CARES Act for Startups - December 2020 updates, including PPP Loan Information

Earlier this year, the federal government signed into law a stimulus bill to try to help smaller businesses - not necessarily startups - during the COVID crisis. The CARES Act offers loans and payroll assistance to small businesses, and if they meet the right requirements, seed and venture-backed startups. While the funding ran out quickly after “launch,” the government added additional funds to the act to help more small businesses. In December 2020, an additional stimulus package was passed by Congress - it was finally signed by the President December 27th or 28th.

Minor update for August 2021: Companies founded after Feb 15, 2020 may be eligible for a special payroll tax credit, the ERC or ERTC. You can learn more about what qualifies as a “recovery startup” and how they can claim the ERC here.

You can scroll down to see our more expansive information on the CARES Act, and it’s most important piece for startups, the PPP Loans. And here is an update written in the morning of December 28th:

Congress just passed a new COVID stimulus package, and it may help certain venture backed startups, and the law was signed by the President.

Assuming the bill is signed as written, many startups - even ones that already have a PPP loan - may be eligible to apply for this next round of stimulus and get a new PPP loan. Additionally, the forgiveness requirements for companies with existing, smaller, PPP loans have been modified in a positive way. Another positive change is that there is good news for your company’s taxes if you have a forgiven loan. Finally - and this is an important update - the Employee Retention Credit may help you save money on payroll taxes. You should discuss the ERC before applying for PPP loan forgiveness.

Some of the highlights:

- Congress is creating an additional PPP loan “tranche,” setting aside $284 billion this time for loans to small businesses impacted by the pandemic. While there are greater restrictions on who can apply for a loan this time, we do think many VC backed startups will be eligible for an additional PPP loan.

- Certain startups will be able to apply for a second loan

- Qualifications:

- Less than 300 employees (this is smaller than round 1, which was less than 500)

- The business must have experienced gross receipts decline by at least 25% in any given quarter vs the same quarter in 2019

- There are some nuances that may impact startups that recently started generating revenue; for example:

- Businesses that were not operating in 2019, but were in operation by Feb 15th, 2020, may be able to get a loan if their Q2, Q3 or Q4 2020 gross receipts were 25% less than the Q1 2020 gross receipts. This is a high bar for companies that started in 2020.

- There are some nuances that may impact startups that recently started generating revenue; for example:

- An example might be a company that did $50,000 each quarter in 2019, but had one quarter in 2020 that was less than $37,500. Note that gross receipts could be interpreted as collections (vs recognized revenue), so a small startup that did not collect much revenue in a particular quarter in 2020 vs 2019 MAY be eligible. You’ll want to ask your banker for more details to see how they are interpreting this particular provision.

- Qualifications:

- Calculating the loan amount:

- The loan this time is capped at $2 million (vs $10 million last time). This won’t impact our direct clients, as they applied for smaller loans, but it may impact larger startups.

- The max loan size for this round is calculated as 2.5 times the monthly average payroll for the last 12 months - or the average payroll for 2019. We found that some of the older school banks liked to try to force companies to use 2019 data, since it’s much easier to calculate vs. calculating the trailing 12 months information. However, if your startup has hired additional people, then this could reduce the loan size. So if you’ve hired, you’ll want your banker to use trailing 12 months or use a bank that is comfortable with this time period (assuming you want to maximize your loan size). The leading startup focused payroll companies like Gusto and Rippling created reports to make this easy in the last round, and we expect that they’ll do the same again. Yet another reason to use modern payroll providers. There are some nuances for companies started in 2020, but in general they will be able to take a loan that is 2.5 times the average monthly payroll - again, ask your banker for their interpretation of this language.

- There appears to be some new language around Chinese investors and board members that we do not remember from the first round of loans. We don’t fully understand how it will impact startups with meaningful Chinese investors or activities. You’ll definitely want to consult with your attorney and banker about this particular exclusion if you think it might apply to you. We were surprised when we noticed this in the legislation’s language, as we don’t remember it being discussed by the press leading up to the vote by Congress.

- Updates on forgiveness that will also impact companies that already have PPP loans, as well as new borrowers:

- More eligible expenses can be used in the forgiveness calculation. So, if your startup did not succeed in spending the full amount in the first round of PPP loans, these expenses may allow you to get a greater forgiveness amount. This includes protective equipment for employees and some items like air filters, some software and SaaS expenses (which should be helpful for many startups) and some “goods” purchases, which may include some inventory purchases for hardware companies. NOTE that this language probably needs to be clarified by the SBA, so your banker may not be ready to act on it when you are applying for forgiveness.

- Congress is asking the SBA to formalize how they will audit companies that raised over $2 million in PPP loans (from the first batch of loans). This won’t impact our client base, but if you raised more than $2 million in the first rounds of PPP, expect more paperwork.

- Easier forgiveness for companies that raised under $150,000 via the PPP loan. Previously, companies that raised under $50,000 were able to use a one page, shorter forgiveness application. This legislation raises that limit to $150,000. So if you haven’t yet applied for forgiveness for your first PPP loan, you should ask your banker if they will use this short form. We estimate that this will help about 50% of startups that have a PPP loan forgiveness process.

- Better tax treatment of forgiven PPP loan expenses. Previously, the IRS was not going to allow companies to deduct expenses paid for by a forgiven PPP loan. So this would increase a company’s tax bill. Congress now allows expenses paid for using a forgiven PPP loan to be deducted from your taxes.

- Non-PPP loan highlights that may be interesting to startup leaders include:

- 100% tax deductibility of certain business meal expenses in 2021 and 2022.

- An important change the ERC - Employee Retention Credit. This will help you save money on your payroll taxes. Previously, you could only get a PPP loan or an ERC, not both. BUT now you can get both.

- If your business:

- Had a gross receipts decrease of 20% or more in one quarter (vs. the previous year’s quarter) you are eligible.

- Or if you were shut down due to government orders

- And had less than 100 employees

- This is a substantial credit. You should discuss with your CPA if you meet the qualifications above. Since you can apply for this AND the PPP, you need to make sure you do so carefully. Congress is not letting you use the exact same wages to get PPP loan forgiveness and the ERC, so make sure you figure out which is right for you.

- Had a gross receipts decrease of 20% or more in one quarter (vs. the previous year’s quarter) you are eligible.

- If your business:

This is our updated information as of August 17th, 2020. Some of this information is a bit dated, so work with your banker, CPA and attorney:

There have been many updates to the law, mainly in the form of additional guidance from the federal agencies in charge of running the program. Congress passed new guidance on June 3rd, which the President is expected to sign soon, that makes it easier for companies to get PPP loans forgiven, and has some other benefits as well. We’ll provide those important updates right after the table of contents.

In mid-August, the SBA issued information about how an borrower can appeal a PPP loan “rejection.” It’s a real process - and we recommend that if this happened to your company, you hire an attorney to help you.

Early Junes Updates to the CARES Act and PPP Loans

The PPP loan was just modified by Congress (as of June 4 in the morning), and we expect the President to sign soon. The last day to apply for a PPP loan is still June 30, 2020 - and there are many billions still available under the program.

Here are some of the major changes:

- Extending the 8-week forgiveness period to 24 weeks.

- If you already have a PPP loan, you can now choose your forgiveness calculator period:

- You can extend the eight-week period to 24 weeks, or

- You can keep the original eight-week period.

- If you don’t yet have a PPP loan, but apply now, you will now have a 24-week covered period.

- This period can’t go beyond Dec 31, 2020.

- Spend at least 60% on payroll, vs. the 75% originally published.

- The legislation reduces the payroll expenditure requirement 60% from 75%. As a reminder, this means you need to document how you spend the PPP loan proceeds, and that you have to be able to show that you spend 60% of the loan on payroll.

- The 60% is now a “cliff,” which means that if you spend less than 60% on payroll you don’t get any forgiveness. Congress members have indicated that they may remove the cliff and replace it with a sliding scale below the 60% payroll cutoff; TBD.

- A longer time period to get payroll and employment levels back to “normal” for the forgiveness calculation.

- You now have 24 weeks to get your payroll and workforce levels up to the pre-pandemic levels. This must be done by Dec. 31, 2020.

- Now there are three exceptions allowing borrowers to achieve full PPP loan forgiveness even if they don’t fully restore their workforce.

- Borrowers can exclude from those calculations employees who turned down good faith offers to be rehired at the same hours and wages (this exception already existed).

- Borrowers can now claim that they couldn’t find qualified employees to restore employment levels.

- Borrowers can now claim that they were unable to restore business operations to Feb. 15, 2020, levels due to COVID-19 related operating restrictions.

- The loan period is now longer for new borrowers.

- 5 year loan vs. a 2 year loan for NEW borrowers only.

- The interest rate remains at 1%.

- Businesses that took a PPP loan can now also delay payment of their payroll taxes, you were specifically forbidden from doing this in the earlier rules. This is something that will help startups, and they should contact their payroll provider to take advantage of it. HOWEVER, and this is very important, even if you go out of business you need to pay your delayed payroll taxes; the IRS can and probably will go after the businesses executives if you don’t.

- Now, if you have a PPP loan that gets forgiven, you can also delay payment of the employer portion of social security taxes. The period that you can do this for is for payroll paid from March 27, 2020, through the end of 2020. It’s unclear if you can go back in time for payroll taxes that you’ve already paid.

- Employees still need to pay their portion of payroll taxes; deferral will not apply to employee income tax withholding, the employee or employer portion of the Medicare tax, or the employee portion of the Social Security tax.

- The payments are deferred on the following schedule:

- 50% of the tax payable on December 31, 2021.

- 50% of the tax payable on December 31, 2022.

- If you already have a PPP loan, you can now choose your forgiveness calculator period:

What is the CARES Act and how does it help startups?

The Federal Government passed a $2 trillion relief legislation to help stimulate the economy during the COVID crisis called the CARES Act. Core components of this legislation that help funded startups include payroll tax help and loans, mainly the Payroll Protection Program (PPP). The $349 billion set aside in loan funding for the PPP ran out quickly, but on April 27th, Congress authorized an additional tranche of $310 billion in loans.

PPP Loans are designed to help small companies continue to pay payroll (and rent/utilities) during the crisis. Unlike most SBA loans, these loans do not require a personal guarantee. This makes them more appropriate for VC backed startups, where the officers and directors do NOT want to take on personal liability for the company’s debt. Additionally, if the funds are used as intended - on payroll - the loan can be forgiven (we get into the rules on forgiveness further down this page).

Where can you get a PPP loan?

We have seen several banks accept loan applications. Ask your current bank if they handle SBA loans - if so, that’s the easiest way to apply. Banks who we have seen accept loans from our clients include:

- First Republic Bank

- Silicon Valley Bank

- Bank of America

- Chase

Our hope is that many venture funded startups will be eligible for the PPP - a Paycheck Protection Program that can provide forgivable loans.

On May 13th, the SBA released additional information regarding the rules for the PPP loan, and how smaller borrowers need to certify the “need” for their loan. This is a new wrinkle that helps clarify some of the issues funded startups have been facing regarding the CARES Act. We’ll address this “need” and how smaller companies can certify that they legitimately require the funds in the PPP section below.

This calculator will help you estimate how much you can borrow under the PPP program

For a while (what seemed like ages, but was in reality a week), it appeared that VC backed startups would not be able to get a PPP loan due to the “affiliation” rule. However, the SBA specifically loosened this rule - read more below - to allow many Silicon-Valley style startups to raise funding through this program. Of course, you’ll need to ask your lawyer to make sure you do not trip the affiliation rule.

April 2nd update: around 8 pm PT, additional clarification was released on how to calculate the monthly payroll for the PPP loan amount. Linked to on the same Treasury site as before, the updated “Interim Final Guidelines - Paycheck Protection Program” file explains what can and can not be included in the payroll calc for the loan size. One big item that many of our clients (and our clients’ law firms) had been asking was answered - contractors can NOT be included in the loan amount. We’ve update the section below and our PPP loan calculator with this information so you can estimate the PPP loan size for your company.

The “PPP,” as it’s called, provides loans of up to 2.5 times your monthly payroll from 2019. Even better, a portion of this loan becomes forgivable assuming you don’t have large layoffs or meaningfully reduce people’s salaries.

Some clients may also be eligible for another program that deferred some payroll taxes (you likely still have to pay them, but this lets you put off some payments for a while). Again, the guidelines are not yet produced, so it’s not 100% clear who or how to do this!

We’ll keep this page updated once the SBA publishes guidance on the CARES act and on the Paycheck Protection Program, payroll deferral and more.

Government Assistance - What does the CARES Act offer Startups?

Overview: Government is offering

- Stimulus Loans - PPP & EIDR

- Help for furloughed employees

- Payroll Tax Relief

- All of these programs are being defined in real-time. Rules & Procedures may change. SBA guidance coming

Fraud Warning

- Large government programs + disasters = lots of fraud.

- Watch out for groups you’ve never heard of asking for large fees to get you access to govt. $$$

Paycheck Protection Program (PPP) Loans

- The SBA will guarantee up to $349 billion for PPP Loans.

- Companies with less than 500 employees.

- Proceeds may be used to cover payroll, mortgage payments, rent, utilities, and any other debt service requirements.

- Administered by Banks, then reimbursed by the SBA program. Startups work with the banks.

- The maximum loan amount is the lesser of (1) $10 million, or (2) 2.5x the average total monthly payments by the applicant for payroll costs—only payroll costs (including health benefits), incurred.

- Interest rate is 1% per the Interim Final Rule.

- New loans mature in 5 years; older loans have a 2 year maturity date.

- No personal guarantee by the founder.

- A sticking point for Venture-Backed Startups is the Affiliate Rules.

- Startups may be consolidated with other VC portfolio companies and fail the 500 employee test.

-

On April 2nd the SBA finally released an updated rule on Affiliation

- 20% owners will have to provide information for the PPP loan application

- 50% “controllers” of the company will likely be affiliated

- Consult with your attorney to make sure you can apply

- Some VCs are blocking their startups from applying - ask your BOD to make sure you will be given permission to take on a PPP

- Some banks began accepting applications Friday April 3rd. We have yet to see actual checks flowing back to the companies that have applied, but will update this when we see our clients getting funded.

- The guidance released in the evening of March 31 indicates that loans can begin happening starting Friday April 3rd.

- As of April 9, we have yet to see any funds flowing into clients’ bank accounts.

Detail on How to Calculate the PPP Loan size

- Disclaimer: you need to work with your bank or lender to determine the exact loan size that is correct for your startup. We are attempting to lay out the calculations, as described in the federal government’s guidance - but it is changing rapidly as new guidance is issued, and you should not rely on our work here to get the loan size right.

-

Update as of March 31 in the evening- the Treasury’s new guidance says that:

- How large can my loan be? Loans can be for up to two months of your average monthly payroll costs from the last year plus an additional 25% of that amount.

- Employees that make over $100k only count up to $8,333/month for the Loan Amount calculation.

- What qualifies as “payroll costs?” Taken from here.

- Payroll costs consist of:

- compensation to employees (whose principal place of

residence is the United States) in the form of salary,

wages, commissions, or similar compensation; cash tips - or the equivalent (based on employer records of past tips

- or, in the absence of such records, a reasonable, good

faith employer estimate of such tips); - payment for vacation, parental, family, medical, or sick leave;

- allowance for separation or dismissal; payment for the

provision of employee benefits consisting of group health care coverage, including insurance premiums, and - retirement;

- payment of state and local taxes assessed on

compensation of employees - Independent contractors are NOT included in the amount - they will need to apply on their own

- compensation to employees (whose principal place of

- Payroll costs consist of:

- Is there anything that is expressly excluded from the definition of payroll costs? Yes. The Act expressly excludes the following:

- Any compensation of an employee whose principal place of residence is outside of the United States;

- The compensation of an individual employee in excess of an annual salary of $100,000, prorated as necessary;

- Federal employment taxes imposed or withheld between February 15, 2020 and June 30, 2020, including the employee’s and employer’s share of FICA (Federal Insurance Contributions Act) and Railroad Retirement Act taxes, and income taxes required to be withheld from employees; and

- Qualified sick and family leave wages for which a credit is allowed under sections 7001 and 7003 of the Families First Coronavirus Response Act (Public Law 116–127).

Walk Through of the March 31 SBA PPP Loan Application

Note that this is the March 30 version of the loan application - the government issued an updated version on April 2nd that is slightly different. Visit the Treasury’s website to keep up to date on the newest applications here.

Certification of Need for a PPP loan

Until May 13th, there had been much uncertainty around how a small company could “prove” that it needed to access the PPP loan. Thankfully, the SBA released additional guidance on the CARES Act for startups on that date that clarifies how a smaller company / borrower can show a need. Quoting from the SBA’s guidance (available here, page 4 of the document as released on May 13):

**Question: How will SBA review borrowers’ required good-faith certification concerning the necessity of their loan request? **

Answer: When submitting a PPP application, all borrowers must certify in good faith that “[c]urrent economic uncertainty makes this loan request necessary to support the ongoing operations of the Applicant.” SBA, in consultation with the Department of the Treasury, has determined that the following safe harbor will apply to SBA’s review of PPP loans with respect to this issue: Any borrower that, together with its affiliates,20 received PPP loans with an original principal amount of less than $2 million will be deemed to have made the required certification concerning the necessity of the loan request in good faith. SBA has determined that this safe harbor is appropriate because borrowers with loans below this threshold are generally less likely to have had access to adequate sources of liquidity in the current economic environment than borrowers that obtained larger loans. This safe harbor will also promote economic certainty as PPP borrowers with more limited resources endeavor to retain and rehire employees. In addition, given the large volume of PPP loans, this approach will enable SBA to conserve its finite audit resources and focus its reviews on larger loans, where the compliance effort may yield higher returns.

Forgiveness of paycheck protection program (PPP) loans

We’ve recently published a “PPP Loan Documentation and Forgiveness” library that includes downloadable files and links to spreadsheets. This may help you keep your documents in order as you prepare to account for your loan’s forgiveness.

- TLDR - to get the loan forgiven

- No layoffs already done or during the loan period

- No salary reductions below $100k salary run rate

- Use the funds for salaries, rent, mortgage interest, utilities

- We are still waiting on the final formula that will be used to calculate what is forgiven, so stay tuned.

- The amount that may be forgiven is the sum of the following payments made by the borrower during the eight-week period beginning on the date of the loan:

- Payroll costs

- Mortgage interest or rent

- Certain utility payments

- The loan forgiveness is contingent upon the employer not reducing the salary or wages paid to any employee who had earned less than $100,000 in annualized salary.

- Forgiven Loan Amounts will not be taxable income for startups.

- The Goal of the CARES ACT is to preserve employment across the United States. Therefore there are reductions in the Loan Amount Forgiven based on the following criteria:

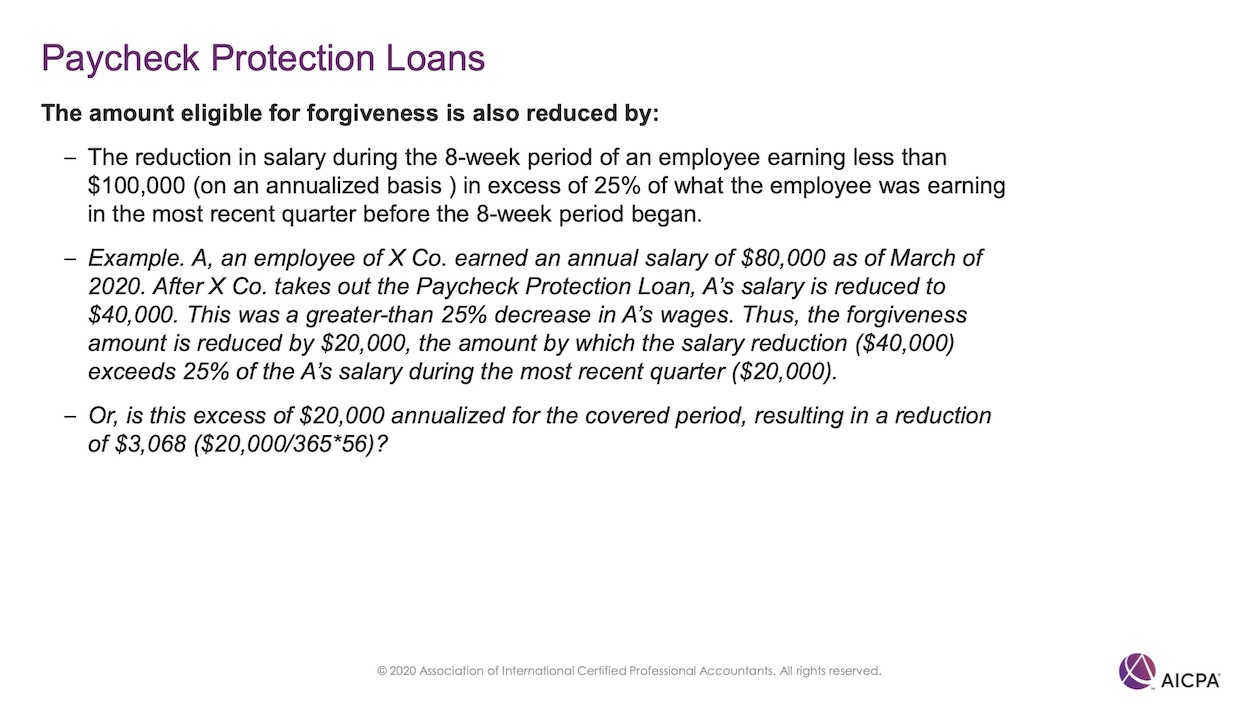

- The Loan Amount Forgiven will be reduced by the amount of any reduction in the total salary of any employee that is in excess of 25% of the total salary of the employee during the most recent full quarter.

- The Loan Amount will be multiplied by the Average # of FTE’s during the coverage period (8 weeks starting from loan origination) divided by Average # of Employees from either (a) Feb 2, 2019 to June 30, 2019 or (b) Jan 1, 2020 to Feb 29, 2020.

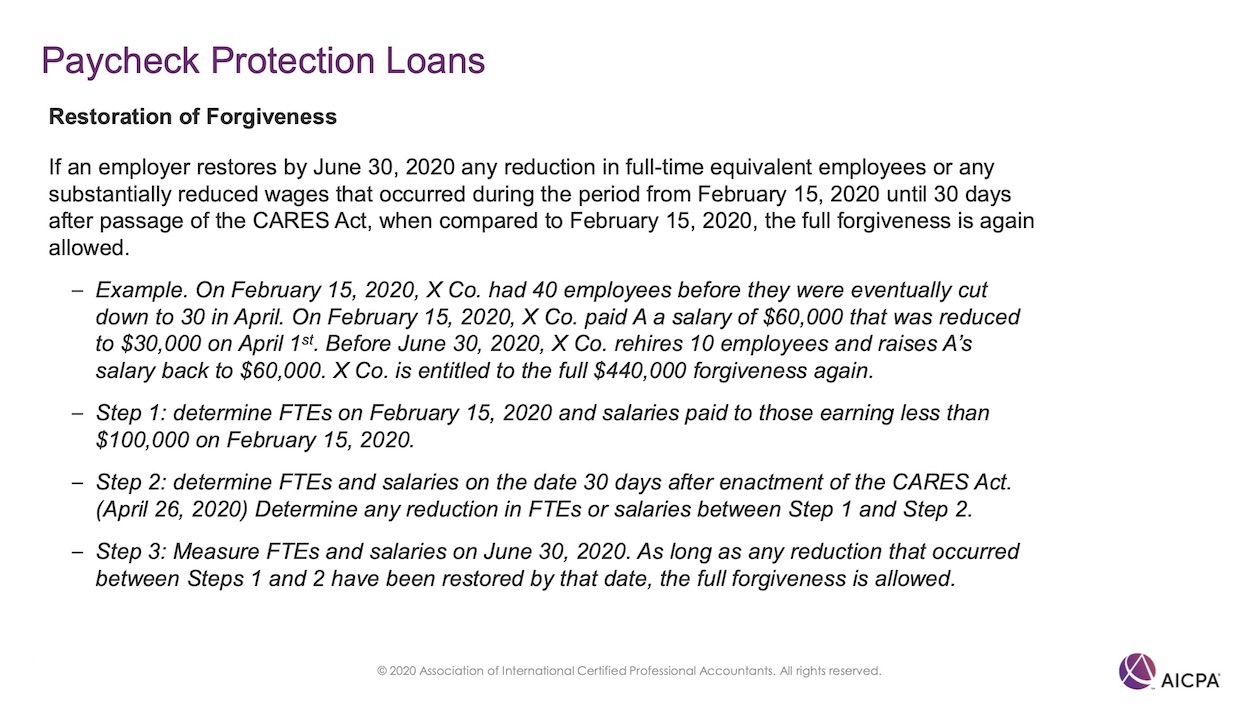

- The Loan Forgiveness Reduction will be reversed for any decreases in salary or personnel reductions that are undone prior to June 30, 2020.

This is the best info we’ve seen on how PPP Loan forgiveness will be calculated. From the AICPA:

Forgiveness Documentation

The government still needs to publish final guidance on the documentation a company will need to have to apply for PPP Loan forgiveness, but we assume the following documents will be needed; consult with your lender to find out what documents they will require:

- Proof you are paying payroll tax: Copies of payroll tax reports file with the IRS (including Forms 941, 940, state income and unemployment tax filing reports) for the the 8 week period following the original of the loan.

- Proof you are paying payroll: Copies of payroll reports for each pay period for the 8 week period following the origination of the loan. Gross wages including PTO (which might include vacation, sick, and other PTO) should be reflected.

- Proof you are paying health insurance: Documentation reflecting the health insurance premiums paid by the company under a group health plan including owners of the company for the 8 week period following the origination of the loan should be provided. Copies of the monthly invoices should suffice.

- Proof you are contributing to the retirement plans: Documentation of all retirement plan funding by the employer for the 8 weeks following the origination of loan should be sufficient. Copies of work papers, schedules and remittances to the retirement plan administrator should be available.

- Proof of rent/mortgage payment: Copies of all lease agreements for real estate and tangible personal property should be presented along with proof of payment during the 8 week period following the loan origination date.

- Not sure what this is for, unless it’s more mortgage payment proof: Copies of all statement of interest paid on debt obligations incurred prior to February 15, 2020 indicating payment amounts and proof of payment for the 8 week period following the loan origination date.

- Proof of utilities payment: Copies of cancelled checks, statements or other evidence of utilities paid during the “covered period” for the 8 week period following the loan origination date.

Economic injury disaster relief (EIDR) loans

- This is a different program

- It was created before the CARES Act Paycheck Protection Program Loans were created.

- You can not currently apply for both, so if you apply for the EIDR you can’t apply for the PPP

- There are some nuances if you already have an EIDR in place, which we will ignore since most VC-backed startups do not have an EIDR in place

- Administered directly by the SBA instead of Banks.

- You apply on the SBA’s website

- We are concerned that the SBA is not staffed to efficiently disburse the amount of loans that are going to be requested - this could result in delays!

- Companies located in states that have been declared a State of Emergency (most have) are eligible for Economic Disaster Relief Loans of up to $2 million.

- The company has to be able to prove it has sustained an economic injury and the majority of the loans require a Personal Guarantee with assets/collateral to back it up.

- No personal guarantee on loans below $200k though.

- Our current recommendation as of March 31, 2020, is for Startups to focus on the PPP Loans through the CARES Act.

The Federal reserve’s main street lending program

- On April 9th, the Federal Reserve announced the “Main Street Lending Program” intended to provide low-cost loans to companies.

- The loans will be delivered through banks and other lenders, with the Fed providing money to backstop/help the lenders deal with the risk.

- These will be low-cost loans between $1 million and $25 million.

- There are two parts to this loan that will make it harder for funded startups to take advantage of these loans:

- The loan required Earnings Before Interest Taxes Depreciation and Amortization in 2019; and most VC backed companies are not making positive EBITDA.

- And even if a startup is EBITDA positive, the rules seem to indicate that the company’s EBITDA needs to be at least $250,000 - so real earnings.

Payroll Tax Help

- Payroll Tax Deferral

- Originally, we believed that payroll tax deferral was ONLY possible for companies who do not receive a SBA loan as part of the CARES Act

- However, the IRS issued guidance saying that companies that take PPP loans can also defer payroll taxes - provided that they pay the deferred taxes as soon as the loan is forgiven.

- Allows businesses to defer 100% of its payroll taxes for the remainder of 2020.

- Normally, companies pay a payroll tax equal to 6.2% of all employee compensation up to $137,700 per employee and a 1.45% of all compensation.

- Under this plan those taxes for the remainder of 2020 will be eligible for deferral – 50% due in December 2021 and 50% due in December 2022. Companies should consult their payroll provider to seek this credit.

- Kruze has reached out to both Gusto & Rippling. They are working on policies and procedures.

Guidance from Rippling, a payroll provider, on some of the new payroll rules

- Emergency Sick pay and Family Leave: Rippling will be pushing out PTO policies to all clients April 1st (the FFCRA's effective date) so that employees can request these leave types. Rippling will then automate the quarterly tax filings associated with these leave types.

- Remote I-9 Verification: Due to social distancing, physical inspection and completion of I-9 documents has been given a 60-day deferment. Rippling has created a task for Admins to verify this when normalcy returns and will automate filings.

- Insurance Open Enrollments: Carriers across the nation have created special Open Enrollments to enable dependents to be added to existing insurance policies. Rippling has already enabled this in product for all individuals affected.

Employee Retention Payroll Tax Credit

- Companies who have experienced a decrease in revenues by 50% or more due to COVID-19 will be eligible for a payroll tax credit equal to 50% of all wages paid to an employee between March 12, 2020 – December 31, 2020 up to $10K per employee or $5,000 credit per employee.

- If the credit is larger than the amount of payroll taxes due, the company will receive a refund from the IRS.

- Companies wishing to participate in this program should contact their payroll provider.

- Extra sick leave assistance

- Not part of the CARES Act package, but R&D payroll tax credits are available up to $250k. This is something we recommend all funded startups consider, and we have a calculator where you can estimate how much you may save in taxes. It’s a great way to reduce your burn rate!

Unemployment for furloughed employees

- Unemployment Insurance has been expanded to cover employees who are still employed but furloughed.

- Companies would still have to pay health benefits during this time but their employees could collect Unemployment Insurance.

- Some companies are moving salaried employees to hourly. If there hours are reduced, these employees can then collect unemployment on the delta between their new pay level and the previous salary pay level.

- Can Founders furlough themselves and collect Unemployment Insurance?

- In theory, yes, a founder could furlough themselves and get Unemployment Insurance through the COVID relief act

What startups can now to take advantage of the cares act funding

- Banks and lenders started accepting loan applications on April 3rd

- Contact your bank to see if they are offering the PPP loans. f your bank doesn’t handle CARES ACT Loans, switch to one that does immediately or find an “agent” like Lendio that will help you.

- Assemble payroll records for each of the 12 months prior to the date of application (e.g. 1/1/19 – 3/31/20) and for full year 2019

- Itemize payroll by employee in order to identify and exclude employees earning more than $100,000 per year.

- Contact your payroll provider to see if they have reports that automatically provide you the above information.

- Assemble evidence that payroll taxes since Jan 2019 have been paid.

- Contact your lawyer to get an opinion on the SBA Affiliate rules and how they apply to your company specifically.

- Contact your VCs to let them know you are going to be applying, get BOD approval and let them know they may need to sign an application if they own more than 20%.

Information Startups should collect to be ready for a PPP loan application

As of April 2nd, we have only seen the government application and haven’t seen any application from a bank. But, we have experience in what banks ask for when doing loans, and we have a good understanding of what the CARES Act is looking for - so we complied this list of data that we think founders should collect so that they are ready for a PPP application once the banks have them ready to go:

- Beneficial Ownership Form - Bank will provide the form.

- Form W-9 (TIN request and certification)

- IRS Form 940 and 941s

- 2018 Business Tax Return

- 2019 Business Tax Return (if filed) or Year-End Financial Statements to include Profit & Loss and Balance Sheet

- 2020 YTD interim financials to include Profit & Loss and Balance Sheet (if available)

- Payroll report(s) for the trailing 12 months ( Rippling, etc) Kruze will Pull

Payroll data from 01/01/19 - 12/31/19 and 04/01/19 – 03/31/20 (we do not yet know which period will be used in calculating the loan size, the government has issued conflicting data). - US-Based Contractors paid via 1099 and amounts paid from 01/01/19 - 12/31/19 and 04/01/19 – 03/31/20. There is conflicting information right now as to if they can be included, and on the date range. This is for contractors who would be employees and not service providers.

- Articles of Organization/Incorporation and any amendments

- DBA fictitious business name statement / assumed name certificate

- Operating agreement / By-Laws and amendments

- Certificate of good standing

- If not operating in the state of organization, a certificate to operate as a foreign Entity (certificate of authority) and a certificate of good standing in the state of operation

- Pull a Report for Gross Earnings + Employer Tax for 1) 2019 and 2) Last 12 Months (April 1, 2019 - March 31, 2020).

- Pull a Report for Total Number of Employees as of 12/31/19, 2/29/20 and 3/31/20.

- Pull a Report for Net Employee Healthcare Benefits Spend for 1) 2019 and 2) Last 12 Months (April 1, 2019 - March 31, 2020)

- For Net Employee Healthcare Benefits Calculation

- Pull A Report for US Based Contractor Payments for 1) 2019 and 2) Last 12 Months (April 1, 2019 - March 31, 2020)

- For the Contractors Payment Calculation, run it based on Cash Payments (like a 1099 Calculation)

- Pull a Report for Total Number of US Contractors as of 12/31/19, 2/29/20 and 3/31/20.

- From 401k Provider (if Client has 401k Matching Program)- Pull a report for Employee Contributions to Retirement Employee Retirement Plan for 1) 2019 and 2) Last 12 Months (April 1, 2019 - March 31, 2020)

We’ll keep this page updated as we learn more - stay tuned, this is a rapidly evolving situation for funded startups (and for the other small businesses that we all depend on!) Stay safe.

Any advice contained in this communication, including attachments and enclosures, is not intended as a thorough, in-depth analysis of specific issues. Nor is it sufficient to avoid tax-related penalties. This has been prepared for information purposes and general guidance only and does not constitute professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice or consulting a qualified law firm.

No representation or warranty (express or implied) is made as to the accuracy or completeness of the information contained in this publication, and Kruze Consulting, its members, employees, and agents accept no liability, and disclaim all responsibility, for the consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.