Startups are required to report to the IRS the amount of compensation for services granted to employees and contractors through stock option exercises. This may seem strange, given that when an employee exercises a stock option they give money TO the startup, but technically the exercise of stock options is a transaction that may have an economic benefit to the employee - and the IRS wants to know! It’s particularly important that you set up your startup’s stock option plan correctly to avoid problems down the line.

As a reminder, when a traditional stock option is vested the employee (or contractor) then has the right to exercise the stock option. This means that the employee may pay the exercise price for the option (the exercise price is paid to the startup) and take ownership of the startup’s stock.

For example, let’s say a developer joins your startup in June of 2016. They are granted options to acquire 8,000 shares at 10 cents per share, the current per-share 409A valuation price. Let’s assume that these are in a traditional 4-year vest, with a one year cliff. In June of 2018, they have half of their options exercisable, and they decide to exercise them by paying the company 4,000 shares times $0.10 each, or $400.

| Options Granted | Vesting Period | Grant Date | Strike Price | Date Exercised | Exercisable | Exercised | Cost to Exercise |

|---|---|---|---|---|---|---|---|

| 8,000 | 4 years | June 1, 2016 | $0.10 | June 2, 2018 | 4,000 | 4,000 | $400 |

Startup Taxes and Option Exercises

In addition to a startup’s yearly corporate income tax return, the company must also supply the IRS and various contractors & employees information returns indicating the amounts paid for services - Forms W-2 for employees and 1099-MISC for non-corporate contractors (Note: the penalties are STEEP for missing the deadline).

In addition to reporting cash payments for services, you will also need to report stock options that have been exercised in the previous year. Your accountant would need exercise dates and other details required to report the following:

- ISO exercises of an employee on Form 3921

- NQO exercises of employees on Form W-2 and contractors on 1099-MISC (for contractors)

You’ll either need to create this file for your CPA, have your law firm do it, or, if you are using a service like Carta, download the report.

How to get a Startup Stock Option Exercise Report

If you are using Carta, here is how you can download a stock option exercise report. In Carta, you are looking for the “Exercised and Settled” Report.

Steps to get the Options Exercise Report:

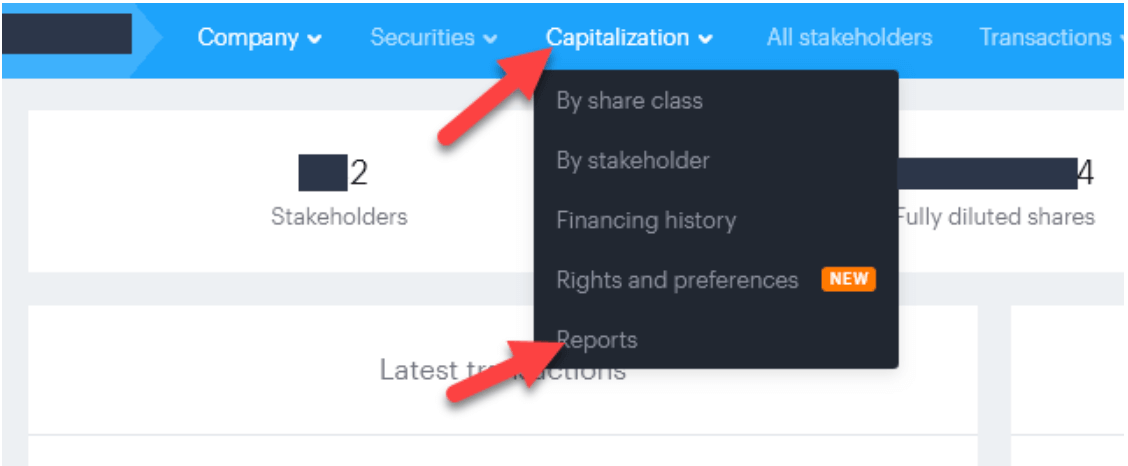

- Login to Carta, select “Capitalization” then select “Reports” from the drop-down menu.

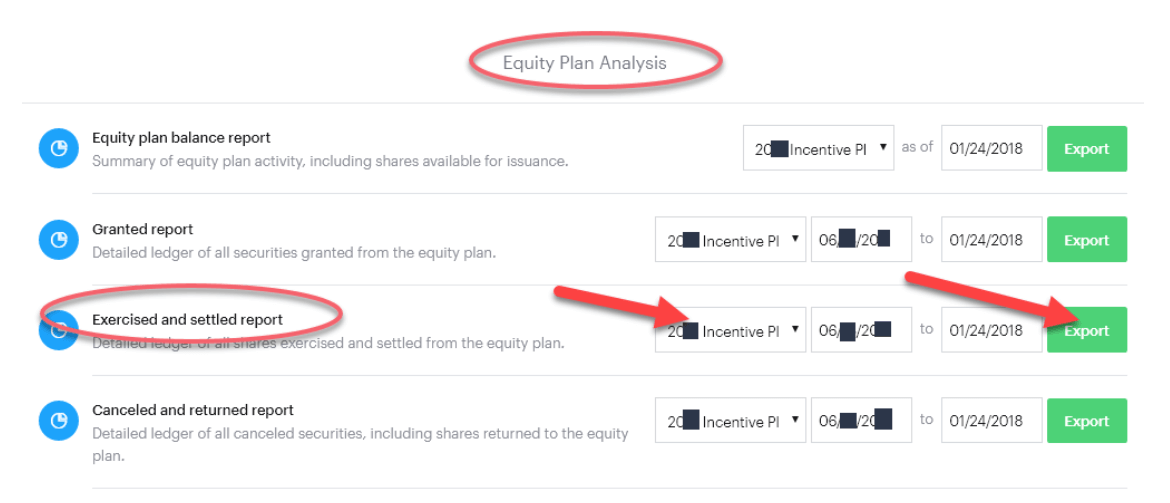

- On the reports screen scroll down to about the middle of the page under the “Equity Plan Analysis” section, find the “Exercised and Settled” report.

- Select the date range - for tax purposes, this is likely January 1 to December 31 of the previous year. If you don’t select the date range Carta will likely default to providing ALL exercises in the company’s history. This is likely OK, but if your CPA charges by the hour they might have to spend extra time sorting the data!

- Select the “Export” button and the file should download.

- Extra step if you have more than one option plan: select the drop-down menu and select each plan and click “Export” for each plan.

- Finally, share the report(s) with your CPA!

Kruze Consulting is a leading CPA 100% focused on startups. Our clients have raised over $500 million in VC and seed financing in the past 12 months. We only offer financial and tax services to fast-growing companies in the Seed, Series A, Series B, and Series C stages. Our practice is built on best of breed cloud accounting software like Carta, QuickBooks, Xero, Netsuite, Gusto, Zenefits, Expensify, Avalara, Brex, and Bill.com. Technology makes us more efficient, saving our clients money and time, and helping derisk our client’s next fundraising round.

If you are a funded startup looking to get your taxes done, get started with us today!

Or if you want to offload your monthly bookkeeping to an expert and save time and money, contact us today!

Disclaimer: Every startup is different and so are its tax compliance needs. This is only a guideline. Please consult your tax professional. _IRS Circular 230 Disclaimer: To ensure compliance with IRS Circular 230, any U.S. federal tax advice provided in this communication is not intended or written to be used, and it cannot be used by the recipient or any other taxpayer for the purpose of avoiding tax penalties that may be imposed on the recipient or any other taxpayer.