2024 Tax Deadlines for Boston Startups

In 2024, Boston-based companies have several important tax deadlines, including the April 15th federal and Massachusetts tax return filings (which can be extended until October 15th). Additionally, Massachusetts and the federal government have various tax filings due on the dates listed below.

Upcoming Boston deadlines in 2024

Total 29 Tax events for Boston in 2024

Click The Links To Learn More About These Filings And 2024 Boston Startup Tax Deadlines

- 15 Jan : Federal Quarterly Estimated Tax 4th installment (fourth quarter 2023).

- 31 Jan : Send 1095-B and 1095-C forms to employees.

- 31 Jan : Boston startups should send 1099s to contractors. Send W2s to employees and e-file 1099-MISC for non-employee compensation with the IRS. Or file Form 8809 for a 30-day extension to file W2s and 1099-MISC for non-employee compensation.

- 31 Jan : Claim Research & Development Tax Credits on Form 941, and file annual Federal Unemployment Tax Act (FUTA) return on Form 940. Use our handy calculator to estimate your possible research and development tax credit.

- 28 Feb : For Boston startups, IRS ACA Compliance 1094-B, 1095-B, 1094-C, and 1095-C filings are due (if paper-filing, due April 1 if eFiling). File Form 8809 for a 30-day extension.

- 1 Mar : Massachusetts State Tax Form 2/Form of List for property tax assessment (billed quarterly).

- 1 Mar : IRS 30-day automatic extension: provide Form 1095-B and Form 1095C to employees.

- 1 Mar : Delaware Annual Franchise Report filing deadline. Your Boston startup will pay a minimum of $400, which increases if you have significant funding.

- 15 Mar : Massachusetts Q1 Corporate Estimated Tax Form 355-ES due date. 40% of estimated tax is due.

- 1 Apr : IRS ACA Compliance 1094-B, 1095-B, 1094-C, and 1095-C filings are due (e-file).

- 15 Apr : Massachusetts Corporation Excise Return Form 355 due. Can extend to October 15.

- 15 Apr : Due date for Boston startup employees to make contributions to Individual Retirement Accounts (IRAs) for 2023 (Employee Benefits).

- 15 Apr : File the R&D Tax Credit Form 6765 with your tax return. Can extend to October 15. We strongly recommend working with a qualified CPA to prepare this form in conjunction with your Form 1120 if you are a high-growth startup – if your company is going to be acquired by a major technology company, that company’s CFO will use a strong tax team to do due diligence on this.

- 15 Apr : Federal Quarterly Estimated Tax 1st installment (first quarter 2024).

- 15 Apr : C Corp Form 1120 Tax Return due. The Federal Form 1120 is the U.S. Corporation Income Tax Return, which the IRS has companies use to report their income, losses, credits, etc., and to figure the income tax liability of the corporation. Can extend the deadline to Oct. 15. All Boston startups are required to file this Federal form by this deadline unless they file an extension.

- 30 Apr : Boston startups can claim Research & Development Tax Credits on Form 941.

- 1 Jun : Delaware Quarterly Estimated Franchise Tax. Pay 40% of estimated annual amount (if annual amount expected to exceed $5,000).

- 15 Jun : Massachusetts Q2 Corporate Estimated Tax Form 355-ES due. 25% of the estimated tax is due.

- 15 Jun : Federal Quarterly Estimated Tax 2nd installment (second quarter 2024).

- 31 Jul : Claim Research & Development Tax Credits on Form 941 .

- 1 Sep : Delaware Quarterly Estimated Franchise Tax. Pay 20% of your estimated annual amount (if annual amount expected to exceed $5,000).

- 15 Sep : Massachusetts Q3 Corporate Estimated Tax Form 355-ES due. 25% of the estimated tax is due.

- 15 Sep : Federal Quarterly Estimated Tax 3rd installment (third quarter 2024).

- 15 Oct : Massachusetts Corporation Excise Return Form 355 due if extended.

- 15 Oct : C Corp Form 1120 Tax Return final due date for Boston startups if extension was filed.

- 31 Oct : Claim your Research & Development Tax Credits on Form 941.

- 1 Dec : Delaware Quarterly Estimated Franchise Tax, Pay 20% of estimated annual amount (if annual amount expected to exceed $5,000).

- 15 Dec : Massachusetts Q4 Corporate Estimated Tax Form 355-ES due date. 10% of the estimated tax is due.

- Rolling: Boston Business Certificate renews every four years.

-

Federal Quarterly Estimated Tax 4th installment (fourth quarter 2023).

-

-

Boston startups should send 1099s to contractors. Send W2s to employees and e-file 1099-MISC for non-employee compensation with the IRS. Or file Form 8809 for a 30-day extension to file W2s and 1099-MISC for non-employee compensation.

-

Claim Research & Development Tax Credits on Form 941, and file annual Federal Unemployment Tax Act (FUTA) return on Form 940. Use our handy calculator to estimate your possible research and development tax credit.

-

Massachusetts State Tax Form 2/Form of List for property tax assessment (billed quarterly).

-

IRS 30-day automatic extension: provide Form 1095-B and Form 1095C to employees.

-

Delaware Annual Franchise Report filing deadline. Your Boston startup will pay a minimum of $400, which increases if you have significant funding.

-

Massachusetts Q1 Corporate Estimated Tax Form 355-ES due date. 40% of estimated tax is due.

-

Massachusetts Corporation Excise Return Form 355 due. Can extend to October 15.

-

Due date for Boston startup employees to make contributions to Individual Retirement Accounts (IRAs) for 2023 (Employee Benefits).

-

File the R&D Tax Credit Form 6765 with your tax return. Can extend to October 15. We strongly recommend working with a qualified CPA to prepare this form in conjunction with your Form 1120 if you are a high-growth startup – if your company is going to be acquired by a major technology company, that company’s CFO will use a strong tax team to do due diligence on this.

-

Federal Quarterly Estimated Tax 1st installment (first quarter 2024).

-

C Corp Form 1120 Tax Return due. The Federal Form 1120 is the U.S. Corporation Income Tax Return, which the IRS has companies use to report their income, losses, credits, etc., and to figure the income tax liability of the corporation. Can extend the deadline to Oct. 15. All Boston startups are required to file this Federal form by this deadline unless they file an extension.

-

Boston startups can claim Research & Development Tax Credits on Form 941.

-

Delaware Quarterly Estimated Franchise Tax. Pay 40% of estimated annual amount (if annual amount expected to exceed $5,000).

-

Massachusetts Q2 Corporate Estimated Tax Form 355-ES due. 25% of the estimated tax is due.

-

Federal Quarterly Estimated Tax 2nd installment (second quarter 2024).

-

Claim Research & Development Tax Credits on Form 941 .

-

Delaware Quarterly Estimated Franchise Tax. Pay 20% of your estimated annual amount (if annual amount expected to exceed $5,000).

-

Massachusetts Q3 Corporate Estimated Tax Form 355-ES due. 25% of the estimated tax is due.

-

Federal Quarterly Estimated Tax 3rd installment (third quarter 2024).

-

Massachusetts Corporation Excise Return Form 355 due if extended.

-

C Corp Form 1120 Tax Return final due date for Boston startups if extension was filed.

-

Claim your Research & Development Tax Credits on Form 941.

-

Delaware Quarterly Estimated Franchise Tax, Pay 20% of estimated annual amount (if annual amount expected to exceed $5,000).

-

Massachusetts Q4 Corporate Estimated Tax Form 355-ES due date. 10% of the estimated tax is due.

Boston Business Certificate renews every four years.

Note: The federal tax deadline in 2024 falls on April 15. The federal extension deadline for 2024 is October 15. Most states usually follow the same calendar for state income tax returns.

If your Delaware C-Corp Boston funded startup needs tax help contact us **today!

BOSTON, STARTUPS AND TAXES

Boston offers a strong knowledge-based economy, with an extensive network of highly regarded universities and first-class hospitals. Boston is a center for life sciences, physical, and engineering research and development. A report by the US Chamber of Commerce ranked Boston as the number 1 city in the US for fostering innovation and entrepreneurship, and Bloomberg named Massachusetts as the most innovative state for the last two years.

The most important taxing authorities for companies based in Boston are:

In 2024, Boston-based companies have several important tax deadlines, including the April 15th federal and Massachusetts tax return filings (which can be extended until October 15th). Additionally, Massachusetts and the federal government have various tax filings due on the dates listed above.

Last Year's Tax Deadlines For Boston Startups

2023 startup tax deadlines are supplied for reference purposes only, and should not be used when making decisions in 2024 or beyond. Always consult your tax professional, and see our disclaimer below.

- JAN 31: Send 1099s to contractors. In general, 1099s go to any individual, partnership, limited liability company (LLC), limited partnership (LP), or estate to which your business paid more than a certain amount in the prior year. Send W2s to employees, and 1099-MISC for nonemployee compensation should be e-filed to IRS on this date.

- JAN 31: File Form 8809 for a 30-day extension to file W2s and 1099-MISC for nonemployee compensation.

- JAN 31: Send 1095-B and 1095-C forms to employees.

- JAN 31: Claim Research & Development Tax Credits on Form 941, and file annual Federal Unemployment Tax Act (FUTA) return on Form 940. If you are looking to estimate your possible research and development tax credit, use our handy calculator.

- MAR 1: IRS ACA Compliance 1094-B, 1095-B, 1094-C and 1095-C filings are due (if paper-filing, due MAR 31 if eFiling). File Form 8809 for a 30-day extension.

- MAR 1: Delaware Annual Franchise Report filing deadline. You will pay a minimum of $400, which increases if you have significant funding.

- MAR 1: Massachusetts State Tax Form 2/Form of List for property tax assessment (billed quarterly).

- MAR 2: IRS 30-day automatic extension: provide Form 1095-B and Form 1095C to employees.

- MAR 15: Massachusetts Q1 Corporate Estimated Tax Form 355-ES due date.

- MAR 31: IRS ACA Compliance 1094-B, 1095-B, 1094-C and 1095-C filings are due (e-file).

- MAR 31: 1099s and W2s must be e-filed with the IRS by this due date.

- APR 18*: C Corp Form 1120 Tax Return due. Can extend to October 16*.

- APR 18*: File the R&D Tax Credit Form 6765 with your tax return. Can extend to October 16*.

- APR 18*: Federal Quarterly Estimated Tax first installment.

- APR 18*: Massachusetts Corporation Excise Return Form 355 due. Can extend to October 16*.

- APR 30: Claim Research & Development Tax Credits on Form 941 .

- JUN 1: Delaware Quarterly Estimated Franchise Tax. Pay 40% of estimated annual amount (if annual amount expected to exceed $5,000).

- JUN 15: Federal Quarterly Estimated Tax second installment.

- JUN 15: Massachusetts Q2 Corporate Estimated Tax Form 355-ES due.

- JULY 31*: Claim R&D Tax Credits on Form 941 .

- SEP 1: Delaware Quarterly Estimated Franchise Tax., You will pay 20% of estimated annual amount (if annual amount expected to exceed $5,000)

- SEP 15: Federal Quarterly Estimated Tax third installment.

- SEP 15: Massachusetts Q3 Corporate Estimated Tax Form 355-ES due.

- OCT 16*: C Corp Form 1120 Tax Return final due date if extension was filed.

- OCT 16*: Massachusetts Corporation Excise Return Form 355 due if extended.

- OCT 31*: Claim your R&D Tax Credits on Form 941 .

- DEC 1: Delaware Quarterly Estimated Franchise Tax, Pay 20% of estimated annual amount (if annual amount expected to exceed $5,000).

- DEC 15: Federal Quarterly Estimated Tax fourth installment.

- DEC 15: Massachusetts Q4 Corporate Estimated Tax Form 355-ES due date.

- ROLLING: Boston Business Certificate renew every four years.

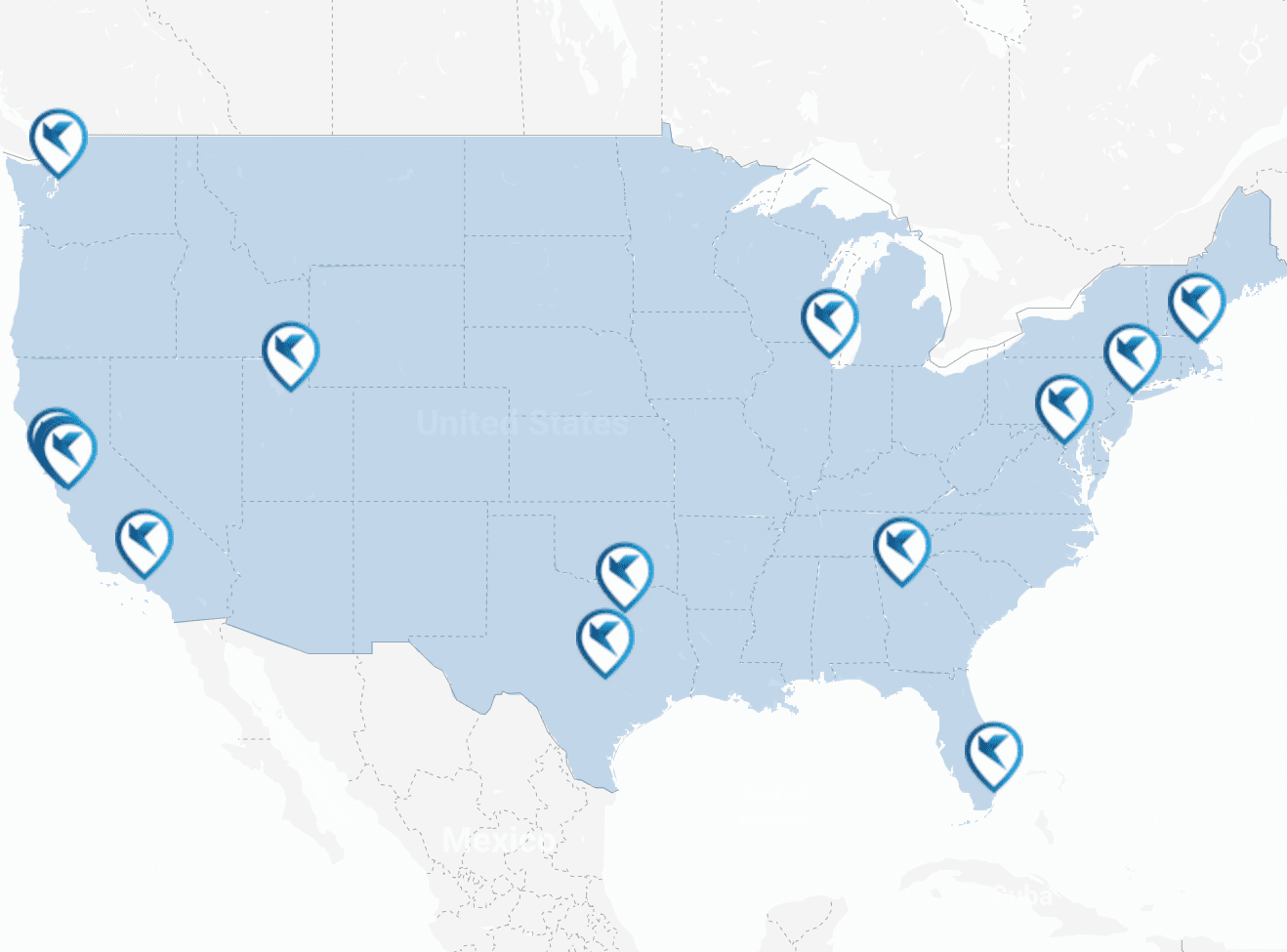

View tax compliance dates for Atlanta, Austin, Boston, Chicago, Dallas, Miami, Mountain View, New York City, Palo Alto, Salt Lake City, San Francisco, San Jose, Santa Monica, Seattle, and Washington DC

How Much Does a Startup Tax Return Cost? Try Kruze Consulting's Tax Preparation Pricing Tool.

How much can your startup save in payroll taxes? Estimate your R&D tax credit using our free calculator.