What KPIs do major venture capital firms track in quarterly information requests from portfolio companies?

Table of contents

As a finance and accounting firm to venture-backed startups, we see these requests pretty often - usually once a quarter!

Assuming you are a “normal” startup based in the US, you signed an “Investors Rights Agreement” with your venture investor. The Investor Rights Agreement likely grants very specific, and also rather open-ended, rights about what financial statements and data you are required to share.

The exact requests vary by venture firm. Some have very standardized requests, usually executed through some sort of a crude online form that requires the startup (or often us, acting on their behalf) to enter in specific metrics. Others are less formulaic (or maybe just less organized), with the individual VC making specific requests at various times of the year.

Some of the information may be specific to your startup’s industry. For example, SaaS startups may be asked for information on customer count, churn rates, bookings, customer acquisition costs. Biotech companies may be asked for information on drug development pipelines or regulatory approvals stages/updates. Regardless, all startups are required to share financial data per the Investor Rights Agreement.

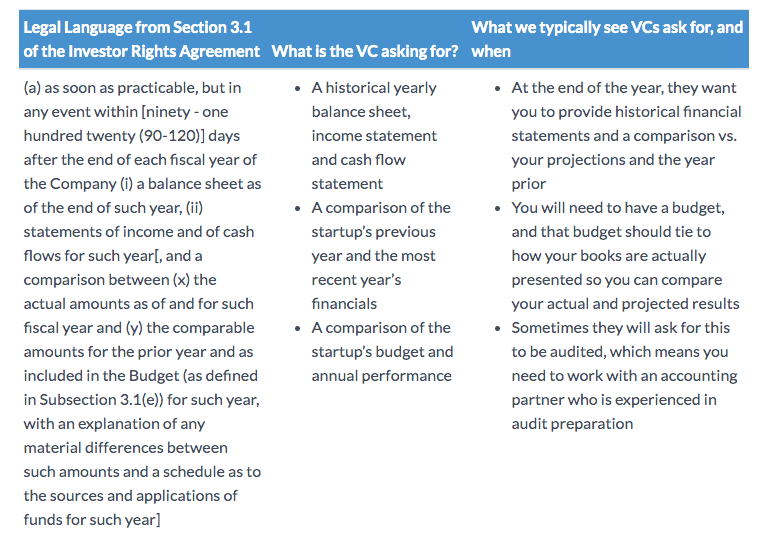

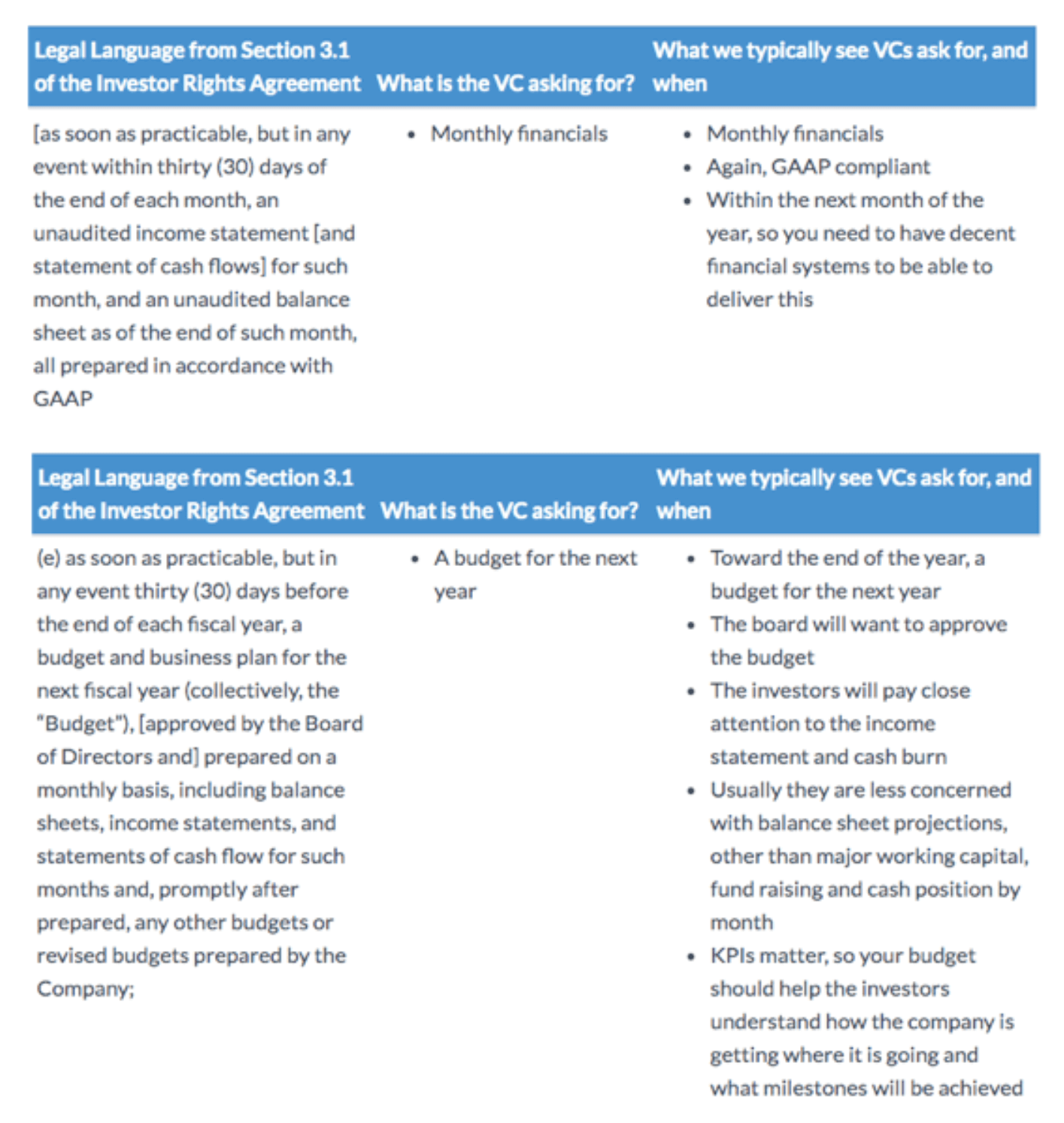

The “3.1 Delivery of Financial Statements” part of the Investor Rights Agreement is the part of the legal documents that your startup will sign that lays out what the investors are going to ask for. The following legal text is taken from the National Venture Capital Associations’ Investor Rights Agreement in their Model Legal Documents.

So what does this really mean to you, as the CEO who has just raised a lot of money?

- Your accounting systems and bookkeeping must be strong enough to:

- Deliver reliable financials every month

- Periodically generate specific reports for your investors

- Do accrual accounting that produces GAAP or close to GAAP numbers

- Survive an audit, should they ask for one - this means having your schedules and back up information neatly organized

- Produce a capitalization table on demand

- Your strategic finances must be strong enough to:

- Create a budget that your team can follow

- Produce a budget before the end of the year

- Compare your actual performance to your projected

- Explain the difference in your period over period difference

- Know when you are running out of cash, and understand the impact of hiring decisions, margins, and more on your projected cash out position

We break have few more of the sections in the Investor Rights Agreement broken down in a more detailed fashion on our blog in a post called “What Financial Information do VCs ask For After an Investment.” And we also explain what financial and accounting resources we suggest that most startups have to support these information requests. Congratulations if you’ve just raise a bunch of money from VCs! You do have work to do though to keep them happy.

Categories:

Venture Capital and FundraisingTable of contents

Recent questions

- Are You Missing Hidden Tax Deductions Because Your Bookkeeping Isn’t Up-to-Date or Detailed Enough?

- How Does Modern Bookkeeping Automation Improve Cash Flow Visibility and Support Smarter Business Decisions?

- What Bookkeeping Strategies Can Help a Fast-Growing Startup Maintain Accurate Financials Without Slowing Down Innovation?

- What Is Net Working Capital in M&A, and Why Does It Matter for Deal Value?

- How Can Startups Identify and Track Sales Tax Nexus Across Multiple States to Ensure Full Compliance?

Top viewed questions

- What happens if the IRS audits me and I do not have the receipt for an expense (assuming it was a legitimate expense)?

- How should convertible note financing be handled on the balance sheet?

- How do startups account for equity and fundraising on the Balance Sheet?

- For startups incorporating in Delaware, what firms are good registered agents to use?

- 2025 Founder Salaries by Stage