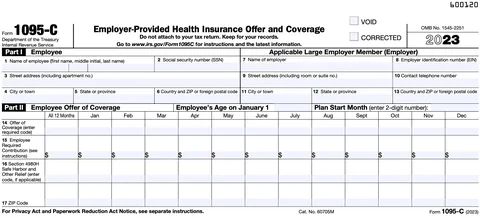

Startups with 50 or more full-time employees, including full-time equivalent employees, use IRS Form 1095-C to report information about the health coverage they offer to their employees.

This form is a key component of the Affordable Care Act (ACA) compliance requirements for applicable large employers (ALEs).

What does Form 1095-C include?

Form 1095-C communicates the details of the health insurance coverage startups provide to their employees, including details about the coverage offered, the cost of coverage, the months it was available, and the employee’s enrollment status.

When is Form 1095-C due?

Startups must furnish Form 1095-C to employees by the deadline specified by the IRS, usually around early February, and also submit copies of these forms to the IRS. Startups need to maintain accurate records to ensure the information they report on Form 1095-C is correct, and many use software programs or work with a professional employer organization (PEO) to help manage the process. Contact us for more information on 1095-C requirements.

Step-by-step instructions: Form 1095-C

IRS Form 1095-C, Employer-Provided Health Insurance Offer and Coverage, is used by applicable large employers (ALEs), typically with 50 or more full-time employees, to report information about health insurance coverage offered to their employees. Like many tax forms, this form can be complex and we strongly recommend that startups consult a tax professional or CPA. This form is part of the Affordable Care Act (ACA) reporting requirements.

Here are step-by-step Form 1095-C instructions for a startup company to fill out this form:

Step 1: Confirm Your Startup’s Filing Requirements

Ensure your startup is required to file Form 1095-C:

- Your startup is considered an Applicable Large Employer (ALE) if you employed an average of 50 or more full-time employees (or full-time equivalents) during the previous calendar year.

- You must file Form 1095-C for each full-time employee, even if they did not participate in your health plan.

Step 2: Download Form 1095-C and Instructions

- Visit the IRS website and download the latest version of Form 1095-C and the corresponding Form 1095-C Instructions.

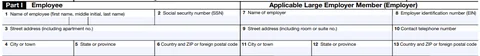

Step 3: Complete Part I - Employee and Employer Information

-

Employee Information (Lines 1-6)

- Line 1: Enter the employee’s full name.

- Line 2: Enter the employee’s Social Security Number (SSN).

- Line 3: Enter the employee’s street address, including city, state, and ZIP code.

-

Employer Information (Lines 7-13)

- Line 7: Enter your startup’s Employer Identification Number (EIN).

- Line 8: Enter your startup’s name (as it appears on tax documents).

- Line 9: Enter your startup’s street address, including city, state, and ZIP code.

- Line 10: Enter a contact phone number for your startup.

- Line 11: Enter your startup’s name again.

- Line 12: Enter your EIN again.

- Line 13: Enter the employer’s address once more (including city, state, and ZIP code).

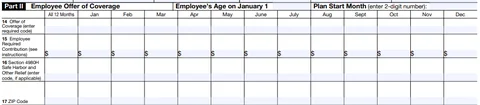

Step 4: Complete Part II - Employee Offer of Coverage

This section reports the offer of health insurance coverage made to the employee during the tax year.

-

Line 14 - Offer of Coverage Code

- Enter the appropriate code for each month in the year to indicate the type of coverage you offered the employee.

-

Example codes:

- Code 1A: Minimum essential coverage providing minimum value offered to full-time employee, with affordable coverage based on the federal poverty line.

- Code 1E: Minimum essential coverage providing minimum value offered to the employee and at least minimum essential coverage offered to dependent(s) and spouse.

- If the offer was made for all 12 months, enter the code in the “All 12 Months” box; otherwise, enter the code in the boxes for each applicable month.

-

Line 15 - Employee Share of Lowest-Cost Monthly Premium

- If Code 1B, 1C, 1D, or 1E was entered in Line 14, enter the employee’s share of the lowest-cost monthly premium for self-only minimum essential coverage that provides minimum value.

- Leave this blank if no offer was made, or if you entered Code 1A in Line 14.

-

Line 16 - Applicable Safe Harbor Codes

- Enter a safe harbor code (if applicable) to explain why your startup may be exempt from a penalty under the employer shared responsibility provisions (IRC Section 4980H).

-

Example codes:

- Code 2A: Employee was not employed during the month.

- Code 2C: Employee enrolled in coverage offered.

- Code 2G: Offer of coverage was affordable based on the federal poverty line.

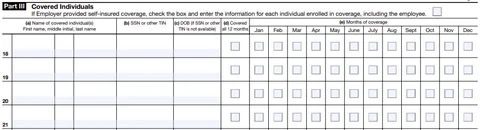

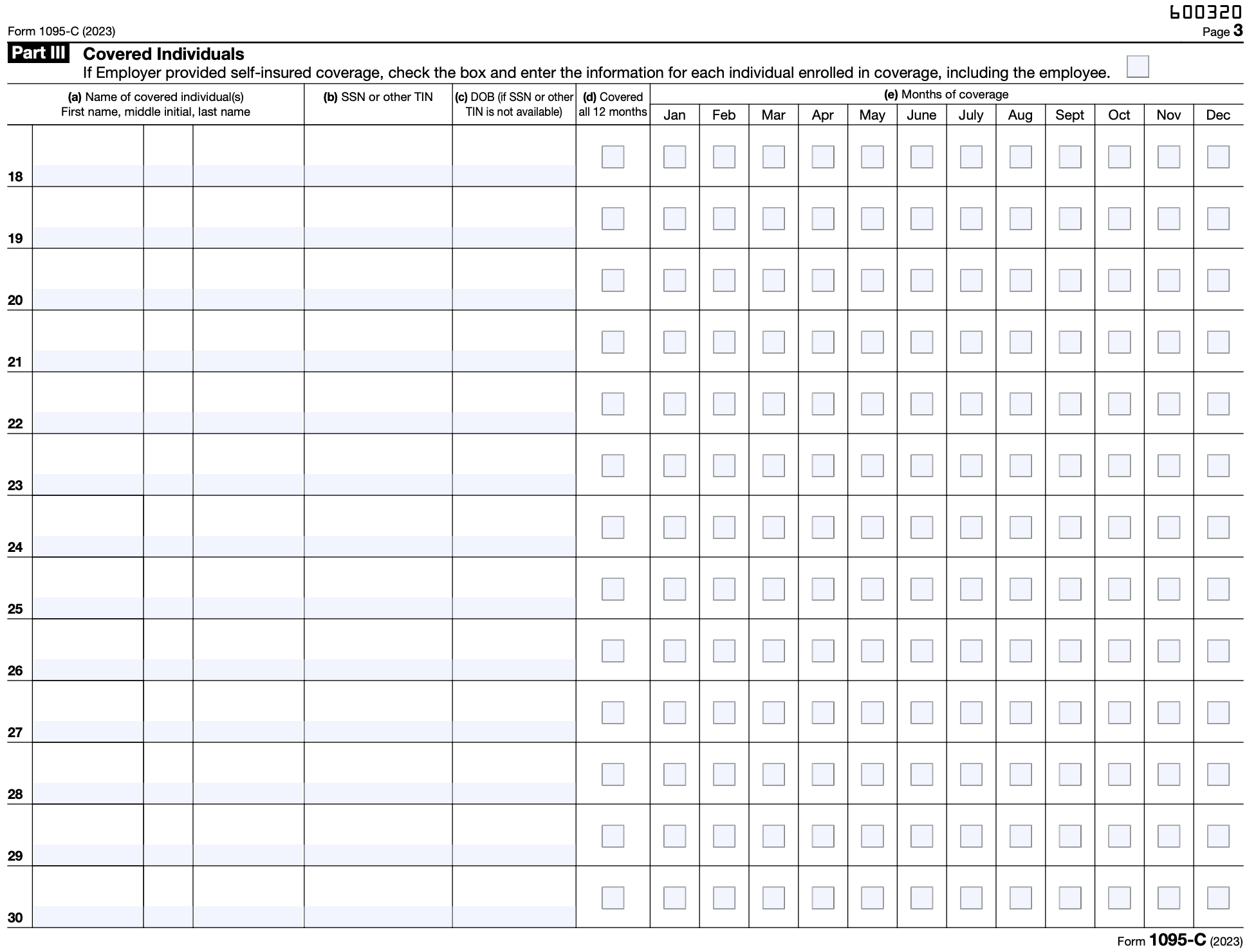

Step 5: Complete Part III - Covered Individuals (if applicable)

This section is completed only if your startup’s health insurance is self-insured. If your startup offers fully insured plans, skip this section.

-

Column (a) - Name of Covered Individual

- List the name of the employee and any covered dependents.

-

Column (b) - SSN

- Enter the Social Security Number for each covered individual. If you do not have an SSN for a dependent, use their date of birth in column (c).

-

Column (c) - Date of Birth

- Enter the date of birth only if the SSN is not available.

-

Column (d) - Covered All 12 Months

- If the individual was covered for the entire year, check this box.

-

Column (e) - Months of Coverage

- If the individual was covered for fewer than 12 months, check the box for each month in which the individual was covered.

Step 6: Review and Prepare for Filing

- Review. Double-check all employee and employer information for accuracy, especially SSNs and EINs.

- Corrections. Make sure all the information aligns with the insurance coverage provided throughout the year.

Step 7: File Form 1095-C with the IRS

- Electronic Filing: If you are filing 250 or more forms, you are required to file electronically through the IRS Affordable Care Act Information Returns (AIR) system.

- Paper Filing: If you are filing fewer than 250 forms, you can submit them by mail. The address depends on your business location, so check the IRS instructions.

Step 8: Distribute Form 1095-C to Employees

- You must provide a copy of Form 1095-C to each employee by March 2 (or the next business day if March 2 is a weekend or holiday) of the year following the reporting year. This can be done electronically (with employee consent) or by mail.

Step 9: Keep Records

- Retain copies of Form 1095-C and all supporting documentation for at least three years in case of an IRS audit.

Tips for Filing Form 1095-C

- Use an experienced startup accountant. As you can see from these Form 1095-C instructions, tax forms are complicated. We recommend you work with an experienced startup tax professional.

- Consult a payroll provider. Many payroll services assist with ACA reporting, including generating and filing Forms 1095-C.

- Use safe harbor codes. Properly applying safe harbor codes can protect your startup from penalties.

- Track full-time equivalents (FTEs). If your startup is close to the 50-employee threshold, carefully track FTEs to determine whether you must file Form 1095-C.

Warning: This information is for informational purposes only and should not be used for official tax matters. Use the official Form 1095-C and instructions, generally found at: https://www.irs.gov/forms-instructions. Rely on this information at your own risk. Visit https://www.irs.gov/forms-instructions for official IRS information. Consult with a tax professional.

Instructions for Recipient

You are receiving this Form 1095-C because your employer is an Applicable Large Employer subject to the employer shared responsibility provisions in the Affordable Care Act. This Form 1095-C includes information about the health insurance coverage offered to you by your employer. Form 1095-C, Part II, includes information about the coverage, if any, your employer offered to you and your spouse and dependent(s). If you purchased health insurance coverage through the Health Insurance Marketplace and wish to claim the premium tax credit, this information will assist you in determining whether you are eligible. For more information about the premium tax credit, see Pub. 974, Premium Tax Credit (PTC). You may receive multiple Forms 1095-C if you had multiple employers during the year that were Applicable Large Employers (for example, you left employment with one Applicable Large Employer and began a new position of employment with another Applicable Large Employer). In that situation, each Form 1095-C would have information only about the health insurance coverage offered to you by the employer identified on the form. If your employer is not an Applicable Large Employer, it is not required to furnish you a Form 1095-C providing information about the health coverage it offered.

In addition, if you, or any other individual who is offered health coverage because of their relationship to you (referred to here as family members), enrolled in your employer’s health plan and that plan is a type of plan referred to as a “self-insured” plan, Form 1095-C, Part III, provides information about you and your family members who had certain health coverage (referred to as “minimum essential coverage”) for some or all months during the year. If you or your family members are eligible for certain types of minimum essential coverage, you may not be eligible for the premium tax credit.

If your employer provided you or a family member health coverage through an insured health plan or in another manner, you may receive information about the coverage separately on Form 1095-B, Health Coverage. Similarly, if you or a family member obtained minimum essential coverage from another source, such as a government-sponsored program, an individual market plan, or miscellaneous coverage designated by the Department of Health and Human Services, you may receive information about that coverage on Form 1095-B. If you or a family member enrolled in a qualified health plan through a Health Insurance Marketplace, the Health Insurance Marketplace will report information about that coverage on Form 1095-A, Health Insurance Marketplace Statement.

TIP

Employers are required to furnish Form 1095-C only to the employee. As the recipient of this Form 1095-C, you should provide a copy to any family members covered under a self-insured employer-sponsored plan listed in Part III if they request it for their records.

Additional information. For additional information about the tax provisions of the Affordable Care Act (ACA), the premium tax credit, and the employer shared responsibility provisions, visit www.irs.gov/ ACA or call the IRS Healthcare Hotline for ACA questions (800-919-0452).

Part I. Employee Lines 1–6.

Part I, lines 1 through 6, reports information about you, the employee. Line 2. This is your social security number (SSN). For your protection, this form may show only the last four digits of your SSN. However, the employer is required to report your complete SSN to the IRS. Part I. Applicable Large Employer Member (Employer) Lines 7–13. Part I, lines 7 through 13, reports information about your employer. Line 10. This line includes a telephone number for the person whom you may call if you have questions about the information reported on the form or to report errors in the information on the form and ask that they be corrected.

Part II. Employer Offer of Coverage, Lines 14–17 Line 14. The codes listed below for line 14 describe the coverage that your employer offered to you and your spouse and dependent(s), if any. (If you received an offer of coverage through a multiemployer plan due to your membership in a union, that offer may not be shown on line 14.) The information on line 14 relates to eligibility for coverage subsidized by the premium tax credit for you, your spouse, and dependent(s). For more information about the premium tax credit, see Pub. 974.

1A. Minimum essential coverage providing minimum value offered to you with an employee required contribution for self-only coverage equal to or less than 9.5% (as adjusted) of the 48 contiguous states single federal poverty line and minimum essential coverage offered to your spouse and dependent(s) (referred to here as a Qualifying Offer). This code may be used to report for specific months for which a Qualifying Offer was made, even if you did not receive a Qualifying Offer for all 12 months of the calendar year. For information on the adjustment of the 9.5%, visit IRS.gov.

1B. Minimum essential coverage providing minimum value offered to you and minimum essential coverage NOT offered to your spouse or dependent(s).

1C. Minimum essential coverage providing minimum value offered to you and minimum essential coverage offered to your dependent(s) but NOT your spouse.

1D. Minimum essential coverage providing minimum value offered to you and minimum essential coverage offered to your spouse but NOT your dependent(s).

1E. Minimum essential coverage providing minimum value offered to you and minimum essential coverage offered to your dependent(s) and spouse. ** **

1F. Minimum essential coverage NOT providing minimum value offered to you, or you and your spouse or dependent(s), or you, your spouse, and dependent(s).

1G. You were NOT a full-time employee for any month of the calendar year but were enrolled in selfinsured employer-sponsored coverage for one or more months of the calendar year. This code will be entered in the All 12 Months box or in the separate monthly boxes for all 12 calendar months on line 14.

1H. No offer of coverage (you were NOT offered any health coverage or you were offered coverage that is NOT minimum essential coverage).

1I. Reserved for future use.

1J. Minimum essential coverage providing minimum value offered to you; minimum essential coverage conditionally offered to your spouse; and minimum essential coverage NOT offered to your dependent(s).

1K. Minimum essential coverage providing minimum value offered to you; minimum essential coverage conditionally offered to your spouse; and minimum essential coverage offered to your dependent(s).

1L. Individual coverage health reimbursement arrangement (HRA) offered to you only with affordability determined by using employee’s primary residence ZIP code.

1M. Individual coverage HRA offered to you and dependent(s) (not spouse) with affordability determined by using employee’s primary residence ZIP code.

1N. Individual coverage HRA offered to you, spouse, and dependent(s) with affordability determined by using employee’s primary residence ZIP code.

1O. Individual coverage HRA offered to you only using the employee’s primary employment site ZIP code affordability safe harbor.

1P. Individual coverage HRA offered to you and dependent(s) (not spouse) using the employee’s primary employment site ZIP code affordability safe harbor.

1Q. Individual coverage HRA offered to you, spouse, and dependent(s) using the employee’s primary employment site ZIP code affordability safe harbor.

1R. Individual coverage HRA that is NOT affordable offered to you; employee and spouse or dependent(s); or employee, spouse, and dependents.

1S. Individual coverage HRA offered to an individual who was not a full-time employee.

1T. Individual coverage HRA offered to employee and spouse (no dependents) with affordability determined using employee’s primary residence ZIP code.

1U. Individual coverage HRA offered to employee and spouse (no dependents) using employee’s primary employment site ZIP code affordability safe harbor.

1V. Reserved for future use.

1W. Reserved for future use.

1X. Reserved for future use.

1Y. Reserved for future use.

1Z. Reserved for future use.

Warning: This information is for informational purposes only and should not be used for official tax matters. Use the official Form 1095-C and instructions, generally found at: https://www.irs.gov/forms-instructions. Rely on this information at your own risk. Visit https://www.irs.gov/forms-instructions for official IRS information. Consult with a tax professional.

Warning: This information is for informational purposes only and should not be used for official tax matters. Use the official Form 1095-C and instructions, generally found at: https://www.irs.gov/forms-instructions. Rely on this information at your own risk. Visit https://www.irs.gov/forms-instructions for official IRS information. Consult with a tax professional.

Instructions for Recipient (continued)

Line 15. This line reports the employee required contribution, which is the monthly cost to you for the lowest cost self-only minimum essential coverage providing minimum value that your employer offered you. For an individual coverage HRA, the employee required contribution is the excess of the monthly premium based on the employee’s applicable age for the applicable lowest cost silver plan over the monthly individual coverage HRA amount (generally, the annual individual coverage HRA amount divided by 12). See the Instructions for Forms 1094-C and 1095-C for more details. The amount reported on line 15 may not be the amount you paid for coverage if, for example, you chose to enroll in more expensive coverage such as family coverage. Line 15 will show an amount only if code 1B, 1C, 1D, 1E, 1J, 1K, 1L, 1M, 1N, 1O, 1P, 1Q, 1T, or 1U is entered on line 14. If you were offered coverage but there is no cost to you for the coverage, this line will report “0.00” for the amount. For more information, including on how your eligibility for other healthcare arrangements might affect the amount reported on line 15, visit IRS.gov.

Line 16. This code provides the IRS information to administer the employer shared responsibility provisions. Other than a code 2C, which reflects your enrollment in your employer’s coverage, none of this information affects your eligibility for the premium tax credit. For more information about the employer shared responsibility provisions, visit IRS.gov.

Line 17. This line reports the applicable ZIP code your employer used for determining affordability if you were offered an individual coverage HRA. If code 1L, 1M, 1N, or 1T was used on line 14, this will be your primary residence location. If code 1O, 1P, 1Q, or 1U was used on line 14, this will be your primary employment site. For more information about individual coverage HRAs, visit IRS.gov.

Part III. Covered Individuals, Lines 18–30 Part III reports the name, SSN (or TIN for covered individuals other than the employee listed in Part I), and coverage information about each individual (including any full-time employee and non-full-time employee, and any employee’s family members) covered under the employer’s health plan, if the plan is “self-insured.” A date of birth will be entered in column (c) only if an SSN (or TIN for covered individuals other than the employee listed in Part I) is not entered in column (b). Column (d) will be checked if the individual was covered for at least one day in every month of the year. For individuals who were covered for some but not all months, information will be entered in column (e) indicating the months for which these individuals were covered. If there are more than 13 covered individuals, additional copies of page 3 may be used.

Warning: This information is for informational purposes only and should not be used for official tax matters. Use the official Form 1095-C and instructions, generally found at: https://www.irs.gov/forms-instructions. Rely on this information at your own risk. Visit https://www.irs.gov/forms-instructions for official IRS information. Consult with a tax professional.