Journal Entry” as shown below.

6. Interest, Taxes, Depreciation, Amortization, are “above the line”. Every Finance professional is familiar with the term, “EBITDA:” it means Earnings before Interest, (Income) Taxes, Depreciation, and Amortization. Because most startups are not directly in control of their Interest, Taxes and Depreciation/Amortization expenses, and because EBITDA is a standard shortcut to operating cash flow, these expenses should be shown below Operating Net Income (with the exception of some FinTech or financial services companies).

7. Nondescript or Duplicate Accounts. Ever see a set of financials that has accounts for “Office Supplies,” “Office Expenses,” “Supplies,” and “Supply Expense?” Isn’t that the same thing? Is there really any difference between these accounts, or can we give them a more distinguishing name? If your financials have duplicate or nondescript accounts, that’s a hallmark of poor bookkeeping.

8. Teeny Tiny Assets have been Capitalized. This is more a tax sin than a bookkeeping sin, but sometimes I just have to laugh at the lack of judgment when I see a $5.64 Office Depot purchase sitting in the Fixed Assets account on the Balance Sheet. I don’t doubt that you’ll use that pen for more than a year, but it does not need to be depreciated. The IRS has prescribed a $2500 threshold for capitalization, and I think that’s very reasonable. More on that subject over here.

9. Not Showing Equity by Funding Round. On occasion, I’ll see a set of financials that just lumps all VC funding, angel investments, and employee stock purchases into one account. That’s not really helpful when you’re analyzing the financials and highlighting your startups’ growth by round. As a subset to this issue, it’s important to net the Fundraising Legal Fees against the Fundraising Round. The right way to book Equity is right here.

10. Growing AP & AR. Accounts Receivable and Accounts Payable should always be moving about as new invoices are created, old invoices are paid, bill is paid and received. While a startup with high revenue growth might see growth in these accounts, if these accounts are growing at a pre-revenue company, it’s very likely that your bookkeeper isn’t marking these items as “paid” by connecting the bank transaction to the invoice or bill. A balance in Undeposited Funds is a dead giveaway. Ultimately, that means that your revenue or expense is being double counted. Similarly, if AR or AP remains static over time, it’s time to think about writing off these transactions. Look at your AP or AR Aging reports and ask management if the transactions are still valid.

If you are a funded startup and you need your books done right, reach out to us. Kruze Consulting is a leading provider of bookkeeping and tax advice to funded startups.