Reporting payroll taxes with Form 941

IRS Form 941, also known as the Employer’s Quarterly Federal Tax Return, is a critical tax form that startups use to report payroll taxes to the Internal Revenue Service (IRS). This form is filed quarterly and details the income taxes withheld from employees’ paychecks, as well as both the employer and employee portions of Social Security and Medicare taxes. Very small companies, with less than $1,000 in employment tax liability, may use Form 944. Most startups, however, quickly grow large enough to use Form 941.

Summarizing the taxes withheld from employees

For startups, Form 941 acts as a comprehensive summary of the company’s quarterly payroll activities. It allows the startup to report the number of employees, total wages paid, and the amount of federal income tax, Social Security tax, and Medicare tax withheld from employees’ paychecks during the quarter.

Form 941 also lets the company calculate the employer’s share of Social Security and Medicare taxes for the quarter, including any adjustments or corrections from previous quarters. Importantly, it serves as a reconciliation tool to ensure that the total tax liability matches the total taxes deposited throughout the quarter.

When is Form 941 due?

Startups must file Form 941 by the last day of the month that follows the end of the quarter. For example, the first quarter’s Form 941 is due by April 30th. Check our tax calendars for all the due dates. Timely and accurate filing of Form 941 is crucial to avoid penalties and maintain compliance with IRS regulations.

To complete Form 941, your company needs to maintain meticulous payroll records, accurately calculate the appropriate taxes, and stay informed about any updates or changes to employment tax requirements. You can use specialized payroll software, or you can work with a professional accounting firm like Kruze Consulting to handle the process and ensure compliance with IRS regulations.

Step-by-step instructions: IRS Form 941

IRS Form 941 is the Employer’s Quarterly Federal Tax Return. It’s used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee’s wages, as well as the employer’s portion of Social Security and Medicare taxes. IRS forms are complicated and we strongly recommend you work with an experienced startup CPA.

Here are step-by-step Form 941 instructions for your startup.

Step 1: Gather necessary information

Before you begin filling out Form 941, make sure you have the following information ready:

- Employer Identification Number (EIN): This is your business’s unique tax identification number.

- Business name and address.

- Payroll information for the quarter: including total wages paid, federal income tax withheld, and amounts withheld for Social Security and Medicare.

- Deposit records: any deposits you’ve made for employment taxes throughout the quarter.

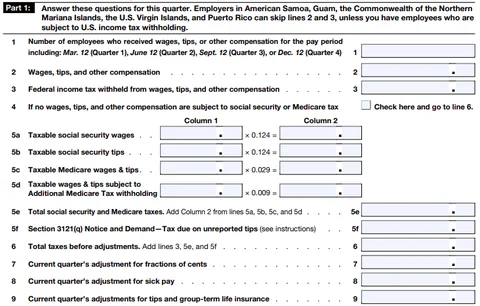

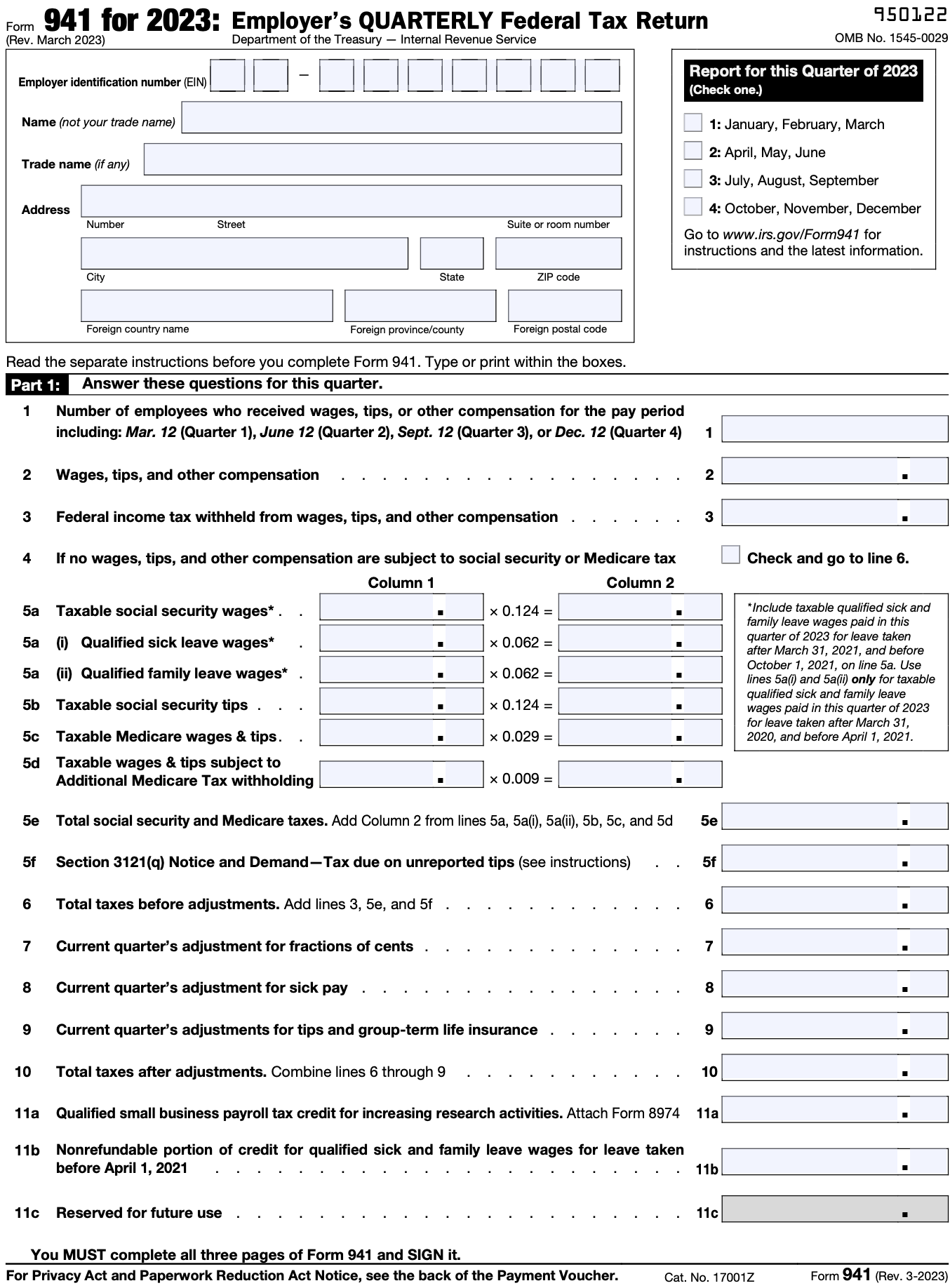

Step 2: Answer these questions for this quarter

Make sure you’ve downloaded the current version of the form and the Form 941 instructions from the IRS web site.

- Enter the number of employees who received wages for the pay period including March 12, June 12, September 12, or December 12 (line 1).

- Enter total wages, tips, and other compensation paid this quarter (line 2).

- Enter the total federal income tax withheld from wages, tips, and other compensation (line 3).

- If no wages were subject to social security or Medicare tax, check the box on line 4.

- Enter taxable social security and Medicare wages and tips (lines 5a-5d).

- Calculate total taxes before adjustments (line 6).

- Make any necessary current quarter adjustments (lines 7-9).

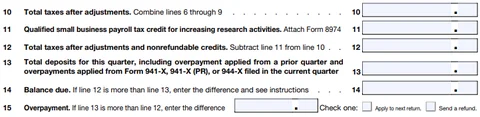

Step 3: Fill in tax adjustments

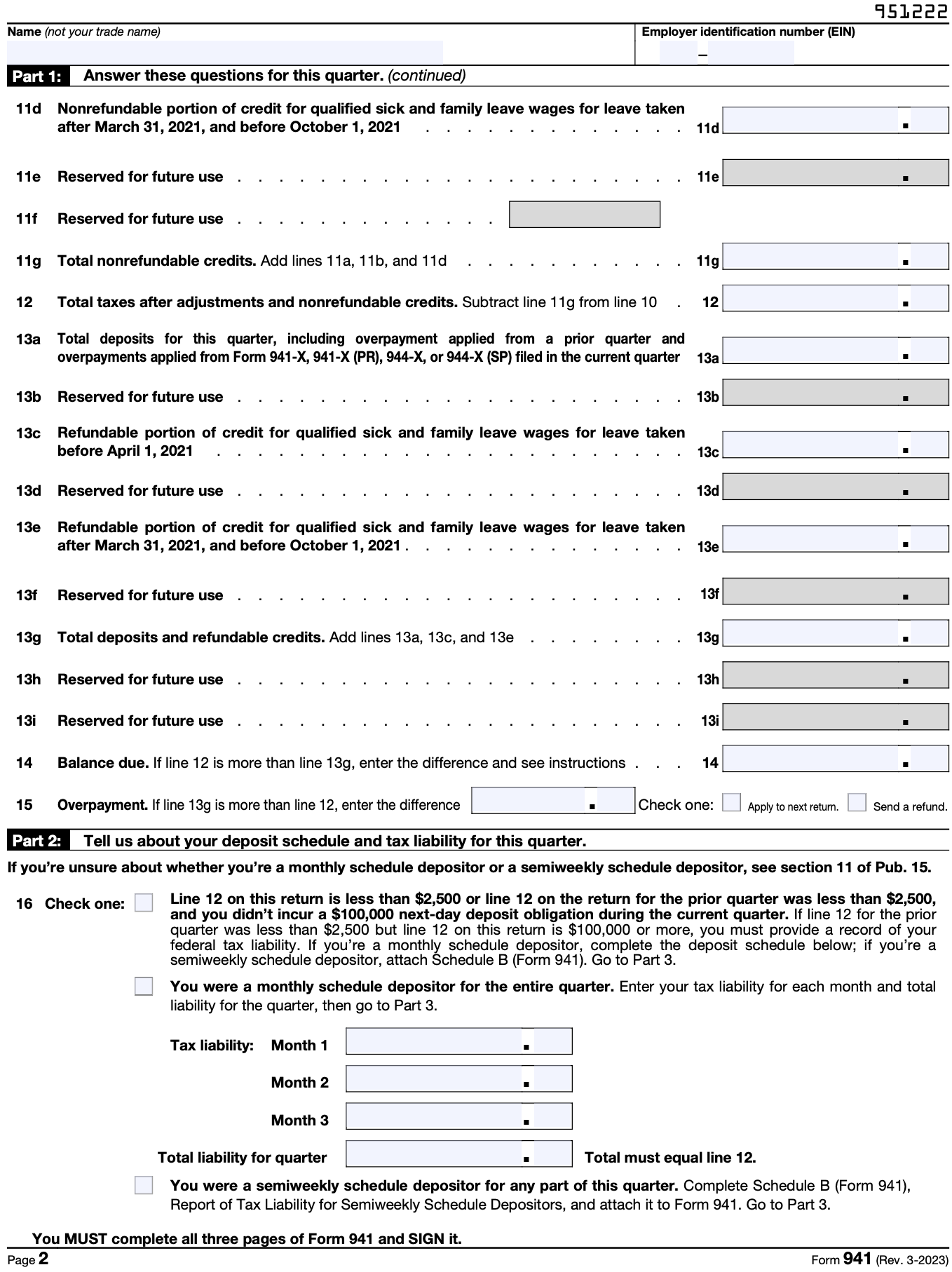

- Complete the remaining calculations as directed on the form.

Step 4: Fill in tax liability and deposits

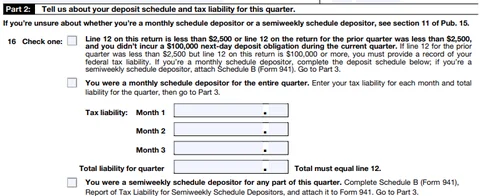

- Determine if you’re a monthly or semiweekly schedule depositor.

- If monthly, enter your tax liability for each month of the quarter on line 16.

- If semiweekly, check the appropriate box and complete Schedule B (Form 941).

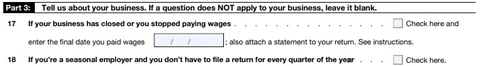

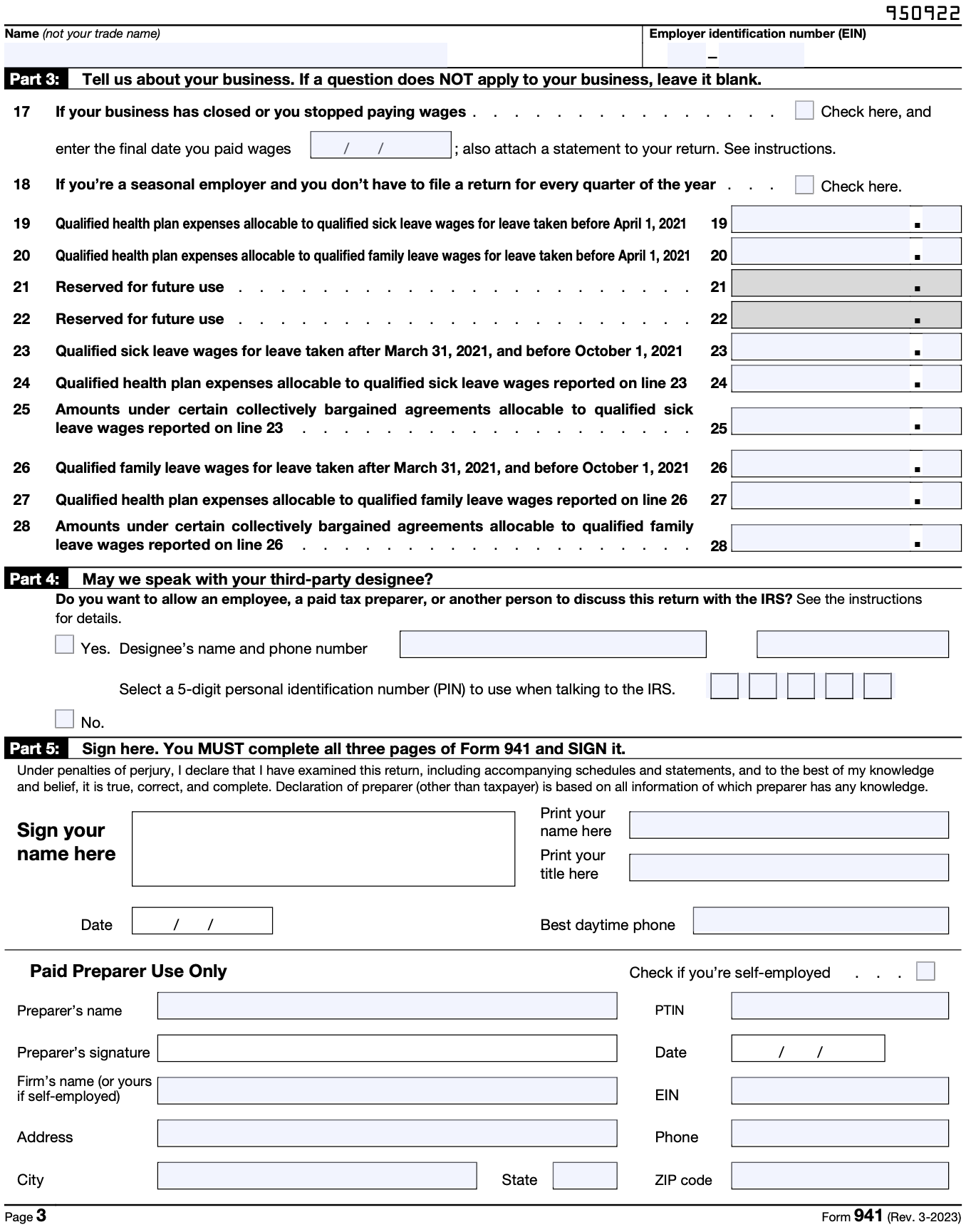

Step 5: Tell us about your business

- If your business has closed or you stopped paying wages, check box 17 and enter the final date you paid wages.

- If you’re a seasonal employer, check box 18.

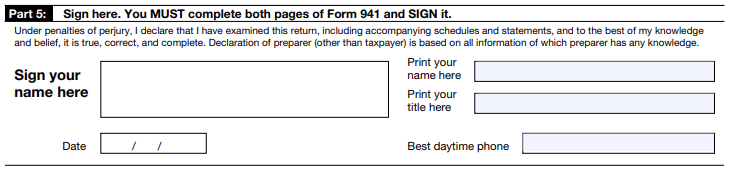

Step 6: Fill in signature

- Authorized signatory. The form must be signed by an authorized person (typically an officer of the company, such as the CEO or CFO). If you’re a startup, this might be the founder or financial officer.

- Date and contact information. Include the date, your job title, and a contact phone number.

Step 7: Review and file the form

- Review the form. Double-check all amounts and calculations to ensure accuracy. Mistakes could lead to penalties or delays in processing.

- File electronically or by mail. You can file Form 941 electronically through the IRS-approved e-file providers, or you can mail the form to the IRS. The mailing address depends on your location and whether you’re including a payment.

Step 8: Make the payment (if required)

If you have a balance due, ensure that the payment is made by the due date to avoid penalties. Payments can be made using the IRS Electronic Federal Tax Payment System (EFTPS), or by mailing a check or money order with your Form 941-V payment voucher.

Important deadlines

Form 941 is due on the last day of the month following the end of each quarter:

- Q1 (January–March): Due by April 30

- Q2 (April–June): Due by July 31

- Q3 (July–September): Due by October 31

- Q4 (October–December): Due by January 31

Remember, it’s important to complete these forms accurately and submit them by the appropriate deadline. We recommend you consult a tax professional with experience in startup accounting to make sure you’re in compliance.

Warning: This information is for informational purposes only and should not be used for official tax matters. Use the official Form 941 and instructions, generally found at: https://www.irs.gov/forms-instructions. Rely on this information at your own risk. Visit https://www.irs.gov/forms-instructions for official IRS information. Consult with a tax professional.

Warning: This information is for informational purposes only and should not be used for official tax matters. Use the official Form 941 and instructions, generally found at: https://www.irs.gov/forms-instructions. Rely on this information at your own risk. Visit https://www.irs.gov/forms-instructions for official IRS information. Consult with a tax professional.

Warning: This information is for informational purposes only and should not be used for official tax matters. Use the official Form 941 and instructions, generally found at: https://www.irs.gov/forms-instructions. Rely on this information at your own risk. Visit https://www.irs.gov/forms-instructions for official IRS information. Consult with a tax professional.

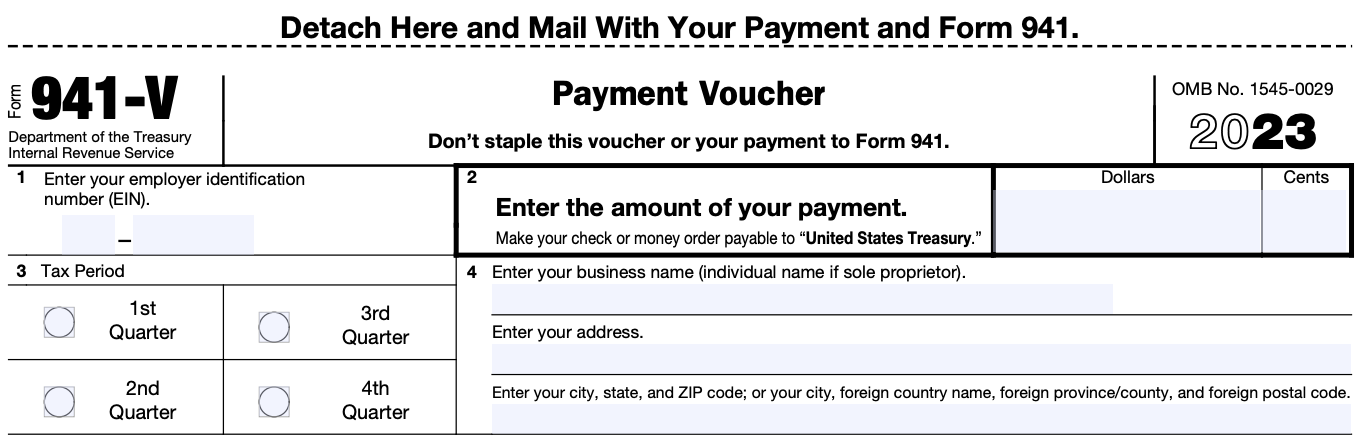

Form 941-V, Payment Voucher

Purpose of Form

Complete Form 941-V if you’re making a payment with Form 941. We will use the completed voucher to credit your payment more promptly and accurately, and to improve our service to you.

Making Payments With Form 941

To avoid a penalty, make your payment with Form 941 only if:

• Your total taxes after adjustments and nonrefundable credits (Form 941, line 12) for either the current quarter or the preceding quarter are less than $2,500, you didn’t incur a $100,000 next-day deposit obligation during the current quarter, and you’re paying in full with a timely filed return; or

• You’re a monthly schedule depositor making a payment in accordance with the Accuracy of Deposits Rule. See section 11 of Pub. 15 for details. In this case, the amount of your payment may be $2,500 or more.

Otherwise, you must make deposits by electronic funds transfer. See section 11 of Pub. 15 for deposit instructions. Don’t use Form 941-V to make federal tax deposits.

CAUTION

Use Form 941-V when making any payment with Form 941. However, if you pay an amount with Form 941 that should’ve been deposited, you may be subject to a penalty. See Deposit Penalties in section 11 of Pub. 15.

Specific Instructions

Box 1—Employer identification number (EIN). If you don’t have an EIN, you may apply for one online by visiting the IRS website at www.irs.gov/EIN. You may also apply for an EIN by faxing or mailing Form SS-4 to the IRS. If you haven’t received your EIN by the due date of Form 941, write “Applied For” and the date you applied in this entry space.

Box 2—Amount paid. Enter the amount paid with Form 941.

Box 3—Tax period. Darken the circle identifying the quarter for which the payment is made. Darken only one circle.

Box 4—Name and address. Enter your name and address as shown on Form 941.

• Enclose your check or money order made payable to “United States Treasury.” Be sure to enter your EIN, “Form 941,” and the tax period (“1st Quarter 2023,” “2nd Quarter 2023,” “3rd Quarter 2023,” or “4th Quarter 2023”) on your check or money order. Don’t send cash. Don’t staple Form 941-V or your payment to Form 941 (or to each other).

• Detach Form 941-V and send it with your payment and Form 941 to the address in the Instructions for Form 941.

Note: You must also complete the entity information above Part 1 on Form 941.

Warning: This information is for informational purposes only and should not be used for official tax matters. Use the official Form 941 and instructions, generally found at: https://www.irs.gov/forms-instructions. Rely on this information at your own risk. Visit https://www.irs.gov/forms-instructions for official IRS information. Consult with a tax professional.

Warning: This information is for informational purposes only and should not be used for official tax matters. Use the official Form 941 and instructions, generally found at: https://www.irs.gov/forms-instructions. Rely on this information at your own risk. Visit https://www.irs.gov/forms-instructions for official IRS information. Consult with a tax professional.

Privacy Act and Paperwork Reduction Act Notice.

We ask for the information on Form 941 to carry out the Internal Revenue laws of the United States. We need it to figure and collect the right amount of tax. Subtitle C, Employment Taxes, of the Internal Revenue Code imposes employment taxes on wages and provides for income tax withholding. Form 941 is used to determine the amount of taxes that you owe. Section 6011 requires you to provide the requested information if the tax is applicable to you. Section 6109 requires you to provide your identification number. If you fail to provide this information in a timely manner, or provide false or fraudulent information, you may be subject to penalties.

You’re not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books and records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law.

Generally, tax returns and return information are confidential, as required by section 6103. However, section 6103 allows or requires the IRS to disclose or give the information shown on your tax return to others as described in the Code. For example, we may disclose your tax information to the Department of Justice for civil and criminal litigation, and to cities, states, the District of Columbia, and U.S. commonwealths and possessions for use in administering their tax laws. We may also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal laws, or to federal law enforcement and intelligence agencies to combat terrorism.

The time needed to complete and file Form 941 will vary depending on individual circumstances. The estimated average time is:

Recordkeeping . . . . . . . . . . 22 hr., 28 min.

Learning about the law or the form . . . . 53 min.

Preparing, copying, assembling, and sending the form to the IRS . . . . . 1 hr., 18 min.

If you have comments concerning the accuracy of these time estimates or suggestions for making Form 941 simpler, we would be happy to hear from you. You can send us comments from www.irs.gov/FormComments. Or you can send your comments to Internal Revenue Service, Tax Forms and Publications Division, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Don’t send Form 941 to this address. Instead, see Where Should You File? in the Instructions for Form 941.

Warning: This information is for informational purposes only and should not be used for official tax matters. Use the official Form 941 and instructions, generally found at: https://www.irs.gov/forms-instructions. Rely on this information at your own risk. Visit https://www.irs.gov/forms-instructions for official IRS information. Consult with a tax professional.