What Is Form 3800

Form 3800 is used to calculate the sum of your general business tax credits available in a single tax year, including any credits carried over from previous years.

If you are a startup that plans to claim one of the general business tax credits for your small business, you must file IRS Form 3800.

What Is the General Business Credit?

The general business credit is not a single tax credit, but a collection of tax credits that help small business owners lower their federal income tax.

If you are claiming several small business tax credits, you must file a separate tax form for each tax credit you are claiming. Those individual credits are then added up on Form 3800 and are known as the general business credit. This ensures the credits are accurately reported and do not exceed the allowable limit for the tax year.

The general business credit is a nonrefundable credit that reduces your total tax bill and must be attached to your corporate income tax return, Form 1120.

The due date for filing Form 1120 (which will include Form 3800) is April 15th, but we often recommend our clients file a Form 1120 extension, extending the filing date to October 15th. To do so, you must file Form 7004. Visit our C-Corporation tax deadlines calendar to see the current year deadlines.

Types Of Tax Credits

Qualified startups can reduce their cash burn and tax burden by using the right tax credits.

While not every tax credit is available for every early-stage startup, there might be one that makes sense for your company, your employees, and your investors. It’s best to talk to your tax advisor to learn about applicable business startup tax credits.

Here is a list of the 20 top tax credits for startups:

- Credit for Small Employer Health Insurance Premiums: Form 8941

- Work Opportunity Tax Credit (WOTC): Form 5884

- Employer Credit for Paid Family and Medical Leave: Form 8994

- Empowerment Zone (EZ) Employment Credit: Form 8844

- Maryland Biotechnology Investment Incentive Tax Credit (BIITC)

- New York State Life Sciences Research and Development Tax Credit Program

- Keystone Innovation Zone Tax Credit (Pennsylvania): KIZ Tax Credit

- California R&D Tax Credit

- California Sales Tax Partial Exemption

- Employee Retention Tax Credit for Recovery Startups (ERTC)

- Federal R&D Tax Credit

- Research and Development (R&D) Tax Credit

- Historic Preservation and Rehabilitation Incentives

- Film, Theatrical, and Motion Picture Credits

- Employer-Provided Child Care Credit

- Job Training Incentives

- Renewable Energy Tax Benefits

- Enterprise Zones (EZ)

- Angel and Venture Capital Investment Tax Credits

- 401k Tax Credit: IRS Form 8881, Credit for Small Employer Pension Plan Startup Costs

This is just a small list of the many credits that fall under the general business credit. For a more comprehensive list of business tax credits, visit the IRS page on business tax credits, or talk to a startup tax advisor.

And in case you need a reminder, here’s the difference between a tax deduction, a tax credit, and a tax incentive.

| Tax Deduction | Tax Credit | Tax Incentive | |

|---|---|---|---|

| Company need to have positive income | Yes | Sometimes | Sometimes |

| Reduces taxable income | Yes | Unlikely | Sometimes |

| Directly reduces a tax owed | Indirect | Direct | Sometimes |

Tax Deduction

A tax deduction reduces your taxable income.

For example, if a business has $100,000 in revenue and $60,000 in tax deductions, it would have $40,000 in taxable income. At a 21% tax rate, the business would owe $8,400 in taxes.

One common tax deduction is the business meal deduction.

Tax Credit

A tax credit reduces the amount of taxes owed, which makes it more beneficial than a tax deduction, which only lowers taxable income.

For example, if a business has $100,000 in revenue and $60,000 in tax deductions, it would have $40,000 in taxable income. At a 21% tax rate, the business would owe $8,400 in taxes.

With a $5,000 tax credit, the amount owed would drop to $3,400.

Tax Incentive

A tax incentive is meant to encourage certain social or economic outcomes in a specific area.

For example, the Work Opportunity Tax Credit encourages employers to hire people from underrepresented groups, like veterans or ex-convicts. This incentive provides financial benefits to businesses while supporting efforts to increase job opportunities for these groups.

How To Get IRS Form 3800

You can find the official Form 3800 on the IRS website. For the latest information about changes or legislation enacted related to Form 3800, it’s always a good idea to go directly to the IRS site to get the form. You can get IRS Form 3800 by clicking here to visit the Internal Revenue Service’s page about Form 3800.

Who Should Fill Out Form 3800?

Any small business claiming one of the general business tax credits must fill out Form 3800.

According to the IRS, an eligible small business is one of the following:

- A corporation whose stock is NOT publicly traded,

- A partnership, or

- A sole proprietorship

Additionally, the average annual gross receipts of a corporation, partnership, or sole proprietorship for the three years before the tax year of the credit cannot be more than $50 million.

Gross receipts for any year should be reduced by any returns and allowances made during that year. Also, any reference to the business includes any predecessor of the business when considering these rules.

If you started your business less than three years ago, your average annual gross receipts should be based on the time it has existed. If the business had a tax year shorter than 12 months, the gross receipts need to be annualized. This is done by multiplying the gross receipts for the short period by 12 and then dividing by the number of months in that period to get an annual equivalent.

Benefits Of Filing Form 3800

There are several benefits to claiming tax credits as a small business. Here’s a look at a few.

Reducing The Amount Of Tax You Owe

Form 3800 helps businesses claim various tax credits, which can lead to major savings on how much you owe in taxes. This can lower the overall tax bill or even result in a refund.

Improve Cash Flow

By using the tax credits through Form 3800, businesses can reduce their tax bills, freeing up extra cash, which can greatly improve a startup’s cash position. This money can then be used for business growth, expansion, or other operating expenses, giving businesses more financial flexibility.

Help To Offset Startup Costs

Form 3800 includes credits that help businesses offset expenses related to setting up retirement plans or providing employee benefits. These credits can be especially valuable for small businesses, which often face financial challenges in their early stages.

Provides Business Incentives

Form 3800 offers tax credits that can encourage participation in certain activities, by rewarding businesses for things like investing in research and development, hiring from specific groups, and investing in renewable energy (such as wind, solar, and battery storage).

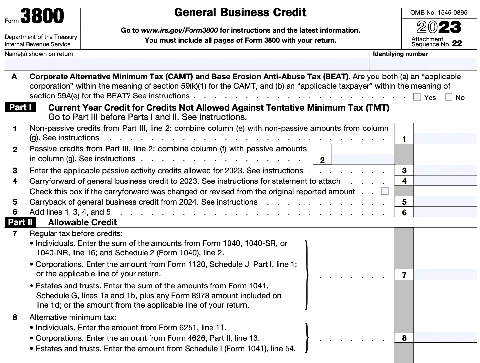

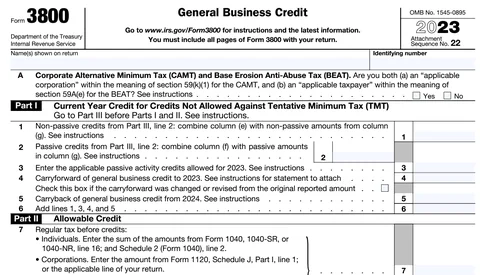

Guide To Filling Out Form 3800

Remember, you will need to fill out a separate tax form for each tax credit you claim, which will be aggregated on IRS Form 3800. This form is filed with your corporation’s annual tax return, Form 1120.

Form 3800 can be complex for small business owners to navigate, so we strongly recommend that you work with an experienced tax preparer. Rather than working through the form in order, you’ll often need to move between different sections, which can make the process more challenging.

Here are high-level instructions for filling out Form 3800.

Step 1: Calculate Your Regular Tax Liability

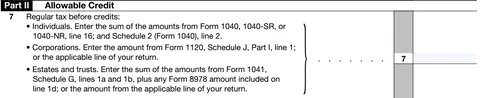

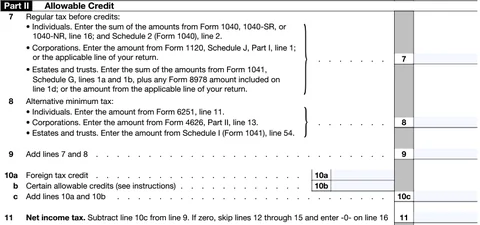

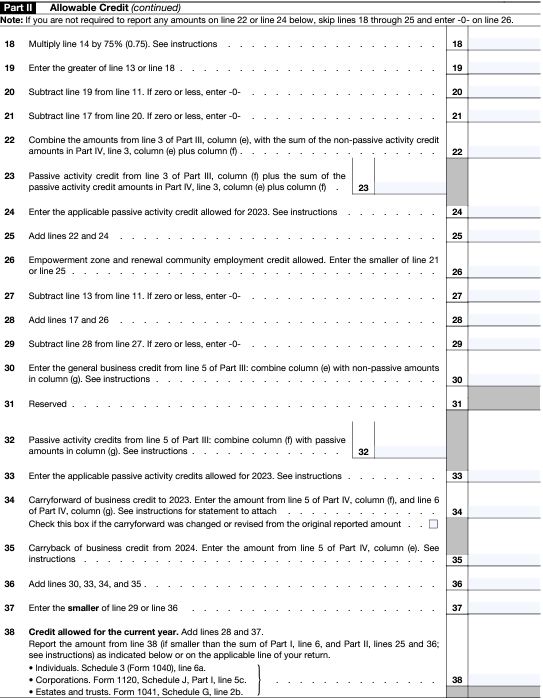

Before you can figure out your general business credit, you need to calculate your regular tax liability. This goes on Part II, Line 7 of Form 3800. To do this, you’ll need to know your business income and any eligible deductions. This is an important step to make sure you claim the correct amount of credit.

Step 2: Calculate Your Alternative Minimum Tax

General business credits cannot reduce the amount of Alternative Minimum Tax (AMT) you owe. The AMT is designed to make sure high-income individuals pay a minimum amount of tax, even if they qualify for various deductions and credits. This tax mostly affects people who earn more than the AMT exemption amount or receive certain types of income, such as incentive stock options or tax-exempt interest. If you have a high income, you will need to calculate your taxes twice—once under regular tax rules and once under AMT rules—and pay whichever amount is higher.

In addition to figuring out your AMT, you also need to calculate your net income tax, which is your regular tax plus the AMT. You’ll also need to determine your tentative minimum tax, which is the AMT minus any foreign tax credit you may be eligible for. The foreign tax credit is available if you or your business pays taxes on the same income to both the U.S. and a foreign country. These calculations are important for completing Form 3800, and they help ensure that you are following the correct tax rules for your situation.

Step 3: Determine Your Allowable General Business Credit

Once you’ve calculated your regular tax liability and your AMT, you can begin calculating your general business credit limit, which is the maximum amount of tax credits you can claim to lower your taxes.

Your allowable general tax credit is equivalent to your net income tax minus the greater of the following:

- Your tentative minimum tax.

- 25% of your net regular tax liability that exceeds $25,000. Net regular tax is your regular tax liability minus specific nonrefundable credits.

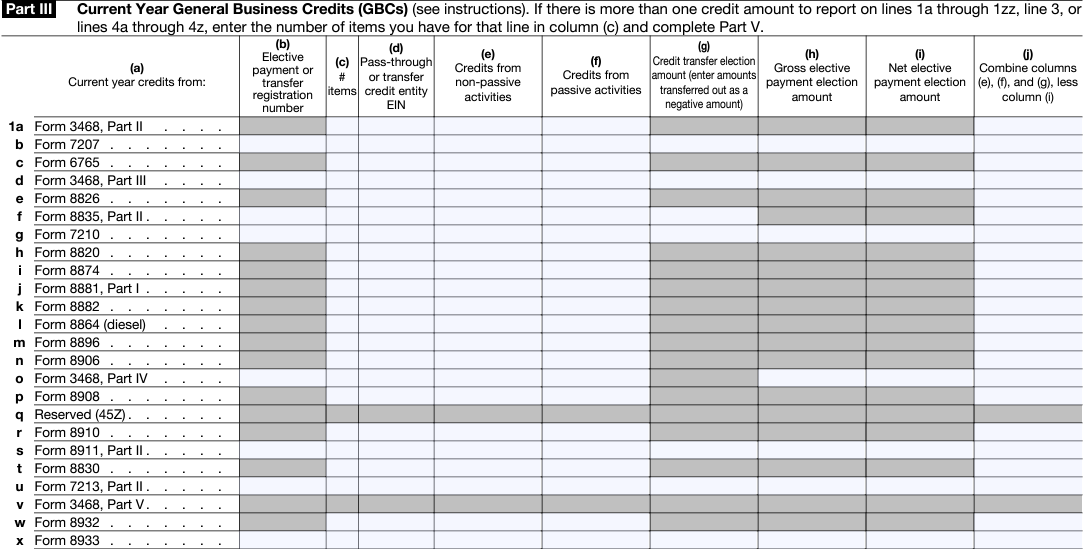

Step. 4: Incorporate Individual Business Tax Credits

When completing Part III of Form 3800, it’s important to correctly carry over all the tax credits you’re claiming. Be sure to include the amount of each credit, and if the credit comes from a pass-through entity, also include the employer identification number (EIN). You’ll also need to identify the type of credit, such as carryforward, carryback, or passive income credits.

Different types of credits must be listed on the form. Carryforward credits are from previous years that weren’t used, while carryback credits apply to past tax years. Passive income credits come from income in a business where you don’t actively participate. Properly reporting these credits helps ensure your tax filings are accurate and avoid mistakes.

It’s also important to remember that when claiming business tax credits, you must follow the correct order:

- Start by applying any carryforwards from previous years, beginning with the oldest credits.

- Then, claim the general business credit earned this year.

- Finally, apply any carrybacks to this year. This first-in, first-out method ensures you use older credits first and get the most benefit from them.

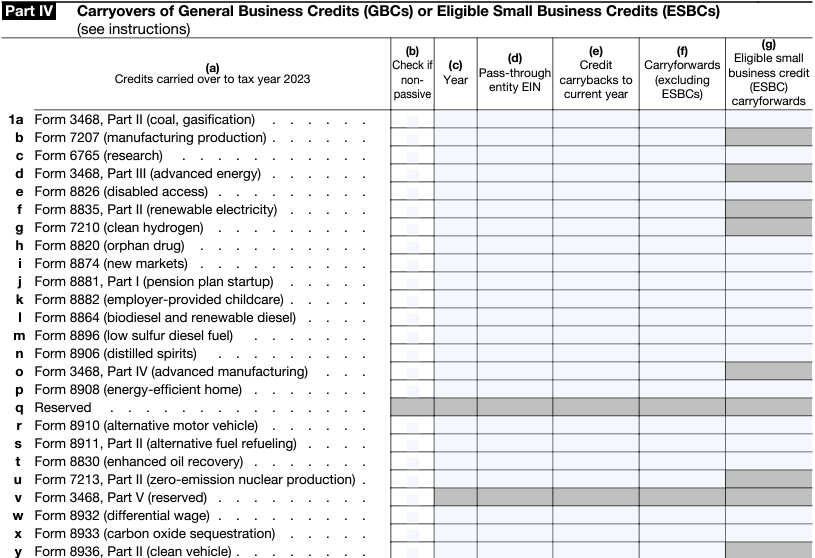

Step. 5: Claim Carryforward And Carryback Credits

When filling out Part IV of Form 3800, you’ll need to report any carryforward or carryback credits you’re using. These credits allow you to apply tax credits that couldn’t be used during the current year. A carryback applies the credit to a previous tax year, while a carryforward lets you use it in future years.

Typically, the IRS allows most business tax credits to be carried back one year if they were available and you qualified for them. But, you might need to amend your tax return for that year. Business credits can also be carried forward for up to 20 years. However, some credits can only be carried forward and used in future years until they are fully applied.

Conclusion

If you need help with startup tax planning, including general business credits, Form 1120, and whether you need to file a tax return at all, reach out to Kruze Consulting for help. We are experts at tax credits for startups.

Form 3800 Department of the Treasury Internal Revenue Service

Sequence No.

Go to Part III before Parts I and II. See instructions.

$25,000. See instructions

(Form 1041), line 52.

Warning: This information is for informational purposes only and should not be used for official tax matters. Use the official Form 3800 and instructions, generally found at: https://www.irs.gov/forms-instructions. Rely on this information at your own risk. Visit https://www.irs.gov/forms-instructions for official IRS information. Consult with a tax professional.