2023 was a difficult year to raise a Series A, with the volume raised dropping precipitously. VCs were less interested in growth at all costs, and swung to demanding growth at sustainable costs, with controlled burn and better unit economics.

What it took to raise an A in 2023 - And What it Will Take in 2024

With over 800 VC-backed clients, Kruze has a unique view into the startup ecosystem. Using anonymized data, we analyzed startups that raised - and those that failed to raise and subsequently went bankrupt/folded - to illustrate what it takes to raise funding in 2023. Our analysis focused on close to 100 startups. About 2/3rds of these were unable to close their next round of funding (and therefore had to close down), while the others were successful getting that next round across the finish line.

Revenue Growth Still Matters

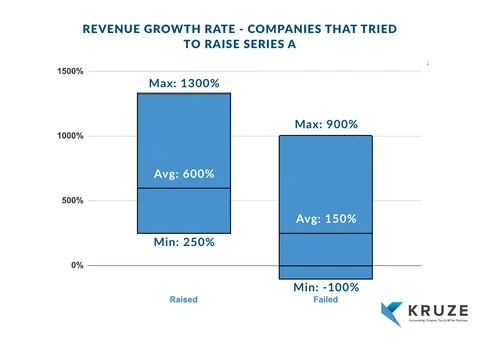

Obviously VCs still love revenue growth. While much has been written about how VCs abandoned the “growth at all costs” mindset, they still want to see revenue increasing. Seed stage companies that raised a Series A had an average 12 month revenue growth rate of 600% when they raised, whereas seed funded companies that couldn’t close their A had approximately 150% revenue growth.

Revenue is No Longer the Only Thing

More interestingly, there is a big overlap in the sales growth of companies that raised and those that failed. The top growing companies that failed had over 900% revenue growth - a massive amount of traction that would get any VC’s attention. That’s an amazing year over year growth rate for a seed stage company - yet that company, and may like it, failed to get their next round close.

Why?

Unit Economics and Efficiency Matter

Now that the era of easy access to capital is over, VCs are discovering religion on solid unit economics and efficiency. High growth isn’t enough.

Gross Margins at the Series A

Companies with poor gross margins - regardless of their revenue growth - had a much harder time raising capital. Gross margin, the percentage of revenue left after covering the cost of goods sold, is pivotal for startups. This margin is critical as it provides essential cash flow to fund the business’ ongoing operations and growth initiatives.

Companies that raised their Series A had an average gross margin of 80% - an acceptable margin for an early-stage software business. Companies that failed to raise had an average gross margin of 9%, meaning that only 9 cents of every dollar in sales generated was available to fund the businesses operations. And less than 10% of the companies that raised their Series A had under a 50% gross margin.

- Raised Gross Margin: 80%

- Failed Gross Margin: 9%

High Burn Multiples Are No Longer Acceptable for at the Series A

High burn rates were acceptable in 2021, as VCs encouraged founders to invest in R&D and spend aggressively on sales and marketing. It’s clear from our analysis that those days are gone, with investors now looking for businesses that can grow without burning a ton of cash.

Burn Multiples Under Control

A burn multiple shows how efficient a startup is at turning cash into new revenue. For smaller companies, a burn multiple of high 3’s isn’t that great, and under 2 is considered OK to good. Our analysis shows that companies successfully raising Series A in 2023 had an average burn multiple of around 3.1. This suggests that these companies were doing an OK job leveraging their spending to boost revenue growth. In stark contrast, companies that failed to secure Series A funding had a much higher average burn multiple of 39.7. This indicates a disproportionate spending relative to their revenue growth, making them less attractive to investors.

- Raised Burn Multiple: 3.1

- Failed Burn Multiple: 39.7

So it doesn’t appear that startups need to have a perfect burn multiple, but excessive spending is a strong negative signal to VCs.

What Does This Mean for Founders?

The bar has been raised! The Series A round is no longer a given for startups with revenue traction. In addition to growth, founders need to focus on solid unit economics, starting with selling a highly profitable product. And, as illustrated by the differences in burn multiples, founders need to keep operating expenses under control. A low burn multiple is a strong signal to possible investors that the company has the ability to generate new revenue without excessive investments in product or sales.

How to Raise a Series A

The exact KPIs and milestones VCs look for for seed funded companies looking to raise a Series A vary by industry. For most industries tech industries like SaaS, marketplace, FinTech, seed funded companies need to have sustainable growth - but still very high growth rates.

But it’s not just financial KPIs that VCs are looking for. Some of the other, very important attributes that founders and their startups need to have include:

The most important attribute is to Develop a Novel Approach to a Big Market Opportunity. VC’s are looking for big outcomes and can stomach some losses, but their winners have to pay off big. Therefore they make a lot of bets in big markets knowing (hoping) that a few investments will pay for the losers and much more.

A big Market Opportunity is not always obvious. Often you solve a small problem in a big market and then find more opportunity than you could have ever imagined from the outside. Airbnb is a great example of this. Originally they were just creating a way to rent out your couch, but soon realized they could revolutionize the entire vacation rental industry.

The Product or Service you are building or the way you are approaching the market should be new. However, often the best startups are minor improvements on old ideas that never quite worked. You also don’t have to be first to market. Lending Club was 3rd or 4th into online lending and it turned out all right for them. The most important thing to do is build something that you love for a market that you have extra special insights into. That’s how you build a great company.

VC’s will judge your Management Team but that doesn’t mean they are looking for tons of experience. They’re really testing your insights into that market. They are looking for someone who is hungry. Someone who has to build this company.

They will also test your Go to Market Strategy, or customer acquisition approach. Nowadays with Google and Facebook, you can do a lot of customer acquisition testing to see what might work.

Investors will want to see a Financial Model that shows what you will do with their money. It’s that simple. “Where are you spending my money?” is a question you’ll get in pitches. :)

They will also want to understand the Competitive Landscape. Know who you will compete against and be able to explain their approach. Good ideas are never lonely, so do not be intimidated by big competitors, especially public companies.

Startups often give big companies too much credit but they move slow. While they are caught up in budget meetings and resource allocation disputes, you will be building your product and go to market. In fact, you want to build startups in markets with big, slow competitors. It means there is a higher probability you will have the opportunity to be acquired when the big companies realize they lost.

Finally, to get the Series A, you have to convince the VC that you are someone special. They are making a bet on you, the Founder. Show them who you are through hard work, frequent updates and traction. That’s how you get your dream funded. :)

What Are Series A Companies Raising At?

At the end of 2023, the average Series A startup gets a $40m valuation. In the past few years, the Series A funding scene has been quite dynamic. Particularly notable was the surge in early 2022, where median Series A company was worth $48 million. This spike, however, was part of a short-lived bubble, as by the fourth quarter of 2022, these figures had decreased to $35 million. They have scooted up a bit since then. Read our article on startup valuations.