What does a US based company need to do to comply with IRS regulations in paying foreign contractors?

Table of contents

What should I do when I pay a foreign or overseas contractor?

In general, a startup will only need to collect a W8BEN form from a developer or professional in order to collect their info. No tax withholding necessary. I highly recommend using Track1099 to collect these forms (+ W9s) and keep you in check. Filing form 1042 for startups is rare, but I have seen a few cases.

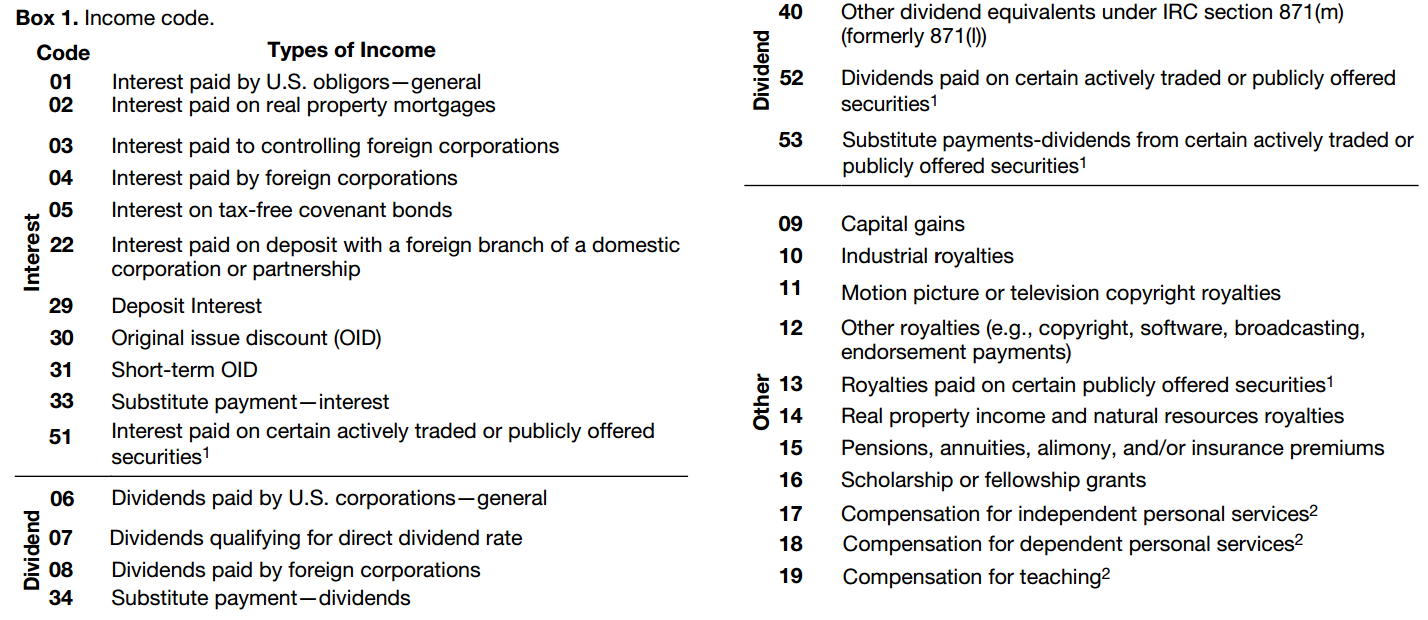

On occasion (for startups that is), you may need to withhold taxes. This usually applies to royalties, athletes, artists, etc. Consult your CPA, but here’s a quick snapshot of what types of they’re looking for:

Categories:

Startup TaxesTable of contents

Recent questions

Top viewed questions

- What happens if the IRS audits me and I do not have the receipt for an expense (assuming it was a legitimate expense)?

- How should convertible note financing be handled on the balance sheet?

- How do startups account for equity and fundraising on the Balance Sheet?

- For startups incorporating in Delaware, what firms are good registered agents to use?

- 2025 Founder Salaries by Stage