How should convertible note financing be handled on the balance sheet?

Table of contents

A convertible note should be classified as a Long Term Liability that then converts to Equity as stipulated from the contract (usually a new fundraising round).

Mechanically, a convertible note represents an exchange of an investor’s money for a convertible debt instrument that will allow the investor to make a modest amount of interest until the note matures or “converts”. At the time of maturity, the investor will either get their money back, roll it over and extend, or convert it to equity. Generally, in Silicon Valley, the investor converts the note into equity at the next financing round. So, from an accounting perspective, you have a long-term liability that (in most circumstances, or at least in most good outcomes) converts into equity.

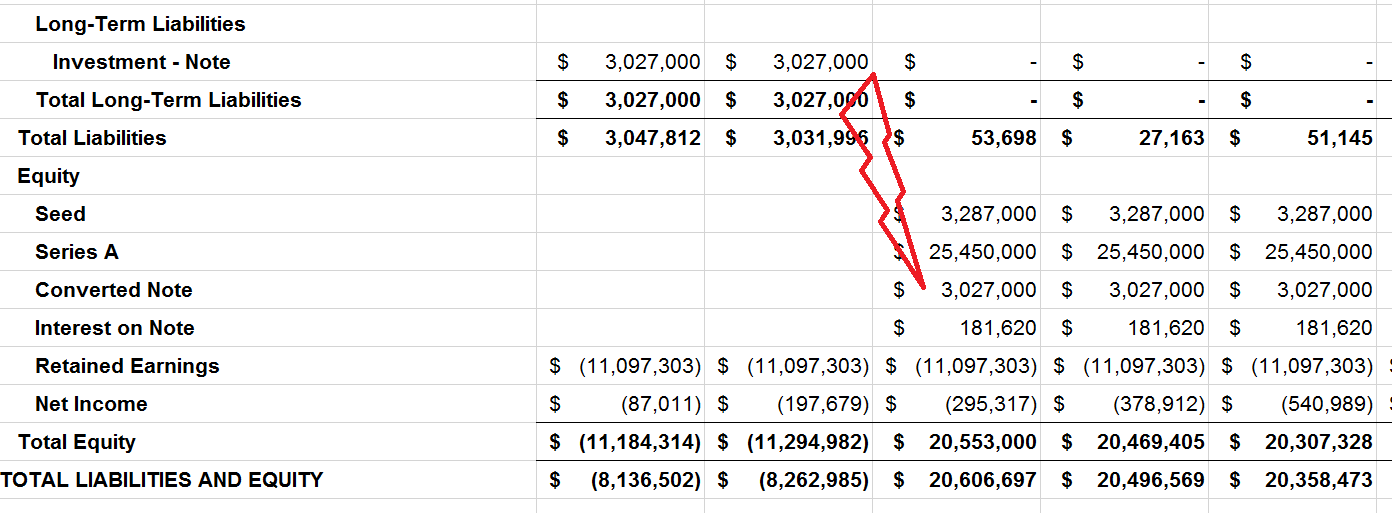

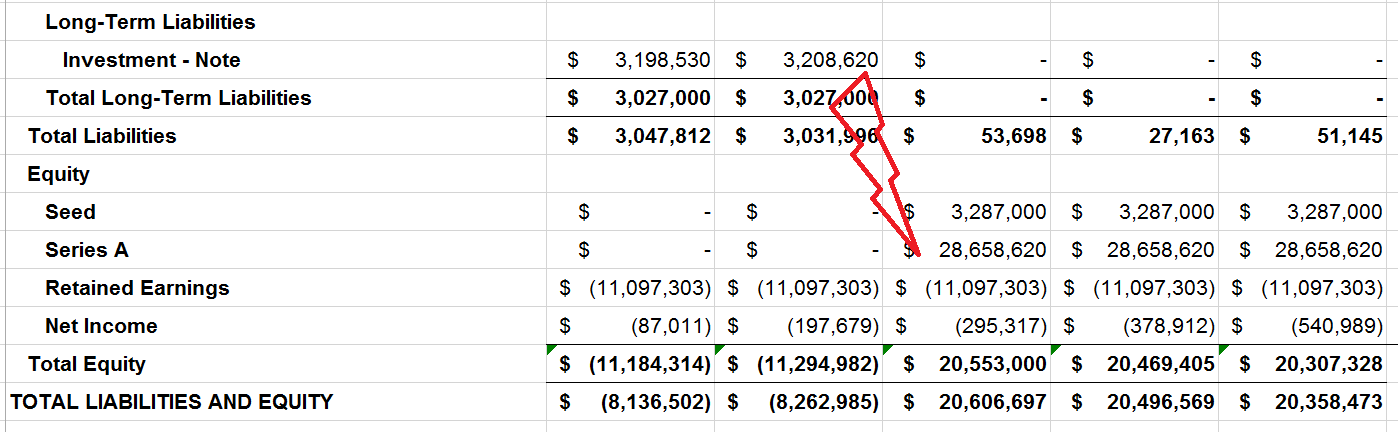

Assuming that there’s a $3,027,000 note with $181,620 in total accrued interest, you’ll have the outstanding note as a liability, plus then you can add another line with the accrued interest. You could consolidate these for presentation purposes, but it’s often easiest to look at them broken out.

This image shows a balance sheet liabilities equity Series A, so you can see what it might look like as converted:

Remember, the balance sheet is trying to balance the assets against the liabilities + equity. So the cash coming in from your convertible note will generally equate to the liability that you add to the balance sheet. And, if your accounting is doing a good job, the accrued interest is a non-cash expense that flows through your income statement and impacts your accumulated net income in the equity section.

Conversion to Equity - Accounting for Convertible Debt

When the note converts, usually during a new funding round, the liability moves to the equity section of the balance sheet. At this stage, the convertible note is settled, and new equity instruments, typically preferred shares, are issued to the investor.

What is Convertible Debt or Convertible Notes?

Convertible debt, commonly known as a convertible note, is an investment vehicle frequently employed by startups that are not yet ripe for a formal valuation. Angels and seed-stage funds invest money into the startup and receive a convertible note, which earns a modest amount of interest until maturity (usually between 20 to 24 months). The note also carries conditions for conversion into equity, commonly when the startup secures additional equity funding, generally in the form of preferred shares.

How Does Convertible Debt Work?

Key features of convertible notes often include a valuation cap and a conversion discount. The valuation cap sets the highest valuation at which the note will convert into equity. On the other hand, the conversion discount compensates the investor for the risk they undertake by holding the note. It effectively reduces the per-share price for converting the note into equity.

In summary, understanding how to account for convertible notes is crucial for startups, especially those with venture capital backing. These notes are initially considered Long-Term Liabilities but may convert to equity based on specific triggers, offering an effective and flexible financing option for early-stage companies.

By maintaining accurate accounting of your convertible notes, you’re not only complying with accounting standards but also giving potential investors a transparent view of your company’s financial health.

How to account for seed or venture capital raises on your balance sheet?

Note that SAFE notes are Equity right from the start

And we have an entire page that talks about convertible notes and some of their accounting (and strategic) implications.

Categories:

Startup AccountingTable of contents

Recent questions

- Are You Missing Hidden Tax Deductions Because Your Bookkeeping Isn’t Up-to-Date or Detailed Enough?

- How Does Modern Bookkeeping Automation Improve Cash Flow Visibility and Support Smarter Business Decisions?

- What Bookkeeping Strategies Can Help a Fast-Growing Startup Maintain Accurate Financials Without Slowing Down Innovation?

- What Is Net Working Capital in M&A, and Why Does It Matter for Deal Value?

- How Can Startups Identify and Track Sales Tax Nexus Across Multiple States to Ensure Full Compliance?

Top viewed questions

- What happens if the IRS audits me and I do not have the receipt for an expense (assuming it was a legitimate expense)?

- How should convertible note financing be handled on the balance sheet?

- How do startups account for equity and fundraising on the Balance Sheet?

- For startups incorporating in Delaware, what firms are good registered agents to use?

- 2025 Founder Salaries by Stage