The Foreign Account Tax Compliance Act (FATCA) places significant tax filing requirements on startups with foreign assets, employees, and contractors, and that’s the reason for Form W-8.

FATCA is an extremely complex piece of legislation that was designed to fight tax evasion by Americans with financial assets held outside the U.S. Enacted in 2010, FATCA requires all U.S. taxpayers, even those living abroad, to report foreign assets to the IRS if they exceed specific thresholds. In addition, foreign financial institutions (FFI) and non-financial foreign entities (NFFE) are required to report the assets of any American clients, or they’ll face a 30% withholding penalty on some payments from the U.S.

FATCA also establishes an individual or entity’s Chapter 4 status. Chapter 4 of the Internal Revenue Code is used to categorize U.S. residents that invest overseas, or foreign vendors that do business with U.S. companies. Categories include U.S. person, specified U.S. person, foreign individual, participating FFI, deemed-compliant FFI, restricted distributor, exempt beneficial owner, nonparticipating FFI, territory financial institution, excepted NFFE, or passive NFFE.

Plenty of paperwork

With so many different Chapter 4 categories to document, the IRS developed a series of W-8 forms that are used to determine the relationships between your startup and overseas employees, contractors, and suppliers. The U.S. has income tax treaties with many foreign countries that state how much their citizens can be taxed. Foreign entities or individuals must use a W-8 form to declare the type of income they earned, how they earned it, their countries of citizenship, and other factors that determine how they will be taxed.

This is when a startup needs a W-8

That means if you’re a startup that employs or pays non-resident aliens, you’ll need to have them complete a W-8 form. Income is defined by the IRS as active or passive. Active income, earned from operating a business in the U.S. or providing services in the U.S. is called “effectively connected income” or ECI. Passive income includes interest, dividends, rent, or royalties, and is called “fixed or determinable annual or periodic income” or FDAP. W-8 forms are only for foreign people and/or entities without citizenship or residency – US residents or resident aliens will not need W-8 forms.

Which W-8 forms do you need?

There are several W-8 forms that are used in different circumstances. Let’s look at the different types:

- W-8BEN is for individuals to to claim foreign status or treaty benefits, or for royalties or other passive income.

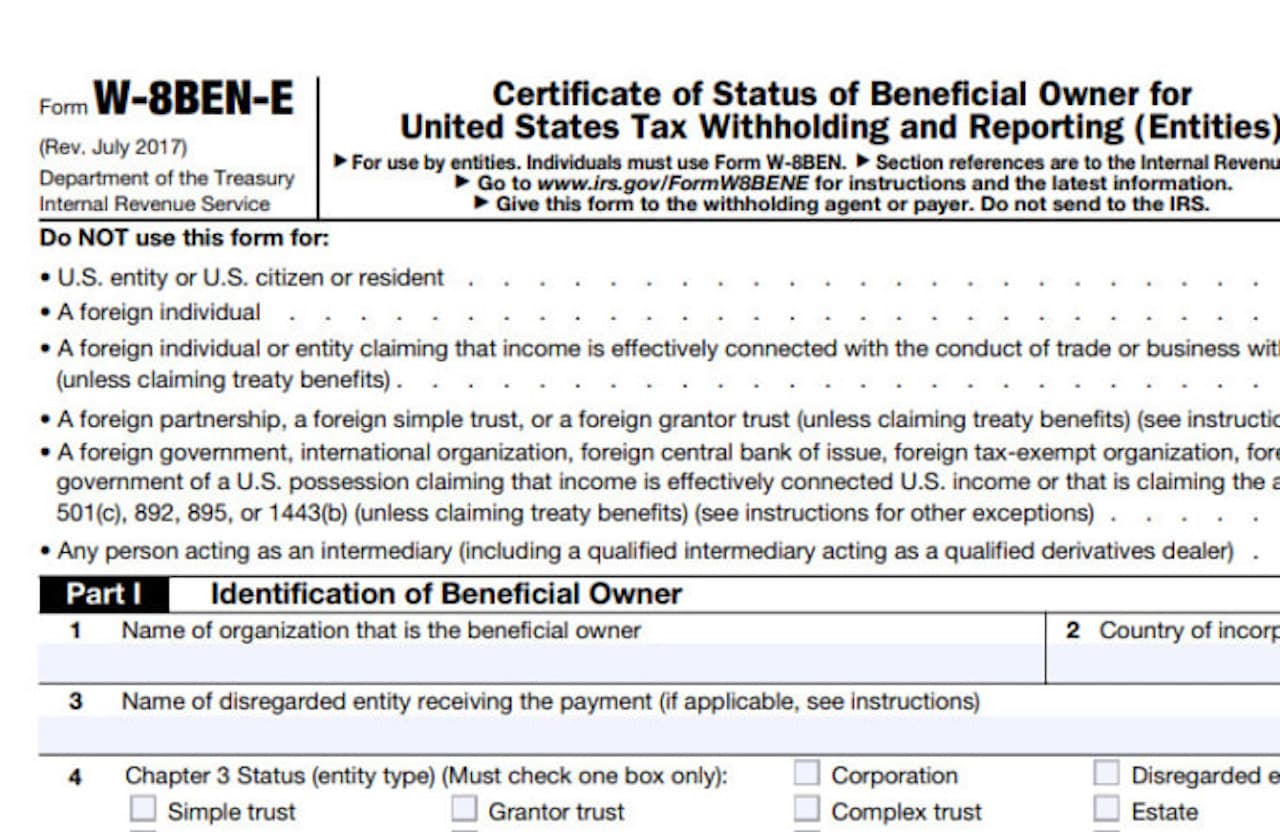

- W-8BEN-E is used by foreign entities, like businesses, to claim foreign status, treaty benefits, or document chapter 4 status.

- W-8ECI is to be completed by payers to confirm that the income listed on the form is connected with a U.S. business or trade.

- W-8EXP is used by foreign governments, foreign tax exempt organizations, foreign private foundations, governments of U.S. possessions, or foreign central banks to claim tax exempt status.

- W-8IMY is for intermediaries, withholding foreign partnerships, withholding foreign trusts, and flow-through entities.

W-8 forms are valid for the year in which they are signed, and for three years after that. All W-8 forms must be sent to the payer or withholding agent before any income is paid to the non-U.S. individuals or entities. If not, the payer may have to withhold the full 30% tax rate that applies to foreign entities.

Talk to a professional tax consultant

There are a lot of rules connected to W-8 forms, and it’s easy to get confused. The W-8BEN-E, for example, has 30 sections, and not all of them apply to every business or entity. Remember all those Chapter 4 statuses? It’s important to select the right status and complete the forms correctly to avoid any misunderstandings with the IRS. If you have questions about W-8 forms, or need assistance with them, please contact us. We’ll be happy to help.