The Keystone Innovation Zone (KIZ) Tax Credit Program was established in 2003 to encourage entrepreneurship in Pennsylvania.

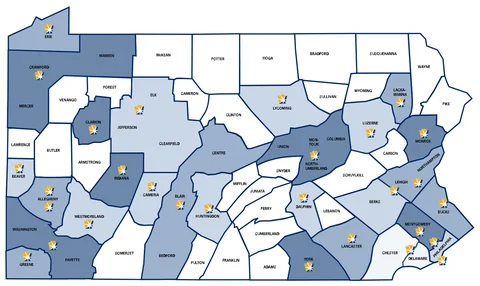

The KIZ program provides a tax credit of up to $100,000 for startup companies, and there is a total of $15 million in sellable tax credits available to eligible companies every year. There are currently 29 KIZs across the state, positioned around Pennsylvania’s research and development clusters. The two most common KIZ zones are the Philadelphia Navy Yard Tax Credit and Philadelphia University City Tax Credit.

Kruze’s TLDR for Venture-Backed Startups:

KIZ tax credits are not for all startups. It’s very rare to get a material credit here and is probably not worth the trouble for most startups. Very few venture-backed startups have material revenue or operations within the applicable tax credit zones (usually Philadelphia), hence they are ineligible. The cost to secure a KIZ tax credit very often outweighs the benefit for the vast majority of Seed, Series A, and Series B startups.

Keystone Innovation Zone eligibility

Each KIZ focuses on different business sectors. The Pennsylvania Department of Community and Economic Development (DCED) provides an interactive map that shows each KIZ and lists the eligible industries in each zone. In general, the eligibility requirements for a company include:

- Operating as a for-profit business.

- In operation for less than eight years.

- Located within a KIZ.

- Conducting business within a KIZ for two years.

- Focused on targeted industry sectors determined by the KIZ (typically technology, life sciences, business services, or materials/manufacturing).

Keystone Innovation Zones

(source: https://dced.pa.gov/business-assistance/kiz-coordinator-locations/; check pa.gov’s site for the most up to date information)

The Keystone Innovation Zone Tax Credit

An eligible company can claim a tax credit equal to 50% of the increase in the company’s gross revenues over the two preceding years, up to $100,000. For example:

- Year 1: Company gross revenues = $50,000

- Year 2: Company gross revenues = $80,000

- In Year 3, the company can apply for a tax credit of $15,000 ($80,000 - $50,000 = $30,000 and then $30,000 x 50% = $15,000)

Gross revenues are defined as revenues from the sale of goods and services from activities in a KIZ targeted industry and from operations transacted within the KIZ. Gross revenues do not include rent collected, loans, funds from investors, or sales of tax credits. If your company has property or pays employees outside your KIZ but within Pennsylvania, you will need to calculate property and payroll factors, in which you will show the percentage of property that is within the KIZ, and the percentage of payroll that is paid to employees within the KIZ. This includes employees whose base of operations is within the KIZ and those whose work is directed or controlled from the KIZ. Worksheets for companies wholly within a KIZ and for those with operations in other areas can be downloaded on the DCED page.

The tax credit must be applied first against the eligible company’s current tax liability and can be carried forward for up to four years. If the company has a gross revenue increase but doesn’t have any tax liability, the company may reassign or sell the tax credit to another eligible company.

One issue we have seen with startups that might be elibible for the Keystone Innovation Zone tax credit - your company needs to be registered to do business in Pennsylvania with the state tax authorties.

Applying for the Keystone Innovation Zone Tax Credit

Applications for the tax credit must be filed by December 1, and the credits are awarded on May 1. The KIZ program has been in existence for nearly 20 years and has no scheduled end date. Eligible companies must start by creating a Keystone Login Account to begin the application process.

The application requires a certificate from your local KIZ coordinator, a Department of Revenue tax compliance form, and company financial information. In addition, companies that want to sell their tax credit need to complete a sales application.

More information on the KIZ Tax Credit is available at the Pennsylvania DCED website. If you have questions about the KIZ program or need assistance with the requirements, please contact us.