As the leading CPA serving venture capital backed startups, Kruze has a wealth of startup statistics from accounting, finance, valuation, spend management, runway and more. We’ll share some of the top startup statistics we’ve produced or seen.

Startup valuations

One of the most important startup statistics, and one that founders we work with obsess the most over, is valuations. In early 2023, the startup landscape experienced a challenging phase, with valuations across various stages of the venture ecosystem decreasing, except for one particular stage.

The above chart is difficult to read, as the growth stage market grew valuations so massively that it hides the performance of the other stages, so we’ll break down the other stages’ performance below. Unless otherwise noted, the source for the valuations metrics in our startups statistics article is PitchBook, the well known venture capital/early-stage company data provider.

Overall startup valuations have compressed, except at the seed stage, into 2023. The venture capital market is currently facing a challenging environment due to several macroeconomic factors. Inflation, at a 40-year high, is increasing operational costs for businesses, leading to diminished profits and reduced investments. The Federal Reserve’s strategy to counter inflation involves raising interest rates, which produces a macro move away from risky assets like early-stage businesses and into bonds that now have yield. Adding to this, the war in Ukraine is contributing to uncertainty and volatility in the global economy, making investors more cautious and hesitant to invest in new ventures. Furthermore, a global economic slowdown is causing a decrease in demand for products and services, which complicates business growth and fundraising efforts. This has reduced the growth of many early-stage companies, leading to a much more difficult fundraising environment and depressing this startup statistic.

Let’s dig into how valuations are performing at specific stages.

Pre-seed and seed stage valuations

Pre-seed valuations have shown considerable fluctuation over the years, peaking in Q3 2019 and Q2 2022 at $8.0 million and $8.3 million, respectively. However, by Q1 2023, they have tapered off to $4.0 million, suggesting a cautious approach by investors towards the most early-stage startups.

Seed stage valuations have demonstrated a steady growth trend since Q1 2019, rising from $7.0 million to reach $12.9 million in Q1 2023. This might indicate that startups with promising ideas and early proof-of-concept are still attracting investor interest, despite overall market conditions.

Early-stage and late-Stage valuations

Early-stage valuations experienced a peak in Q1 2022 at $60.5 million, but have since declined to $38.2 million in Q1 2023. This downward trend is due to the tighter funding environment for startups moving beyond the seed stage, reflecting investors’ increased scrutiny and demand for evidence of business viability and growth potential, and the overall issues in both the later-stage market and the public technology stock market. Note that Pitchbook lumps Series A and Series B startups together in this analysis for some reason.

Late-stage valuations have been fairly volatile, reaching a peak of $80.0 million in Q3 and Q4 2021. However, by Q1 2023, they had decreased to $55.0 million, which is the lowest value since Q1 2020. At Kruze, we don’t see signs of the late-stage market returning to prior levels. 2021 was … bonkers. In 2021, venture capitalists invested a record $621 billion in startups, up 111% from 2020. A huge percent of these dollars were deployed into late-stage and growth stage companies.

Growth stage startups witnessed the most dramatic fluctuations. They peaked in Q1 2022 at a whopping $600.0 million, but saw a steep decline to $90.0 million by Q1 2023. The rapid contraction suggests a significant shift in investor sentiment, with an increased focus on profitability over growth, and a potentially challenging fundraising environment for growth-stage startups. So have VCs over corrected in growth stage valuations? Probably not, we believe that the average maturity of companies that raised was irrationally compressed in 2021, leading to a lot fewer companies that have the metrics they need to raise true growth rounds.

More Valuation Statistics

We’ve also compiled and analyzed recent Q2 2023 data from Carta on startup valuations. We’ll provide some charts and commentary - in general, the exact averages may be slightly different from the PitchBook data, but the trends are aligned.

Series B Startup Quarterly Valuation Data from Carta

Series B valuations have proven to be one of the most volatile numbers in 2023. These valuations skyrocketed to a jaw-dropping median of $160 million in Q1 2022, making it one of the standout trends in the venture capital arena. However, the tide turned sharply, echoing broader market downturns. By the first quarter of 2023, the median Series B valuation had taken a nosedive to $81 million, almost halving in a span of just 12 months. This precipitous drop has been a challenging adjustment for numerous clients in the startup ecosystem.

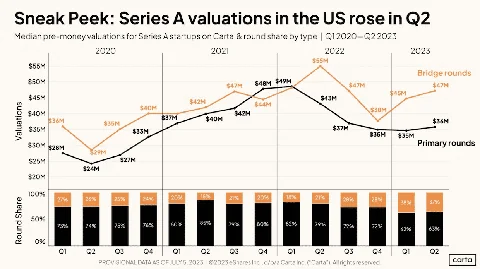

Series A Valuations by Quarter

Carta released some powerful stats around Series A valuations. It looks like, in Q3 2023, that Series A valuations have bottomed out in the mid $30 million range (that’s a pre-money valuation mark). We’ve just updated these statistics with new numbers from Carta, which somehow slice the valuation stats slightly differently. Not sure why Carta is showing slightly different statistics from one report to the next for startup valuations, but we’ll roll with it. We do have deeper analysis on that our valuation article linked to in the previous sentence.

Putting our own spin on the valuation statistics, you can see how far Series A metrics have fallen since the peak in late 2021. Valuations are just over 25% lower in the middle quarters of 2023 than they were at the peak of the bubble. However, they are 25% higher than they were, on average, in 2020, so it remains to be seen if there is more room to drop. Our take is that valuations will bottom out for most startups, although we believe that we are seeing a bubble in the AI space, and this is pushing up valuations in a way that may pull the average up quite a bit. However, for non-AI startups, it’s probable that this won’t help improve pre-money valuations that VCs will give startups.

Carta Data on Seed Valuations in Mid-2024

As of Q3 2023, seed-stage valuations have found a stable footing at approximately $13 million, basically flat from $13 million in the last quarter of 2022. In contrast to the dramatic shifts seen in Series A and Series B valuations, seed-stage metrics have been almost oddly stable. Median valuations have shown minor fluctuations, hovering between $8 million and $15 million from Q1 2019 through to Q2 2023. We’ve written a lot about this in our seed/pre-seed stage article.

Be aware of the startup valuations trends.

Key Insights into the Resilient Seed Valuation Landscape:

- Reduced Market Sensitivity: One of the defining characteristics of seed valuations is their relative immunity to broader market upheavals. This could likely be attributed to ample liquidity from seed and pre-seed funds, as well as limitations on how much equity founders are willing to part with in initial funding rounds.

- Decline in Funding Volume: It’s important to acknowledge that while seed valuations have maintained their equilibrium, the number of new seed funding rounds has significantly diminished since its 2021 apex. This indicates that although the startups that secure funding are highly valued, the bar for entry has become increasingly higher.

- Risk Appetite among Investors: The steadiness in seed-stage valuations may also signal a greater willingness among investors to undertake higher risks, especially given the prospective for amplified returns in a volatile market.

- Focus on Fundamentals: Much like their Series A and Series B counterparts, seed-stage startups also face a discerning investment landscape that underscores the importance of a well-crafted pitch, robust business model, and solid fundamentals.

Startup statistic: Months of runway

VC backed companies’ fuel is venture capital dollars - and they measure how long they have before they run out of capital with a term called “runway.” Runway is simply the number of months left before the company needs to raise additional funding, become profitable or cease being a standalone company (so out of biz or getting acquired.)

In 2023, runway is slowly decreasing, due to the difficult fundraising environment. However, both the average and median runway statistics are at historically ‘healthy’ levels. Digging deeper into the stats, you can see that all companies are not equal:

A large percentage of startups have over 24 months of runway, and another large slug have sub six months of cash. This is a pretty serious divergence of this statistic, you can see that prior to mid-2020, there wasn’t such a large number of companies with over 24 months of cash, and that recently, the percent of companies with less than 6 months of runway has been meaningfully increasing.

Founder and CEO pay statistics

One of the most common requests for startup statistics we get from founders is about their compensation. Since 2018 we’ve compiled our CEO Salary Report, analyzing comp at hundreds of funded companies.

Salary by Year

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|---|---|

| Average Startup CEO Salary | $130,000 | $142,000 | $139,000 | $146,000 | $150,000 | $142,000 | $141,000 |

| Median Startup CEO Salary | $125,000 | $131,000 | $130,000 | $135,000 | $140,000 | $145,000 | $147,000 |

In 2023, the average startup CEO salary decreased by 5.3% vs 2022 to $142,000 - reversing the upward trend that we’ve seen recently. Interestingly, the median pay went up, even though the average went down; the median startup CEO pay increased from $140,000 to $145,000. This is the first time that we’ve seen the average and median not move together, reflecting a change in the distribution.

Prior to 2023, overall compensation levels were up and to the right from 2018 to 2022, with a blip during COVID. In 2021 and into 2022, comp for founders went up in line with the hot fundraising market. However, the shift in the fundraising environment in late 2021/early 2022 seems to have created a divergence in the pay trends based on the company’s funding. Better-funded companies were able to increase CEO compensation, while less funded ones reduced it. This led to the drop in compensation that we are seeing in 2023

Top startup payroll providers

Payroll is the largest expense at pretty much every single early-stage business. We’ve compiled the top payroll providers’ market share.

Startups and rent - another major expense statistic

Prior to COVID, rent (and / or legal) was the 2nd largest expense most VC backed companies had.

Before the COVID-19 pandemic, we used to advise our clients to anticipate spending approximately 7% of their overall expenses on rent. However, at the start of 2023, this has decreased to just above 3%.

The 7% rate was quite steady across various locations, since there was a close correlation between office rental prices and average salaries in each region. For instance, businesses in high-rent areas like New York typically had to offer higher salaries, making the 7% prediction fairly accurate.

Nevertheless, the landscape has significantly shifted with many startups transitioning to a fully remote working model. Furthermore, numerous companies have chosen a hybrid approach where some team members work remotely while others come into the office on certain days. This means they need smaller offices, and thus helps decrease the average amount spend on rent.