Advantages of a remote bookkeeper for startups

As a startup founder, your priority is running your business, and managing your own financial data takes time and energy away from that. That’s why more and more startup and early-stage companies are outsourcing their bookkeeping. A remote bookkeeper is:

- Cost-effective. As a small business, you probably don’t need a full-time bookkeeper. Remote bookkeepers normally offer part-time services that will meet your business needs.

- Professional. Established remote bookkeeping firms have an extensive client base, which means you’ll have an experienced team helping you.

- Flexible. An outsourced bookkeeper can adjust to your needs and response to your requests quickly and effectively.

- Efficient. Bookkeeping can be time-consuming, and outsourcing your financial activities allows you to focus on developing your startup.

- Objective. An outside bookkeeper provides a fresh and unbiased perspective on your financial situation, providing you with alternatives and options you may not have considered.

- Accurate. You can’t effectively manage your business without accurate information, and a remote bookkeeper can provide you with financial data to help you reduce inefficient spending, increase your productivity, and prepare for growth.

- Organized. An outsourced bookkeeper can help monitor your invoices, payments, billing and other transactions to make sure you’re collecting funds that are due to you, as well as paying your vendors and contractors on time.

Outsourcing your bookkeeping needs can be essential to growing your business, and accurate bookkeeping gives you a basis to improve your cash management, monitor your financial position, and provide accurate reports to your board and investors.

What does a startup bookkeeper do?

Kruze’s startup bookkeepers will help your company have accurate, up-to-date financial statements that you can use to manage your business’ growth and cash flow. The basic tasks we will handle are the same as what any other quality bookkeeping provider would do - except that we have developed highly automated systems, and our team is experienced handling the nuances of early-stage, venture funded companies.

Our account managers have an average of 11 years of experience, and are experts on helping young, funded businesses with their bookkeeping. But that experience helps our team go beyond simple, outsourced bookkeeping, and offer financial advice and due diligence help that other accounting firms can not match.

We think bookkeepers for startups should provide the following services to early-stage, VC backed companies:

RECORDING FINANCIAL TRANSACTIONS

When revenue or expenses happen, it’s your startup bookkeeper’s job to record these into your company’s accounting system. This probably involves categorizing the “transaction” in a way that makes sense, say a payment to your payroll provider as a payroll expense.

Traditionally this work was all done manually, but Kruze is a pioneer is using automated systems to make this process faster (and cheaper for our clients!) By using a combination of off-the-shelf accounting solutions like Brex, Ramp and Bill.com, plus custom built software, Kruze can quickly and accurately record the vast majority of your company’s transactions without you or your Kruze bookkeeper having to do anything. However, automation is not enough.

Early-stage companies move quickly, and you need an experienced bookkeeper or accountant to review your books and financial records to make sure that the automated systems haven’t made any errors. There are particular moments when automated systems are likely to introduce mistakes, such as when employee benefits are changed.

Our team is trained to look for specific errors based on your company’s stage.

REVENUE RECOGNITION

Many companies raise their next round of venture capital based on their revenue growth. Many early-stage CEOs use a variety of dashboards to visualize their revenue.

Smart VCs will check to see what the difference is between the CEO’s revenue number and the actual financial statements recognized revenue.

Making the financial statements correctly mirror these dashboards is not as simple as it sounds! Kruze uses automated systems to record the revenue. But, correct accounting relies on more than just data feeds, and our team knows the questions to ask our CEOs for the information needed to produce GAAP revenue.

Incorrect revenue recognition is one of the biggest reasons startups switch to Kruze as their bookkeeper, especially the online bookkeepers with questionable accounting experience that claim to do everything with “automation” - which is really a code word for the founder having to code everything correctly.

RECONCILING ACCOUNTS

Companies that raise venture capital need to have accurate books - in fact, a company’s executives typically promise recurring delivery of accurate financial records to venture investors in the funding documents.

Reconciliation is an important step in bookkeeping. This is when your bookkeeper makes sure that the different records balance, and that the money leaving an account (like your company’s bank account) matches the actual money spent.

Reconciliation is an especially important part of bookkeeping for funded companies, since investors (and potential acquirer) expect accrual accounting and financials that are close to GAAP. Kruze helps set up connected, automated systems that help do much of this work automatically. But, we go the next step and have our experienced team do several levels of reviews to help catch anything that the automated systems might miss.

MANAGING BILL PAY

Early-stage companies need to carefully manage their burn, and best in class bill pay helps give founders the controls they need to preserve cash.

Kruze clients used to almost exclusively use bill.com, which is a provider of accounts payable for companies of all sizes. However, other vendors such as Ramp and Brex have emerged that provide similar services at a fraction of the cost (typically bundled with credit cards for free!) Regardless of the system, if you want to automate your startup bookkeeping, you need a solution for bill pay. That’s because an automated bill pay system integrates directly into accounting software, minimizing the amount of data entry and saving your startup bookkeeper time.

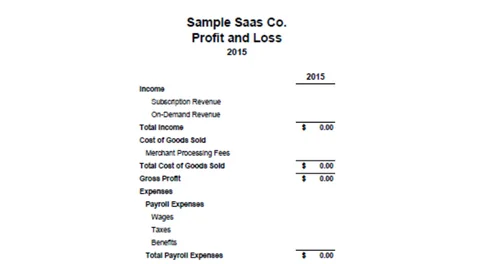

PREPARING FINANCIAL STATEMENTS

Investors, board members and experienced founders want to see three important financial statements, usually every month: the income statement, cash flow statement and balance sheet.

Bookkeepers have been preparing these financial packets for ages, but modern bookkeepers like Kruze use automated systems. We’ve built our own, specialized software that interfaces directly with QuickBooks API, and combine it with best-in-class off the shelf solutions to give early-stage startups low cost, highly accurate financial statements and financial reports.

However, not all founders are trained finance professionals - software and financial packets are only half the story. Kruze’s accounting team knows how to explain what financial statements mean and how important metrics impact a startup’s strategy.

How is Kruze different?

Kruze Consulting is 100% focused on helping seed and venture funded businesses, and one of our key services is accurate and affordable bookkeeping for startups.

Companies that have raised capital from professional investors require a specialized level of bookkeeping and accounting. It goes well beyond getting the books right - our integrated tax preparation team, FP&A team and CFOs can help your company be ready for the strategic situations that make running a startup special.

Investor updates, board meetings, being prepared for that next venture round or the unexpected M&A interest - we know what the top venture capitalists and public company M&A teams what to see, and make sure our clients’ books are solid.

Kruze Consulting is a leader in Finance as a Service (FaaS), offering outsourced, integrated services that include a full range of financial services through a single provider. Our accounting, controllership, financial planning, business strategy, and tax filing and compliance services cost significantly less than hiring and managing your own departments. You get multiple highly skilled and experienced team of financial professionals that can scale as your startup grows.

Artificial intelligence is revolutionizing the business landscape, and at Kruze Consulting, we are at the forefront of this transformation. We don’t just adopt cutting-edge technology—we lead the way in integrating the latest advancements to provide outstanding accounting, finance, and tax services for startups.

Our clients gain a competitive edge by leveraging the best automated fintech and accounting platforms available. Kruze Consulting has earned accolades for our innovative approach, utilizing both in-house and third-party technologies. Our thought leadership in AI has been featured in major publications like The New York Times, The Information, and Newcomer, and venture capitalists frequently turn to us for expert insights during due diligence on AI-driven accounting technologies.

Bookkeeping experience in the most important startup industries

It’s not just about knowing how do book debits and credits, or knowing how to recored a journal entry. It’s having specific experience with the industry that YOUR startup is in, and knowing what finance challenges you will face as you scale. From Biotech to SaaS to Crypto to eComm and beyond, our team likely has relevant experience. Don’t waste your time trying to manage a bookkeeper who is trying to reinvent the wheel - the only team doing any inventing should be your startup!

PROFESSIONALS IN BOOKKEEPING

Kruze bookkeepers will help your startup have accurate, up-to-date financial statements that you can use to manage your business’ growth and cash flow

QUALITY BOOKKEEPING PROVIDER

Our account managers have an average of 11 years of experience, and are experts on helping young, funded businesses with their bookkeeping

HIGHLY AUTOMATED SYSTEMS

We have developed highly automated systems, and our team is experienced handling the nuances of early-stage, venture funded companies.

Kruze’s key advantages:

The Best Automated Bookkeeping Systems and People Who Care

- We’ve created an all-in-one bookkeeping service and back office solution for VC backed businesses using best in class accounting automation.

- Even more importantly, our team loves what we do and we care deeply about your startup’s success.

- We’ve got the systems, experience and the people to scale with your business from one person to hundreds, from a half a million in seed financing to your $100 million Series D round.

- Our clients have collective raised over $15 billion in venture and seed financing, and one to three of our clients are acquired each and every month.

- We know what it takes to be ready for the next fund raise - and how to navigate the due diligence public companies conduct when they acquire a venture backed company.

Do startups need a bookkeeper?

Most very-early stage startups do not need a third party, nor a full-time, bookkeeper. Assuming that the startup has a bookkeeping software like QuickBooks Online set up, we recommend one of the founders DIY the books until the company has raised a reasonable amount of funding. The typical point where it starts to make sense to hire a startup bookkeeper is when a company has raised over $250,000 in funding and has 6+ months of runway. At that point, it makes more sense for the founders to be 100% focused on growing the business, and let an experienced startup bookkeeper handle the books.

When does a funded startup need to start worrying about doing bookkeeping?

If you haven’t been keeping track of your books by the time you raise your first outside money, you need to get your books in order.

We generally recommend that businesses move away from spreadsheets and into an accounting software as soon as possible.

- Day one you start the company and start a bank account.

- Connect that bank account to QuickBooks.

- Start getting the bank feed going into QuickBooks and actually characterize the transactions inside of QuickBooks.

Should you do your bookkeeping in a spreadsheet?

No. When a business takes outside money, they need to have a firm understanding of their books, since investors usually demand transparency. Spreadsheets are great - every bookkeeper loves them - but you need to spend the $50 a month on a solid bookkeeping software like QuickBooks Online.

The transition from spreadsheets to actual bookkeeping software for financial management greatly benefits businesses in a few key ways:

- Accuracy: Bookkeeping software reduces the risk of errors that are common in manual calculations on spreadsheets. They have built-in error-checking tools and ensure that all financial records are accurate and consistent.

- Efficiency: Software automates various accounting tasks like reconciling bank statements, tracking expenses, and calculating financial ratios, saving valuable time and effort. They also make tax reporting efficient and easy.

- Scalability: As a business grows, its financial data becomes more complex and voluminous. Bookkeeping software can easily handle this growth, even at an exponential rate.

- Integrations: The best bookkeeping tools, like QuickBooks, can integrate with various systems like bank accounts, payroll systems, and revenue systems for seamless scalability. This means data comes in automatically - unlike with a spreadsheet where you need to manually key in information. And I’m sure you didn’t found your startup to do data entry!

Additionally, software gives you:

- Version Control: With the right software, businesses own their data and it will always be theirs regardless of who is doing the bookkeeping work. Spreadsheets are ripe for version control issues, meaning it’s hard to have multiple people make updates without causing possible conflicts.

- Insights and Reporting: Accounting software provides startups with important financial data information like burn rate, revenues, cash flows, etc. QuickBooks, for instance, has built-in Income Statement and Balance Sheet reports. This helps the business gain insights into its financial health and performance and make informed decisions.

- Ease of Use: Using off the shelf software like QuickBooks ensures that virtually any accountant or CPA can operate it as it’s an industry-standard system. As businesses grow and shift their bookkeeping from in-house to outsourced services and vice versa, this interoperability is crucial. Unlike a custom spreadsheet, which requires training.

- Double-Entry Bookkeeping: A cornerstone of sound accounting, the double-entry bookkeeping system is designed to keep your financial equation—assets = liabilities + equity—always balanced. While spreadsheets allow for manual double-entry bookkeeping, the process is prone to human error and can be extremely time-consuming. In contrast, specialized accounting software has built-in capabilities for double-entry accounting. This feature ensures automatic balancing; when you record an entry in one account, a corresponding entry is automatically made in another. The system also enhances financial accuracy by providing an additional layer of verification—should your accounting equation ever fail to balance, it’s a red flag that prompts you to search for discrepancies. Furthermore, as startups evolve and engage in increasingly complex financial transactions, a built-in double-entry system simplifies these complexities by clearly detailing both the cause and effect of each transaction in your financial statements.

Upgrading from spreadsheets to accounting software can considerably increase the accuracy, efficiency, and scalability of financial management in businesses, besides offering additional benefits. Nobody wants to accidentally run out of money… or fail to raise a Series A round due to messy books!

Bookkeeping software: Letting startups to maintain accurate books and records

Choosing the right bookkeeping software can be a game-changer for startups. Such software aids in recording financial transactions efficiently and ensures that the financial records are always up to date. This level of detail is invaluable when it comes to financial reporting, filing tax returns, and validating the business transactions recorded. It’s also a key component in demonstrating due diligence and maintaining accurate books, which are necessary when it’s tax time.

So, here are the basics of bookkeeping for startups - in particular, early-stage companies that have or are going to raise outside venture capital or seed funding.

What to look for in a startup bookkeeper

Startups need more than a robot to reconcile the accounts, they need a trusted advisor who is in tune with their unique growth path.

Kruze’s finance and bookkeeping team combines experienced startup accountants with the best off the shelf, and custom built, accounting software. We automate everything but have our experts keep an eye on your financials to catch the mistakes the systems make. Founders shouldn’t be burdened with making sure they carefully and correctly code financial transactions so automated bookkeeping services don’t mess up.

We believe that it’s our team’s job to help save our CEOs time and take care of the basic bookkeeping tasks that other services dump onto their clients. Unlike other startup bookkeeping services, our team deals with the complexities of early stage books and sets you up with good bookkeeping so you are ready for VC and M&A due diligence - plus you’ll have the financial data you’ll need to grow your company. As pioneers in cloud accounting, Kruze has been an Intuit Firm of the Future Finalist, an Expensify Emerging Partner of the Year, and is a Gusto Gold Partner.

Here is what to look for in a startup bookkeeper:

ACCURACY

Venture capitalists don’t like it when their portfolio companies’ numbers change, and you don’t want your numbers to be squirrely during an acquisition. Because we are totally focused on startup business models, we understand the nuances required to get the numbers right. And because we are one of the leaders in accounting automation, we’ve seen the mistakes the automated systems make. If you are aiming for your early-stage company to become a unicorn, you need accurate books!

SPEED

At early-stage companies, decisions are made on tight timeframes. We know that your company is burning cash, and understand how important it is to get the financial data you need to make critical decisions. Kruze’s bookkeepers will work with you to find the financial delivery date that works for your needs.

RELIABILITY

Startup CEO’s don’t have time to proof their books. Our team conducts multiple reviews on every client’s financials - every month. And because we are familiar with early-stage companies’ business models, we understand the complexities (and importance) of issues like revenue recognition, ARR, capitalized vs. non-capitalized development costs and more.

EXPERT ADVICE

Our team loves working with early-stage companies, and we’ve got the experience to help you make critical financial decisions. And our advice can grow with your company, from simple bookkeeping to part-time CFOs. We have former VC’s on staff to help prepare you for your next funding round, and former IRS agents on hand to assist you as you think through the tax ramifications of selling your company. And we have one more critical advantages - we care more!

LOW TIME COMMITMENT COMMITMENT

CEOs of early-stage companies have a tremendous number of things to accomplish. Managing the books shouldn’t be one of them! Kruze’s bookkeeping team strives to handle all the minutia so you can focus on growing your business, achieving product-market fit, advancing your R&D, hiring, etc. We understand the pressure of running a hyper-growth business, and want to make your financials as easy as possible.

PRICE

Early-stage companies are rightfully price sensitive. Kruze offers a variety of pricing plans to help startups afford accurate bookkeeping services. Check out our pricing page to learn more.

How to hire the best bookkeeper for your startup’s growth

Hiring the right bookkeeper for your startup can influence your startup’s financial health, so make sure you pick the right one. For most young companies, hiring an outsourced bookkeeping firm is often more cost-effective than bringing on a full-time hire. The right outsourced team can bring a wealth of expertise—from tax law to GAAP compliance and VC financing—that’s challenging to find in a single hire. Look for firms experienced with venture-backed startups, like Kruze, as they’ll understand the unique metrics and financial rigor required to attract and retain investors.

To hire the right bookkeeper, prioritize firms with deep experience in the startup ecosystem. Look for a team that not only understands the basics but also has expertise in supporting rapid growth, handling complex reporting, setting up new systems and that knows what investors will look for in board meetings or in diligence sessions. Make sure you hire someone with in-house experience with startup-specific needs like the R&D tax credit, which can help reduce your burn rate, and confirm that they have an in-house tax team to handle compliance and diligence directly. You don’t want to have to coordinate calls between two different accounting firms during M&A diligence!

Additionally, pay attention to how they handle client relationships. You want a firm that provides a dedicated accountant for consistency and clear communication, rather than a rotating cast of advisors. Ensure there’s a backup plan in case your primary contact is unavailable. When interviewing firms, talk directly with an accountant, not just a salesperson—this gives you a clearer sense of the team’s approach and capabilities. Ultimately, hiring a startup-savvy bookkeeper with these qualities will set a strong financial foundation as your company scales.

The due diligence edge: how startups benefit from professional bookkeeping

Professional bookkeeping is a pretty serious advantage for startups, especially when due diligence is involved. While we do think you can succeed if you DIY your books, you’ve really got to be on the ball. When you have a professional you get some serious advantages. Whether it’s for internal checks or preparing for investor scrutiny, maintaining a double-entry bookkeeping system ensures accuracy in financial records. It’s also about being ready for all types of financial data requests, from the most common to the very specific, like the net profit margin ratio or cash runway analysis, which could be pivotal in strategic business decisions. VC due diligence is getting harder, so be prepared by working with an experienced pro.

Incorporate as a Delaware C Corp

If you are going to raise real Angel and VC capital, then incorporate as a Delaware C Corp. Venture Capitalists do not typically want to invest in LLCs and S Corps. So if you are raising money, especially from professional or experienced investors, you’ll need to choose a Delaware C Corp as your entity type. Btw - LLC and S corp structures are great if it’s a family owned business and you will not be raising VC capital.

Standalone bank account

Get a standalone bank account for the business. Don’t intermingle investor funds or your business expenses with your personal money!

Set up expense tracking

Set up a system to help with expense tracking. In particular, go for automation that can: document the paper trail of expenses for IRS audit purposes, help keep founder and businesses expenses cleanly separate, and easily integrate with your accounting system. We recommend Expensify, because it’s got a great mobile app, solid online interface, and works well with QuickBooks Online. Learn more about setting up expense tracking.

Set up payroll system

Fire up a payroll system. If you are hiring a team, or getting ready to pay yourself, one of the most important steps in bookkeeping for a startup is getting an automated payroll system that smoothly interfaces with your accounting software.

We typically recommend Gusto or Rippling

Set up a bill payment system.

We suggest Bill.com. Their system has a solid audit trail, works easily online, and interfaces with your accounting system automatically, saving you time. You can also use it to pay contractors - which is a pretty common expense for most startups.

Get an accounting system

We recommend QuickBooks Online (“QBO”) as the right bookkeeping software for early-stage companies and high growth small businesses. It’s the leading small business accounting software in the US for small businesses, and interfaces nicely with other automated systems like payroll.

Set up your chart of accounts

The chart of accounts will list every “account” where you’ll organize all the records of expenses, revenue, etc. on your general ledger. Basically, it’s a list of all of the places where you might want financial transactions to be recorded.

Now that you’ve got your basic bookkeeping systems setup and connected, it’s time to actually do your books!

For early-stage businesses without a ton of complexity, and who are using the systems above that automate a lot of the work, it’s not so hard to generate the financial records that you will need to run your business.

Let’s dig into the basic steps required to DIY your startup’s books.

Bookkeeping for Startups - DIY steps

Not every startup will be ready to hire an outsourced bookkeeping service on day one. We understand that money can be very tight day one. But that’s no excuse for not keeping track of your financials.

So here are some tips, and the steps, for a small company that wants to manage the financial statements in house. If you are a company that expects to raise venture funding, you may also want to check out our free due diligence checklist, so you know what sort of materials you’ll need to keep track of prior to raising outside capital.

How to set up your startup’s bookkeeping and accounting system

1. Reconciling your bank account

Your bank account never lies. The bank account is where all the transactions actually happen. And you have a record of that, basically “verified” by your financial institution. Now with Quickbooks, you first must have connected Quickbooks into your bank account. To do this, you actually type in your company’s bank username and password to get all the financial transactions flowing into Quickbooks.

This is important, because then you can match transactions that are in Quickbooks against the bank transactions. It’s this nice little clearinghouse in what accountants call “reconciling.” If you reconcile your transitions and actually match them against bank transactions, then Quickbooks becomes reliable. So a good example of why this is important is that sometimes people might put fake revenue transactions or fake expenses or make journal entries to cover up expenses so that no one could see them.

And you only know those transactions are false after you’ve actually compared every transaction coming from the bank and against the statement versus what’s in Quickbooks. So reconciling cash (which is shown in your bank account) is your way to detect fraud. It’s your way to make sure your finances are actually legit and a way to make sure there’s no funny business going on. So you really want to have those bank transactions flowing into Quickbooks so that you can reconcile. So one of the first things when you are doing bookkeeping for startups is to reconcile the bank account against Quickbooks.

2. Enter Other Transactions into Quickbooks

Next, you’ll need to get all of your other transactions into QBO, and also reconcile other important parts of your financial statements.

We recommend you do what are called “intra-month reconciliations.” This means you should look at your books and transactions in the middle of the month, not just after it’s over. By reconciling some of your transactions in the middle of the month and getting all that information into your bookkeeping software, you’l reduce your workload at the end of the month. Plus, you’ll give yourself more visibility into your performance.

And - we can’t stress this enough - your bank account should be the source of truth, so you have to reconcile your figures back to the bank!

3. Recognize Revenue

Bookings are the culmination of all the contractual payments you’re gonna get, usually over the next 12 months. So, if you close a $1.2 million contract, over the next 12 months you recognize that as bookings.

Revenue is a backward-looking metric and revenue you recognize over the length of the service period. So, if you close that same $1.2 million contract over 12 months, each month going forward you’re gonna recognize $100,000.

4. Send invoices and review your receivables

If you are billing clients, send invoices and review your receivables; and review AP Aging.

Founders need to understand a few key items to understand how their cash burn may differ from their income statement’s operating loss.

5. Payroll

If you use one of the automated payroll systems we recommend, like Gusto or Rippling, running payroll is easy - in fact, it just happens.

You’ll want to check that your payroll has synced into QuickBooks Online, and then you should be good. However, if you are paying contractors, there are some tips you should think about

6. Account for any Investments

Most early-stage companies are going to raise a SAFE, convertible note or preferred equity to get going. When doing bookkeeping for startups, you need to make sure that you account for these fund raises correctly.

We have a few pieces that will help you understand how to record these investments into your company.

Signs of a bad bookkeeper

Time and time again, we see not very good bookkeepers not labeling the vendor names in their clients’ accounting software.

Putting the vendor name in for each expense is a simple thing. But, low quality bookkeepers are trying to get the transactions into QuickBooks as quickly as possible to save time, and they don’t really care if they’re labeled or if they’re in the right categories.

At Kruze, we have a different methodology. Kruze uses a proprietary software that plugs into QuickBooks and it categorizes about 70% of the transactions, and automatically. And we complement that automated bookkeeping with high-quality staff accountants. When you have your vendors labeled, you can actually run reports by vendor and see exactly what you’re spending.

This became very important in the early days of COVID because a lot of companies were trying to cut burn. If companies didn’t have their vendors labeled in their accounting software, then they couldn’t see how they were spending their money. So make sure your vendors are labeled and it will make your financials actually actionable.

How good bookkeeping pays for itself

Companies that are planning on raising venture capital need good bookkeeping services - VCs, strategic acquirers and IPO underwriters want financials that are done right - the 1st time.

Founders who try to skimp on bookkeeping services can find that poorly kept books can end up being super-costly for a number of reasons. Here are some of the reasons why good bookkeeping matters to early-stage companies:

- Know where you are spending your money so you can manage costs, control your burn and look good to investors

- Good books mean you can move fast during VC and M&A due diligence - and being able to share your financials quickly with strategic partners inspires confidence

- A good accountant helps you make sure your a collecting your revenue and not over-paying vendors, reducing your burn rate

- Solid record keeping means you can cut your burn by capturing an R&D tax credit - this could save your startup up to $250,000 a year

Watch out for these common startup bookkeeping mistakes

We strongly encourage lightly funded startups to do their bookkeeping themselves - it’s not that hard, at least when you are small and have very few transactions. However, there are several common bookkeeping mistakes you should be aware of if you are doing your own books.

- Not booking equity investments correctly - it’s not revenue, even though cash comes into your business!

- Procrastinating - you actually do need to manage to your numbers

- Using cash accounting instead of accrual (note that we find that a lot of “automated” bookkeepers do this also, mainly because they are lazy

- Using Excel instead of QuickBooks

- Not setting up payroll integrations into QuickBooks for easier accounting

- Not keeping track of vendor invoices and accidentally paying the same vendor or contractor multiple times

- Forgetting to bill clients

- Not doing 409a’s if they have stock options

- Forgetting to file income taxes

- Forgetting to pay Delaware Franchise tax

Why a CPA firm is the best startup bookkeeping service provider

Kruze is not your typical startup bookkeeping service - we are a CPA firm. CPA firms are held to a higher standard of accuracy, and offer a superior range of services than both typical small business bookkeepers and technology enabled bookkeeping service providers. Here are some of the reasons that founders choose Kruze:

- Expertise: A CPA firm like Kruze has a team of licensed, trained and experienced accounting professionals who are knowledgeable about GAAP based accounting, tax rules and high-growth startup finance. The Kruze team provides valuable insights and guidance to help your startup stay compliant, make informed financial decisions and be prepared for VC due diligence.

- Efficiency: By outsourcing your bookkeeping to a CPA firm like Kruze, founders free up their time to focus on running and growing their business. Kruze handle all of your financial record-keeping, including projections, payroll, and tax preparation.

- Tax planning: Kruze has in-house tax professionals, both CPAs and IRS Registered Agents, who can help you develop a tax strategy that maximizes your tax credits and stay compliant. Tax diligence is an important part of selling a startup to large technology companies, and since Kruze is a one-stop-shop, founders only have one team to coordinate with.

- Venture capital experience: If your startup is looking to raise capital, having a CPA firm with former VCs on staff can be a huge advantage. These individuals have firsthand knowledge of what investors are looking for, can help you put your financials in the best possible light and make sure your numbers tell your story and reflect your vision.

With reasonable, fixed fee pricing plans, startups can get CPA level expertise for the cost of what most technology enabled bookkeeping service providers charge from Kruze.