From revenue recognition to SaaS metrics, our SaaS accounting guide covers everything a founder needs to know about accounting for a subscription business.

SaaS Accounting - Quick tips

If you are getting your SaaS accounting stack going fresh, here are our tips for the systems you should set up first and the metrics you’ll want to start tracking right away:

Best accounting software for SaaS startups - QBO

Right payroll for VC-backed startup - read more here

Billing for SaaS - Intuit is easy for first B2B revenue; Stripe for volume / b2c

How to calculate ARR - read more here

Best CPA - that’s us, our SaaS clients have raised billions in funding

Why does good accounting matter for SaaS companies?

SaaS has been one of the hottest business models for the past decade, if not more. But accounting for SaaS is anything but simple.

From revenue recognition to understanding R&D vs customer service costs, SaaS business founders rely on tons of metrics to run their business. And VCs look for specialized SaaS ratios and calculations, like LTV to CAC, magic numbers and more.

Here are some of the reasons an high-growth SaaS business needs great accounting:

- Small changes in churn, ARPU or other user metrics can drive massive swings in cash flow

- Executives make better decisions when they use credible data

- Understanding and projecting working capital, especially as it relates to deferred revenue, can help a company reduce its need on outside venture capital - if managed well

- Sales taxes and state and federal taxes require good accounting

- Revenue recognition is always a pain, but is also critically important - especially when selling the business to a large player or when raising millions of venture capital financing.

- VCs love the financial metrics produced by subscription businesses. ARR, ACV, revenue churn, etc. all matter - so getting these numbers right matters at a fundraise!

Another important aspect of good accounting is how efficiently and effectively your accounting firm can handle your bookkeeping and financials. Your accounting firm should include CPAs with expertise in accounting for SaaS startups, and your firm should rely on the most current new technologies to deliver accounting, finance, and tax services. Tools like AI help accountants automate manual processes like invoice processing and expense management, expedite analysis and forecasting, and support decision-making.

When does a SaaS company need to start worrying about doing bookkeeping?

If you haven’t been keeping track of your SaaS bookkeeping by the time you raise your first outside money, you need to get your books in order.

We generally recommend that businesses move away from spreadsheets and into an accounting software as soon as possible. Because well-run SaaS businesses are so metrics driven, it is especially important for SaaS accounting to be done well from the start!

The good news is that pre-revenue SaaS accounting isn’t that hard, and a good founder can handle the basic bookkeeping on their own.

Steps to get DIY SaaS accounting running

- Day one you start the company and get a dedicated bank account for the business

- Connect that bank account to QuickBooks.

- Start getting the bank feed going into QuickBooks and actually characterize the transactions inside of QuickBooks.

- It also makes sense to get a business credit card as soon as you are funded (get one with no personal guarantee). A dedicated card can feed data directly into QuickBooks, making your accounting easier and more accurate. Our recommendations on the best credit cards for SaaS startups.

SaaS Accounting 101: Cash vs Accrual Accounting

Which does your SaaS business need, cash or accrual based accounting? If you are funded, you need accrual! Some bootstrapped founders may be totally fine only doing cash based accounting - but they do need to realize that all of the SaaS metrics that are commonly used to measure a subscription business’ efficiency and trajectory are NOT going to work. You need accrual accounting to use the most common SaaS metrics!

And VCs are GOING to need accrual accounting - as close to GAAP (generally accepted accounting principals) as possible. VC’s expect accrual.

How can you tell if you have cash based accounting?

It gets pretty obvious for most subscription companies if they have cash, not accrual accounting. Cash accounting recognizes transactions as they happen, all at once. If cash comes in, it’s recorded as revenue.

Here is a quick example that shows the difference between a cash and accrual based revenue accounting:

Say your SaaS business sells a $120,000 contract that with a 12 month term in January, and the customer pays you right away.

In cash based accounting, you’d recognize $120,000 in revenue in January. Then in February, you’d have zero revenue from this contract - even though you are delivering service to the customer.

But accrual accounting recognizes $10,000 each month, with the remaining balance on the balance sheet as deferred revenue, making it more accurate and predictable for investors.

What is GAAP in SaaS - and why does it matter?

SaaS companies should create their financial statements in compliance with GAAP to ensure they maintain financial transparency, use trustworthy metrics to manage the business, and communicate clearly with venture capital investors. GAAP (Generally Accepted Accounting Principles) are created by FASB (Financial Accounting Standards Board), and GAAP uses accrual accounting.

The biggest GAAP issue for most SaaS companies is revenue recognition, which we discuss above. Other items that require focus for accurate accounting include getting the cost of goods sold right, knowing when to capitalize software expenses, equity based compensation (tbh, not always worth the cost and effort for early-stage companies to do the equity based comp), and using accrual accounting for major expense items.

How GAAP helps subscription company founders

GAAP helps founders better understand and manage their business in several ways:

- Produces Consistent and Accurate Financial Reporting: GAAP provides a standardized set of accounting principles and guidelines that subscription companies should use to ensure that their financial statements are consistent and accurate. This consistency and accuracy lets founders compare results across different time periods, and helps them make metrics-driven decisions about their business based on consistent/reliable financial data.

- Provides Visibility into Business Performance: GAAP-compliant financial statements provide a clear picture of a SaaS company’s financial performance, including revenue, expenses, and profitability. This visibility can help founders identify areas of the business that need improvement or investment and make strategic decisions based on financial data.

- Helps Secure Venture Funding: Subscription companies are favorite investment target for VCs - because of their metrics (and sticky revenue streams). GAAP-compliant financial statements can provide potential investors with a clear and reliable picture of the company’s financial health, increasing the likelihood of securing funding. And your BOD is going to want to regularly see financials presented in accordance with GAAP.

- Facilitates Compliance with Regulatory Requirements: SaaS companies are subject to various regulatory requirements, such as sales tax laws (and once they get ready to go public, SEC reporting requirements). Consistent financials also help secure startup-specific tax credits like the R&D tax credit, which requires a founder to know which efforts were spend on innovation.

- Enhances Transparency and Trust: GAAP compliance can enhance transparency and trust with stakeholders, including customers, investors, and employees. By providing accurate and reliable financial statements, SaaS companies can build trust with stakeholders and demonstrate their commitment to ethical and responsible business practices.

By adhering to GAAP US guidelines, SaaS companies can present accurate financial reports, build investor trust, and ultimately grow their businesses.

SaaS and venture funding - why good SaaS accounting matters

Our SaaS clients have raised billions in seed and venture capital funding - so we’ve helped hundreds of SaaS clients complete important financial diligence. We know the accounting metrics a Software as a Service company needs to have ready for diligence. It’s not just ARR, MRR and CAC - the best investors have questions around cohort churn rates, revenue run rates and more. In fact, our team has been interviewed by TechCrunch about the metrics needed to raise rounds and trends in the VC market.

MRR needs to match your recognized revenue

During diligence, your potential investors will compare your historical books to the ARR metrics you share with them. Many companies produce their MRR/ARR metrics out of a billing system, like Chargbee, Shopify, through QuickBooks invoicing, an internal product database, etc. However, these systems don’t always sync perfectly into the accounting books. In fact, a major reason SaaS VCs recommend us to their portfolio companies is that they realize that the current accounting provider is not able to produce accrual based revenue - critical for a recurring revenue business. Make sure your accounting provider can produce GAAP compliant revenue metrics to ensure a smoother fundraising process!

SaaS Revenue at a Fundraise

With hundreds of clients who have raised billions of dollars in VC funding, we know what revenue a SaaS company needs to raise a seed, A or B round. Keep in mind that financing for these types of startups is usually based on a number of factors, not just revenue size - in particular, revenue growth matters as well.

This analysis was done for the height of the recent boom in startup financing. We’ve noticed that in 2022, SaaS companies need higher revenue to raise funding - we’ll update the metrics soon!

We analyzed over 200 fundraises and noticed a distinct trend where the revenue needed to successfully raise a round decreased around the second quarter of 2021. This was certainly a “hot” time to fundraise, and the numbers show it. Here is the data:

ARR at Close of Financing

| 2019 - Q1 2021 | Q2 2021 - Q4 2021 | 2022 | |

|---|---|---|---|

| Seed | $339k | $59k | $156k |

| Series A | $1,795k | $1,234k | $3,342k |

| Series B | $11,435k | $3,387k | $8,136k |

How much Revenue does a SaaS company need to raise a Seed round?

We are seeing plenty of slam-dunk seed rounds happening with SaaS startups that have $100k+ in ARR and good growth. However, this is significantly harder that the hot fundraising market of 2021. Prior to the second quarter of 2021, the average SaaS startup needed about $340k of ARR, with a 12 month trailing growth rate of about 600% to raise a seed round of financing. During the hot financing market, starting around Q2 2021, the average company needed just under $60k of ARR and was only growing at about 140% year over year - a tremendous drop on both size and growth metrics.

How much Revenue does a SaaS company need to raise a Series A round?

In early 2023, SaaS startups with ARR of over $3M are the average at the Series A. However, we do see some companies with ARR as low as $1M (and some pre-revenue) companies raising an A successfully - just not as much as we saw in the boom times of 2021. Prior to the second quarter of 2021, the average SaaS startup needed about $1.8 million of ARR, with a 12 month trailing growth rate of about 330% to raise a Series A. When the venture market heated up, starting around Q2 2021, the average company needed about $1.2 million of ARR and was only growing at about 170% year over year. Once again, this was a tremendous drop on both size and growth metrics.

How much Revenue does a SaaS company need to raise a Series B round?

In early 2023, SaaS startups need significant revenue to raise a Series B - on average, over $8M in ARR with solid growth. In our analysis of over 200 SaaS companies that raised funding, before Q2 2021, the average SaaS company needed about $11million in ARR, with a 12 month trailing growth rate of about 180% to raise a Series B. In Q2 2021, the average company needed only $3.4 million in ARR and was only growing at 220% year over year. That’s a massive drop in ARR, likely driven by hedge funds moving into the market and bidding aggressively to lead Series B’s. It makes sense that the revenue growth would go up on a smaller ARR base, so at least there is some rationality at the Series B vs. the Series A and Seed numbers we referenced above. Once again, we’d expect that the ARR hurdle would increase in early 2022 as the funding market may be cooling.

B2B SaaS vs B2C SaaS - how SaaS accounting changes

SaaS companies can serve enterprises, consumers or anything in between. The size and type of contractual relationship with a client makes enterprise focused Software as a Service companies completely different from consumer apps sold on a recurring revenue stream through an app store. While the LTV to CAC relationship and other metrics matter for both, enterprise-focused companies have to deal with other metrics like book to bill. And consumer focused businesses should be monitoring churn cohorts and other user data very closely.

One of the biggest differences in how B2B vs B2C businesses run and manage their SaaS accounting is billing and invoicing. B2B startups with only a handful of large, enterprise clients often get away with using simple invoicing solutions like the billing offerings offered by Intuit (embedded in QuickBooks). Consumer facing companies have more robust billing requirements, and often have a SaaS accounting system setup that includes Shopify, app store billing and other complicated systems.

The good news is that Kruze’s team is familiar with all flavors of Software as Service business models, and we can support your financials and metrics whether you sell to Fortune 500’s or to consumers.

What financial statements do SaaS accountants need to produce?

Software as Service companies need to regularly produce three major financial statements. These are the Income Statement, Cash Flow Statement and Balance Sheet. Additionally, SaaS companies have other metrics that may or may not be on the actual financial statements - like bookings, ARR and more. It makes sense to work with an expert bookkeeper or controller who understands how these numbers relate to your business’ GAAP financials.

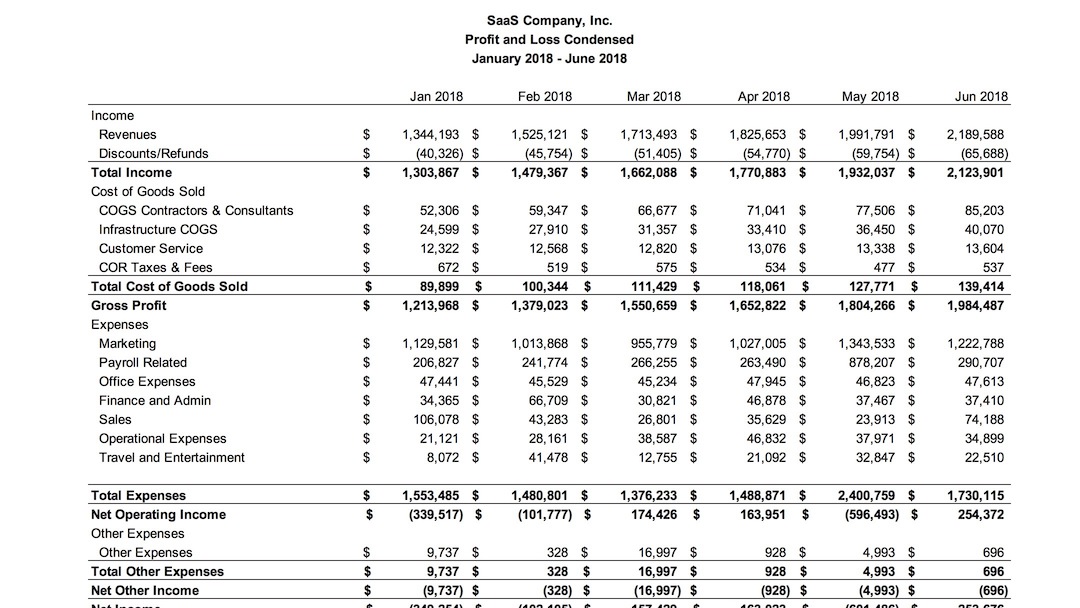

The Income Statement

The income statement is often the first financial statement that a VC will evaluate when looking at a subscription business, so get the accounting right! This statement shows:

- Revenue

- Cost of Goods Sold (COGS or COS)

- Gross Profit (Revenue - COGS)

- Operating Expenses

- Net Profit

We go into the accounting for revenue and cost of goods sold in greater detail below, and we have an entire article on the income statement here.

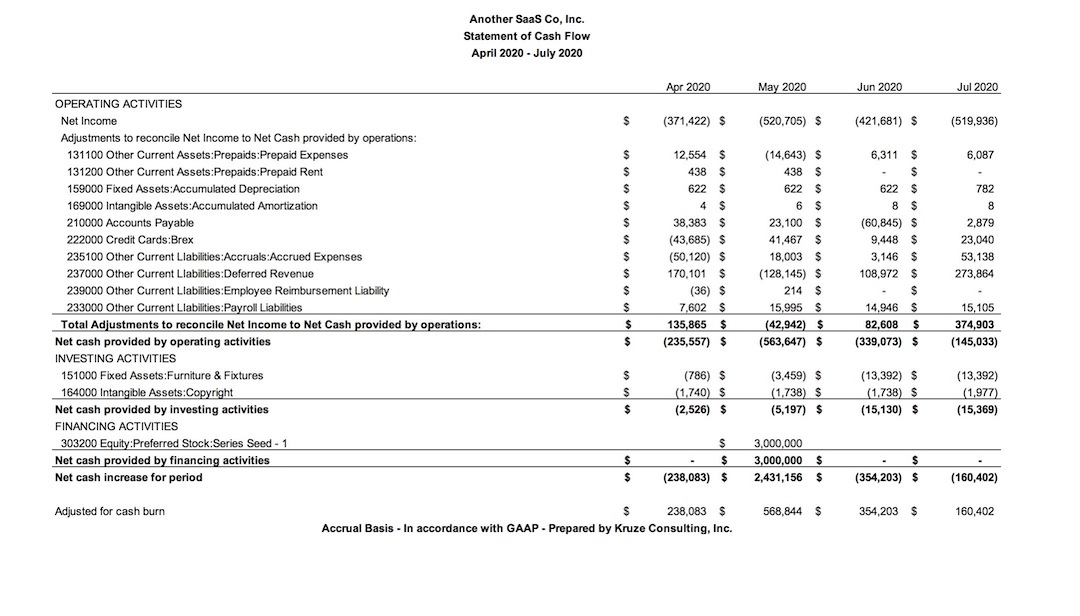

Cash Flow Statement

This accounting statement shows the company’s:

- Changes in Inventory

- Other working capital changes (like changes in payables)

- Operating income

- Investments in equipment

- Capital raises and loan paydowns

- Net cash flow / change in cash position

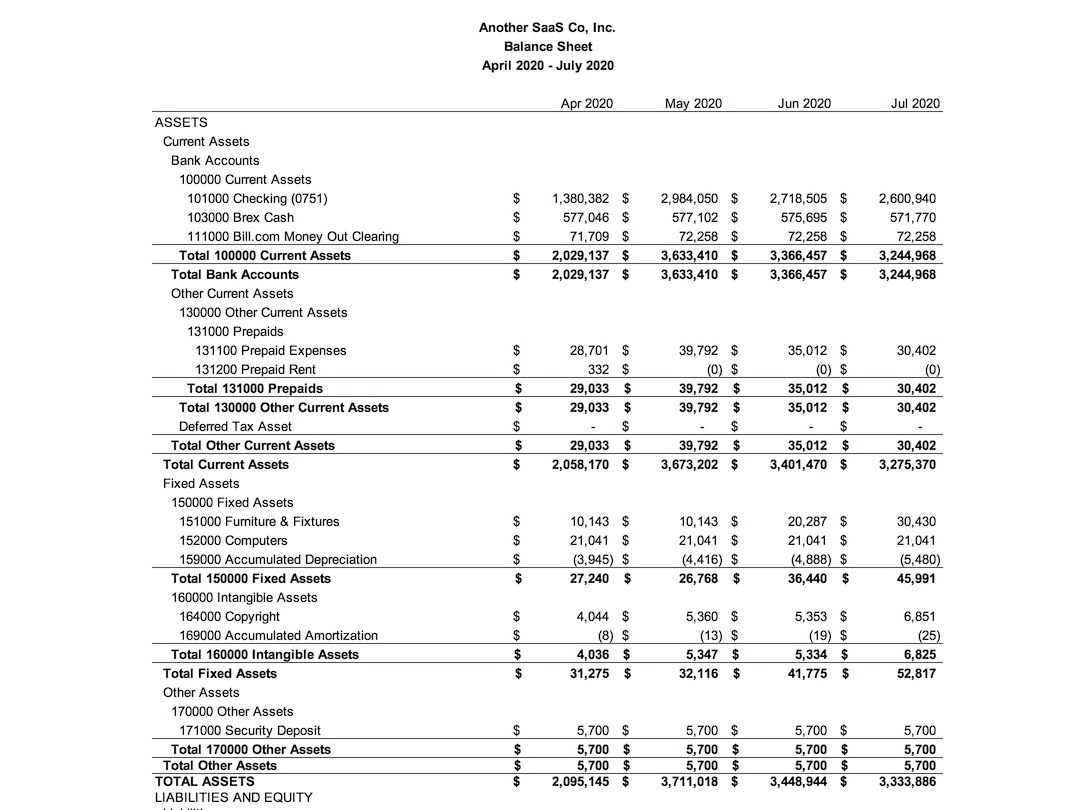

The Balance Sheet

The balance sheet shows:

- Assets

- Cash

- Inventory

- Accounts Receivable

- Other assets like equipment, buildings, etc.

- Liabilities

- Accounts Payable

- Deferred Revenue

- Credit Card liabilities

- Loans (like Convertible Notes)

- Equity

- Invested equity (includes SAFEs)

- Retained earnings

Setting up a chart of accounts for a SaaS business

Every business needs a chart of accounts - we’ve got a sample chart of accounts for a SaaS company here for you to use if you’d like. Keep in mind that every business is unique - so you may want to modify it to fit your specific business.

If you don’t know what a chart of accounts is you should probably hire a good bookkeeper, but what it does is translates your general ledger entries into your income statement, balance sheet, etc. It’s like the map of where the specific expenses and other accounting items flow to in your financial statements.

5 things that make SaaS accounting difficult

- Revenue recognition

- Sales tax

- Understanding gross profit - parsing server and R&D costs between serving customers and R&D, correctly positioning customer service, etc.

- Customer refunds or upsells

- Deferred revenue

- LTV to CAC and other SaaS-specific metrics

Understanding Revenue: Bookings vs Billings vs MRR - SaaS Accounting Tips

Revenue is the lifeblood of SaaS businesses, but the accounting is anything but simple. Later on in this article on SaaS accounting we’ll discuss what goes into calculating ARR, but here we’ll discuss how revenue is recognized, and the different flavors of revenue that founders and VCs like to track.

Revenue recognition in SaaS businesses

While many of the best subscription businesses collect payment upfront, they recognize revenue over the life of the contract. According to GAAP, a SaaS business can recognize revenue when 1) evidence of an arrangement exists; 2) services have been rendered/the product is live; 3) the price is set; 4) collectibility is probable.

Once these criteria are met, the SaaS business can recognize revenue over the term of the contract, usually on a subscription basis.

Revenue recognition in a subscription service over the lifetime of the contract is done using the subscription revenue model. The following steps are involved in recognizing revenue:

- Determining the contract value: The total amount of revenue to be recognized over the contract period is calculated.

- Allocating the contract value: The total contract value is then allocated to each period over the contract term. For most SaaS companies, this is relatively simple accounting, with the total contract value being divided by the number of months that the contract is live.

- Recognizing revenue: Revenue is recognized each period based, based on the allocated contract value in that period.

This method of revenue recognition is used as it accurately reflects the value of the services being provided to the customer over the contract term and provides a consistent and predictable revenue recognition pattern.

Here are a few examples of subscription contracts with the total contract value and how the revenue is recognized over time:

24-Month Subscription Contract:

Total Contract Value: $24,000

Revenue Recognition: $1,000 per month for 24 months

12-Month Subscription Contract:

Total Contract Value: $12,000

Revenue Recognition: $1,000 per month for 12 months

18-Month Subscription Contract:

Total Contract Value: $18,000

Revenue Recognition: $1,000 per month for 18 months

In each of these examples, SaaS accounting requires the revenue to be recognized on a recurring basis ratably over the lifetime of the contract. This helps the SaaS business to accurately reflect the value of the services being provided to the customer over the contract term and provides a consistent and predictable revenue recognition. The sweet, sweet predicitbility loved by VCs!

Revenue metrics in SaaS Accounting

Founders of SaaS companies have several top-line metrics that they may be tracking - bookings, billings and MRR (which gets annualized into the all too famous ARR number). These revenue items can get a little confusing for founders who aren’t experienced finance professionals. This is a great place that an experienced accountant can help a founder stay focused.

Bookings

Bookings is the dollar amount of a signed contract with a customer - it shows written commitment from a customer to purchase your service.

Bookings is not actually defined by GAAP, so SaaS accountants don’t usually produce this metric out of the accounting system - instead, it is produced out of a sales CRM like Salesforce or Hubspot.

Founders should clearly define what bookings means at their SaaS company, since this is NOT a GAAP defined metric. What exactly constitutes a signed contract? Does this metric include multi-year deals, or just the annualized contract value?

Bookings really only matters for companies that are signing contracts with clients and then where there is a gap between when the contract is signed and the service period delivery begins. This can happen with enterprise focused companies, in particular.

Billings

A billing is produced when a company actually sends a bill (really, and invoice) to a client. While invoicing usually lives in a SaaS company’s accounting system, it’s not the same as the revenue item that is officially recognized under the GAAP revenue recognition definition. For a business that bills and collects immediately, this is a much less important accounting metric. Examples would include a consumer-SaaS company that bills and collects through an app store - billing and collection happen at the same time, so there is no need to monitory this metric separately.

For enterprise companies that track bookings, billings become very important. Bookings indicated the dollar amount of a signed contract with a customer - it shows written commitment from a customer to purchase your service. The book to bill ratio shows how healthy and committed the signed contracts are (that are tracked by the bookings metric). A low book to bill number is an indication that a company is having problems getting signed contracts to convert into live customers.

MRR - Monthly Recurring Revenue

This is where a founder, their sales team, their accounting system and their SaaS accountant need to be in tight sync! Companies recognize revenue when the service is actually delivered to the client. SaaS accounting rules state that a contract is recognized ratably over the life of the contract live/as the service is used by the customer.

MRR is a difficult metric to fully automate. Companies that try to fully automate their MMR recognition often find that their payments processor has a different metric than their accounting system - something that experienced VCs will notice during due diligence. Read on to learn more about how we think about recognizing revenue.

Revenue Recognition and Deferred Revenue - the Hardest Part of SaaS Accounting

Our Software as a Service companies tend to carefully track their MRR and ARR. However, along with deferred revenue, MRR and ARR calculation and revenue recognition is the most difficult part of providing SaaS accounting services.

ARR, MRR and recognized revenue are difficult for many SaaS companies. While accounting systems can produce automated revenue numbers, someone needs to review them. And if there isn’t a real accounting doing that, the work falls to the SaaS company’s CEO.

In SaaS, the customer never “obtains control” of the software/service, so the general rules of revenue recognition don’t cleanly apply. Instead, accounting rules generally require SaaS businesses to recognize revenue over the contract term. This recognition is the case regardless of when the client pays the SaaS company, so even if the client pays upfront or quarterly, the revenue is recognized the same. We can’t tell you how often we see this mistake when a SaaS company uses an “automated” accounting provider.

Deferred revenue is even more complicated since it’s not as easy of a financial figure to understand. At its most basic level, if your clients are paying ahead of time for services, your company will put a deferred revenue liability onto the balance sheet. And as you deliver this service and recognized revenue, the deferred revenue liability decreases.

The price of incorrectly accounting for revenue and deferred revenue can be high. During due diligence, experienced SaaS VCs will request your financial statements, and they expect the numbers to match (although, reporting a bookings ARR number is 100% legitimate and won’t be reflected in your GAAP financial statements). Public technology companies spend even more time doing due diligence of SaaS revenue recognition, so if you are going to be acquired these numbers matter.

Invest in a good partner to help your business get these right!

ASC 606 - Revenue

When a SaaS business enters into a contract for the provision of services or goods, the revenue recognition should follow some very specific accounting guidelines laid out under accounting standards known as ASC-606 and IFRS 15.

The following five-step process is crucial for SaaS revenue recognition:

- Contract Identification: Understand the contract terms.

- Performance Obligation Identification: Determine the obligations within the contract.

- Transaction Price Determination: Ascertain the price of the transaction.

- Transaction Price Allocation: Allocate the price across the contract’s obligations.

- Revenue Recognition: Recognize revenue as the obligations are fulfilled.

These standards ensure that revenue from customer payments is recognized in a manner that reflects the delivery of services as stipulated in the contract. VCs will expect that you follow those rules and present revenue using the accrual method of accounting.

When Can You Recognize Revenue?

To recognize revenue, your SaaS business must meet the following criteria:

- There’s evidence of a customer arrangement

- Your product or service is live and accessible to the customer

- The price is clearly defined

- You’re confident that you’ll be able to collect payment

How to Recognize Revenue

Once you’ve met the above criteria, you can recognize revenue over the term of the contract, usually on a subscription basis. Here’s how:

- Determine the total contract value

- Divide the total contract value by the number of months in the contract term to allocate the revenue to each period

- Recognize the allocated revenue each period

Accounting for gross margins in a subscription business

Gross margins and gross profit are important accounting metrics closely watched by venture capitalists - and the best founders. Low gross profit companies are described as having poor unit economics. And experienced investors like David Sacks often talk about the importance of software margins - leading us to remind founders that accounting matters!

The accounting formula that calculates gross profit is:

Recognized revenue - cost of goods sold = gross profit

And the gross margin is usually expressed as a percentage that is calculated as:

Gross profit (in dollars) / recognized revenue = gross profit margin

The COGS in a SaaS business typically includes costs related to hosting, server and network infrastructure, as well as personnel costs for customer service and billing expenses. To accurately calculate the gross margin, it is important to track and account for these costs appropriately.

The gross margin/gross profit in a subscription business matters because this is the amount of customer dollars that will be available to service and cover the other operations of the business, like sales and marketing or R&D. Proper accounting matters.

It is also important to note that the gross margin calculation provides a snapshot of the efficiency of the SaaS business in generating revenue from its operations, and does not take into account other expenses such as marketing, research and development, and general and administrative expenses. These expenses should also be considered when evaluating the overall profitability of the SaaS business. And many of the most popular SaaS metrics should be calculated using gross profit, not revenue.

How Kruze is Like a SaaS provider for Accounting

Through our work with hundreds of funded startups, we realized that VC backed businesses like to purchase all their services like a SaaS business. That’s why we price our bookkeeping services on a set, recurring monthly level - our clients can know what their basic accounting will cost each and every month. This helps them manage their cashflow, plus it gives our founders less mental overhead when they think about their upcoming expenses.

What to look for in a good SaaS accountant

Getting the books right for a SaaS business is surprisingly challenging. The biggest issue we see with clients that come to Kruze from another bookkeeper is serious mistakes with revenue recognition and deferred revenue - especially from “bot” bookkeepers and from non-SaaS accountants. Because of the way revenue transactions recur in a subscription business, small errors can become big problems if not caught early - including having to restate the balance sheet and income statement.

At Kruze, we combine automated software with experienced controllers and CFOs. We can work with both enterprise and SMB/consumer focused companies with recurring revenue streams. Our custom-built automated software works directly with QuickBooks Online, saving you money through the labor-savings, while putting your financials into an industry standard, 3rd party software so you can take it to any provider or use it with any potential acquirer or auditor.The best SaaS accountants understand the complications of revenue recognition, GAAP expense recognition, enterprise vs consumer software as a service billing systems and more. Plus, accountants specialized in the recurring business model have the ability to help founders think through the cash implications of different billing and pricing plans. Our accounting team has over 11 years, on average, experience, and collectively our team has experience with everything from hardware as a service to recurring app-revenue models to enterprise SaaS contract revenue recognition.

We believe that it’s our team’s job to help save our CEOs time and take care of the basic bookkeeping tasks that other services dump onto their clients. Our SaaS clients have raised billions in venture capital, and former clients have been acquired by massive public companies like Cisco, Apple and others - so we know how to prepare you for due diligence. If you’re ready to work with the top SaaS accountants in Silicon Valley (and beyond), reach out to us.

Typical SaaS accounting metrics

Investors love SaaS companies because they the predictability of the recurring revenue. But they also love all of the metrics that are generated by subscription businesses as they grow. Of course, the best founders also embrace these metrics to help them build a best-in-class company. On this page we’ll focus on the accounting driven metrics, but visit our SaaS metrics article to see an expanded list of important KPIs (or read about these metrics from one of the leading SaaS VCs), not all of which are driven by accounting numbers. The KPIs below are some that our accounting team has been asked to produce during VC due diligence.

LTV to CAC

LTV to CAC is the OG SaaS multiple. It combines a prediction of a customer’s ‘life time value’ (some VCs call it ‘long term value’; you say potato I say potatoe) with the cost to acquire the client. The theory behind the metric is that it shows how much possible cash flow each customer produces vs. the up front expense of acquiring them.

It is calculated by dividing the lifetime value (LTV) of a customer by the customer acquisition cost (CAC). The formula is:

LTV to CAC Multiple = LTV / CAC

A higher LTV to CAC multiple is generally considered to be better, as it indicates that the company is generating more revenue from each customer over their lifetime, relative to the cost of acquiring that customer. Typically a metric over 3x is good; under 3x and there is a danger that the company will never generate enough cashflow to over come operating expenses, and thus will never become cashflow positive.

ACV - Annual Contract Value

Annual Contract Value (ACV) is a financial metric used by SaaS companies to measure the annual value of a customer contract. It is calculated by taking the total contract value and dividing it by the number of years in the contract. It’s not a GAAP or accounting defined metric, but it’s a way of looking at contracts that has been informally agreed upon by well-known SaaS investors and startup founders. It’s important to let investors know how you’re calculating it, so there are no surprises. It doesn’t include non-recurring revenue streams such as installation or one-off consulting revenue. It’s important for SaaS companies because it helps them understand the average value of a customer contract and predict future revenue. It’s also used to measure the performance of sales teams and the overall health of the business. Larger ACVs usually unlock more expensive and elaborate sales and marketing activities. We write more about ACV here.

Net Dollar Retention

Net Dollar Retention (NDR), also referred to as Net Revenue Retention, is a crucial SaaS metric that gauges revenue evolution within an existing customer base over a specific period, taking into account expansions, churn, and contractions. It serves as an indicator of customer satisfaction, their perceived product value, and the efficacy of retaining and upgrading customers. For founders and venture capitalists, NDR provides insights into a startup’s health, growth potential, product-market fit, and profitability prospects.

Rule of 40

The Rule of 40 is a “back of the envelope” metric used by venture capitalists to evaluate the performance and potential of SaaS startups. It is calculated by adding the company’s annual growth rate to its net profit margin (typically this is a negative margin as the vast, vast majority of early-stage SaaS startups are losing money both on a GAAP accounting basis and on a cash basis!). The goal is to have a number above 40 as it indicates that the company’s growth is overcoming its loss.

Most VCs think of this metric as a quick and simple way to measure the health of a startup and is used by VCs to assess a SaaS company’s potential for scaling and profitability.

It’s important to note that most VCs only use recurring revenue growth in the calculation, ignoring non-recurring revenue or one-time earnings. The Rule of 40 should not be taken as a definitive metric and should be used in conjunction with other financial and operational metrics to evaluate the performance and potential of a SaaS startup.

SaaS Burn Multiple

Not to be confused with a cash burn rate, a SaaS burn multiple is a measure of a company’s capital efficiency vs its growth. It’s a good metric for evaluating the financial health and growth potential because the metric takes into account both gross margins/profit and sales and marketing expenses.

To calculate it, divide the net cash burn (excluding any financing activities) by the net new ARR for the same period.

Gross Profit

As accountants, it pain us to say this, but gross profit is an under appreciated SaaS metric. A SaaS company’s Gross Margin is a financial metric that measures the profitability of a company’s products or services. It is calculated by subtracting the cost of goods sold (COGS) from the revenue (generating the gross profit) and then dividing that number by the revenue. The resulting percentage represents the percentage of revenue that a company retains after deducting the direct costs of producing its products or services.

For SaaS startups, gross margin is a crucial accounting metric to track because it indicates the efficiency and scalability of their business model. A high gross margin means that the startup is able to generate revenue from its products or services at a low cost, which makes it more profitable and sustainable in the long run. Additionally, a high gross margin also indicates that the company has room to invest in growth, such as sales and marketing efforts, R&D, and hiring new employees.

How do SaaS startups recognize revenue from annual contracts that are paid upfront?

The answer to this question involves accrual accounting, which is the best way for startups to handle their accounting. Venture capital firms, venture lenders, investors, and others want to see your financials on an accrual basis. You need to recognize that revenue on a monthly basis as you provide the service over the year. Essentially, you’ll recognize 1/12 of that upfront payment each month. If you recognize the full amount when you received it, that’s called cash accounting. And you’ll have a really good month, followed by 11 months of no revenue. That doesn’t accurately represent your financial position. So you need to book this revenue on an accrual basis.

What is SaaS accounting?

SaaS accounting refers to the financial management, tax and bookkeeping practices specific to businesses that operate on a software as a service model. Subscription businesses that follow accrual/GAAP based accounting need to correctly account for recurring revenue recognition, subscription billing, deferred revenue, and expense accrual. Additionally, subscription companies have unique revenue forecasting, cash management and specialized KPIs.

How to calculate ARR

ARR is generally the most important metric tracked by subscription companies. It shows the scale of a SaaS business, and can be used to track growth over time. Plus, comparing it to burn, spend and other metrics produces powerful efficiency KPIs.

Confusingly, it’s not a metric defined by accountants and it doesn’t show up on the income statement!

Recognized revenue is the metric that should be used to calculate Annual Recurring Revenue for most SaaS companies. It is the revenue that has been earned and is recognized on the company’s financial statements, meaning the company has delivered the product or service and is entitled to receive payment. This is a major reason why it makes sense to work with an experienced SaaS accountant!

However, for some enterprise B2B SaaS companies, tracking booking ARR may be more appropriate. Booking ARR is the value of new annual contracts that are booked in a given period, regardless of when the revenue is recognized. This metric is useful for enterprise B2B SaaS companies because the sales cycle is often longer and the revenue may not be recognized until later. It can provide a more real-time view of the company’s revenue growth and sales performance.

SaaS Sales Tax - An Increasingly Difficult Accounting Issue

Several years ago, SaaS companies have become subject to charging (or at least collecting!) sales tax in many states in a Supreeme Court ruling entitled Wayfair vs North Dakota. This is one of the most difficult recent changes that SaaS companies have to think about vis a vis their accounting. Of course, we recommend you work with a CPA like Kruze, since we have in-house tax experts who can interface with your monthly financial reporting/accounting team to help deal with compliance issues, like SaaS sales tax, proactively.

Working capital for subscription companies

Working capital is one of the more challenging aspects of bookkeeping (and building projections) for subscription companies.

At a high level, working capital is the difference between a company recognizes and expense or revenue and when it pays/collects the cash.

Subscription companies often get paid ahead of time for a service that will be delivered over the course of a year. This is great for cash flow! However, it complicates the accounting. We see many inexperienced bookkeepers recognize the full cash payment upfront as revenue instead of recognizing it over time. This can cause significant misstatement of ARR, and can not only make a founder incorrectly run their business, but can damage a VC fundraise.

SaaS Financial Modeling 101

One of the reasons investors love subscription businesses is that they are easier to forecast - which is also why it’s really important to create a great financial model for your SaaS business. Thankfully, this has all been done before, and we have some free model templates that will help you get started. Here is how to begin.

Startup Model Template

To begin with, every startup should have a financial model that includes revenue and expense projections, along with a net cash position. Although some comprehensive templates comprise the three main financial statements (income statement, cash flow statement, and balance sheet), these might be too complex for early-stage startups without professional assistance.

To maintain investor confidence and avoid errors, we recommend a simpler model, one that prioritizes the income statement and a projected cash position. These models are easier to manage and sufficient for most early-stage SaaS startups. We have free templates available here.

Forecasting Best Practices

It is a great idea to start with a three-year model that is dynamic, allowing changes to assumptions for each year. Sales (and revenue recognition) will be primary things to focus on once you are generating revenue. Also, consider the delays in your sales cycle and customer collections as these have a direct impact on your cash flows.

Stress testing the model against variables like conversion rates and growth rates will help you prepare for eventualities. Remember, honesty and realism are key in building your model.

Creating a Financial Model

The process of creating a financial model for your startup begins with understanding the model’s purpose. Identify the level of complexity necessary for your goals. Whether you’re sizing the market, raising capital, or creating a detailed cash flow model, the level of detail will vary.

Next, determine the key performance indicators (KPIs) for your company. Organizing your KPIs numerically helps track your performance against projections. Using industry standard KPIs as a starting point is a good practice.

We recommend using an existing financial model template as a base instead of starting from scratch. Once you have a template, incorporate your actual financial results into it to ground your projections in reality.

Revenue forecasting is the next step. Understand the drivers of your revenue, be it the number of customers, salespeople, or marketing spend. Our article on B2B SaaS financial models goes into this in depth.

For SaaS startups, headcount is usually the largest expense, so project your personnel needs accurately. Additionally, estimate other expenses, using benchmarks from successful companies if needed.

Reviewing Projections

Finally, it is essential to review and perform a sanity check on your financial projections. This ensures the projections align with your business narrative and makes sense in terms of the SaaS industry’s financial norms. And we recommend a recurring budget vs actuals exercise, where you compare recent results with projections to understand how you are performing vs expectations.

A well-structured financial model is crucial for SaaS startups. It not only aids in understanding your business’s financial health but also helps in fundraising, strategic planning, and tracking your progress against milestones.

Significant Dates for SaaS Startups

-

Review cash management strategy and investments

-

Analyze financial model and update projections for recent performance

-

Review cap table to prepare for 2nd half of year new hire option grants

-

Solicit investor feedback on monthly investor updates

-

Hold leadership team meetings

-

Hold all-hands meetings

Ready to work with a SaaS accounting expert?