The AI Gold Rush Matures

Most startups are using AI and LLMs are becoming the new tech commodity

The last two years have witnessed an unprecedented surge in artificial intelligence adoption among startups. What began as a frenzied gold rush is now showing signs of maturation and stabilization. This white paper, based on spending data from over 1,000 venture-backed startups, reveals a shifting landscape where the initial AI boom is giving way to a new phase.

Kruze Consulting’s CFOs and controllers frequently discuss major spending trends with our clients, all of which are VC-backed startups. AI is becoming a major line item for many startups, and the founders we work with are constantly thinking about how to optimize their businesses – do they need to use AI to improve their developers’ productivity? Can they avoid hiring marketing or sales if they take on an AI solution? Are they spending too much with one AI API and are other options available?

These conversations, and our unique dataset of startup spending, give us insights into how early-adopters are using AI.

Looking across spending by these 1,000+ startups, two key trends emerge: most startups are already paying for at least one AI tool, and Large Language Models (LLMs) are becoming increasingly commoditized. Increasingly, startups are using multiple AI tools, and now we’re entering a phase where we’ll see if they continue to rely on general-purpose LLMs or begin to adopt more specialized, point solutions. Additionally, the major spenders on AI, who are using APIs to access the major LLMs, are showing that they can quickly move from one model to the other based on new releases, pricing and performance. These trends are reshaping how startups approach AI integration and spend, with far-reaching implications for both AI providers and users in the startup ecosystem.

The state of AI adoption in startups

The rapid rise of AI tool adoption among startups has been nothing short of remarkable. Our data reveals a clear S-curve adoption pattern, with the steepest growth occurring in early 2023. The initial growth was driven by the release of OpenAI’s low-cost ChatGPT subscription, which we’ll touch on in a moment.

As of August 2024, approximately 70% of startups in our sample are paying for at least one AI tool. We believe that tech startups are early-adopters of new technology, and it appears that these early-adopters are now comfortable with AI and are using it as part of their workflow. This represents a significant majority, suggesting that we’ve moved beyond the early adoption phase and are entering a period of market saturation.

Breakdown by industry

While the overall adoption rate is high, it’s not uniform across all sectors. Our industry breakdown reveals interesting patterns by the type of startup purchasing (or not purchasing) AI solutions.

SaaS companies lead the pack in AI adoption, with nearly 80% of SaaS startups in our sample using AI tools. We aren’t surprised by this! The high adoption rate by SaaS startups is likely driven by several key trends:

- The natural synergy between AI capabilities and SaaS product offerings – many are rapidly trying to integrate AI into their product, or are pivoting to becoming AI startups themselves.

- Leveraging subscription-based AI services for operational tasks such as writing marketing copy, image generation, assisting in coding, and Excel modeling.

- Utilizing AI APIs for data processing, cleansing datasets, improving data management processes, and enabling data-driven decision-making.

- Incorporating AI APIs directly into products, enhancing offerings with features like chatbots or personalized content generation.

- Training custom AI models tailored to specific SaaS use cases, demonstrating a shift towards more sophisticated AI strategies.

Interestingly, e-commerce and marketplace startups, after an initial surge, have shown a recent decline in AI tool usage. This unexpected trend may indicate that these sectors found initial use cases for AI but are either reevaluating this use of AI, or they used AI for a process (such as writing product descriptions or doing data cleansing) and have now finished with that use case.

In contrast, biotech and healthcare startups lag behind in AI adoption. This lower adoption rate can be attributed to several factors specific to these industries. Biotech and healthcare startups often focus on highly specialized research and development that may not directly benefit from general-purpose AI tools. Unlike SaaS companies, these startups typically have less need for generating marketing copy or rapid software development, which are common use cases for AI in other sectors. The specialized nature of their work and reduced demand for general AI applications explain why these industries are not adopting AI tools at the same rate as their SaaS counterparts.

Analysis of adoption trends and what they signify

The slowing growth in overall adoption rates suggests that we’re approaching a point where most of the early-adopters have already discovered AI and are actively paying for AI products. However, the fast curve – and what we’ll see in the dominant players section – indicates that there is still room for new tools.

And, since the median startup is only paying for two AI products (up from one at the beginning of the year), there is still room for more specialized products to get rapid adoption.

There is also room for tools that are focused on specific industries. Different sectors are finding varying degrees of value and applicability in current AI offerings.

The dominant players in the AI space

OpenAI’s market leadership

At the moment, the major first mover – OpenAI – has emerged as the clear market leader among startups. Our data shows a remarkable adoption rate for OpenAI’s tools, particularly following the release of their ChatGPT model and API.

As of August 2024, approximately 65% of startups in our sample are paying for OpenAI’s services. This dominance can be attributed to several factors:

- First-mover advantage with the release of ChatGPT

- Low-cost, general purpose subscription product

- Robust API offerings that allow for easy integration

- Continuous model improvements and new releases

- Strong brand recognition in the AI space

We’ll get into how their dominance may be challenged – but the fact that their penetration rate actually declined in the past several months, while their major competitor, Anthropic, is growing, suggests that competition is heating up in the LLM space…

Anthropic’s growth and competition

While OpenAI maintains a commanding lead, Anthropic has emerged as a real challenger in the LLM space. Our data shows a sharp increase in Anthropic’s adoption rate, particularly in early 2024.

This growth coincides with the release of Anthropic’s new models, which have been well-received for their performance and ease of use. In particular, the March 2024 release was well received, and the impact on their market share is noticeable, with a huge pop and change in the growth curve beginning in March.

We will look deeper into how OpenAI and Anthropic’s fortunes change with the releases of their improved models this year when we discuss how the power users of AI – those using the APIs – are shifting their spending based on model availability.

Other notable AI tools and their market share

Beyond OpenAI and Anthropic, several other AI tools have gained traction among startups:

Notably, Midjourney has maintained a steady user base, likely due to its focus on image generation. Perplexity (a Kruze client) has shown impressive growth, potentially driven by its specialized search and question-answering capabilities.

The diversity of tools being adopted reflects the expanding range of AI applications in the startup ecosystem. From text generation to image creation and specialized data analysis, startups are leveraging a variety of AI capabilities to enhance their products and operations.

How startups are leveraging multiple AI tools

Startups are increasingly using a combination of general-purpose and specialized AI tools. For example, a SaaS startup might use OpenAI’s GPT for content generation and customer support, while also employing a specialized tool like Midjourney for creating product visuals.

This multi-tool approach allows startups to leverage the strengths of different AI models and platforms, creating more comprehensive and effective AI strategies.

Financial aspects of AI adoption

Prior to OpenAI’s public launch of Chatgpt, most startups that were paying for AI tools were either using APIs to access OpenAI’s LLM, or were paying for enterprise AI tools like Databricks or Gong. This drove a high average and median spend.

However, once OpenAI’s LLM was available to the public, we saw a huge increase in adoption, and a dramatic decrease in the average and median spend on AI. Many companies - the majority - were purchasing the ~$20 per month Chatgpt subscription for a handful of seats at their startup. This pushed the median AI spend down to below $60 per month.

Startups’ spending on AI is on the upswing, driven by a higher number of seats for AI subscriptions like Chatgpt and Anthropic’s Claude - and by an increasing number of companies using APIs to access larger amounts of AI power. We’d expect this trend to continue: a higher number of seats for the standard AI subscriptions, and more and more API usage. The counterpoint to growing the API spend is that the major players continue to release LLMs that have lower API costs, meaning that even as usage increases the spend may moderate.

The financial investment in AI tools by startups has evolved over time. Our data shows that:

- The average monthly AI spend for startups using AI has increased from about $2,000 in the first half of 2023 to $5,000 to $6,000 in the past few months.

- The median monthly AI spend seems to have bottomed out the first half of 2023 to $40 to $60, and is on the upswing, at over $130 in August 2024, mainly driven by startups purchasing more seats of LLM subscriptions.

LLMs as commodities: A new paradigm

As the AI market matures, we’re observing a fascinating trend: Large Language Models (LLMs) are increasingly behaving like commodities. This shift has significant implications for both AI providers and the startups that rely on these technologies.

Evidence of commoditization

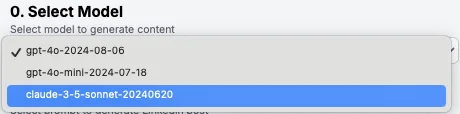

There are essentially two markets for the major LLMs - the “consumer” like $20 per month subscriptions, and the APIs. In our chart that shows the percent of startups paying for OpenAI vs Anthropic, the adoption is mainly driven by the $20 per month subscriptions. The number of startups paying for Anthropic dramatically increases in two key moments: the March Sonet 3.0 release and the June Sonet 3.5 release.

OpenAI’s penetration was asymptoting prior to Antorhopic’s releases, but it seems like the introduction of another, very capable model with a low price point and easy monthly subscription is challenging OpenAI’s dominance. And the percentage of startups paying for OpenAI dropped in August of 2024, whereas Anthropic continued to gain market share.

API users are not showing deep loyalty

We analyzed the top 50 spenders on AI for 2024, and found evidence that many are quick to move usages from OpenAI to Anthropic. These spenders are using the API to access the two major LLMs, and our data on API usage among top AI users reveals clear signs of LLM commoditization:

This chart shows the monthly spending patterns of our top API users on OpenAI and Anthropic services. Note the significant fluctuations, particularly for Anthropic:

1. We see a sharp increase in Anthropic spending starting in March and really taking off in April 2024, corresponding to the release of a new, more capable model. Our CFO work indicates that startups were excited about the advent of a second, highly useful LLM with a stable API, and quickly added it to their existing process/product.

2. In June, Anthropic released Claude 3.5 Sonnet – this was a much lower-cost model than their prior model. We see the impact of this start to hit in June, then really show up in July, as the average amount spent with Anthropic dramatically dropped. Our CFO team indicates that startups using the Claude API were ecstatic at what was essentially a major price drop.

3. From our conversations with CEOs, we expect the recently released OpenAI models, which are also cheaper, to follow a similar pattern.

An easy to switch product

We see evidence of how easy it is to integrate with these APIs, and how quickly startups can switch usage between the two. The chart below shows the percent of the top API users who were using only one API, namely OpenAI, at the beginning of the year - and how quickly the majority were able to add in a second.

The chart with the major API users further illustrates the shifting landscape:

1. OpenAI maintained a dominant position early in the year.

2. We observe a significant shift towards using both OpenAI and Anthropic services as the year progressed.

3. By August 2024, the majority of top API users were leveraging both services, suggesting easy interchangeability between the two.

The ease of switching between models

One of the key indicators of commoditization is the ease with which users can switch between different providers. In the case of LLMs, this switching has become remarkably simple.

Startups using AI APIs are remarkably efficient and quickly switch from one API to another. For some, making the switch can be made shortly after the new models and APIs are released. This ease of transition between models underscores the commoditization of LLMs.

Price competition and its impact on the market

The commoditization of LLMs has led to increased price competition among providers. We’ve observed that when one provider lowers their prices or introduces a more cost-effective model, it often leads to a rapid shift in usage patterns.

This price sensitivity is a classic hallmark of a commodity market. It suggests that while there may be some differentiation between models in terms of capabilities, many users view them as interchangeable for their specific needs.

Comparison to other commodity markets

The emerging LLM market shares several characteristics with traditional commodity markets:

1. Fungibility: Different LLMs are often interchangeable for many use cases.

2. Price sensitivity: Users quickly shift to lower-cost options when available.

3. Ease of switching: Changing between providers requires minimal effort.

However, the LLM market also has unique characteristics:

1. Rapid technological advancement: Unlike physical commodities, LLMs are continually improving.

2. No physical inventory: Switching between LLMs doesn’t require depleting existing stock; our clients prove how quickly usage can change.

3. Rapidly dropping pricing: The price of API tokens has dropped significantly over the course of the year, and with AI being a major cost center, startups are quick to jump to a lower priced option.

These factors make the LLM market a fascinating new frontier in tech commoditization. Will startups be able to negotiate and get leverage with the major LLMs? Or is their use of the APIs too small for the major LLMs to take notice, and instead these startups will simply jump from one model to the next based on pricing and performance?

The new reality of AI as a commodity in the startup ecosystem

The commoditization of LLMs marks a new chapter in the AI revolution. What was once a cutting-edge technology accessible to only a few is now becoming a standard tool in the startup toolkit. This shift is democratizing access to AI capabilities and changing the competitive landscape for both AI providers and startups.

Final thoughts on what this means for innovation and competition in tech

As AI becomes commoditized, the focus of innovation is likely to shift from the underlying models to their applications. Startups that can creatively leverage these powerful, readily available AI tools to solve real-world problems will be the ones that thrive in this new landscape. We are working with many founders that now expect access to AI APIs with high-quality output and lower and lower costs.

For AI providers, the challenge will be to find new ways to differentiate and add value beyond raw language processing capabilities. This could lead to a new wave of innovation in AI services, benefiting the entire tech ecosystem.

Ultimately, the commoditization of LLMs is not the end of the AI story, but rather the beginning of a new chapter. It sets the stage for more widespread AI adoption, more innovative applications, and potentially, entirely new categories of AI-powered businesses. As this trend continues, we expect to see AI become an increasingly integral and invisible part of the startup world, driving efficiency, creativity, and innovation across all sectors.

Interested in more proprietary research on AI? Read our article on how expensive compute costs are for AI startups.