An income statement (also called a profit & loss – or P&L – statement) is one of the three major financial statements that a startup needs. The others are the balance sheet and the cash flow statement.

The three statements are crucial when trying to secure funding from venture capitalists, investors, and lenders. You’ll also need to provide them to your board of directors at your regular meetings.

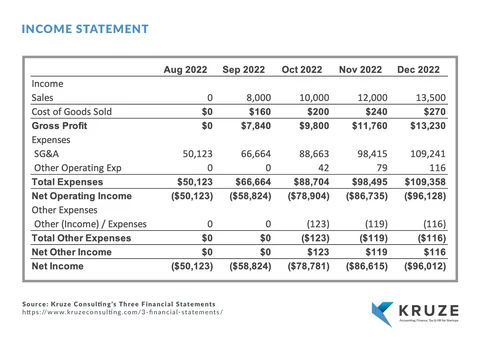

The income statement shows how much a startup is spending, and how revenue the company is bringing in, over a specific time period. Typically startups in their initial stages have negative income, because the company is investing in building a new product. Even if revenue is zero, startups need to produce P&L statements! Listing the company’s expenses shows where the startup is spending money, and controlling expenses is one of a founder’s most important responsibilities.

The income statement is usually the first financial statement that a VC will look at when evaluating a startup. And experienced founders obsess over their financials, starting with this one, since it shows both revenue and expense performance.

What does an Income Statement include?

As noted above, the income statement has two main sections: revenue and expenses. Revenues include any money the startup has earned, and expenses include all the money a company has spent on its business activities. The difference between those amounts is net income (or loss).

An income statement covers a specific span of time, and are typically done monthly, quarterly, or annually. We recommend producing this every month. And you’ll need an annual report as well for your tax returns.

How to read it - the formulas on the Income Statement

The general formula for the income statement is Total Revenues - Total Expenses = Net Income (or Net Loss). Start at the top of the report, where revenues are reported, and then flow down to take out the expenses and eventually get to the net income or loss.

To give a more detailed look at how a company builds an income statement, we can break down the general formula into some steps:

- Revenue - Cost of Goods Sold = Gross Profit

- Gross Profit - Operating Expenses = Operating Income

- Operating Income - Interest Expense = Pre-Tax Income

- Pre-tax Income - Income Tax = Net Income (or Net Loss)

Let’s look at some of these terms that can be included on your income statement:

- Revenue. This is money your startup earned through selling your products or services.

- Cost of Goods Sold (COGS). These are all of the direct costs that your company incurs to produce your products, such as materials and labor. COGS does not include indirect expenses like marketing, sales, distribution, or administrative expenses.

- Operating Expenses. These are expenses a business incurs through its normal operations, including things like rent, equipment, inventory costs, marketing, payroll, and research and development.

-

Selling, General, and Administrative Expenses (SG&A). This is part of your operating expenses, and includes the costs of managing the startup and the expenses of selling and delivering your products.

- Interest Expense. Interest expense is the interest that’s payable on any funds a startup has borrowed, including loans, convertible debt, and lines of credit.

Why does a startup need an income statement?

The income statement is a great way for founders, investors, analysts, and other stakeholders to get an overview of the financial health of your startup. While many startups don’t earn a profit, the income statement also provides detailed information about the startup’s expenses and revenue trajectory. It can help founders determine if they’re operating efficiently. Tracking expenses closely lets founders and CEOs see more easily where they should allocate resources, or where the company may need to cut costs.

Most importantly, the income statement will help startup management decide when they should raise additional funds – every startup industry has particular metrics that VCs look for that indicate that the company is mature (or hot!) enough to raise the next round of capital. This is where those metrics live.

As noted earlier, you’ll need an income statement when you try to raise funding from venture capital firms or if you’re seeking debt funding. While income statements show a business’s current profits and losses, they’re also used to predict your future profitability, showing the potential for earnings and increased share value.

Of course, income statements depend on what type of startup you are. A retail startup with high inventory is not going to have the same expenses as a tech startup with minimal inventory and high fixed asset costs. So investors also compare your income statement to similar startups, to help them evaluate your operational efficiency and how well your startup manages expenses.

Income statement analysis

When analyzing income statements, there are two primary methods: vertical and horizontal analysis.

- Horizontal analysis compares changes in the dollar amounts of the various amounts on the income statement over a number of accounting periods. Those changes can pinpoint patterns or trends that provide insights into a company’s performance. For example, if the cost of goods sold (COGS) increases dramatically, it may indicate issues with sourcing raw materials.

- Vertical analysis focuses on the relationship between the numbers in a single reporting period. Each item is listed as a percentage of a base figure in the income statement instead of in dollars. For example, to show the relative size of different expenses, the expense line items could be listed as percentages of operating expenses. That way the analyst can review the relative proportions of expenses, to see where costs rose or fell.

Creating an income statement for your startup: a comprehensive guide

For managing your startup’s finances and generating essential financial statements like an income statement, it’s highly recommended to use accounting software such as QuickBooks Online. You really should use one. These tools can automate much of the process, ensuring accuracy and saving time.

However, we are all human, and some of us may suddenly realize we need an income statement when it’s tax time or when an VC asks. This isn’t a good situation, but if that’s the case - and if you’re not using software - here’s a guide on how to create an income statement manually.

Creating your startup’s income statement

The first step in creating an income statement is collecting accurate financial data. Make sure that you are choosing data that all fits into the same time period; for example, an entire calendar year, or a particular month. You’ll need to gather the following documents and information:

- Sales records: Invoices, receipts, and any other documentation of money earned from your primary business activities.

- Expense receipts: Bills for utilities, rent, office supplies, and any other costs incurred in running your business.

- Payroll records: Documentation of employee salaries and benefits.

- Bank statements: To verify income and expenses.

- Credit card statements: For any business expenses charged to credit cards.

- Loan documents: For information on interest paid.

- Tax documents: Previous tax returns and any estimated tax payments made during the period.

These documents will provide the necessary information for:

- Total revenue

- Operating expenses

- Non-operating expenses

- Cost of goods sold

- Employee salaries

- Office supplies

- Interest paid

- Tax

Ensure you have all the necessary financial details to avoid discrepancies in your financials.

There are several types of income statements:

- Single-step income statement: This is the simplest format. It groups all revenues together and all expenses together, then subtracts total expenses from total revenues to get net income. It’s called “single-step” because there’s only one subtraction to arrive at the bottom line. Might be OK if you are just trying to do taxes, but won’t cut the mustard if you are trying to get a VC to invest.

- Multi-step income statement: This format is more detailed. It separates operating revenues and expenses from non-operating ones. It typically shows steps to calculate gross profit, then operating income, and finally net income. This gives more insight into the company’s operations and sources of profit. If you are raising funding, or trying to understand your financial situation, or are getting ready to produce financial projections, this is a better format.

- Contribution income statement: Not really recommended, but this income statement format focuses on separating variable costs from fixed costs. It’s useful for understanding how changes in sales volume affect profitability. It first calculates the contribution margin (sales minus variable costs) before subtracting fixed costs.

For most startups, a basic income statement using the single-step or multi-step format is sufficient.

Structure your income statement as follows if you are using the multi-step format (recommended):

- Revenue

- Cost of Goods Sold

- Gross Profit

- Operating Expenses

- Operating Income

- Non-operating Revenue and Expenses

- Net Income

Determine important financial ratios such as:

- Gross profit margin

- Net profit margin

- Operating profit margin

Double-check all calculations and ensure all financial details are accurately recorded.

Uses of income statements for your startup

- Internal financial analysis An income statement helps you assess your startup’s financial health by comparing revenue and expenses. It shows where you’re making money and where you might be losing money, enabling you to make informed decisions about your business operations.

- Attracting potential investors Investors rely heavily on income statements to evaluate a startup’s profitability. A well-prepared income statement can demonstrate your ability to generate recurring revenue and manage expenses effectively, making your startup more attractive to potential investors.

- Securing loans and financing Lenders use income statements to assess a company’s ability to repay loans. A strong income statement can improve your chances of securing financing for your startup’s future growth.

- Budgeting and forecasting By analyzing past income statements, you can identify trends and make more accurate financial projections for your startup’s future.

- Tax reporting and compliance Income statements are essential for calculating your company’s net income and determining tax liabilities. They help ensure compliance with tax regulations and can identify potential tax deductions.

- Tracking business growth Comparing income statements from different periods allows you to track your startup’s financial progress and identify areas for improvement.

- Evaluating marketing campaigns By examining changes in revenue on your income statement, you can assess the effectiveness of your marketing campaigns and adjust your strategies accordingly.

Key elements of an income statement

- Total Revenue: The money your startup earns from its primary business activities.

- Cost of Goods Sold: Direct costs associated with producing your products or services.

- Gross Profit: Total revenue minus cost of goods sold.

- Operating Expenses: Costs incurred in running your business, such as rent and employee salaries.

- Operating Income: Gross profit minus operating expenses.

- Non-operating Revenue and Expenses: Income and costs not directly related to your core business activities.

- Net Income: The company’s total profit or loss after all expenses are deducted from revenue.

Cash flow vs. income statement

While both are important financial documents, a cash flow statement differs from an income statement. The cash flow statement shows the inflow and outflow of cash in your business, while the income statement focuses on revenue and expenses to determine profitability.

Balance sheet and income statement

The balance sheet and income statement work together to provide a complete picture of your startup’s finances. While the income statement shows profitability over time, the balance sheet reports on your company’s assets, liabilities, and shareholder equity at a specific point in time.

Is the Income Statement the same as the Profit & Loss Statement?

Yes, the income statement and the profit & loss (P&L) statement are indeed the same. They are simply two different terms for the same financial report. Both provide an overview of the financial performance of a business over a specific period of time, showing the revenues, costs, and expenses incurred during that time. The resulting figure, which can be either a net income or net loss, indicates the profitability (or lack thereof) of the business. They are easy to find in your accounting software - for example, in QuickBooks, click reports to get to them.

The term you use can depend on personal preference, industry standards, or regional norms. If you have a venture investor, they should know both terms and use them interchangeably. In some parts of the world, for example, “income statement” is the more commonly used term, while in others, “P&L” is the standard. Regardless of the term used, the core purpose remains the same: to give a detailed account of a company’s financial status and performance.

It’s worth noting that the term “P&L statement” may be more common among entrepreneurs, particularly in the startup scene, because it emphasizes the concept of profit and loss, which are key indicators of a company’s operational success or failure. However, in financial accounting, among professional accountants, and investment analysts, the term “income statement” is often preferred.

Financials effectively communicate your startup’s progress

Financial statements aren’t the most exciting things that founders have to work on. But compiling complete and accurate financial statements on a regular basis is crucial to convince investors that you have a solid business concept. It also sends a strong message to investors, creditors, shareholders, and board members that you’re reliable and serious about your business.

For more information about financial statements and startup accounting, please contact us.