What Is Form 4562

IRS Form 4562: Depreciation and Amortization is used by businesses to claim deductions for assets they’ve purchased, whether tangible items like equipment or intangible ones like patents. The form is also used to expense certain property under Section 179 and to report how business vehicles and other assets are used. Kruze generally works with VC-backed startups, and startups that purchase a lot of equipment for manufacturing or R&D, who build out datacenters, or that operate fleets often make use of this tax form.

By filling out Form 4562, businesses can lower their tax bills by accounting for the depreciation of these assets over time.

If you’ve bought any major assets for your business during the tax year, you’ll need to complete and include this form with your corporate income tax return, Form 1120 to claim those deductions.

Here are some examples of property you can depreciate with IRS Form 4562:

- Vehicles

- Office equipment

- Manufacturing equipment

- Patents and copyrights

When is Form 4562 Due?

The due date for filing Form 1120 (which will include Form 4562) is April 15th, but we often recommend our clients file a Form 1120 extension, extending the filing date to October 15th. To do so, you must file Form 7004. Visit our C-Corporation tax deadlines calendar to see the current year deadlines. Always work with a qualified tax professional when filing complicated IRS forms like 4562 - your business’ situation is unique, and many industries have special government tax incentives and programs.

In the Context of Taxes, What Are Depreciation And Amortization?

Tax Depreciation

Depreciation is an annual tax deduction that helps you recover the cost of your business or investment property over time. It begins when you first use the property for your business or to generate income and ends when you stop using the property, fully deduct its cost, or take it out of service.

Typically, you can depreciate the following:

- Tangible property like buildings, machinery, vehicles, furniture, and equipment.

- Intangible property such as patents, copyrights, and computer software.

There are several different types of depreciation methods, with the following three being the most common:

- Straight-line depreciation: Straight-line depreciation spreads an asset’s cost evenly over its useful life, resulting in the same expense each year.

- Declining balance depreciation: Double declining balance depreciation applies higher expenses in the early years of an asset’s life and lower expenses in later years, which is useful for assets with higher early usage or value.

- Sum-of-the-year’s digits: Sum-of-the-years’-digits is a more complex accelerated depreciation method, used for assets with higher usage or value later in their life.

For most startups, depreciation isn’t a major financial concern. However, in industries like clean energy, telecom, and manufacturing, it can have a bigger impact on a company’s financial performance and valuation. Depreciation lowers reported profits, which can make the company seem less profitable than it actually is. Since depreciation is a non-cash expense, it doesn’t affect cash flow directly. However, it matters when calculating EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), a key measure used by investors to evaluate the company’s performance without non-cash expenses like depreciation.

Tax Amortization

Amortization is similar to straight-line depreciation, allowing you to take yearly deductions to recover certain costs over a fixed period. You can amortize things like business startup costs, goodwill, and other intangible assets.

For example, under the Tax Cuts and Jobs Act, companies are required to spread out their research and development (R&D) deductions over five years for domestic R&D and 15 years for foreign R&D, instead of deducting the full amount at once. Read more about this tax law, Section 174, and how it impacts startups here.

Other Types Of Tax Credits & Deductions

Qualified startups can lower their cash burn and reduce their tax bills by taking advantage of the right tax credits and deductions.

While not every tax credit is available to all early-stage startups, there may be one that’s a good fit for your company, your employees, or your investors. The best thing to do is talk to your tax advisor to learn about applicable business startup tax credits.

Here is a list of the top 20 tax credits for startups:

- Credit for Small Employer Health Insurance Premiums: Form 8941

- Work Opportunity Tax Credit (WOTC): Form 5884

- Employer Credit for Paid Family and Medical Leave: Form 8994

- Empowerment Zone (EZ) Employment Credit: Form 8844

- Maryland Biotechnology Investment Incentive Tax Credit (BIITC)

- New York State Life Sciences Research and Development Tax Credit Program

- Keystone Innovation Zone Tax Credit (Pennsylvania): KIZ Tax Credit

- California R&D Tax Credit

- California Sales Tax Partial Exemption

- Employee Retention Tax Credit for Recovery Startups (ERTC)

- Federal R&D Tax Credit

- Research and Development (R&D) Tax Credit

- Historic Preservation and Rehabilitation Incentives

- Film, Theatrical, and Motion Picture Credits

- Employer-Provided Child Care Credit

- Job Training Incentives

- Renewable Energy Tax Benefits

- Enterprise Zones (EZ)

- Angel and Venture Capital Investment Tax Credits

- 401k Tax Credit: IRS Form 8881, Credit for Small Employer Pension Plan Startup Costs

This is just a small list of the many credits that fall under the general business credit. For a more comprehensive list of business tax credits, visit the IRS page on business tax credits, or talk to a startup tax advisor.

And in case you need a reminder, here’s the difference between a tax deduction, a tax credit, and a tax incentive.

| Tax Deduction | Tax Credit | Tax Incentive | |

|---|---|---|---|

| Company need to have positive income | Yes | Sometimes | Sometimes |

| Reduces taxable income | Yes | Unlikely | Sometimes |

| Directly reduces a tax owed | Indirect | Direct | Sometimes |

How To Get IRS Form 4562

You can find the official Form 4562 on the IRS website. For the latest information about changes or legislation enacted related to Form 4562, it’s always a good idea to go directly to the IRS site to get the form. You can get IRS Form 4562 by clicking here to visit the Internal Revenue Service’s page about Form 4562.

Who Has To Complete Form 4562?

You are only required to fill out Form 4562 if you are claiming a deduction for a depreciable asset on your tax return.

According to the IRS, you’ll need to file IRS Form 4562 if you are claiming the following deductions:

- Depreciation for property placed in service during the 2023 tax year.

- A Section 179 expense deduction, including any carryover from a previous year.

- Depreciation on a vehicle or other listed property, no matter when it was placed in service.

- A deduction for any vehicle reported on a form other than Schedule C (Form 1040).

- Any depreciation claimed on a corporate income tax return (other than Form 1120-S).

- Amortization of costs that started in the 2023 tax year.

Keep in mind that you will need to file a separate Form 4562 for each business or activity on your tax return that requires it.

What Do I Need To Complete Form 4562

To fill out IRS Form 4562 you will need to gather your general tax records and the following specific information:

- The price of the asset you’re depreciating

- A receipt as proof of purchase

- The date the asset was first used for business

- Your total reported income for the year.

If you are using the asset for both personal and business purposes, you will also need the following:

-

A percentage breakdown of how often it’s used for business vs. personal purposes.

-

Supporting records, like mileage logs for vehicles.

Is Form 4562 Required Every Year?

Businesses only need to file IRS Form 4562 each year they claim depreciation or amortization on their tax return. This form is required if they are depreciating property bought during the tax year, claiming a Section 179 expense deduction, or depreciating vehicles or other listed property.

Form 4562 is also needed if a business is deducting vehicle expenses on forms other than Schedule C (Form 1040) or claiming depreciation on a corporate tax return, except Form 1120-S. If amortization started during the tax year, Form 4562 is also required.

A separate form must be filed for each business or activity, and it must be submitted every year while the asset is being depreciated.

Form 4562 Instructions

When filing Form 4562, we strongly recommend working with an experienced tax preparer. Depreciation can be tricky, and an experienced tax preparer can make it easier while also finding ways for your business to save money on your tax return.

Here are high-level instructions for filling out Form 4562.

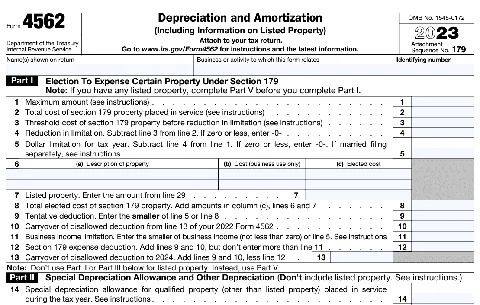

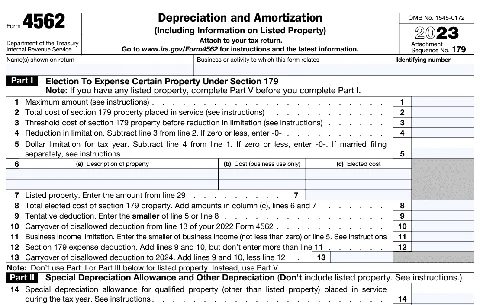

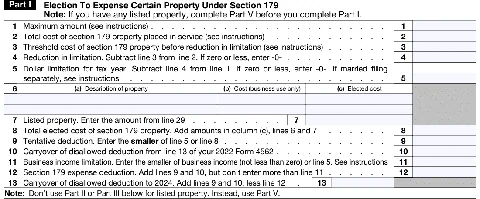

Step 1: Election To Expense Certain Property Under Section 179

Part one of Form 4562 deals with Section 179, which lets businesses write off part or all of the cost of equipment and other property bought during the tax year.

For 2023, the maximum amount you can deduct under Section 179 is $1,160,000. If the total cost of the property exceeds $2,890,000, the deduction limit goes down. However, you can only deduct up to the amount of taxable income your business made that year, meaning you can’t deduct more than your earnings. Any amount over the Section 179 limit is depreciated over future years.

When filling out part one, you’ll need to list the assets, calculate the deductible amount based on business use, and determine if any depreciation will carry over to future years if the full amount can’t be written off in the current year.

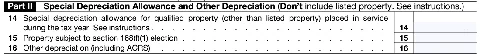

Step 2: Special Depreciation Allowance and Other Depreciation

Part two of Form 4562 is for businesses that want to use bonus depreciation to write off a large part of an asset’s cost in the first year it’s purchased.

Like Section 179, bonus depreciation allows for an immediate deduction, but it focuses on deducting a percentage of the asset’s cost upfront. Businesses can even combine both deductions in the same year.

The 100% bonus depreciation expired at the end of 2022, and in 2023, the bonus depreciation rate is 80%. This rate will keep dropping by 20% each year until 2027. Businesses with eligible property, like farming equipment or green technology, may qualify for this deduction. Always consult a qualified tax CPA, as your business may be eligible for items that are unique to your industry, and tax law often changes.

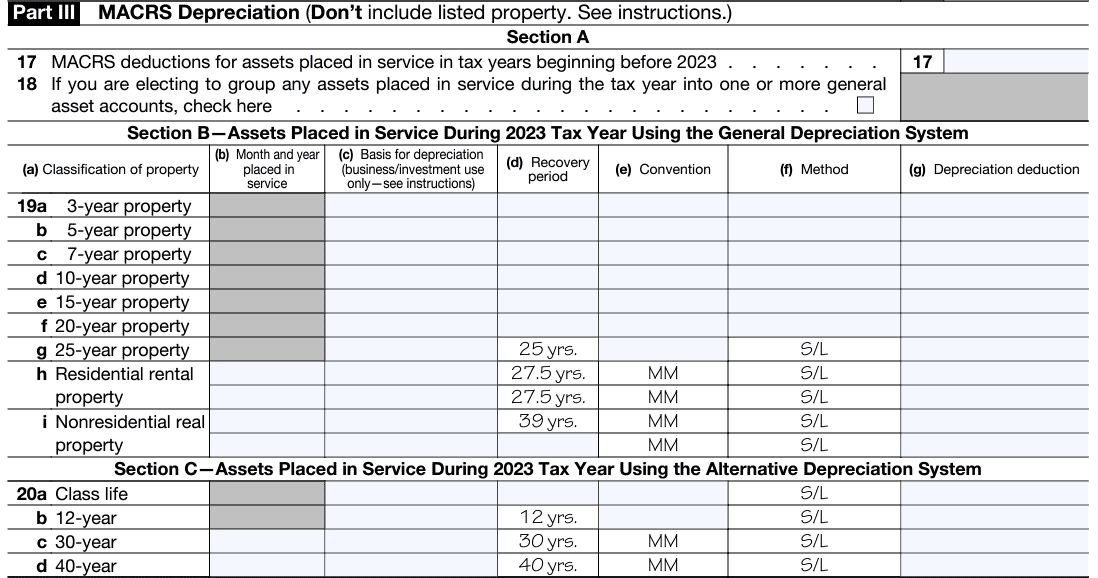

Step 3: MACRS Depreciation

Part three of Form 4562 is where you report depreciation using the Modified Accelerated Cost Recovery System (MACRS). Instead of taking immediate deductions with Section 179 or bonus depreciation, MACRS allows businesses to spread out deductions over time, with bigger deductions in the early years and smaller ones later on.

This method applies to most business, rental, and investment property placed in service after 1986. Depending on the type of property, the depreciation period can range from 3 to 25 years.

In this section, you’ll also need to report any previous MACRS deductions carried over from past years. If you have multiple similar assets, like office computers, you can group them for simplicity.

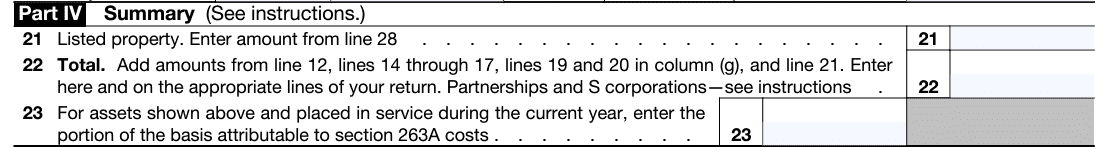

Step 4: Summary

Part four of Form 4562 is where you summarize the totals from Parts I, II, and III, plus any listed property from Part V. Even though it’s in the middle of the form, this section brings together all your deduction information. If you’re reporting listed property, such as assets used for both business and personal reasons, you’ll enter it here.

However, if your business is a partnership or S corporation, you can skip this part since the totals will be reported on each shareholder’s tax return.

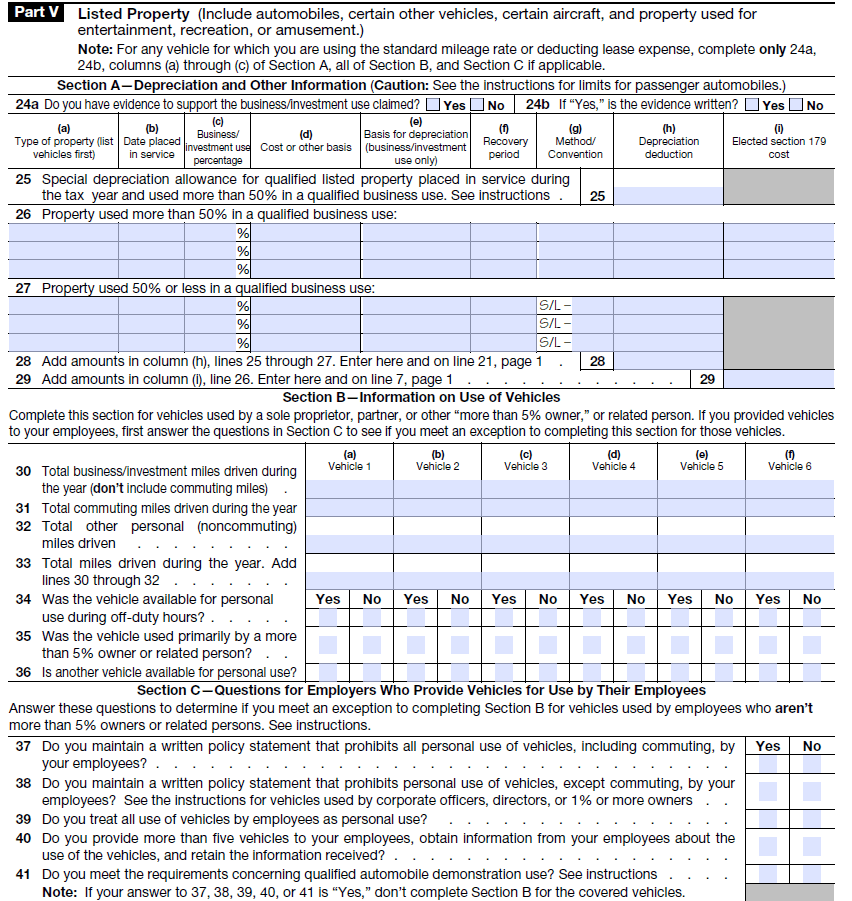

Step 5: Listed Property

Part five of Form 4562 is where you report vehicles and other property used for both business and personal purposes. This section covers any special depreciation, MACRS depreciation, and Section 179 deductions for these assets.

You’ll need to list vehicles or other property used for both work and personal use, like a car used for business deliveries and family trips. Separate items that are used mainly for business from those used more for personal reasons.

You’ll also enter mileage details for business vehicles and answer a few questions to see if additional reporting is needed for employees using company vehicles.

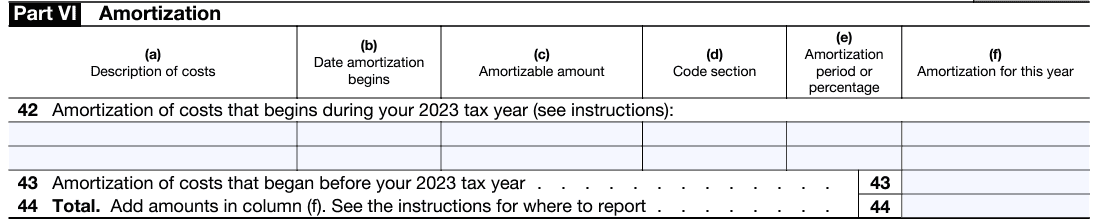

Step 6: Listed Property

Part six of Form 4562 is where you report the amortization of intangible assets like patents, trademarks, copyrights, licenses, and leases. Amortization spreads the cost of these non-physical assets over time. If you’ve recently purchased any intangible assets, you’ll list them in this section.

Remember, assets you amortize can’t be claimed for Section 179 or depreciation deductions.

Conclusion

If you need help with startup tax planning, including deductions and amortization, Form 1120, and whether you need to file a tax return at all, reach out to Kruze Consulting for help. We are experts at tax credits for startups.

Form 4562 Department of the Treasury Internal Revenue Service

Sequence No.

Note: If you have any listed property, complete Part V before you complete Part I.

separately, see instructions

during the tax year. See instructions

asset accounts, check here ▢

Warning: This information is for informational purposes only and should not be used for official tax matters. Use the official Form 4562 and instructions, generally found at: https://www.irs.gov/forms-instructions. Rely on this information at your own risk. Visit https://www.irs.gov/forms-instructions for official IRS information. Consult with a tax professional.