All About Stock Options (ISOs, NQSOs, RSUs) Tax Reporting for Startups

Table of contents

If your startup employees exercised stock options in any given year, you’ll need to report that transaction to the IRS and provide the person a tax form. Which tax form depends on whether they were an employee or contractor, and whether they exercised RSU (Restricted Stock Unit), an ISO (Incentive Stock Option), or an NQSO (Non-Qualified Stock Option). I’m a tax CPA who has worked with hundreds of VC-backed startups - let’s review which types of stock options get which tax forms below.

RSU vs ISO vs NQSO - Tax Forms to Use

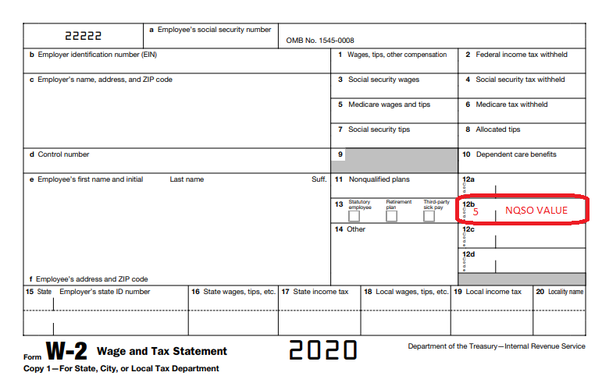

Startup Employee Exercises an RSU: provide the employee with an updated tax form W-2 (and edit boxes 1–6, 16–19) by Jan 31 of the following year. Note that most payroll providers will ask you whether you issued NQSOs to employees in December so that they can issue W2s as early in January as possible. Its imperative that the company respond to these end of year surveys.

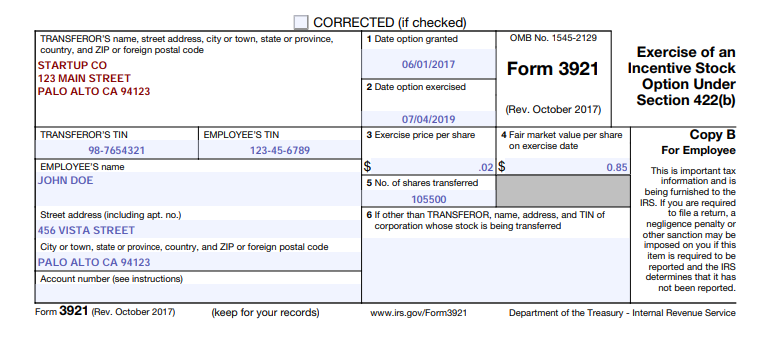

Startup Employee Exercises an ISO: provide the employee with tax form 3921 by Jan 31 of the following year. Note that ISO’s can only be issued to employees, not contractors. Many of our startups use Carta to track and record these transactions, but they do not file the 3921s for you. They will fill the form, but they cannot file for you… and you need to file with the IRS. In order to file your 3921s on Carta, you will need a unique TCC Code. Your TCC code is unique to your company, kind of like an FEIN number. Given that applying for and receiving a TCC Code can take weeks. Therefore, we recommend that you file your 3921s on Track1099 and transfer the information over from Carta.

Startup Employee Exercises an NQSO: provide the employee with an updated tax form W-2 (and edit Box 12, Code 5) by Jan 31 of the following year. Note that most payroll providers will ask you whether you issued NQSOs to employees in December so that they can issue W2s as early in January as possible. Its imperative that the company respond to these end of year surveys.

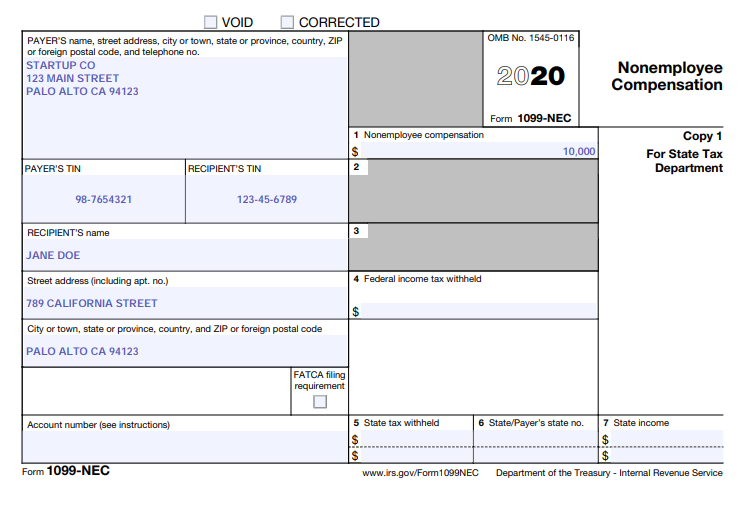

Startup Contractor Exercises an NQSO: provide the contractor with a tax form 1099-NEC and edit Box 7, Non-Employee Compensation. Note that for tax years before 2020, a 1099-MISC was used to report Contractor NQSOs. Track1099 files 1099s online and is excellent.

Please see my grid below that outlines the difference between ISO and NQSO’s, and the tax reporting that they need to get.

| ISO Incentive Stock Option |

NQSO Non-Qualify Stock Option |

||

|---|---|---|---|

| Who? | Employees only | Employees | Consultants |

| Which tax form? | 3921 (Part of the 1099 series) |

W2 Box 12 |

1099-MISC |

| Due date? | Give form by January 31st of the following year | Give form by January 31st of the following year | |

| When is tax recommended? | Sell the stock = you get taxed | Grant date has no income tax Exercise the stock you get taxed When stock is sold capital gains / losses | |

| How the company books it? | Company gets minimum from deduction Company can only give $100K per employee |

No tax effect to the business |

More on startup stock options

As a leading CPA serving VC backed startups, we get a LOT of questions on stock options. Here are some other questions and resources that may be helpful.

How Boards Set Option Strike Prices

Boards of directors are responsible for approving a company’s stock option strike price - but how do they actually determine that price? Years ago, boards had total discretion, and typically would set the strike price at a nominal amount, often 1 cent. However, the IRS decided that this was unusually favorable to employees, from a taxation standpoint, and now boards hire outside valuation experts. Read about how boards set strike prices here. Hint: you need a 409a (not an ASC 718; that’s for a different purpose related to stock based compensation!)

Categories:

Startup TaxesTable of contents

Recent questions

- Are You Missing Hidden Tax Deductions Because Your Bookkeeping Isn’t Up-to-Date or Detailed Enough?

- How Does Modern Bookkeeping Automation Improve Cash Flow Visibility and Support Smarter Business Decisions?

- What Bookkeeping Strategies Can Help a Fast-Growing Startup Maintain Accurate Financials Without Slowing Down Innovation?

- What Is Net Working Capital in M&A, and Why Does It Matter for Deal Value?

- How Can Startups Identify and Track Sales Tax Nexus Across Multiple States to Ensure Full Compliance?

Top viewed questions

- What happens if the IRS audits me and I do not have the receipt for an expense (assuming it was a legitimate expense)?

- How should convertible note financing be handled on the balance sheet?

- How do startups account for equity and fundraising on the Balance Sheet?

- For startups incorporating in Delaware, what firms are good registered agents to use?

- 2025 Founder Salaries by Stage