What the changing rent expense says about startups

Startups in 2023 are NOT spending the same amount of rent as they would have prior to COVID. In fact, the way startups are having - or not having - offices has dramatically changed in recent years, and we are seeing a divergence in how companies work based on where the companies are headquartered.

What do startups spend on rent?

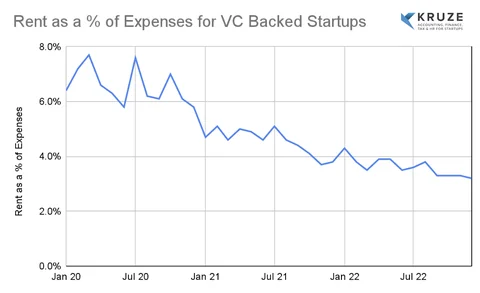

Pre-COVID, we used to tell our clients to forecast that they’d spend about 7% of their expenses on rent. This has dropped to just over 3% at the beginning of 2023.

The 7% figure was a pretty consistent figure across geographies, as office rental rates and average pay by region were pretty tightly correlated. Companies in high-rent New York usually have to pay a premium for their talent, so the 7% estimate worked pretty well.

However, all that has changed as many startups have become fully remote. And many others have opted to have a hybrid, where some employees work from home and others come into the office some days of the week.

Startup rent expense by geography

The old rubric of 7% of expenses going to rent, regardless of the company’s geography, appears to be broken as well. Startups in different locations are spending different amounts on their rent as a percent of expenses, indicating that both rental costs have diverged from wage costs, and that early-stage companies in different metropolitan areas are adopting different back-to-office strategies. For example, startups in New York are allocating 3.4% of their expenses to rent, 50% higher than startups in SF at 2.2%.

In particular, startups in San Francisco appear to be aggressively spending less on rent, per capita, on rent than their counterparts in other parts of the country. While some of this is clearly driven by lower rental costs, it can’t explain the massive divergence from other parts of California or other major startup hubs.

I believe that much of this may be driven by San Francisco based companies more aggressively embracing the hybrid model. In fact, SF based startups lead the pack in terms of the percent having a rent expense!

Percent of Startups With Rent Expense by Region

So some regions, like New York, seem to have embraced the back in the office culture, while San Francisco seems to be leading the pack in terms of adopting a hybrid approach, indicated by the high percentage of startups paying for rent while having the paradox of a very low amount of money spend on rent.

The hybrid approach does lead to some significant POSSIBLE advantages.

Possible advantages of a remote work or hybrid startup

- Ability to hire the best candidate for a role, regardless of geographical location

- Ability to hire lower cost personnel

- Less distracted developers and creatives (the open office floor plan has been proven to be very distracting for some types of knowledge workers)

- Cash burn savings by not having an office expense

- Need to invest and create better collaboration and production systems

If there are any advantages to having a remote or hybrid workspace, where would we see it? My first place to look was time to revenue. I analyzed recently founded startups to see if the remote vs. the ones with office expense got to first revenue more quickly.

The results:

Fully remote startups get to first revenue about 1 month faster.

Fully remote startups got to revenue in about 4.5 months, whereas startup with an office got there in about 5.6 months. (Side note, it takes the average startup about 5 months to generate first revenue!)

My next question was do startups without offices grow revenue faster than ones with offices.

I found that fully remote startups grew about 2.7x the rate of ones with offices!

So it seems that having an office MAY be overrated.

That being said, I would strongly encourage any founders to manage their company in the way that feels best for them. Not every founder will be comfortable (or enjoy) managing a fully remote company. So everyone should do what is right for their particular business model, management style, culture, etc.

A note on this startup rent analysis

Note on this startup rent analysis - this dataset contains data from over 750 VC backed companies that have raised billions in venture capital funding. The revenue growth was narrowed to only companies in non-location dependent industries, so excluded biotech, hardware type companies. Additionally, the revenue comparison only analyzed startups recently founded, to eliminate any survivor or other type biases. Headquarters location was based on their main address.

As the leading CPA 100% dedicated to VC-backed startups, we regularly publish data studies that provide insights for our startup CEOs and their investors. From our Startup CEO Salary Report to our startup statistics page to early-stage banking marketshare, we’ve got you covered. Follow us on LinkedIn to keep up with our latest data and insights.