Today I’m answering the question, what is an 83(b) election, and how and when to file? If you want to save on your business taxes, this is a must-read. And remember, if you need help with startup accounting, startup tax returns, or startup tax services, Kruze can help.

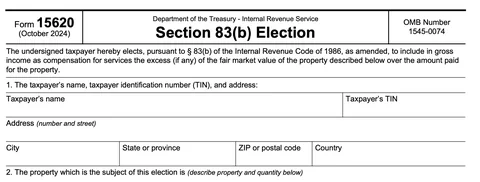

New IRS Form 15620 - file and 83(b) election

Historically, if you wanted to file an 83(b) election you had to send in your own paperwork. However, the IRS has released Form 15620, which is a form that you can use to tell them about your election. Get the form directly from the IRS’s website here.

Do you have to use the IRS form to make your 83(b) election.

We recommend using the form created by the IRS to make your election - you used to just send them a letter (and we have a template below for that) - but now that there is an official form, we recommend that you use it. Note that there isn’t at the moment an official notice from the IRS that you have to use the form, but still, better safe than sorry.

How to fill out the 83(b) election form

- Get Form 15620 from the IRS’s website here

- Fill out Section 1 with your personal taxpayer information

- Boxes 2 to 8 are where you describe the “property” that you are getting - in the case of most startups, this is shares. Both box 2 and 5 seem to have some freeform sections, where you can describe the stock that you are getting, and if there is any vesting etc.

- Section/box 9 is where you fill out the information on the company that you are getting the shares from; looks like they want the TIN (taxpayer information number) so you’ll have to make sure you get that from the company.

What is an 83(b) Election?

The 83(b) election is a formal letter that you send into the IRS telling the IRS that you are electing to buy your stock immediately, even if it hasn’t all vested yet, and you are looking to lock in a low tax basis.

Therefore, all appreciation after you’ve filed an 83(b), and after you bought that stock, is going to be taxed at a capital gains rate, which is about 20%.

If your company IPOs someday, you are going to have a huge gain, and will only have to pay capital gains tax.

Why Should You File an 83(b) Election?

This election is named after Section 83(b) of the Internal Revenue Code. When a founder or employee is granted restricted stock by a startup, it means they receive shares subject to certain rules. These restrictions may include a vesting schedule or other conditions that must be met for the shares to become fully transferable or non-forfeitable. Without making an 83(b) election, those founders or employees would typically be taxed on the value of the stock when it vests.

The 83(b) election can be a strategic tax planning tool, offering the potential for lower tax liability and the opportunity to optimize your tax position based on your expectations for the company’s growth.

An 83(b) Election Can Reduce Your Future Tax Liability - Sometimes Dramatically

By making an 83(b) election, you’re choosing to recognize the income associated with the restricted stock at the time of grant, even before it vests. This means you’re opting to pay taxes on the stock’s fair market value now, in exchange for a better tax rate later when your stock vests. So if you believe the value of your startup is going to increase significantly, you may find making an 83(b) election advantageous.

It’s important to note that an 83(b) election involves some risk. If the startup doesn’t succeed or the value of the stock decreases, you may have paid taxes on a higher value than the stock eventually proves to be worth. Founders should carefully consider their specific circumstances and consult with tax professionals before making this election.

What Do You Need to File?

Filing an 83(b) election isn’t that complicated, but it does have to be done in a timely manner, within 30 days of receiving your stock grant. So here are the steps you need to follow to complete the form. Below you’ll find information on how you actually need to file your election. It’s always a good idea to consult with your personal tax advisor or CPA; use this information and form at your own risk.

- We used to say that you should start by downloading this IRS Section 83(b) Election Form. However, now that the IRS has published their own form, we suggest that you use that here: Get Form 15620 from the IRS’s website here. You’re going to need some information to fill out the form, including the fair market value of the shares you’re receiving and the total amount of income that will be added to your gross income. There’s also a sample cover letter for you to include when you mail in your form.

-

Header: Insert your name, address, and date at the top of your form. Address the form to the IRS Service Center where you file your taxes. Note that these addresses were correct in early 2024; check the IRS’ website to make sure you have the most recent address, and confirm with your personal tax CPA.

- If you live in Florida, Georgia, North Carolina, or South Carolina send your form to Department of the Treasury, Internal Revenue Service, Atlanta, GA 39901-0002.

- If you live in Arkansas, Connecticut, Delaware, District of Columbia, Maine, Maryland, Massachusetts, Missouri, New Hampshire, New Jersey, New York, Ohio, Pennsylvania, Rhode Island, Vermont, Virginia, or West Virginia, send your form to Department of the Treasury, Internal Revenue Service, Kansas City, MO 64999-0002.

- If you live in Alabama, Kentucky, Louisiana, Mississippi, Tennessee, or Texas, send your form to Department of the Treasury, Internal Revenue Service, Austin, TX 73301-0002.

- If you live in Alaska, California, Hawaii, Ohio and Washington state, send your form to Department of the Treasury, Internal Revenue Service, Ogden, UT 84201-0002.

- If you live in a foreign country, American Samoa, or Puerto Rico (or are excluding income under Internal Revenue Code section 933) or use an APO or FPO address, or file Form 2555, 2555-EZ, or 4563, or are a dual-status alien or nonpermanent resident of Guam or the Virgin Islands, send your form to Department of the Treasury, Internal Revenue Service, Austin, TX 73301-0215.

- If you are a permanent resident of Guam, send your form to Department of Revenue and Taxation, Government of Guam, PO Box 23607, GMF, GU 96921.

- If you are a permanent resident of the Virgin Islands, send your form to VI Bureau of Internal Revenue, 9601 Estate Thomas, Charlotte Amalie, St. Thomas, VI 00802.

- Section 1: Write your name, address, and Social Security Number on the appropriate lines.

- Section 2: Provide the number of shares and a description of the shares for which you’re making the 83(b) election.

- Section 3: Insert the calendar year during which you were granted your restricted stock.

- Section 4: Describe the restrictions on your stock award. You can find this information in your stock award agreement.

- Section 5: Note the closing price of your company’s stock on the grant date.

- Section 6: Note the amount you paid for your stock award. If you didn’t pay anything, state that no amount was paid for your shares.

- Sign and date the form. You’ll need three copies (see below for more details on filing your election).

What if you don’t file an 83(b)?

If you forget or just don’t send in an 83(b) election form, you will have to pay income tax on the delta of appreciation every year as the stock vests. So if a stock goes up in value after the first year or two, you are going to have to pay income tax on that appreciation. And income tax rates are somewhere between 30 and 40%.

So there’s a really big delta there. You are talking about a lot of money, especially if your company gets bought or IPOs.

Additionally, you are setting the clock for your capital gains taxation period. Basically, if you hold your stock for long enough, when the company is sold or you sell the stock after it goes public, you either, personally, pay income tax or capital gains tax. In the US, long-term capital gains taxes are much, much lower. So you want to get that clock running as soon as possible so that you maximize the amount of gains that you get to claim as long-term capital gains.

When and How to File an 83(b) Election:

You only have 30 days to elect an 83(b) so do it right away, ideally the day your company is incorporated. Your trusted tax professionals can help you.

Fill out that 83(b) election form that was provided to you, and mail it in to the IRS with certified mail to have proof that you sent it in. Note the certified mail part - more on that in a bit - but it’s really the only way to confirm that the IRS actually got your election.

More detail on how to actually file the election

- Prepare Your 83(b) Election Form: Ensure that your form is accurately filled out and includes all the necessary information.

- Make 3 copies of the form - one for yourself (keep this in a safe place), one to give to your startup, and one to send to the IRS.

- Visit Your Local Post Office: You cannot send certified mail from your home mailbox; it needs to be processed at a post office.

- Request Certified Mail Service: At the post office, inform the clerk that you want to send your envelope via certified mail. You’ll be given a certified mail form to fill out.

- Attach the Certified Mail Form: The form has a barcode for tracking and a perforated receipt. Attach the form to the front of your envelope, as directed.

- Pay for Postage and Fees: Certified mail costs slightly more than regular postage. Pay the required amount, which will include the postage and a small fee for the certified service.

- Obtain a Mailing Receipt: After processing, you’ll receive a mailing receipt. Keep this as it’s your proof of mailing.

- Track Your Mail: Use the tracking number on your receipt to monitor the delivery status online through the USPS website.

- Wait for Delivery Confirmation: Once delivered, you’ll receive an electronic confirmation of the date and time of delivery and the recipient’s signature.

- Ask your personal tax CPA if you need to append a copy of the form to your state tax returns - some states have specific rules, so consulting with your tax person.

Where to file an 83(b) election?

Mail your completed 83(b) letter to the same IRS Service Center address where you mail your personal tax returns - make sure to consult with your personal tax CPA so that you have the right address. For example, the Fresno California processing center was closed down, so California tax payers now use the Utah IRS Service Center. Check the IRS’ website for addresses to mail many tax forms here.

Can you efile an 83(b) election?

No - the IRS doesn’t have a method to accept electronically filed 83(b) elections! Founders have to print and mail their elections! There is a push to make it possible to efile the election, but as of early 2024, there is no way to efile it. Carta does have an 83(b) solution where they will generate the form in a printable format, but it still need to be physically printed and mailed to the IRS.

How do you confirm with the IRS that they got your 83(b) election?

Really, the only way to confirm that the IRS got your election is to send the election using certified mail. When you send something by certified mail, you’ll receive a mailing receipt and a unique tracking number. Additionally, the IRS or any recipient must sign upon delivery, providing you with an electronic verification that the document was received. This is proof that they got your filing - keep it so that if there are any problems down the line you have the proof!

In closing, filing an 83(b) form is worth it. Again, make sure to file within the allotted time frame. This will ensure that your company gets favorable tax treatment.