Bookkeeping for Bay Area Startups

The best bookkeeping partner for startups changing the world

Become investor-ready for your startup’s next venture capital round. Work with a startup expert.

KRUZE CONSULTING FOUNDER FORMER STARTUP CONTROLLER

Affordable Startup Bookkeeping and Accounting

Check out Kruze's affordable monthly bookkeeping options.

Basic Bookkeeping

Great for pre-revenue, seed-stage companies

Starting at $600 per month Starting at $750 per month

- Dedicated accounting manager

- Accrual-basis bookkeeping

- Pre-revenue companies

- Tax services available

Founder Timesaver

Best for companies starting to scale

Starting at $850 per month Starting at $1,250 per month

- Dedicated accounting manager

- Accrual-basis bookkeeping

- Revenue recognition support

- Monthly call included

- Earlier financial delivery

Premium

Ideal for high-growth, well-funded businesses

- Dedicated accounting manager

- Accrual-basis bookkeeping

- Complex revenue recognition

- Monthly call included

- Support for multiple entities, consolidation

- Support for class / department tracking

Our experts can help you find the right solution for your budget and business needs.

Get in touch with us today to learn more about our monthly bookkeeping options.

What does a bookkeeper do?

Kruze bookkeepers will help your startup have accurate, up-to-date financial statements that you can use to manage your business’ growth and cash flow. The basic tasks we will handle are the same as what any other quality bookkeeping provider would do - except that we have developed highly automated systems, and our team is experienced handling the nuances of early-stage, venture funded companies.

Our account managers have an average of 11 years of experience, and are experts on helping young, funded businesses with their bookkeeping. But that experience helps our team go beyond simple, outsourced bookkeeping, and offer financial advice and due diligence help that other accounting firms can not match.

We think bookkeepers for startups should provide the following services to early-stage, VC backed companies:Recording financial transactions - When revenue or expenses happen, it’s your bookkeeper’s job to record these into your company’s accounting system. This probably involves categorizing the “transaction” in a way that makes sense, say a payment to your payroll provider as a payroll expense. Traditionally this work was all done manually, but Kruze is a pioneer is using automated systems to make this process faster (and cheaper for our clients!) By using a combination of off-the-shelf accounting solutions like Expensify and Bill.com, plus custom built software, Kruze can quickly and accurately record the vast majority of your company’s transactions without you or your Kruze bookkeeper having to do anything. However, automation is not enough. Early-stage companies move quickly, and you need an experienced bookkeeper or accountant to review your books and financial records to make sure that the automated systems haven’t made any errors. There are particular moments when automated systems are likely to introduce mistakes, such as when employee benefits are changed. Our team is trained to look for specific errors based on your company’s stage.

Revenue recognition - Many companies raise their next round of venture capital based on their revenue growth. Many early-stage CEOs use a variety of dashboards to visualize their revenue. Smart VCs will check to see what the difference is between the CEO’s revenue number and the actual financial statements recognized revenue. Making the accounting statements correctly mirror these dashboards is not as simple as it sounds! Kruze uses automated systems to record the revenue. But, correct accounting relies on more than just data feeds, and our team knows the questions to ask our CEOs for the information needed to produce GAAP revenue. Incorrect revenue recognition is one of the biggest reasons startups switch to Kruze as their bookkeeper, especially the online bookkeepers with questionable accounting experience that claim to do everything with “automation” - which is really a code word for the founder having to code everything correctly.

Reconciling accounts - Companies that raise venture capital need to have accurate books - in fact, a company’s executives typically promise recurring delivery of accurate financial records to venture investors in the funding documents. Reconciliation is an important step in bookkeeping. This is when your bookkeeper makes sure that the different records balance, and that the money leaving an account (like your company’s bank account) matches the actual money spent. Reconciliation is an especially important part of bookkeeping for funded companies, since investors (and potential acquirer) expect accrual accounting and financials that are close to GAAP. Kruze helps set up connected, automated systems that help do much of this work automatically. But, we go the next step and have our experienced team do several levels of reviews to help catch anything that the automated systems might miss.

Managing bill pay - Early-stage companies need to carefully manage their burn, and best in class bill pay helps give founders the controls they need to preserve cash. Kruze clients use bill.com, which is a leading provider of accounts payable for companies of all sizes. An automated bill pay system also integrates directly into accounting software, minimizing the amount of data entry.

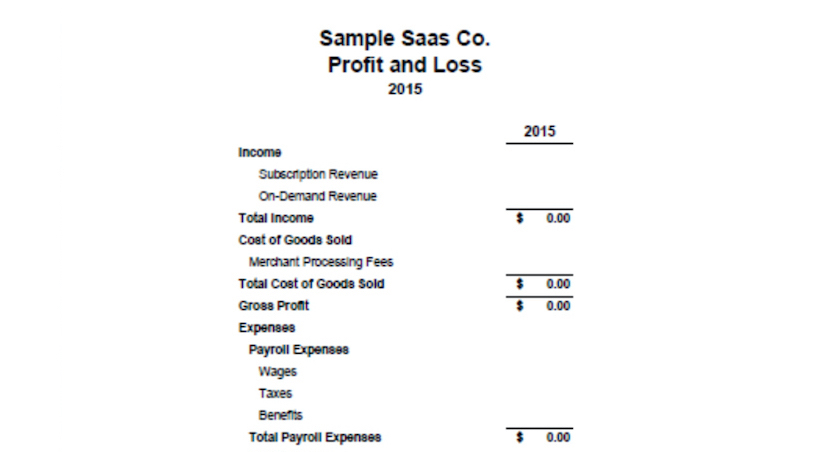

Preparing financial statements - Investors, board members and experienced founders want to see three important financial statements, usually every month: the income statement, cash flow statement and balance sheet. Bookkeepers have been preparing these financial packets for ages, but modern bookkeepers like Kruze use automated systems. We’ve built our own, specialized software that interfaces directly with QuickBooks API, and combine it with best-in-class off the shelf solutions to give early-stage startups low cost, highly accurate financial statements and financial reports. However, not all founders are trained finance professionals - software and financial packets are only half the story. Kruze’s accounting team knows how to explain what financial statements mean and how important metrics impact a startup’s strategy.

How is Kruze different?

Kruze Consulting is 100% focused on helping seed and venture funded businesses, and one of our key services is accurate and affordable bookkeeping for startups.

Companies that have raised capital from professional investors require a specialized level of bookkeeping and accounting. It goes well beyond getting the books right - our integrated tax preparation team, FP&A team and CFOs can help your company be ready for the strategic situations that make running a startup special.

Investor updates, board meetings, being prepared for that next venture round or the unexpected M&A interest - we know what the top venture capitalists and public company M&A teams what to see, and make sure our clients’ books are solid.

PROFESSIONALS IN BOOKKEEPING

Kruze bookkeepers will help your startup have accurate, up-to-date financial statements that you can use to manage your business’ growth and cash flow

QUALITY BOOKKEEPING PROVIDER

Our account managers have an average of 11 years of experience, and are experts on helping young, funded businesses with their bookkeeping

HIGHLY AUTOMATED SYSTEMS

We have developed highly automated systems, and our team is experienced handling the nuances of early-stage, venture funded companies.

Kruze’s Key Advantages:

The Best Automated Bookkeeping Systems and People Who Care

- We’ve created an all-in-one bookkeeping service and back office solution for VC backed businesses using best in class accounting automation.

- Even more importantly, our team loves what we do and we care deeply about your startup’s success.

- We’ve got the systems, experience and the people to scale with your business from one person to hundreds, from a half a million in seed financing to your $100 million Series D round.

- Our clients have collective raised over $15 billion in venture and seed financing, and one to three of our clients are acquired each and every month.

- We know what it takes to be ready for the next fund raise - and how to navigate the due diligence public companies conduct when they acquire a venture backed company.

Your books will be ready!

When does a funded startup need to start worrying about doing bookkeeping?

If you haven’t been keeping track of your books by the time you raise your first outside money, you need to get your books in order.

We generally recommend that businesses move away from spreadsheets and into an accounting software as soon as possible.

- Day one you start the company and start a bank account.

- Connect that bank account to QuickBooks.

- Start getting the bank feed going into QuickBooks and actually characterize the transactions inside of QuickBooks.

Should you do your bookkeeping in a spreadsheet?

When a business takes outside money, they need to have a firm understanding of their books, since investors usually demand transparency.

And since nobody wants to accidentally run out of money… or fail to raise a Series A round due to messy books!

So, here are the basics of bookkeeping for startups - in particular, early-stage companies that have or are going to raise outside venture capital or seed funding.

What to look for in a startup bookkeeper

Startups need more than a robot to reconcile the accounts, they need a trusted advisor who is in tune with their unique growth path.

Kruze’s finance and bookkeeping team combines experienced startup accountants with the best off the shelf, and custom built, accounting software. We automate everything but have our experts keep an eye on your financials to catch the mistakes the systems make. Founders shouldn’t be burdened with making sure they carefully and correctly code financial transactions so automated bookkeeping services don’t mess up.

We believe that it’s our team’s job to help save our CEOs time and take care of the basic bookkeeping tasks that other services dump onto their clients. Unlike other startup bookkeeping services, our team deals with the complexities of early stage books and sets you up with good bookkeeping so you are ready for VC and M&A due diligence - plus you’ll have the financial data you’ll need to grow your company. As pioneers in cloud accounting, Kruze has been an Intuit Firm of the Future Finalist, an Expensify Emerging Partner of the Year, and is a Gusto Gold Partner.

Here is what to look for in a startup bookkeeper:

ACCURACY

Venture capitalists don’t like it when their portfolio companies’ numbers change, and you don’t want your numbers to be squirrely during an acquisition. Because we are totally focused on startup business models, we understand the nuances required to get the numbers right. And because we are one of the leaders in accounting automation, we’ve seen the mistakes the automated systems make. If you are aiming for your early-stage company to become a unicorn, you need accurate books!

SPEED

At early-stage companies, decisions are made on tight timeframes. We know that your company is burning cash, and understand how important it is to get the financial data you need to make critical decisions. Kruze’s bookkeepers will work with you to find the financial delivery date that works for your needs.

RELIABILITY

Startup CEO’s don’t have time to proof their books. Our team conducts multiple reviews on every client’s financials - every month. And because we are familiar with early-stage companies’ business models, we understand the complexities (and importance) of issues like revenue recognition, ARR, capitalized vs. non-capitalized development costs and more.

EXPERT ADVICE

Our team loves working with early-stage companies, and we’ve got the experience to help you make critical financial decisions. And our advice can grow with your company, from simple bookkeeping to part-time CFOs. We have former VC’s on staff to help prepare you for your next funding round, and former IRS agents on hand to assist you as you think through the tax ramifications of selling your company. And we have one more critical advantages - we care more!

LOW TIME COMMITMENT COMMITMENT

CEOs of early-stage companies have a tremendous number of things to accomplish. Managing the books shouldn’t be one of them! Kruze’s bookkeeping team strives to handle all the minutia so you can focus on growing your business, achieving product-market fit, advancing your R&D, hiring, etc. We understand the pressure of running a hyper-growth business, and want to make your financials as easy as possible.

PRICE

Early-stage companies are rightfully price sensitive. Kruze offers a variety of pricing plans to help startups afford accurate bookkeeping services. Check out our pricing page to learn more.

Ready to work with the early-stage bookkeeping experts at Kruze?

Bookkeeping for startups - recommended systems and files if you are raising money

If you are doing to DIY your books, here are they systems and records your new company needs to

Create clean books

Keep your investors happy

Get the numbers you need to make smart financial decisions

Here is more detail on the recommended systems and files:

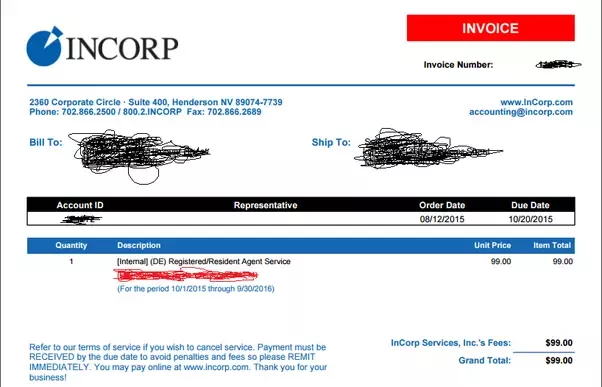

Incorporate as a Delaware C Corp

If you are going to raise real Angel and VC capital, then incorporate as a Delaware C Corp. Venture Capitalists do not typically want to invest in LLCs and S Corps. So if you are raising money, especially from professional or experienced investors, you’ll need to choose a Delaware C Corp as your entity type. Btw - LLC and S corp structures are great if it’s a family owned business and you will not be raising VC capital.

Standalone bank account

Get a standalone bank account for the business. Don’t intermingle investor funds or your business expenses with your personal money!

Set up expense tracking

Set up a system to help with expense tracking. In particular, go for automation that can: document the paper trail of expenses for IRS audit purposes, help keep founder and businesses expenses cleanly separate, and easily integrate with your accounting system. We recommend Expensify, because it’s got a great mobile app, solid online interface, and works well with QuickBooks Online. Learn more about setting up expense tracking.

Set up payroll system

Fire up a payroll system. If you are hiring a team, or getting ready to pay yourself, one of the most important steps in bookkeeping for a startup is getting an automated payroll system that smoothly interfaces with your accounting software.

We typically recommend Gusto or Rippling

Set up a bill payment system.

We suggest Bill.com. Their system has a solid audit trail, works easily online, and interfaces with your accounting system automatically, saving you time. You can also use it to pay contractors - which is a pretty common expense for most startups.

Get an accounting system

We recommend QuickBooks Online (“QBO”) as the right bookkeeping software for early-stage companies and high growth small businesses. It’s the leading small business accounting software in the US for small businesses, and interfaces nicely with other automated systems like payroll.

Set up your chart of accounts

The chart of accounts will list every “account” where you’ll organize all the records of expenses, revenue, etc. on your general ledger. Basically, it’s a list of all of the places where you might want financial transactions to be recorded.

Now that you’ve got your basic bookkeeping systems setup and connected, it’s time to actually do your books!

For early-stage businesses without a ton of complexity, and who are using the systems above that automate a lot of the work, it’s not so hard to generate the financial records that you will need to run your business.

Let’s dig into the basic steps required to DIY your startup’s books.

Bookkeeping for Startups - DIY steps

Not every startup will be ready to hire an outsourced bookkeeping service on day one. We understand that money can be very tight day one. But that’s no excuse for not keeping track of your financials.

So here are some tips, and the steps, for a small company that wants to manage the financial statements in house. If you are a company that expects to raise venture funding, you may also want to check out our free due diligence checklist, so you know what sort of materials you’ll need to keep track of prior to raising outside capital.

How to set up your startup’s bookkeeping and accounting system

- Incorporate as a Delaware C-Corp

- Get a startup-focused bank account

- Set up expense tracking

- Set up a payroll system

- Get accounting software

- Set up a startup-friendly chart of accounts

Reconciling your bank account

Your bank account never lies. The bank account is where all the transactions actually happen. And you have a record of that, basically “verified” by your financial institution. Now with Quickbooks, you first must have connected Quickbooks into your bank account. To do this, you actually type in your company’s bank username and password to get all the financial transactions flowing into Quickbooks. This is important, because then you can match transactions that are in Quickbooks against the bank transactions. It’s this nice little clearinghouse in what accountants call “reconciling.” If you reconcile your transitions and actually match them against bank transactions, then Quickbooks becomes reliable. So a good example of why this is important is that sometimes people might put fake revenue transactions or fake expenses or make journal entries to cover up expenses so that no one could see them. And you only know those transactions are false after you’ve actually compared every transaction coming from the bank and against the statement versus what’s in Quickbooks. So reconciling cash (which is shown in your bank account) is your way to detect fraud. It’s your way to make sure your finances are actually legit and a way to make sure there’s no funny business going on. So you really want to have those bank transactions flowing into Quickbooks so that you can reconcile. So one of the first things when you are doing bookkeeping for startups is to reconcile the bank account against Quickbooks.

Enter Other Transactions into Quickbooks

Next, you’ll need to get all of your other transactions into QBO, and also reconcile other important parts of your financial statements.

We recommend you do what are called “intra-month reconciliations.” This means you should look at your books and transactions in the middle of the month, not just after it’s over. By reconciling some of your transactions in the middle of the month and getting all that information into your bookkeeping software, you’l reduce your workload at the end of the month. Plus, you’ll give yourself more visibility into your performance.

And - we can’t stress this enough - your bank account should be the source of truth, so you have to reconcile your figures back to the bank!

Recognize Revenue

Bookings are the culmination of all the contractual payments you’re gonna get, usually over the next 12 months. So, if you close a $1.2 million contract, over the next 12 months you recognize that as bookings.

Revenue is a backward-looking metric and revenue you recognize over the length of the service period. So, if you close that same $1.2 million contract over 12 months, each month going forward you’re gonna recognize $100,000.

Send invoices and review your receivables

If you are billing clients, send invoices and review your receivables; and review AP Aging.

Founders need to understand a few key items to understand how their cash burn may differ from their income statement’s operating loss.

Payroll

If you use one of the automated payroll systems we recommend, like Gusto or Rippling, running payroll is easy - in fact, it just happens.

You’ll want to check that your payroll has synced into QuickBooks Online, and then you should be good. However, if you are paying contractors, there are some tips you should think about

Account for any Investments

Most early-stage companies are going to raise a SAFE, convertible note or preferred equity to get going. When doing bookkeeping for startups, you need to make sure that you account for these fund raises correctly.

We have a few pieces that will help you understand how to record these investments into your company.

Signs of a Bad Bookkeeper

Time and time again, we see not very good bookkeepers not labeling the vendor names in their clients’ accounting software.

Putting the vendor name in for each expense is a simple thing. But, low quality bookkeepers are trying to get the transactions into QuickBooks as quickly as possible to save time, and they don’t really care if they’re labeled or if they’re in the right categories.

At Kruze, we have a different methodology. Kruze uses a proprietary software that plugs into QuickBooks and it categorizes about 70% of the transactions, and automatically. And we complement that automated bookkeeping with high-quality staff accountants. When you have your vendors labeled, you can actually run reports by vendor and see exactly what you’re spending.

This became very important in the early days of COVID because a lot of companies were trying to cut burn. If companies didn’t have their vendors labeled in their accounting software, then they couldn’t see how they were spending their money. So make sure your vendors are labeled and it will make your financials actually actionable.

How Good Bookkeeping Pays for Itself

Companies that are planning on raising venture capital need good bookkeeping services - VCs, strategic acquirers and IPO underwriters want financials that are done right - the 1st time.

Founders who try to skimp on bookkeeping services can find that poorly kept books can end up being super-costly for a number of reasons. Here are some of the reasons why good bookkeeping matters to early-stage companies:

- Know where you are spending your money so you can manage costs, control your burn and look good to investors

- Good books mean you can move fast during VC and M&A due diligence - and being able to share your financials quickly with strategic partners inspires confidence

- A good accountant helps you make sure your a collecting your revenue and not over-paying vendors, reducing your burn rate

- Solid record keeping means you can cut your burn by capturing an R&D tax credit - this could save your startup up to $250,000 a year

Ready to work with the best Bookkeeper?

About Us

A CPA Firm Specialized in Startup Accounting & Finance

Startups are our niche, and our passion. Our clients have raised over $15 billion in VC funding. We are one of only a few outsourced accounting firms that specialize in funded early-stage companies - we only offer financial and tax services to fast growing startups in the Pre-Seed, Seed, Series A, Series B and Series C stages.

The Right Accounting Partner for Your Startup’s Next Round

We know how to de-risk your startup’s next venture capital round. Our team makes sure you are ready to fly through your next VC’s accounting, HR and tax due diligence. And when you use us as your bookkeeper, we set up and keep up-to-date a due diligence folder so you can get that next round of fundraising.

A Leader in Cloud Accounting Software

Our practice is built on best of breed cloud accounting software like QuickBooks, Netsuite, Gusto, Rippling, Taxbit, Avalara, Brex, Ramp and Deel. Technology makes us more efficient, saving our clients money and letting us offer higher value services like FP&A modeling, 409A valuation, and treasury advice. Startups deserve to work with CPAs using modern software.

Trusted by Top Venture Investors

Top angel investors and VCs refer Kruze because they trust us to give the right advice. Our clients are portfolio companies of top technology and Silicon Valley investors, including Y-Combinator, Kleiner, Sequoia, Khsola, Launch, Techstars and more. With us, your books and taxes are in order when it’s time to raise another round of venture financing.

What types of startups does Kruze Consulting usually work with?

Kruze Consulting works with funded Delaware C-Corps. Our clients have secured Pre-Seed to Series C or Series D funding. We look to partner with our clients, going beyond the typical outsourced accounting relationship and seeking to provide a higher level advisory role. We feel honored to be a part of making the world a better place, even if it’s one debit and credit at a time.

Accounting, Finance, Taxes, & Payroll all in one solution

Startup CFO services, startup accounting and bookkeeping services, startup annual taxes, expense reports, payroll, state sales taxes: we've got you covered. Our software provides custom tailored dashboards that can be provided weekly or monthly, depending on your preference and plan. Founders are often so busy building their company that they don’t have time to take care of their finances. Traditionally, these companies have had to work with a basket of people to get their work done, including bookkeepers, accountants, AP clerks, CFOs, consultants, and tax accountants. At Kruze Consulting, our founders have one point person, saving time and money.

Client testimonials

We're huge fans of Vanessa and the folks at Kruze Consulting. They set up our books, finances, and other operations, and are constantly organized and on top of things. As a startup, you have to focus on your product and customers, and Kruze takes care of everything else (which is a massive sigh of relief). I highly highly highly recommend working with Vanessa and her team.

Vivek Sodera

Co-Founder @ Superhuman

Prior to Kruze, as a remote-first team, we were weighed down by a lot of the bureaucracy involved with having a distributed workforce. Kruze has supported us above and beyond basic accounting needs by ensuring we have everything we need to expand and support our team wherever they may be located

Zack Fisch

Pequity's Head of Operations & Legal

Avochato has been growing rapidly in the past year – in fact, too quickly for us to keep up with books, taxes, and budgeting for growth. Partnering with Kruze Consulting has been fantastic to manage, track, and analyze our finances while we continue focusing on building our customer base. Kruze’s team knows what startups need.

Alex De Simone

CEO @ Avochato

Everybody, go to Kruze Consulting. They do a great job. I personally can tell you, they've done a great job for our companies, including Calm.com. I'm sure they’ll do a great job for you.

Jason Calacanis

Angel investor

Consulting, Tax and Valuation Prices

Competitively priced for high-growth companies

Financial Consulting

| Staff Accountant | $120 |

| Senior Staff Accountant | $170 |

| Controller | $200 |

| Senior Controller | $250 |

| Financial Modeling | $400 |

| CFO / COO / VP | $400 |

Tax Advice

| Administrative | $115 |

| Tax Analyst | $175 |

| Senior Tax Analyst | $295 |

| Tax Manager | $395 |

| Tax VP | $495 |

| CEO | $495 |

Startup 409A Valuation

| Pre-Seed/Seed | $2,000 |

| Seed A | $2,500 |

| Seed B | $3,000 |

| Seed C | $3,500 |