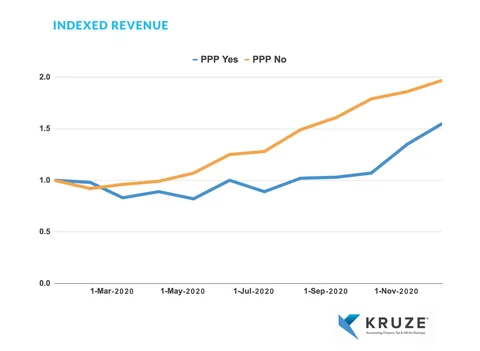

We recently compared revenue trends amongst 400 early-stage startups that took a Payment Protection Program (PPP) loan last year to startups that did not. According to the data, startups that did not take PPP loans doubled their monthly revenue over the course of 2020. Startups that received PPP loans showed a more challenging year, with revenue growing, on average towards the end of the year - spiking 50% since October.

We believe that our data indicates that:

- Many VC backed startups had a solid 2020, despite the pandemic

- Startups were surprisingly smart at applying for a PPP loan if their business was going to be impacted by COVID - and also surprisingly good at NOT taking government money if their business was going to avoid a COVID slump

- VC backed businesses that did take PPP loans were able to use the government funding to keep their companies poised to grow (and headcount in place) as the pandemic’s impact on the economy lessened at the end of 2020 - which we think means that the loans were effective at keeping startup employees employed and companies healthier than they would have been otherwise.

80% of Startups Did Not Take PPP Loans

The data indicates that, on average, about 80% of startups did not take PPP loans. Most of these companies managed to relatively quickly recover from a small revenue dip at the beginning of the crisis, and experienced healthy growth during the middle and end of 2020.

However, Startups That Did Take PPP Loans Experienced More Pronounced Revenue Hikes at the End of 2020

Startups that did take PPP loans tended to experience a more pronounced and prolonged revenue trough, lasting through July/August. On average, these companies did have a spiking revenue recovery November, and managed to grow revenues 50% by the end of the year.

“The COVID19 pandemic was totally unexpected and unprecedented. Many startups required PPP loans to sustain through the shutdown. Our data is consistent with our anecdotal experience with clients and I can confidently say that the PPP loans helped many startups keep critical staff on payroll. And because those teams were able to stay together, many companies were able to rebound in the last quarter,” said Scott Orn, COO of Kruze Consulting.

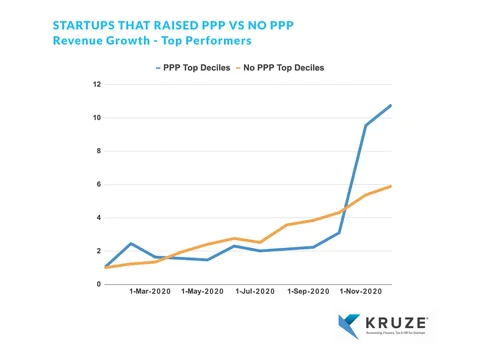

When narrowing the data to look at the top performing, non-PPP startups, it showed they had relatively consistent growth during the year, and their monthly revenue was about 6x higher at the end of the 2020 vs the beginning of 2021. We believe this data concludes that startup Founders and their boards were extremely effective at understanding whether or not they needed the loans to survive.

Other Startup PPP Loan Statistics

We also compiled other startup PPP loan statistics such as loan size, percentage of startups interested in PPP who actually got it and VC backed startup PPP loan forgiveness tracker.It is worth noting the following:

-

~25% of VC backed startups with PPP loans have applied for forgiveness (although only 18% have gotten it so far)

-

Only 14% of VC backed startups interested in PPP Round 2 have gotten a loan - likely because some didn’t meet the requirements.

PPP Loan Size Statistics

| PPP Loan Size Statistics | |

|---|---|

| Average Loan Size | $244,391 |

| Median Loan Size | $116,269 |

Percent of Startups interested in PPP who actuall got PPP

| PPP Round 1 | PPP Round 2 | |

|---|---|---|

| Percent of Startups interested in PPP who actuall got PPP | 51% | 14% |

Loans

| % of Loans | % of Funds | |

|---|---|---|

| Loans over $500K | 13% | 43% |

| Loans between $250K and $500K | 23% | 33% |

| Loans between $100K and $250K | 25% | 14% |

| Loans under $100K | 39% | 10% |

Indexed Revenue

Startups that Raised PPP vs No PPP Revenue Growth - Top Performers

Want to Learn More?

PPP Loan Best Practices Library

Access Kruze’s PPP documents and free templates — PPP Documentation Best Practices, PPP Expense Tracking Spreadsheet, IRS Guidance PPP Loan Deductibility, and more.

Can My Startup Retroactively Apply for PPP 1?

Kruze’s COO, Scott Orn, answers the question, can my startup retroactively apply for a PPP 1 loan? This is a question I’m getting quite a bit from startup founders who were eligible but didn’t apply for the Payment Protection Program loan in March, April, and May of last year.

PPP Loan Documentation and Forgiveness

Now that PPP loans are flowing to our clients, what are the steps you need to take to make sure you get the maximum amount of loan forgiveness possible?