Hey, it’s Scott Orn at Kruze Consulting, and today we’re talking about 409A valuation reports and why startups need them.

What Is a 409A Valuation Report?

Startups use 409A valuations to price the options for their employees, and the valuation report is used to defend that price to the IRS. That’s right, the common strike price for employee stock options is determined by a 409A. And the IRS is involved because there are tax ramifications to the stock strike price, so the reason why people do that is so that there’s an independent third party that provides that valuation in the form of a 409A valuation report. That third party helps prepare a 409A valuation report that you can share with the IRS to show how you reached the option pricing. That way the management team, or the board, isn’t figuring out what the strike price is; instead, you’ve got an independent, third party valuation study/report.

One reason why you want to work with a quality accounting firm to do your 409A is because you want that 409A valuation report, and the option strike price, to be audit-proof. You don’t want to have to come back three or four years down the line after you’ve had a really successful company and have the auditors say, “Hey, that price is not accurate. That was too low, therefore we need to restate a bunch of options and it’s going to have major tax consequences for the company.” So doing it right the first time, making sure it’s audit-proof by an accredited partner, is incredibly important. That’s the whole point of the entire exercise and why you need a 409A valuation study.

What does a 409A valuation report include?

First, leA 409A valuation is an appraisal of your startup’s stock shares that’s done for tax purposes, and the name comes from IRS Section 409A. The 409A sets the strike price of stock options issued to founders, employees, contractors, advisors, and others who receive common stock from your startup. When paying taxes on equity compensation, the 409A valuation is going to let the IRS determine how much the shareholders owe. So it’s an important part of launching a startup company.

The 409A should be conducted by an independent appraisal company that will follow the IRS rules and protect the shareholders from possible IRS penalties. You’ll need a 409A valuation every 12 months, or after any “material event,” which includes funding rounds, but can also include any major financial or operational changes at your startup. Material events can also include changes in the economy. So if you’ve made major changes to your financial forecasts, such as reducing your burn rate, you may need a new 409A.

If you’ve never seen a 409A valuation, you may wonder what exactly is included. Individual 409A providers will have different formats for their reports, but the best 409A valuation reports typically include the following elements. NOTE: Not every valuation method is used for every valuation. Different methodologies are applied to startups based on their maturity, financing, industry, and many other variables. Your report will specify the methods used.

Engagement letter

Your 409A valuation report will probably begin by reproducing your engagement letter. This document is one that you signed before beginning the 409A process, and it outlines the scope of the valuation, the methodology used by your valuation provider, and may also define specific terms used as part of the valuation. For example, the engagement letter may define fair market value (FMV) and how the term is used by the IRS and the Financial Accounting Standards Board (FASB).

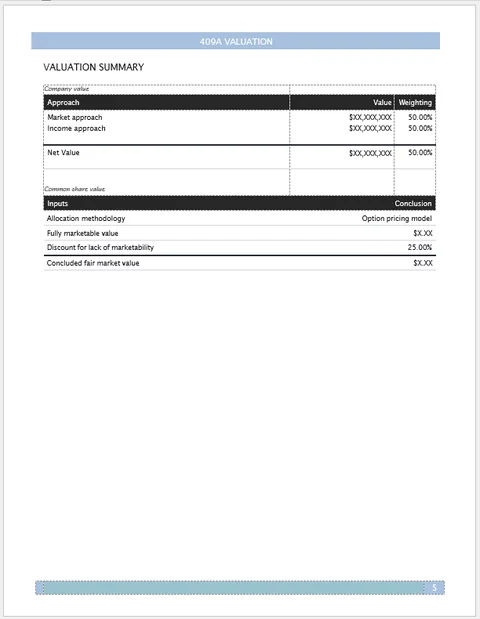

409A valuation summary

This is the summary report of the 409A valuation and the valuation approaches used by the reviewer. It will usually include a valuation for your startup as a whole, and then the common share value. One important term to note is the discount for lack of marketability (DLOM). This is a discount applied to the share price because the share prices of private companies, such as startups, are not publicly traded and aren’t completely liquid. So investors that buy shares of a private company should pay less than the price investors would pay for a publicly traded stock.

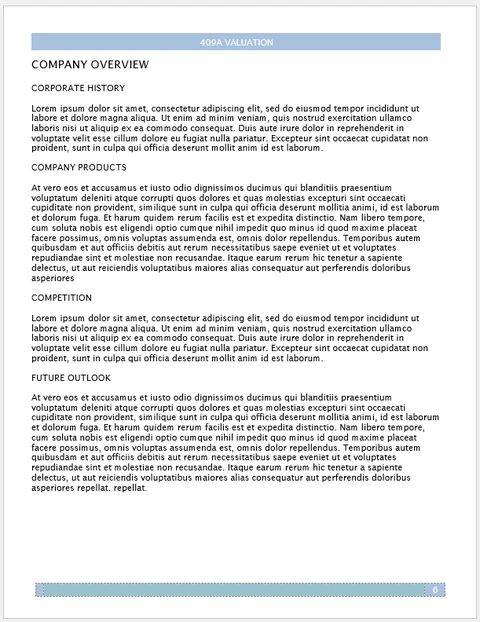

Company overview

This is a brief explanation of your company, its competitive market position, and the product it is developing. The company overview will often include a recap of your startup’s progress, milestones it has achieved, and other targets the company has reached, like stage of development, and an industry overview.

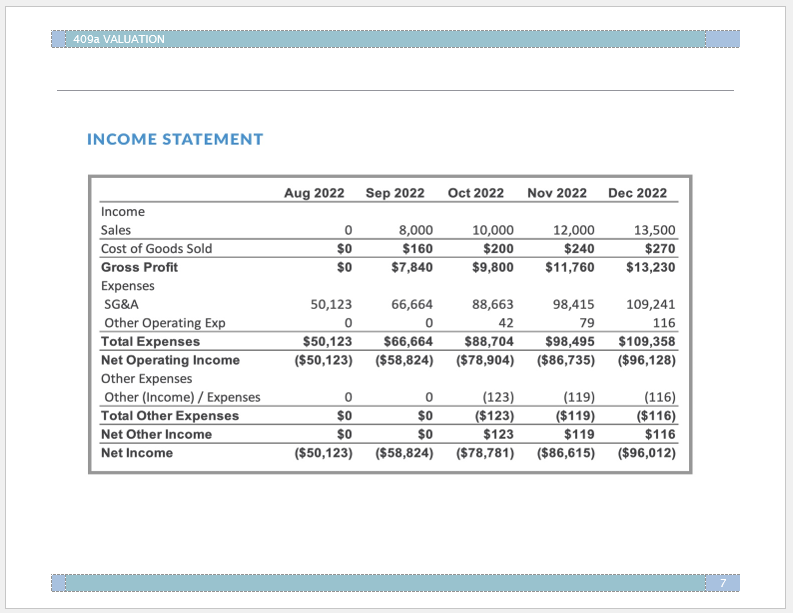

Company financials

The report may include your startup’s financial statements: the income statement, balance sheet, and cash flow statement. These are statements that your startup provided to the valuation provider.

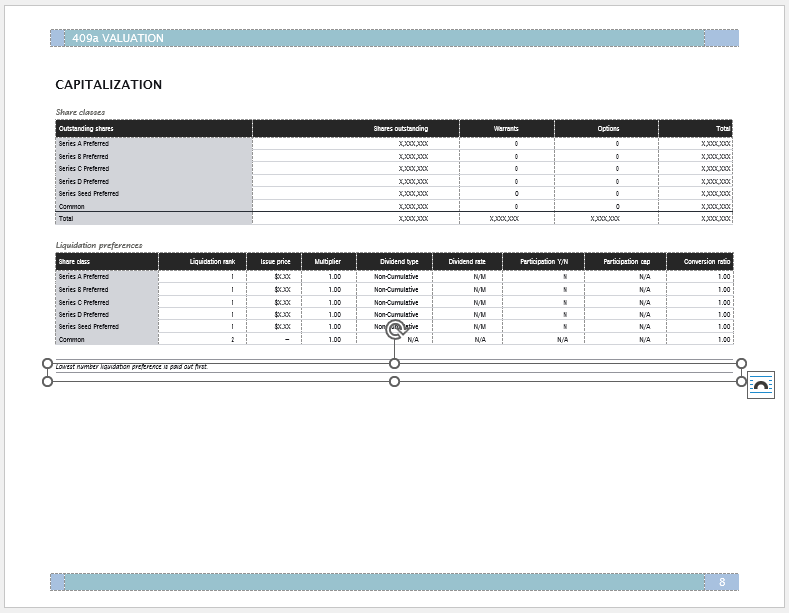

Capitalization

This section is drawn from your startup’s capitalization table, and outlines the number of outstanding shares and preferred status.

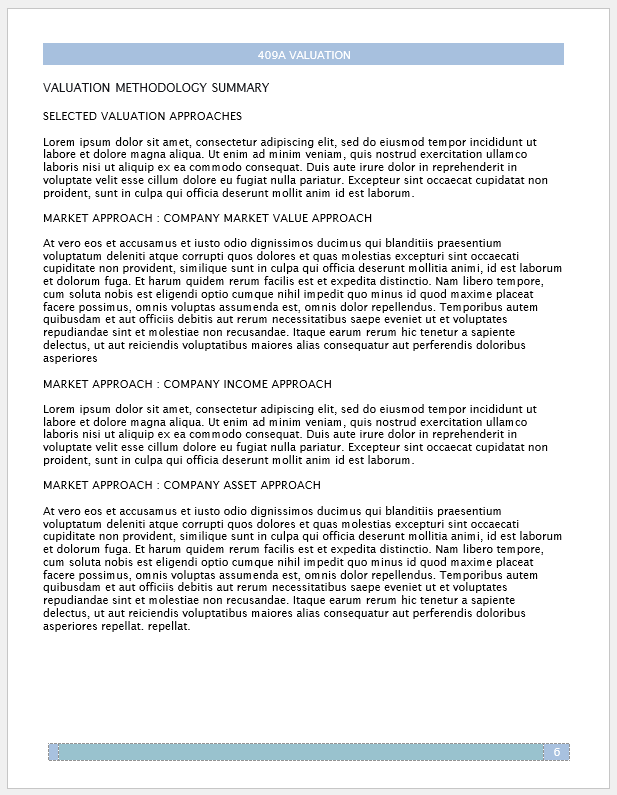

409A valuation report methodology

This section outlines the ways that a provider can arrive at a 409A valuation. Many times there is some boilerplate language about how to value a startup, and then the provider will explain which method(s) they picked to do this particular valuation. In general, there are three primary methods:

- The market value approach can use different methods to reach an assessment of fair market value. If your startup has recently closed a round, it can be assumed that the investors paid a fair market value for their equity in the company. This is called the option pricing model (OPM) backsolve method. Venture investors normally receive preferred stock, so a formula is applied to reach a fair market value for common stock (more details below). Another market value method is to look for comparable companies that are traded publicly, and then adjust for differences between those companies and the startup to get a fair market value.

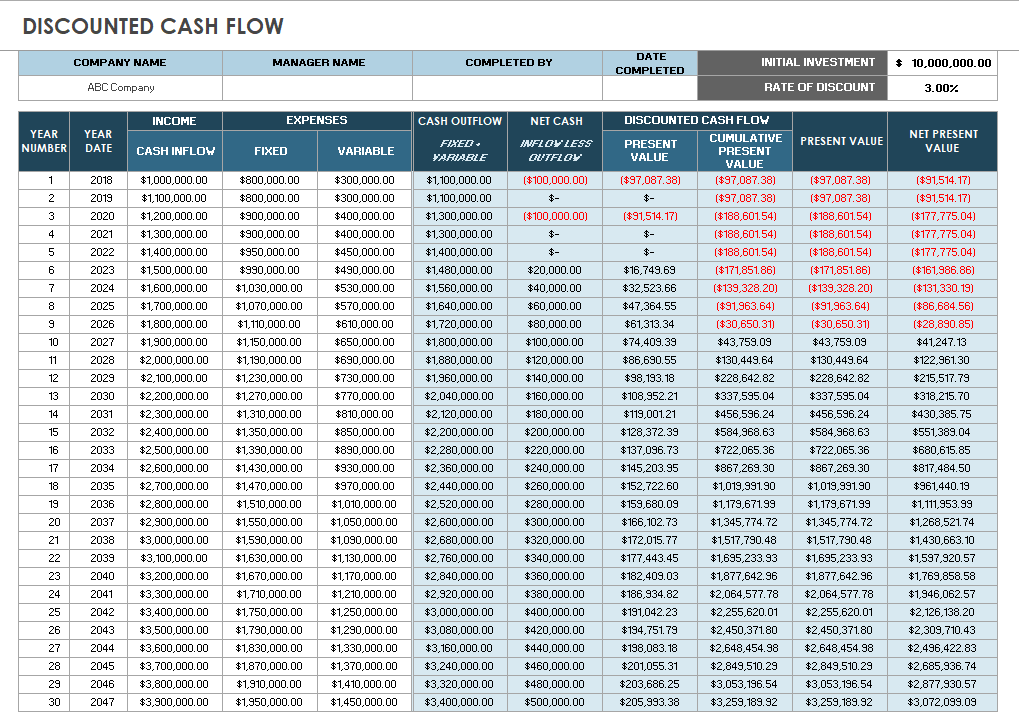

- The income approach uses a discounted cash flow analysis to reach the net present value (NPV) of the money your startup is expected to earn in the future. This method works better for startups that have established income streams, or are close to becoming profitable.

- The asset approach is based on your startup’s net asset value. This is used more for very early-stage companies that don’t have a track record and haven’t started earning income.

In addition to outlining the potential valuation methods, this section will normally note which methodologies were selected and explain why those methods are considered the most accurate representation of your startup’s value.

|

Valuation Method: |

Description: |

When It’s Used: |

|

Market Approach: Backsolve Method |

Uses the most recent financing round to create an option pricing model (OPM) to calculate share value |

Startups that are pre-revenue or have negative cash flows but have raised funds |

|

Market Approach: Comparable Companies |

Compares similar companies to infer share value |

Can be used for any startup |

|

Income Approach |

Focuses on revenue generated by the company |

More mature startups that have established cash flows |

|

Asset Approach |

Calculates the net assets of a company |

Very early-stage startups that haven’t formally raised financing |

Market 409A valuation approach: Backsolve method

Recent financing rounds are usually considered the most reliable ways to determine a startup’s value. The basic concept is simple: If an investor pays $1 million for a 10% interest in a startup, then the startup’s value is $10 million.

The process becomes complicated because VC investors don’t typically buy common stock. Instead, they use hybrid equity instruments like convertible preferred shares. That gives the investor some risk protection since they have liquidation rights that supersede those of common equity, but they can also convert to common stock if the company is doing well and they want to take advantage of that. To adjust the preferred stock price paid by investors to a common stock price, 409A appraisers may use backsolving.

Backsolve valuation methods usually are about 25% to 35% of the preferred stock share price

Backsolving involves a pretty complex analysis, but there is a shortcut. Often the 409A common stock valuation on the price per share is about 25% to 35% of the preferred price per share. For a quick, back-of-the-envelope estimate, founders can backsolve to get an idea of what the valuation should be. That means if your investors paid a dollar a share, it should be 25 cents to 35 cents per share for the common. If you were doing the work yourself using the backsolve method, you’d want to include some marketability discounts and other things (more on that below) but you’d typically get to that 25% to 35% range.

Taking a deeper look at the process, when an investor buys $1 million of convertible preferred stock, it’s difficult to say what percentage of ownership the investor paid for, because the protections we already mentioned make it not easily comparable to common stock. If the company does well and has a large sale or IPO, the investor may convert to common stock. If the sale amount is lower, the investor may decide to keep their preferred shares and liquidation priority. Both choices give a different ownership percentage at the sale. So the percentage interest that investor will have is contingent on the future value of the startup.

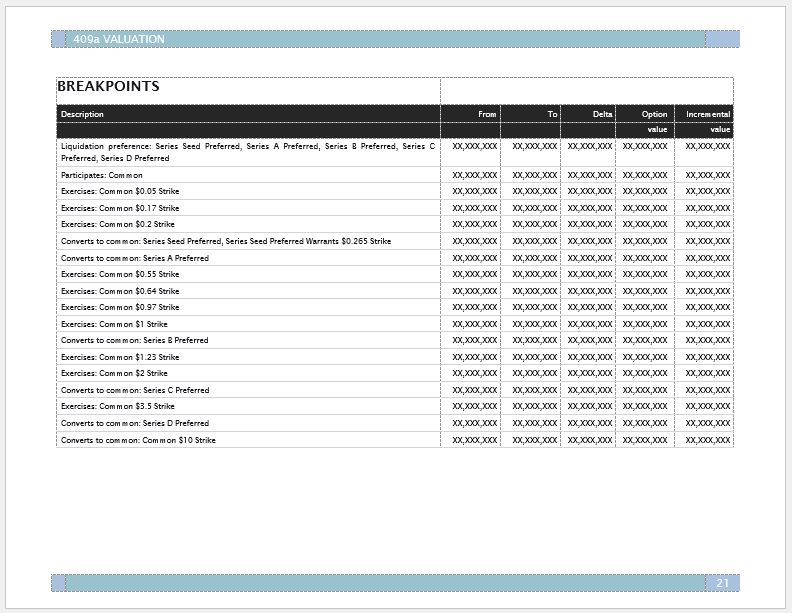

To adjust for these variables, the backsolve method models the company’s shares as a series of call options on the overall value of the equity. The equity is assigned a series of “breakpoints” where it’s advantageous to the investor to convert their preferred stock into common stock. The payoffs at each breakpoint are assigned probabilities and then discounted to their present value. Once this process is completely modeled, the value needed for the most recent financing round to equal the price that the investors paid is solved for, and the valuation has been “backsolved.” If your 409A provider uses backsolving to get to your valuation, you’ll get a full breakdown of all these calculations.

Backsolve = easy way to see if you got the best 409A valuation report

Really, the easiest way for a startup executive quickly check to see if you’ve gotten a great 409A valuation report is to do the simple backsolve calculation outlined above. It’s reasonably accurate, it’s fast, and it’s based off what a sophisticated investor paid for the company. The full backsolve method has a lot of validity with auditors, so if the valuation you received with your 409A report fits within that 25% - 35% range, your report is probably accurate and will stand up to review.

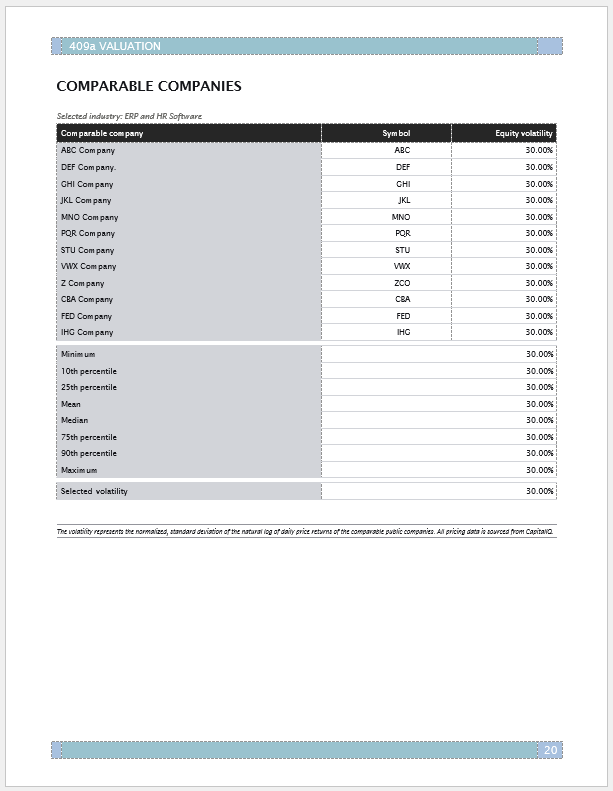

Market 409A valuation approach: Comparable companies

If the report uses the market value approach based on comparable companies, the 409A valuation provider will compile a list of publicly traded companies that are similar to your startup, and then analyze those companies to derive a valuation. There are a variety of sources for such information, and this section will explain where the company got its data. It may also break down the criteria used to determine how the comparable companies are similar to your startup.

The 409A report will provide statistics on each of the comparable companies used in the analysis, including information such as income; historic growth rate and projected growth; EBITDA margin; and historic and projected EBITDA growth. The report may also rank your startup in these categories against the comparable companies.

Market 409A valuation approach: Income approach

The income approach tries to estimate the future earnings of a startup and then discount them to establish a present value for the company. The first step is to project the future cash flows, typically over the next five years. Then the valuation provider will apply a discount rate to get the the present value of the startup. The discount rate can vary widely among startups – often from 20% to 80%. Younger, early-stage companies that don’t have an established track record will see higher discount rates, toward the 80% end of the spectrum. Less risky, more mature startups with more reliable projects will see lower discount rates. And, since many companies don’t end at the five-year mark, the valuation will also factor in future growth beyond five years, and discount that back to the present value. While the income approach is widely recognized and accepted, it does rely on a number of hypothetical variables, from the cash flow estimates to the discount rate chosen for the company.

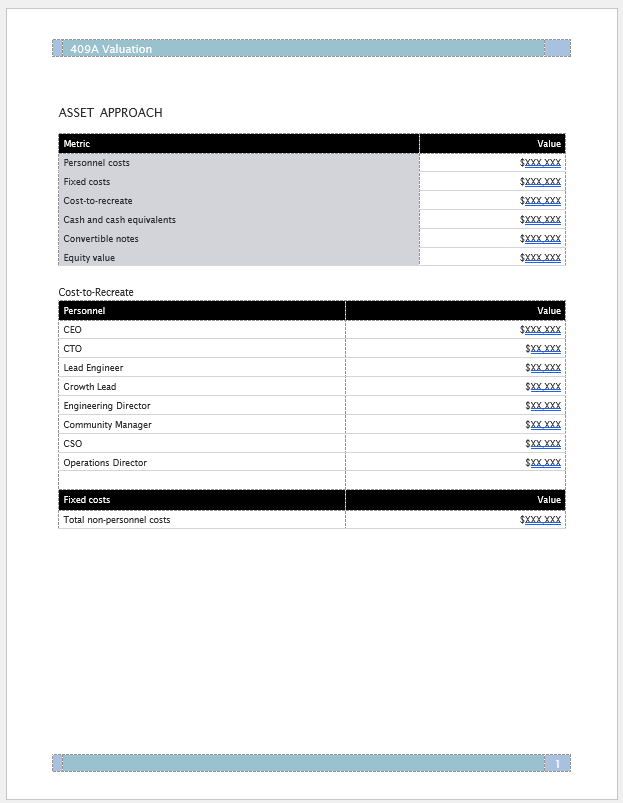

Market 409A valuation approach: Asset approach

The asset approach uses the startup’s financial reports to identify the company’s assets, both tangible and intangible, and its liabilities. A fair value is assigned to both liabilities and assets, and liabilities are subtracted from assets to derive a fair market value. If this sounds familiar, it’s because it’s the standard accounting equation for the company’s balance sheet: Assets - Liabilities = Stockholder’s Equity. So the process typically begins with the startup’s balance sheet, and stockholder’s equity is a rough estimate of the startup’s value.

However, for 409A valuations, a closer look needs to be taken at the items on the balance sheet. While some values are largely straightforward (cash), there are some items that may need to be reviewed. Typically these are property, plant & equipment (PPE) or inventory. If the startup has production equipment, for example, it was purchased at one price and then depreciated. However, its depreciated value may be different from the price it could be sold for. So the 409A valuation provider will need to research some items to assign an appropriate value. For assets that aren’t accurately captured on the balance sheet, the appraiser may use the “cost to recreate” method, which assumes that the assets value is the same as the cost to replace that asset.

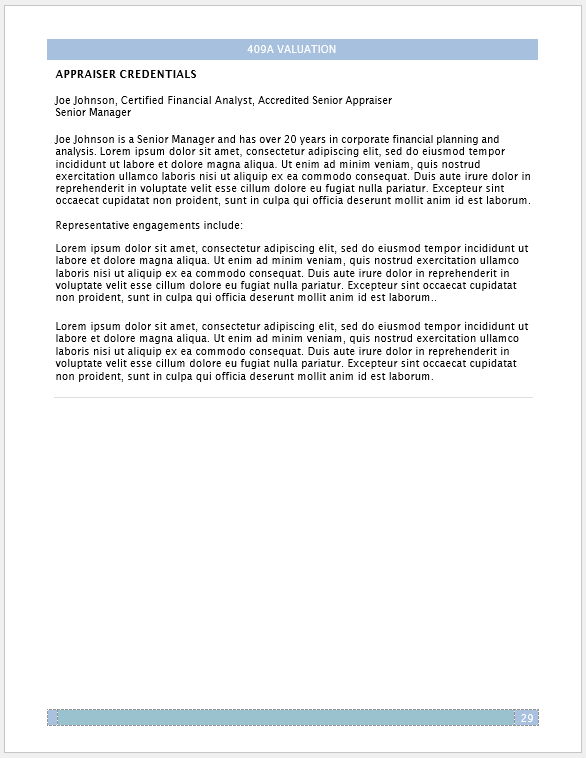

409A valuation report: Appraiser credentials

This section lists the appraisers who participated in creating your 409A report and outlines their experience and educational background. It’s important to have qualified, independent valuation providers perform your 409A analysis. You may need to prove to the IRS that your estimate of the fair market value of your common stock is reasonable (also called “safe harbor”). To help with safe harbor, the valuation provider you choose should have experience evaluating startups that are similar to yours, in the same sector, industry, and stage. So having appraisers with the right credentials and expertise is essential.

What to Look for When Choosing a 409A Valuation Report Provider

When choosing a 409A valuation provider, it is important to consider the following factors:

- Experience: Look for a provider with the required expertise and any relevant certifications who has worked with companies with similar business models. In our case, we recommend providers who know how to work with venture capital portfolio companies.

- Service: Choose vendors who are known for providing fast, efficient service and who come strongly recommended. Also make sure the vendor is willing to speak with you to determine your goals, so that they exercise can be tailored to your needs.

- Flexibility: Avoid vendors that are highly templated and that lack flexibility - not every company’s situation is the same, so just because your metrics are similar does not mean the valuation should be the same.

- Audit-readiness: The valuation report should be audit-ready and the provider should be able to stand with you in the event of an audit.

- Detailed reports: The report should be detailed and easy to understand, with clear explanations of how the final valuation was reached.

- Cost: some vendors are expensive, others are bundled with pricey software that you may not need. Choose a provider that offers the right price for the service you need.

Choose your 409A valuation firm carefully

As your startup grows, your 409A valuations will become more complex, and your provider needs to be able to calculate your valuation correctly and confidently. Remember that the major reason for doing a third-party 409A study is so that it’s audit-proof three or four years from now when you get an audit.

IRS penalties for getting a 409A valuation wrong can be substantial for your employees, including penalties and interest on all deferred vested amounts. If a poor valuation causes your employees to under-report income, more penalties could be assessed. And state tax authorities could add even more penalties.

You want to make sure that you don’t have to go back and restate anything. Make sure your provider is using assumptions tailored to your startup’s unique situation, and they are providing a 409A valuation report that you can use to defend your option strike price.

Talk with us about providing a quality startup 409A valuation report today!

Kruze offers 409A reports at attractive prices.

|

Startup Funding Level |

Kruze 409A Cost |

What Others Charge |

|

Seed |

$2,000 |

$4,000 |

|

Series A |

$2,500 |

$5,000 |

|

Series B |

$3,000 |

$5,000+ |

|

Series C |

$3,500 |

$5000+ |