IRS Form 1095-B is a tax form used by startups that provide “minimum essential health coverage” to their employees.

The form reports information about the coverage provided. Part of the Affordable Care Act (ACA) compliance requirements, Form 1095-B is for businesses that are not considered applicable large employers (ALEs) because they have fewer than 50 employees. ALEs (companies with 50 or more employees) provide a similar form, 1095-C, to their employees.

Providing health coverage information

For startup employers who offer health coverage to their employees, Form 1095-B communicates details about the health insurance they provide. It includes information about the individuals covered under the plan, including employees, their spouses, and dependents. The form also indicates the length of time for which the coverage was in effect during the tax year.

When is Form 1095-B due?

Startups are responsible for furnishing Form 1095-B to covered individuals by the deadline specified by the IRS, usually around early February, and for submitting copies of these forms to the IRS. Accurate records are important to make sure the information reported Form 1095-B is correct. Compliance with the Form 1095-B requirements is crucial for startups to avoid potential penalties. Using payroll software solutions can help simplify the process, and many startups work with professional employer organizations (PEOs) to make sure they comply with ACA reporting requirements and stay up to date with any changes in ACA regulations.

Form 1095-B vs Form 1095-C

The main difference between these two IRS healthcare forms is that 1095-B reports actual coverage, while 1095-C reports offers of coverage by large employers. Which form(s) an individual receives depends on their employer size and type of health plan.

If you have questions about Form 1095-B, contact us.

Guide To Filling Out Form 1095-B

Only small businesses that self-fund their employee health coverage need to complete this form. And, while filling out Form 1095-B may not be complex, it can take up valuable time for small business owners.

We recommend working with an experienced tax preparer to help you navigate IRS requirements and make tax compliance easier.

Here are high-level instructions on how to fill out Form 1095-B.

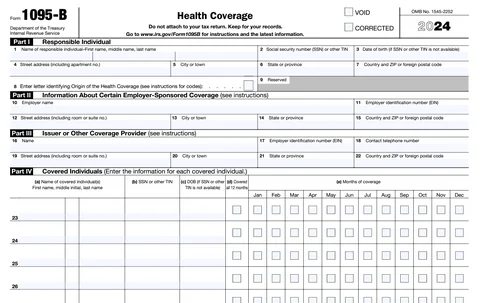

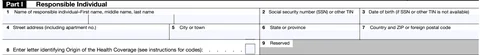

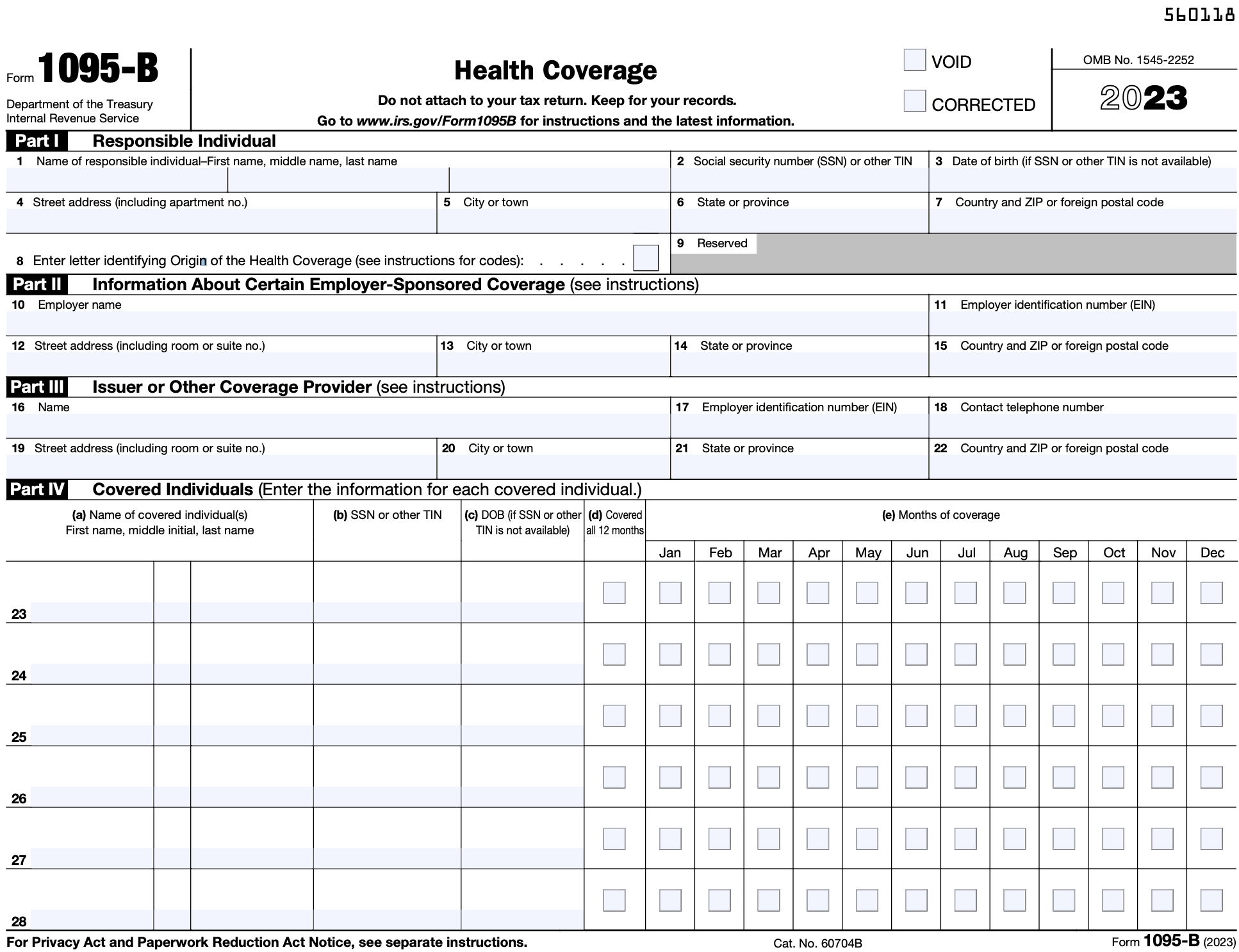

Step 1: Responsible Individual

To complete Part I of Form 1095-B, you’ll need to provide personal information about the responsible individual or employee. This section includes nine specific lines to fill out:

- Line 1: Name – Enter the full name (first, middle, last) of the responsible individual.

- Line 2: Social Security Number (SSN) or other Tax Identification Number (TIN) – Enter the individual’s 9-digit SSN or, if not available, another TIN.

- Line 3: Date of Birth – Only complete this line if SSN/TIN is unavailable.

- Line 4: Street Address – Enter the street address, including apartment number. Use a P.O. box number if mail is not delivered to the street.

- Line 5: City or Town – Provide the city or town of the individual.

- Line 6: State or Province – Enter the state or province.

- Line 7: Country and ZIP or Postal Code – Provide the country and ZIP or postal code.

-

Line 8: Health Coverage Origin Code – Enter the relevant letter for the coverage source:

- A: Small Business Health Options Program (SHOP)

- B: Employer-sponsored coverage

- C: Government-sponsored program

- D: Individual market insurance

- E: Multiemployer plan

- F: Other designated minimum essential coverage

- G: Individual coverage health reimbursement arrangement (HRA)

- Line 9: Reserved for future use – Leave blank for 2024.

Step 2: Information About Certain Employer-Sponsored Coverage

Part II of Form 1095-B is used to provide details about employer-sponsored health coverage, completed specifically by issuers or carriers of insured group health plans, including those purchased through the Small Business Health Options Program (SHOP). This section requires entering essential employer information for the coverage provider.

- Line 10: Employer Name – Enter the full name of the employer sponsoring the coverage.

- Line 11: Employer Identification Number (EIN) – Provide the employer’s EIN.

- Line 12: Street Address – Enter the full street address, including room or suite number. Use a P.O. box if mail is not delivered to the street address.

- Line 13: City or Town – Input the city or town of the employer’s address.

- Line 14: State or Province – Specify the state or province where the employer is located.

- Line 15: Country and ZIP or Postal Code – Enter the country and ZIP or postal code for the employer.

This information helps ensure accurate identification of employer-sponsored health coverage, especially for group health plans provided through SHOP or other employer-based arrangements.

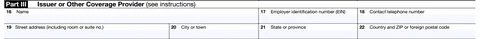

Step 3: Issuer or Other Coverage Provider

Part III of Form 1095-B captures information about the issuer or coverage provider, which may be the insurer, government agency, self-insured employer plan sponsor, or another coverage sponsor. This section allows individuals to identify and contact the provider if they need additional information.

- Line 16: Name – Enter the full name of the coverage provider.

- Line 17: Employer Identification Number (EIN) – Provide the EIN of the provider.

- Line 18: Contact Telephone Number – List a contact number for individuals seeking more information.

- Line 19: Street Address – Enter the provider’s full street address, including room or suite number.

- Line 20: City or Town – Enter the city or town of the provider’s location.

- Line 21: State or Province – Specify the state or province of the provider.

- Line 22: Country and ZIP or Postal Code – Enter the provider’s country and ZIP or foreign postal code.

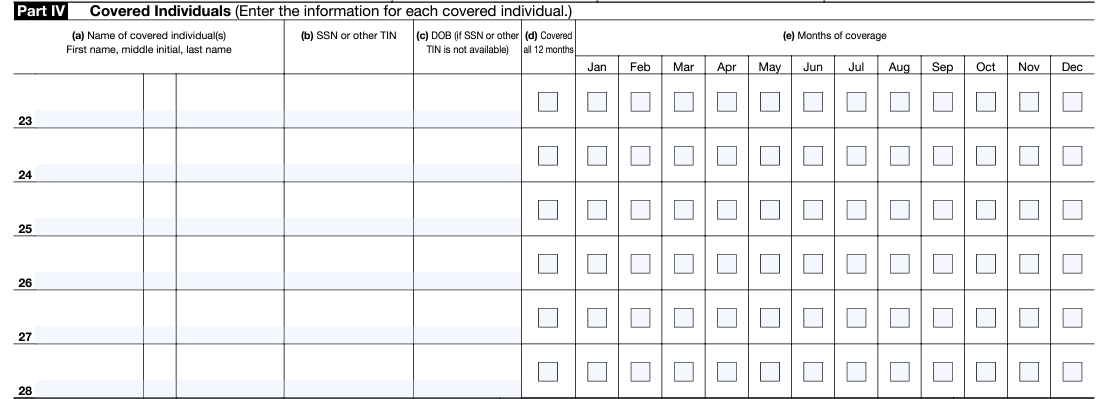

Step 4: Covered Individuals

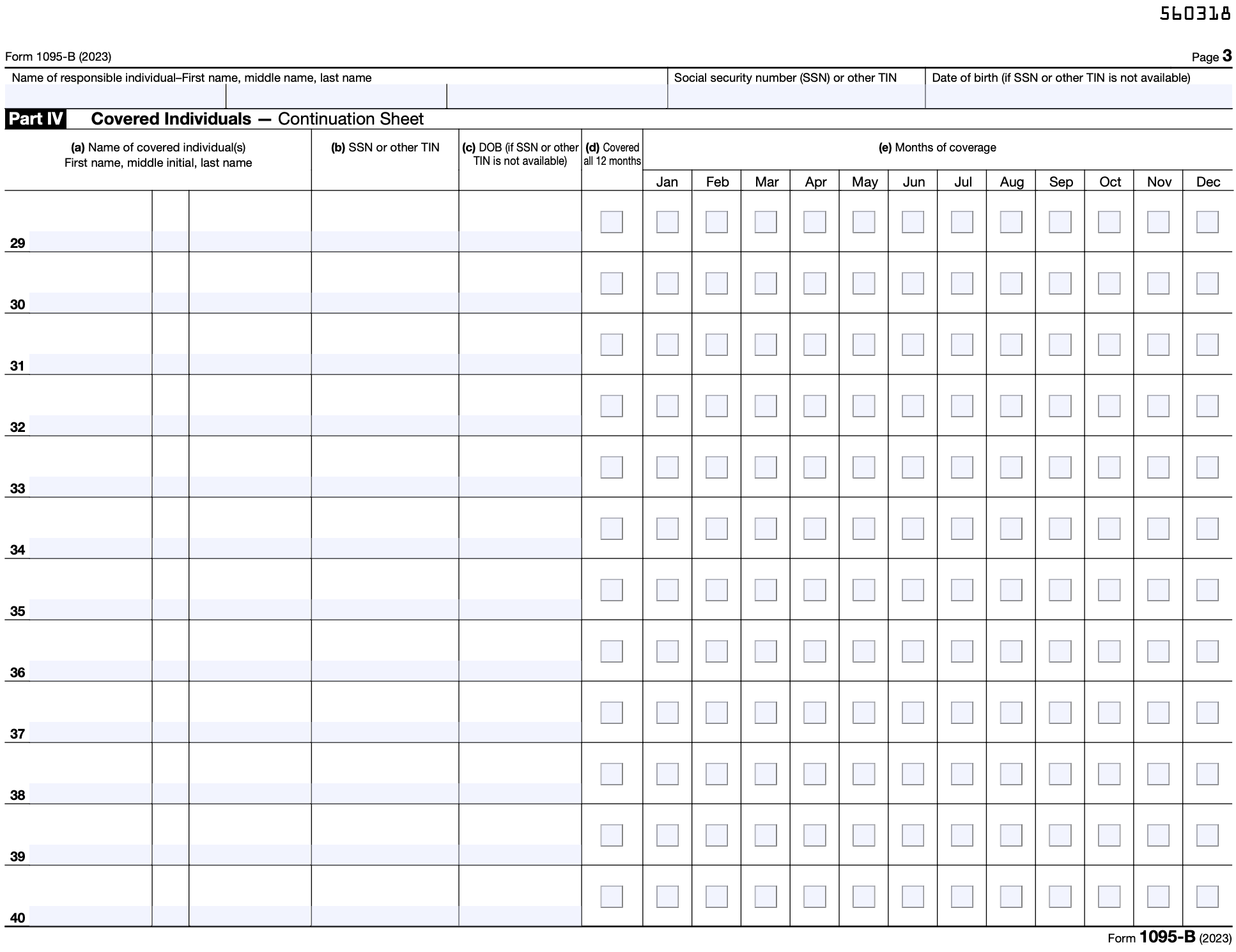

Part IV of Form 1095-B records information about each individual covered under the policy, including the primary insured person and any dependents. If there are more than six covered individuals, Continuation Sheets can be added without counting as separate Forms 1095-B.

- Column (a): Name of Covered Individual(s) – Enter each covered individual’s full name, including first name, middle initial, and last name.

- Column (b): SSN or Other TIN – Provide the Social Security Number (SSN) or other Tax Identification Number (TIN) for each covered individual. Leave blank if the individual does not have a TIN.

- Column (c): Date of Birth – Enter the date of birth (YYYY/MM/DD) only if no SSN or TIN is available in Column (b).

- Column (d): Covered All 12 Months – Check this box if the individual had coverage for at least one day per month throughout the entire calendar year.

- Column (e): Months of Coverage – If the individual was not covered for all 12 months, check the box(es) for each specific month they were covered for at least one day.

Warning: This information is for informational purposes only and should not be used for official tax matters. Use the official Form 1095-B and instructions, generally found at: https://www.irs.gov/forms-instructions. Rely on this information at your own risk. Visit https://www.irs.gov/forms-instructions for official IRS information. Consult with a tax professional.

Instructions for Recipient

This Form 1095-B provides information about the individuals in your tax family (yourself, spouse, and dependents) who had certain health coverage (referred to as “minimum essential coverage”) for some or all months during the year. Minimum essential coverage includes government-sponsored programs, eligible employer-sponsored plans, individual market plans, and other coverage the Department of Health and Human Services designates as minimum essential coverage.

If individuals in your tax family are eligible for certain types of minimum essential coverage, you may not be eligible for the premium tax credit. For more information on the premium tax credit, see Pub. 974, Premium Tax Credit (PTC).

TIP

Providers of minimum essential coverage are required to furnish only one Form 1095-B for all individuals whose coverage is reported on that form. As the recipient of this Form 1095-B, you should provide a copy to other individuals covered under the policy if they request it for their records.

Additional information. For additional information about the tax provisions of the Affordable Care Act (ACA) and the premium tax credit, see www.irs.gov/ACA or call the IRS Healthcare Hotline for ACA questions (800-919-0452).

Part I. Responsible Individual, lines 1–9. Part I reports information about you and the coverage.

Lines 2 and 3. Line 2 reports your social security number (SSN) or other taxpayer identification number (TIN), if applicable. For your protection, this form may show only the last four digits. However, the coverage provider is required to report your complete SSN or other TIN, if applicable, to the IRS. Your date of birth will be entered on line 3 only if line 2 is blank.

Line 8. This is the code for the type of coverage in which you or other covered individuals were enrolled. Only one letter will be entered on this line.

A. Small Business Health Options Program (SHOP)

B. Employer-sponsored coverage

C. Government-sponsored program

D. Individual market insurance

E. Multiemployer plan

F. Other designated minimum essential coverage

G. Individual coverage health reimbursement arrangement (HRA)

TIP

If you or another family member received health insurance coverage through a Health Insurance Marketplace (also known as an Exchange), that coverage will generally be reported on a Form 1095-A rather than a Form 1095-B. If you or another family member received employer-sponsored coverage, that coverage may be reported on a Form 1095-C (Part III) rather than a Form 1095-B. For more information, see www.irs.gov/Affordable-Care-Act/Questions-and-Answers-About-HealthCare-Information-Forms-for-Individuals.

Line 9. Reserved.

Part II. Information About Certain Employer-Sponsored Coverage, lines 10–15. If you had employer-sponsored health coverage, this part may provide information about the employer sponsoring the coverage. This part may show only the last four digits of the employer’s EIN. This part may also be left blank, even if you had employer-sponsored health coverage. If this part is blank, you do not need to fill in the information or return it to your employer or other coverage provider.

Part III. Issuer or Other Coverage Provider, lines 16–22. This part reports information about the coverage provider (insurance company, employer providing self-insured coverage, government agency sponsoring coverage under a government program such as Medicaid or Medicare, or other coverage sponsor). Line 18 reports a telephone number for the coverage provider that you can call if you have questions about the information reported on the form.

Part IV. Covered Individuals, lines 23–28. This part reports the name, SSN or other TIN, and coverage information for each covered individual. A date of birth will be entered in column (c) only if the SSN or other TIN is not entered in column (b). Column (d) will be checked if the individual was covered for at least 1 day in every month of the year. For individuals who were covered for some but not all months, information will be entered in column (e) indicating the months for which these individuals were covered. If there are more than six covered individuals, see Part IV, Continuation Sheet(s), for information about the additional covered individuals.

Warning: This information is for informational purposes only and should not be used for official tax matters. Use the official Form 1095-B and instructions, generally found at: https://www.irs.gov/forms-instructions. Rely on this information at your own risk. Visit https://www.irs.gov/forms-instructions for official IRS information. Consult with a tax professional.

Warning: This information is for informational purposes only and should not be used for official tax matters. Use the official Form 1095-B and instructions, generally found at: https://www.irs.gov/forms-instructions. Rely on this information at your own risk. Visit https://www.irs.gov/forms-instructions for official IRS information. Consult with a tax professional.