Startups should file Form 6765 because they can get up to $250,000 in cash refunds quickly, even if the startup doesn’t have any revenue or is running at a loss. Want to see how much your startup could potentially get back with the R&D tax credit? Estimate your credit using our free calculator.

Most startups with these qualities are eligible for the R&D Tax Credit. Most, but not all, of these traits are frequently seen for startups who can achieve the R&D Tax Credit:

- Delaware C-Corporation

- Venture backed

- Employs Engineers (Software, Mechanical, Chemical, or otherwise)

- Hires Domestic R&D Contractors

- Utilizes Amazon Web Services, or similar Cloud Computing Hosting Platform

- Purchases supplies and hardware components to build a new hardware product

- Has secured, or will secure patents

- Incorporated within 5 years

- Is within the Software, Hardware, Clean Energy, or Biotechnology Industries

- Generates less than $5M in revenue, or no revenue at all

What does Section 174 have to do with R&D tax credits?

IRS Code Section 174 and the R&D tax credit are two distinct provisions of the Internal Revenue Code that provide tax benefits for research and development (R&D) activities. While they both address R&D expenses, they serve different purposes and have different implications for taxpayers.

IRS Code Section 174

Since the Tax Cuts and Jobs Act, Section 174 forces taxpayers to amortize certain R&D expenses for income tax calculation purposes. This means that businesses spread these expenses out out over a period of time, instead of recognizing them right away.

R&D Tax Credit

The R&D tax credit is a credit against taxes owed, rather than a deduction. This means that it directly reduces the amount of taxes a business owes. The R&D tax credit is designed to encourage businesses to invest in R&D activities. This is actually a big deal, and it can push money losing startups into a position where they actually owe income tax, as if they were a profitable company!

Interaction between Section 174 and the R&D Tax Credit

The primary interaction between Section 174 and the R&D tax credit is that the expenses eligible for the R&D tax credit must also be expenses that are amortizable under Section 174. In other words, most businesses cannot claim the R&D tax credit for expenses that are not already deductible or amortizable.

In addition, there are some special rules that apply when both Section 174 and the R&D tax credit are applicable. This makes it important to work with a tax accountant who is very familiar with IRS rules, and who knows a lot about the preparation of your financial statements.

Implications for Taxpayers

The interaction between Section 174 and the R&D tax credit can have significant implications for taxpayers. Businesses should carefully consider both provisions when planning their R&D activities and tax strategies.

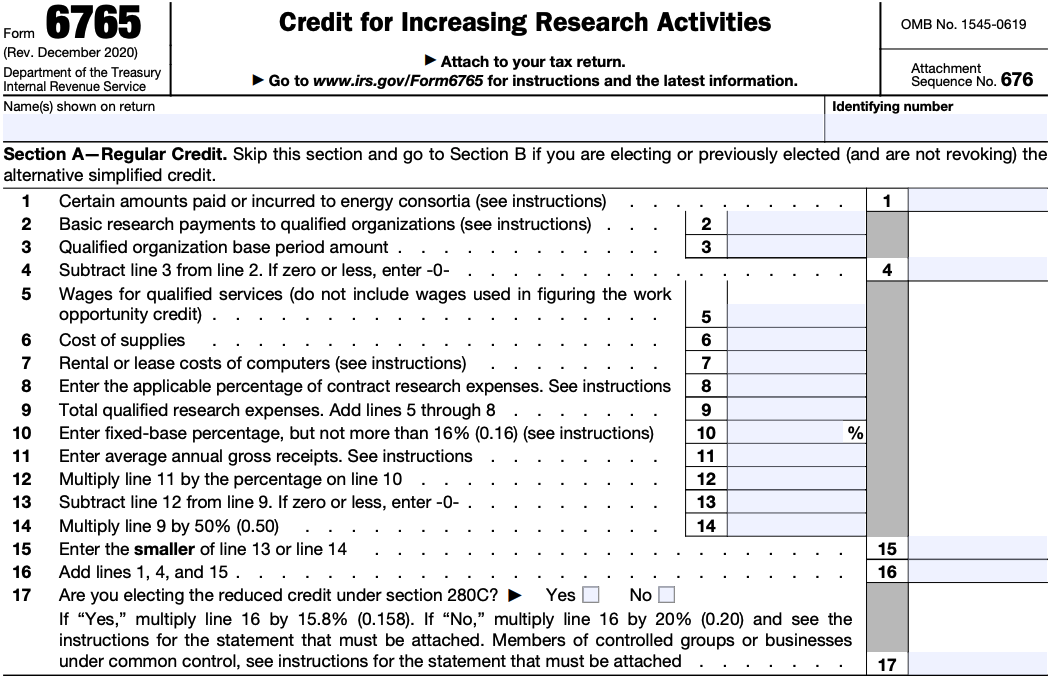

When speaking with your startup accountant, refer to Form 6765 as “Sixty-Seven, Sixty-Five.” In fact, most accountants refer to these forms with the first two numbers, followed by the second two numbers. For example, a Form 1040 is “Ten-Forty” and a Form 1120 is an “Eleven-Twenty”

Form 6765 is filed as part of the 1120 package, also known as the Annual Income Tax Return for C-Corporations. Form 6765 is also accompanied by Forms 3800: General Business Credit within the 1120 package, and then also accompanied by Form 8974: Qualified Small Business Payroll Tax Credit for Increasing Research Activities, which is filed quarterly after the 1120 package has been filed.

Form 6765 must be filed or extended by April 15th of every year in order to capture the cash-back payroll tax credit and collect up to $250,000. If the 1120 package is extended, you must file by Oct 15th of every year. If you fail to file timely, you lose out on the cash-back payroll tax credit to $250,000. Even if your startup is not generating revenue, or is unprofitable, you must file on time to collect the cash-back payroll tax credit of up to $250,000. Note that the Inflation Reduction Act will increase the maximum credit from $250,000 to half a million dollars for the tax year 2023.

Yes, you can file Form 6765 yourself by completing the Form manually or completing it through a software provider such as Intuit TurboTax. Keep in mind that you will need to complete the entire 1120 package as well. Realize that this form is likely the number one reason unprofitable, VC-backed companies are audited by the IRS - and that major corporations M&A teams will likely conduct due diligence on any tax credits so that they do not assume any unexpected liabilities. Beware of the following possible issues if you DIY or use a software solution:

- Overstated Form 6765: with a potential for hundreds in thousands of dollars in cash back, it can be easy to pile on “qualified” expenses that the IRS doesn’t truly consider to be qualified R&D. For example, we often see Founders mistakenly include employees who are engaged in Quality Assurance with the R&D process, but this activity is strictly forbidden from being included in the R&D calculation. There’s a myriad of other qualifications. The more cash back you are getting from the IRS, the more ripe you are targeted for an audit. You are, after all, taking money from them - which is arguably worse than understating your taxes. If the audit demands that you pay back the money and your startup has either gone out of business or doesn’t have the money, YOU the founder are liable and will have to pay the tax bill.

- Understated Form 6765: there’s also the possibility of understating the amount of R&D that your company engaged in. In this case, you could be leaving tens of thousands in cash, every year, unclaimed.

In sum, we highly recommend that you work with a tax CPA to file both your 1120 and your Form 6765 R&D Tax Credit to ensure that your startup claims all reasonable and qualified R&D expenses in order to achieve up to $250,000 in cash back every year. And note that the maximum amount cash back is doubling, but for the tax year 2023.

Finally, if you do choose to file Form 6765 and 1120 yourself, the work does not stop there. You will need to file and monitor Form 8974: Qualified Small Business Payroll Tax Credit for Increasing Research Activities, every quarter with your payroll provider until the full credit is claimed, which often takes 5 quarters. This lead us to another problem that we see every year:

We regularly see payroll providers who make mistakes getting the credit to their startup clients. This error could cost your company hundreds of thousands of dollars! When we prepare the Form 6765 for our bookkeeping clients, we help make sure that they get the credit that they are owed. If you DIY this form, make sure you talk to your payroll provider to understand what you need to get to them and when you’ll benefit from the credit.

As one of the leading CPAs serving VC-backed startups, we prepare hundreds of corporate tax returns every year - and we do not accept outside, non-CPA prepared Form 6765’s for several specific reasons:

- Liability - payroll tax credits are a leading cause of audits for cash-burning startups. It’s the tax preparer who bears this risk, so using a non-CPA prepared dramatically increases the risk of the return. We do not recommend our fellow business CPAs take on the risk of outside tax credit work.

- Cost - any CPA worth their salt will want to dig in on any outside 6765. That increases the cost of preparing a return. If a client asks us to take a look at a third-party 6765 - in particular ones prepared by “automated” systems, we regularly find significant errors. The work to untangle these errors and keep our clients out of trouble is not worth the effort or risk, so we prepare these forms for our clients ourselves.

- Timing - the Form 6765 has to be filed with the Form 1120. We can’t delay the filing of our clients’ Form 1120’s. It’s not worth the risk of delaying or missing deadlines, when we know we can prepare this form on time, usually at a lower cost.

Caveat: The information on this page intended as general guidance and it doesn’t substitute the need to work with a professional. It’s also a high level overview and is in no way complete. Your company is unique; contact Kruze Consulting.