Update as of December 23rd, 2020:

We have seen a number of clients successfully have their PPP loan forgiveness applications processed. Additionally, Congress passed an additional piece of legislation that has yet to be signed by the President that will make loan forgiveness easier for many companies.

Here are some of the key points, as of the morning of December 23rd, 2020. AGAIN, this bill has not yet been signed by the President, and so it’s unclear if this language will actually become law. But, here is what think this bill will do if it is signed:

These will impact companies that already have PPP Loans, as well as companies that may raise if there is another tranche of loans:

- More eligible expenses can be used in the forgiveness calculation. So, if your startup did not succeed in spending the full amount in the first round of PPP loans, these expenses may allow you to get a greater forgiveness amount. This includes protective equipment for employees and some items like air filters, some software and SaaS expenses (which should be helpful for many startups) and some “goods” purchases, which may include some inventory purchases for hardware companies. NOTE that this language probably needs to be clarified by the SBA, so your banker may not be ready to act on it when you are applying for forgiveness.

- Congress is asking the SBA to formalize how they will audit companies that raised over $2 million in PPP loans (from the first batch of loans). This won’t impact our client base, but if you raised more than $2 million in the first rounds of PPP, expect more paperwork.

- Easier forgiveness for companies that raised under $150,000 via the PPP loan. Previously, companies that raised under $50,000 were able to use a one page, shorter forgiveness application. This legislation raises that limit to $150,000. So if you haven’t yet applied for forgiveness for your first PPP loan, you should ask your banker if they will use this short form. We estimate that this will help about 50% of startups that have a PPP loan forgiveness process.

- Better tax treatment of forgiven PPP loan expenses. Previously, the IRS was not going to allow companies to deduct expenses paid for by a forgiven PPP loan. So this would increase a company’s tax bill. Congress now allows expenses paid for using a forgiven PPP loan to be deducted from your taxes.

Banks are slowly beginning to allow their clients to apply for PPP loan forgiveness. We’ve seen several that now have online “forgiveness portals” where their clients can submit documents to apply for forgiveness. Kruze’s clients has successfully raised millions in funding through this stimulus program, and we are preparing to help them apply for forgiveness now.

HOWEVER, the banks that we commonly work with are throttling access to their PPP forgiveness portals. So don’t be surprised if your banker hasn’t asked you to start your application. We have heard that this is so that the bank’s teams don’t get overwhelmed while they work out the kinks in the process. So don’t be offended if your bank hasn’t asked you to apply yet.

Secondly, bankers we work closely with have said that if your loan is less than $150,000, it is likely that the bank will NOT let you begin the application process. This is because loans under $150,000 may end up being automatically forgiven - depending on how the SBA or Congress steps in.

Before you ask your banker for access to the portal, there is one important item you need to think through:

8 week or 24 week PPP forgiveness period

The legislation now allows for companies to pick the period over which the forgiveness eligibility is calculated. Companies can choose an 8 week or a 24 week period when calculating the total payroll, rent, etc expenses that will be applied to the loan for forgiveness. While the original PPP legislation only allowed an 8 week period, Congress added the option to use 24 weeks over the summer. Kruze agrees with Congress’s logic that many businesses were not able to spend the full PPP loan amount on approved expenses in that short 8 week window, and would lose out on some loan forgiveness. In conversations with Kruze clients, we’re seeing most default to the 24 week time period so they can be sure to get every dollar of the PPP Loan forgiven.

Most Kruze clients PPP loans were funded in late April & early May, so those startups have already hit the 8 week mark. However, if you were funded in that April / May time period, you still have about another month to wait before you clear the 24 week forgiveness period.

Please note that some banks are allowing applications to be submitted before the 24 week period is complete. However, Kruze recommends against that because if something changes in your employee base and you have to restate your application, it’s likely you will be deprioritized and also your risk of audit will likely increase. We can’t know this for sure but for a financial transaction this important and with government funds involved, we’re preaching patience so you get it right the first time.

So which should you pick?

Most of the venture backed startups that we serve can quickly “eyeball” if the 8 week period makes sense. Here are the basic questions to ask:

- Did your company spend the entire loan amount on approved expenses? The biggest question for VC-backed startups should be on payroll - did your startup spend the full loan amount on employee payroll? Remember, the per employee payroll amount is capped at $100k per year in annualized salary. Therefore, when running this calculation make sure you reduce highly compensated team members to the $100k run rate amount. Since the loan amount was probably 2.5 months worth of eligible payroll, you likely did not spend the full amount during the 8 week period. Therefore, the 24 weeks will probably make more sense for many companies.

- Was your headcount down, flat or up over the initial 8 week period? The purpose of the PPP Loan was to help businesses maintain employment and stabilize the US economy. Therefore the guidelines state that the amount forgiven will be decreased if headcount was reduced. If you let people go, you need to estimate if you are likely to have more employees at the end of the 24 week period.

We’re finding that some Kruze clients had employees leave their employer through the normal course of business and not because of a headcount reduction. Those same companies then took a few months to replace those employees but ultimately did hire replacements. If your startup followed this pattern of a small dip in employment, followed by actual employee headcount growth, which resulted in more employees now than at the beginning of the period, you’re an excellent candidate for the 24 week forgiveness period.

What paperwork will be required?

The documentation your startup will require will likely come from your payroll provider, plus you may have to ask your friendly accountant for a bit of help as well.

Right now, the government is saying that the official documentation will be one of two forms, a SBA PPP forgiveness application form (SBA Form 3508) or the “EZ” forgiveness application form (SBA Form 3508EZ). HOWEVER, it’s important to realize that your bank may actually fill out these forms using the information you provide through their forgiveness portal - so don’t run to fill these out until you talk to your banker.

To generalize, the EZ form is quite a bit simpler and will likely be used for companies that did not reduce headcount since January 1, 2020, and did not reduce salaries more than 25% since then.

The non-EZ Form 3508 has a section that gets into how your employee count and salaries have changed. We believe that the payroll providers are working on creating reports to make this easier to gather, but it may require some work. For our clients, we’ll review the first few of these payroll system reports to make sure we agree with the calculations.

How long will PPP forgiveness take?

Patience is going to be required, unfortunately. The banks have 60 days to approve the application and then the SBA has another 90 days to confirm and process. The entire process could take 150 days after the application is submitted to receive your forgiveness approval. In fact, the banks Kruze has been talking to have indicated they expect it to take the full 150 days.

Please be patient with the banks. They have made investments in technology and staff to handle the flood of applications.

Now that forgiveness for the Paycheck Protection Program loans are on the cusp of being processed, it’s time to gather the materials you will need.

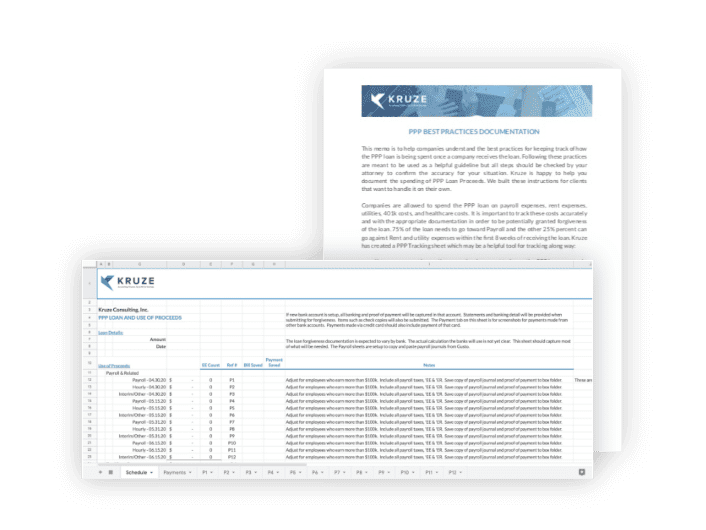

We’ve created documents and spreadsheets to help our accountants and clients follow best practices managing the PPP loan funds. You can get them here:

Get our Suggested PPP Loan Forgiveness Documentation

Click on the right to visit our PPP Loan Best Practices Library, where we have:

Our Library contains

- A best practices list to help you keep the right documents

- A memo you can use to memorialize your PPP loan request and document your need with your Board of Directors (make sure to get legal help)

- A spreadsheet that you can use to consolidate your forgivable spending, including payroll, rent, utilities, etc.

We strongly suggest that you work with an accountant and lawyer to make sure your startup is following the letter (and intent!) of the law, as there have started to be some high profile instances of companies “getting into hot water” over their loans - for example, the LA Lakers. And make sure you ask your bank what materials they will require to forgive your PPP.

Remember, startups are allowed to spend the PPP loan on payroll expenses, rent expenses, utilities, 401k costs, and healthcare costs. It is important to track these costs accurately and with the appropriate documentation in order to be potentially granted forgiveness of the loan. Originally, 75% of the loan needs to go toward Payroll and the other 25% percent can go against Rent and utility expenses within the first 8 weeks of receiving the loan. However, in early June Congress passed changes to the law that let companies that already have a loan extend the forgiveness calculation period to 24 months (maximum date of December 31, 2021) AND reduces the 75% on payroll to just 60% on payroll. Note that as of the morning of June 4, the President still had to sign this law into effect.

If you don’t get yours forgiven, you still have a nice little stimulus for your business - a 1% interest rate, 2 year loan that doesn’t require a personal guarantee. The updated law, passed in early June, allows new PPP loans to be 5 years in length.

And if you didn’t get one, check out our CARES Act page to see what other stimulus options might be available for your business.

Any advice contained in this communication, including attachments and enclosures, is not intended as a thorough, in-depth analysis of specific issues. Nor is it sufficient to avoid tax-related penalties. This has been prepared for information purposes and general guidance only and does not constitute professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice or consulting a qualified law firm.

No representation or warranty (express or implied) is made as to the accuracy or completeness of the information contained in this publication, and Kruze Consulting, its members, employees, and agents accept no liability, and disclaim all responsibility, for the consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.