Kruze’s CFOs, tax CPAs, controllers and bookkeepers have deep expertise in the most important startup industries, from biotech to ecommerce to SaaS and beyond.

Our team provides online bookkeeping services to hundreds of funded startups and high-growth companies, and our experience in specific industries sets up apart from both traditional accountants and automated solutions.

Learn more about our online offerings for specific, high-growth industries below - or get in touch with us to learn more.

Ecommerce - Accounting, Tax and CFO services

Online bookkeeping and CFO services for high growth ecommerce companies

Online bookkeeping and CFO services for high growth ecommerce companies

High growth ecommerce companies require more than just simple financial statement preparation and tax returns.

Cash flow forecasting based on inventor trends, state and local taxes, SKU level analysis, the nuances of Amazon vs Shopify vs Paypal, gross vs net revenue - all of these complications require an experienced accounting team. Just like your ecommerce customers expect a great online experience, our outsourced bookkeeping and CFO team will produce your financial statements online.

SaaS - Accounting and more for high growth SaaS companies

Enterprise SaaS, small business SaaS, consumer SaaS, app store SaaS - they’re all different, and we’ve worked with hundreds of SaaS companies, delivering high quality books, tax advice and CFO level advice.

SaaS companies should look for online bookkeeping solutions that are paired with experienced SaaS accountants. That’s because not all accountants know how to correctly recognize SaaS revenue and expenses. Many online bookkeepers fail to correctly identify contract lengths, discounts and more. And when the MRR and ARR numbers don’t match the books, VCs get concerned.

Online accounting and more for high growth SaaS companies

Online accounting and more for high growth SaaS companies

Biotech - bookkeeping, accounting and cash management support

Bookkeeping, accounting and cash management support for biotech companies

Bookkeeping, accounting and cash management support for biotech companies

Biotech companies bookkeeping and accounting needs are extremely specialized.

Managing cash burn and taking advantage of government tax incentives can’t be automated; your biotechnology startup needs experienced healthcare and drug development accounting advice.

As your biotech company is getting ready to head through FDA and government trials and certification, you’ll want to work with an experienced CFO who can help you anticipate the costs and possible bottlenecks.

And your online bookkeeping needs to be both fast and accurate, so you can carefully manage your burn rate as you develop your drug.

Learn about our experience running accounting for biotech startups.

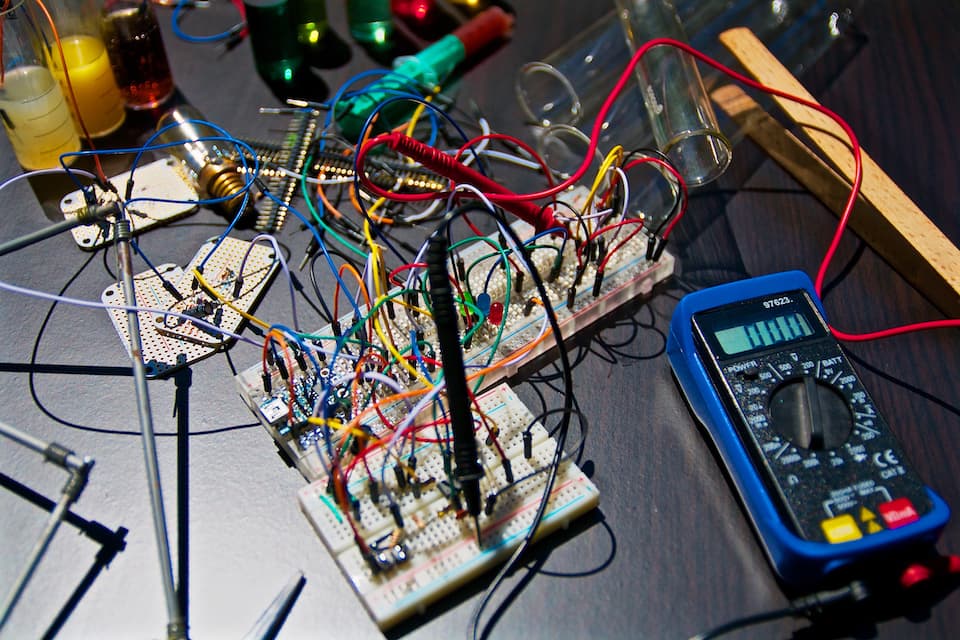

Hardware startups - bookkeeping, inventory accounting and more

Inventory accounting, build of material calculation and working capital constraints make even early-stage hardware companies complex from an accounting and bookkeeping perspective.

Kruze’s team works with agtech, healthcare, direct-to-consumer and other hardware startups, helping the founders understand their cash flows and prepare for venture capital rounds. We have a number of “hardware as a service” clients that combine SaaS revenue streams with hardware.

Building a physical product is hard enough - work with an accounting firm that can help you focus on your technology and not your books.

Learn about our experience running accounting for hardware startups.

Hardware startups - bookkeeping, inventory accounting and more

Hardware startups - bookkeeping, inventory accounting and more

Healthcare hardware and software - accounting support

Healthcare hardware and software - accounting support

Healthcare hardware and software - accounting support

Building a startup is hard enough - but layering on the complex regulatory environment and difficult purchasing cycles of the healthcare industry adds a whole new level of complexity.

Founders of healthcare startups deserve an accountant who has seen the healthcare startup journey more than once and who can offer valuable guidance and advice.

From claiming R&D tax credits to accurately projecting cash burn, the Kruze team is ready to support your healthtech company.

Our online bookkeeping will help you understand where you’ve been, and our outsourced CFOs can help you visualize where you are going.

Learn about our experience running accounting for healthcare startups.

Startup CPG company accounting

Fast growing CPG companies should have specialized accounting help to deal with complex issues related to inventory, BOMs, gross vs net revenues and more.

Kruze’s team has worked with food startups, supplement providers, subscription fashion and more. And we know that high growth comes with its own problems, especially understanding how inventory and manufacturing impact cash flow and getting a handle on customer acquisition costs.

Getting a new product in the hands of consumers is hard. Don’t let your accounting distract you!

Accounting support for food startups, supplement providers, subscription fashion and more

Accounting support for food startups, supplement providers, subscription fashion and more

Startups with Crypto

Online accounting and more for crypto

Online accounting and more for crypto

Increasing numbers of startup companies are using cryptocurrencies for operational, transactional, and investment purposes, and the wide range of these transactions creates a need for crypto accounting.

These startups are taking advantage of the convenience, security, and portability of crypto assets for vendor and contractor payments, smart contracts, decentralized applications, and more.

Work with a team that knows crypto accounting.

B2B accounting with Kruze

B2B startups face unique accounting challenges, including complex tax compliance across multiple jurisdictions, complex revenue models, cash flow management based on longer sales cycles, and more.

Kruze Consulting offers customized accounting services for B2B startups, including financial planning and analysis, cash flow forecasting, tax planning and compliance, and investor reporting.

B2B accounting and more with Kruze

B2B accounting and more with Kruze

B2C - Accounting and bookkeeping for business-to-consumer startups

B2C accounting and more with Kruze

B2C accounting and more with Kruze

B2C startups experience a lot of challenges as they grow and scale, including acquiring funding, managing expenses and cash flow, recognizing revenue, and much more. That means B2C companies need a strong accounting function to maximize their runway, minimize cash burn, create accurate financial reports for investors and management, and comply with all the appropriate regulatory requirements.

Serving most startup industries

Don’t see your type of startup listed here?

Don’t worry! From Fintech to Agtech and most industries in between, Kruze’s team has worked with a wide range of companies.

Reach out and we’ll let you know if we can help you.

Important Dates for Multiple Startup Industries

-

Review monthly financial statements

-

Close January books

-

Update financial model with January results

-

Hold leadership team meetings

-

Hold all-hands meetings

-

Delaware Annual Franchise Report filing deadline. Your Founder startup will pay a minimum of $400, which increases if you have significant funding.

Kruze is all about startups

Kruze serves hundreds of startups across every major startup industry. This enables us to offer powerful advice to our clients, as we have startup statistics that we can use to help provide helpful guidance for early-stage companies. From the typical marketing spend to metrics VCs use to analyze investment opportunities, we know what it takes to get to the next level.