FORM 1120: EVERYTHING YOU NEED TO KNOW

What is Form 1120?

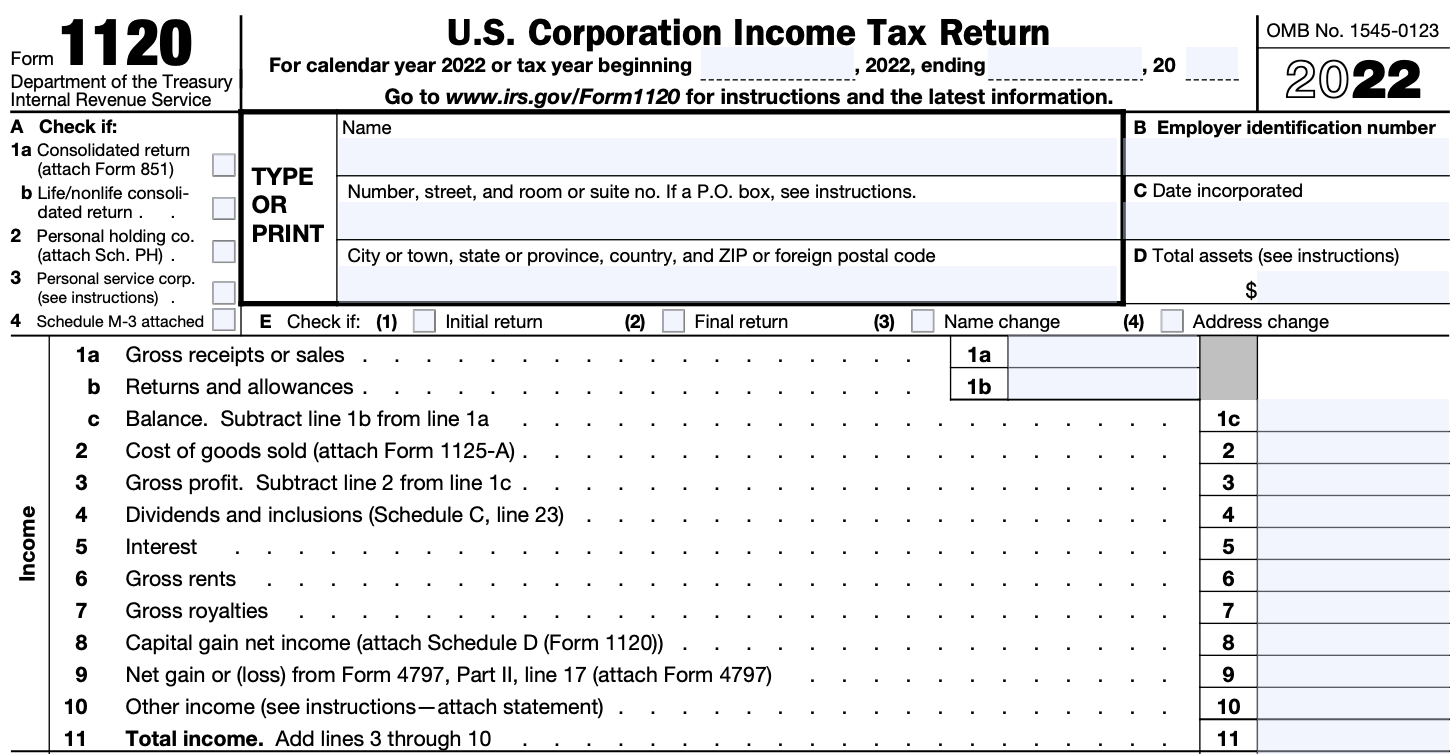

Form 1120 is the corporate income tax return form that US corporations need to file with the Internal Revenue Service (IRS). It is used to report the company’s income, deductions, and tax liability. The due date for filing Form 1120 is typically April 15th, but it can be extended until October 15th by filing Form 7004. Visit our C-Corporation tax deadlines calendar to see the current year deadlines.

To complete Form 1120, companies will need various documents and financial statements related to their business, including the IRS Employer Identification Number (EIN) letter, basic business information, shareholder SSN/address info, existing tax communications, prior year tax returns, local tax returns (if applicable), financial statements, and a capitalization table.

We strongly recommend keeping track of these materials throughout the year to avoid any last-minute rush! And for newly incorporated startups, the biggest issue we find founders have with gathering materials is the EIN. The EIN is required to complete Form 1120 and is a unique nine-digit number assigned by the IRS to identify a business entity for tax purposes.Look for your EIN confirmation letter: When you initially applied for an EIN, the IRS would have sent you a confirmation letter that includes your EIN. Search for this letter in your records.

Other Types of Form 1120

While the standard 1120 is what most of Kruze’s client use, since they are C-Corps, there are a few other popular versions that may be applicable to your business - this can be confusing, and is why you should work with an experienced CPA to get your business’ taxes done. The most common other version are the 1120-S, for S-Corps, and the 1120-F, for foreign corporations. And if you want to get obscure, try the Form 1120-ND, the return filing for nuclear decommissioning.

What important things should founders know about Form 1120?

Tax season can be a busy time for startup founders, and there are a lot of different forms to complete and regulations to follow. One of the most important is Form 1120, which startups use to report income, deductions, and credits every year. We’ll go into more detail, but first let’s look at the top five things founders need to know about this tax form.

- Your startup needs Form 1120 for due diligence.

- Every company needs to file this form, even if you lost money.

- The deadline is April 15 but can be extended to October 15

- It’s complex! Get professional help.

- You’ll probably also need to file a state return.

Do I need to file a Form 1120 if the business had no income?

Most folks only think about the annual Form 1120 Tax return, but there’s actually a ton of taxes and tax deadlines for Delaware C-Corps.

And Yes, even bootstrapped pre-revenue startups must pay taxes. You might not be subject to Income Taxes (which are based on profitability) but you will still be subject to a wide variety of other taxes which aren’t always connected to Revenue.

To start, here are 4 Startup Tax Calendars, based on metro:

- New York Startup Tax Calendar

- Palo Alto Startup Tax Calendar

- Santa Monica Startup Tax Calendar

- San Francisco Startup Tax Calendar

Quick caveat though, these startup tax checklists aren’t complete. There are actually a bunch of taxes out there, some of which may or may not apply to you (depending on your unique circumstances, of course). Here’s a list of just some of the different types of taxes out there that you may need to consider:

- Income Tax: this type of tax is what most people think of when they hear taxes. It’s taxes based on your Net Income, or profit.

- Gross Receipts Tax: some cities, like San Francisco, will tax your Gross Revenue.

- Franchise Tax: this type of tax is imposed on businesses who just…exist. Yes, for the pleasure of existing, you will be asked to pay a tax. There’s often a minimum fee, and most times it has nothing to do with whether you’ve generated income. The most common type of Franchise Tax for venture backed startups is DE Franchise Tax, which runs $400+ every year.

- Payroll Tax: if you have employees, you have payroll tax. Be sure to use a payroll provider like Gusto to help you pay the right taxes at the right time, and file all the requisite forms (like the 941s).

- Sales Tax: if you tangible goods (eg clothes, furniture, widgets, stuff you can hold in your hand), you’ll need to register, pay, and file sales tax. Use Avalara, because like payroll tax, it can get super crazy very quickly.

- SaaS Tax: see more here.

- Property Tax: if you have significant property holdings, whether that be land, or even just computers/tables/chairs, you might be subject to property taxes. This type of filing is frequently known as a “571-L.”

- Foreign Tax: if you have a foreign subsidiary or parent company, you might be subject to withholding tax, or FBAR/5471/5472 reporting. Be sure to get this one right; the penalties for getting it wrong can be $10K+.

A very common misconception is that the CPA or firm that filed your annual tax return (the 1120) will have taken care of all these types of taxes: that is never the case!! It is always the CEO’s responsibility to make sure that these taxes are addressed and paid on time. Granted, a CEO can only know so much… and the CPA can only guess as to which types of taxes a company might be subject to. Hence, it’s really important to sit down with a CPA to make sure that all bases are covered based on your company’s unique situation.

How to get the Form 1120

You can find the official Form 1120 on the IRS’ website. Always go directly to the IRS’ site to get the form, as they tend to have minor changes from year to year. You can get the IRS Form 1120 by clicking here to visit the Internal Revenue Service’s page about Form 1120.

When is the 2023 Form 1120 filing date?

For most US corporations, April 15th is the due date for the Form 1120, the corporate income tax return. This can be extended six months.

If a corporation wishes to extend its Form 1120 due date, it can request an extension of time to file. To obtain an extension, the corporation must file Form 7004, “Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns,” by the original due date of the return. The extension will generally allow the corporation to file its tax return up to six months after the original due date.

The Internal Revenue Service (IRS) is responsible for enforcing the federal income tax laws and for administering the tax system in the United States. The IRS is a bureau of the U.S. Department of the Treasury and is responsible for collecting taxes, enforcing the tax laws, and providing tax assistance to taxpayers.

When was the 2023 Form 1120 due?

Due to a Federal holiday, the IRS moved the 2023 Form 1120 deadline to April 18th, 2023 and this could have been extended until October 16th, 2023.

Why does the Form 1120 due date change some years?

If the due date for filing a tax return falls on a Saturday, Sunday, or legal holiday, the due date is moved to the next business day. This means that if April 15 falls on a weekend or legal holiday, the due date for filing the tax return would be the next business day. Recently, a combination of Emancipation day, a holiday in Washington DC, where the IRS is headquartered, and the 15th falling on a weekend, have pushed out the Form 1120 due date.

Where to file Form 1120

Corporations wishing to file the Corporate Income Tax Form 1120 with the IRS by mail must use the correct mailing address for the IRS based on the corporation’s location, and in some instances, the corporation’s total assets at year end. Visit the IRS’ website here to find the correct mailing address.

What materials do you need to complete a Form 1120?

To file Form 1120, a startup founder will need several documents and financial statements related to their business. Here’s a good starting list of the materials you’ll need to have on hand to complete Form 1120:

- IRS Employer Identification Number (EIN) letter: This is the letter you received from the IRS when you obtained your EIN. You’ll need to reference this number on your tax return.

- Basic business information: This includes your company’s legal name, business address, and other contact information.

- Shareholder SSN/address info: You’ll need to provide the Social Security numbers and addresses of all shareholders who own more than 5% of the company’s stock.

- Existing tax communications: This includes any tax documents you’ve already received from the IRS or state tax agencies, such as tax payment vouchers or notices.

- Prior year tax returns: You’ll need copies of your prior year federal and state tax returns, as they contain information that will be used to calculate your current year taxes.

- Local tax returns: If your business is required to file local tax returns, such as city or county taxes, you’ll need to have copies of those returns as well.

- Financial statements: This includes a full year balance sheet, profit and loss statement (also known as an income statement), and general ledger. These statements should accurately reflect your company’s financial position for the tax year.

- Capitalization table: This document lists all the shareholders of your company, along with their ownership percentages and the type of shares they hold (e.g., common, preferred).

Getting these materials together will help you produce your tax return Form 1120 more quickly and efficiently. One good tip is that it makes sense to keep track of these materials as you create them during the year, so that there isn’t a rush in March trying to get everything pulled together!

And, answering a common question we get:

Do I Need my EIN to Complete a Form 1120?

Yes, you need your EIN to complete a Form 1120. An Employer Identification Number (EIN) is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to identify a business entity for tax purposes. It’s quite similar to a social security number for an individual trying to do their taxes. A startup founder will need to provide their EIN when filling out Form 1120, along with other financial and business information such as the date of incorporation, total assets, gross receipts and sales, cost of goods sold (COGS), tax deductions, tax credits, capital gains, dividend, interest, and royalties earned, liabilities, and shareholder equity. The EIN is used by the IRS to track the startup’s tax returns, payments, and other tax-related activities, so make sure you have it on hand when it’s time to do your federal returns.

Summary

Here is a high-level set of instructions for filling out Form 1120; we strongly recommend working with an experienced tax preparer for your corporate tax returns.

- Enter Corporation Information

- Provide your corporation’s name, address, employer identification number, date incorporated, and total assets.

- Indicate if this is your first or final return, or if you’ve had a name or address change.

- Report Income

- Enter gross receipts or sales, returns and allowances, cost of goods sold, and gross profit.

- Include income from dividends, interest, rents, royalties, capital gains, and other sources.

- Claim Deductions

- Deduct allowable expenses such as officer compensation, salaries and wages, repairs and maintenance, bad debts, rent or lease expenses, taxes, interest, charitable contributions, depreciation, advertising, and pension/benefit plan contributions.

- List any other deductible expenses not reported elsewhere.

- Calculate Taxable Income

- Subtract total deductions from total income to arrive at taxable income before net operating loss deduction and special deductions.

- Apply any net operating loss carryovers and special deductions.

- Compute Tax and Credits

- Calculate total tax liability using the applicable tax rate and schedules.

- Report any estimated tax payments and refundable credits.

- Determine Amount Owed or Overpaid

- If total payments and credits exceed total tax liability, indicate the overpayment amount and whether you want it refunded or applied to next year’s estimated tax.

- If total tax liability exceeds total payments and credits, calculate the amount owed, including any estimated tax penalty.

- Sign and Date

- An authorized corporate officer must sign and date the return.

- Indicate whether the IRS is allowed to discuss the return with the paid preparer.

Remember to attach all required schedules and forms, such as Schedule C, Schedule D, etc.

Common schedules and forms associated with Form 1120

When filing your corporate tax return, startup founders will typically need to complete several key schedules as part of Form 1120. Here are some of the most common tax forms and schedules that VC-backed startups file in association with their annual corporate tax return:

Schedule K (Other Information)

A required questionnaire about your corporation’s activities and structure that uses a straightforward “Yes/No” format. This schedule helps ensure compliance by gathering critical information about ownership, investments in other companies, and various business activities throughout the tax year. Schedule K must be completed by all C-Corporations, including both domestic and foreign corporations doing business in the United States. Learn about Form 1120 Schedule K - Other Information.

Schedule M-1 (Income Reconciliation)

Explains differences between your company’s book income and taxable income, which is especially important for venture-backed startups that often have significant differences between their GAAP financial statements and tax reporting. This schedule helps the IRS understand how your company arrived at its taxable income by listing all items that create differences between financial accounting and tax treatment. Learn about Form 1120 Schedule M-1 - Reconciliation of Income (Loss).

Schedule M-2 (Retained Earnings Analysis)

Shows changes in your corporation’s retained earnings during the tax year, which is particularly relevant for startups tracking their accumulated losses. This schedule helps shareholders understand important details such as basis calculations, dividend distributions, and previously taxed income, while also serving as a statement of retained earnings for financial reporting purposes. Learn about Form 1120 Schedule M-2 - Analysis of Unappropriated Retained Earnings.

These schedules are crucial components of your corporate tax return. We recommend working with an experienced CPA to ensure they’re completed accurately and consistently with your other financial reporting.

Step-by-step instructions: Form 1120

Filling out IRS Form 1120, the U.S. Corporation Income Tax Return, can be a complex process for startup companies. We strongly recommend that you work with an experienced startup CPA to make sure the form is completed accurately and completely. The form is used by C corporations to report their income, gains, losses, deductions, and credits, and to calculate their income tax liability.

Here are step-by-step Form 1120 instructions to help startup companies complete this tax form:

Step 1: Gather necessary information and documents

Before starting Form 1120, gather the following documents:

- The company’s Employer Identification Number (EIN).

- The company’s financial statements, including income statement, balance sheet, and cash flow statement.

- Details of income, deductions, and credits.

- Supporting documents for any transactions during the tax year, such as receipts, invoices, payroll records, and depreciation schedules.

- Information on any prior-year carryovers (such as Net Operating Loss carryovers).

Step 2: Download IRS Form 1120

Download Form 1120 from the IRS website to ensure you have the most current version and the Form 1120 instructions. Familiarize yourself with the form’s instructions and any changes or updates relevant to the tax year you’re filing for.

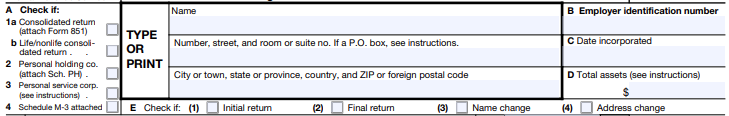

Step 3: Complete the basic information section (Page 1)

- Name and Address: Enter the corporation’s legal name and address.

- Employer Identification Number (EIN): Enter the corporation’s EIN.

- Date of Incorporation and Business Activity Code: Provide the date of incorporation and select the business activity code that best describes the company’s primary business activity.

- Total Assets: Enter the total assets from the company’s balance sheet as of the end of the tax year. The Total Assets amount should match the end-of-year total on Schedule L.

- Initial Return, Final Return, Name Change, or Address Change: Check the appropriate box if any of these situations apply to your corporation.

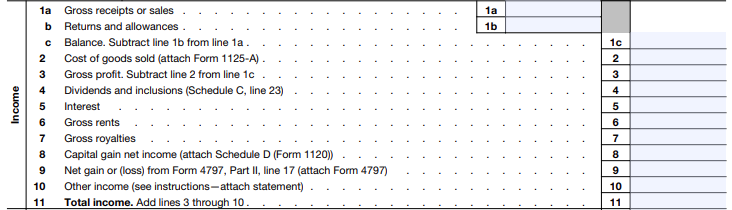

Step 4: Calculate gross income (Lines 1-11)

- Line 1: Enter the corporation’s gross receipts or sales from its operations.

- Line 2: Subtract any returns and allowances from Line 1 to get net receipts.

- Line 3: Enter the cost of goods sold (COGS). This is derived from Schedule A (Cost of Goods Sold), which must be completed if applicable.

- Line 5: Add any other income, such as interest income, dividends, or rental income.

- Line 10: This is for “other income,” and should include any income not reported on previous lines.

- Line 11: The total of Lines 3 through 10 will give the corporation’s total gross income.

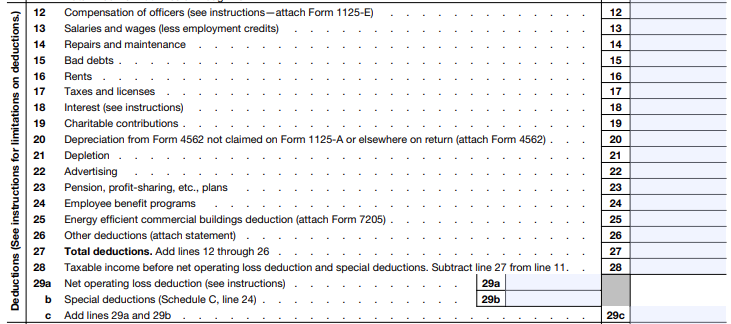

Step 5: Calculate deductions (Lines 12-29)

- Line 12: Enter the compensation of officers. If more than $500,000 was paid to any one officer, complete Schedule J.

- Line 13: Enter salaries and wages paid to employees (other than officers).

- Line 16: Enter any bad debts that have been written off during the year.

- Line 20: Enter any depreciation and amortization expenses, which are further detailed on Form 4562.

- Line 26: List all other deductions not specifically itemized on Lines 12-25, including advertising, legal and professional fees, and office expenses. Remember that startup costs and organizational expenses may be deductible and, if so, should be included.

- Line 27: The total of Lines 12 through 26 will give the corporation’s total deductions.

- Lines 28 through 29a: Complete the calculations as indicated.

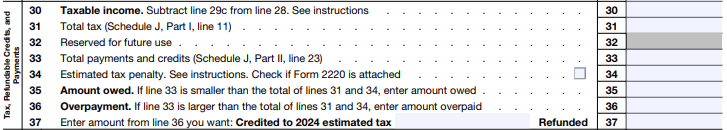

Step 6: Calculate taxable income (Lines 30-37)

- Line 30: Subtract total deductions (Line 29) from total income (Line 11) to calculate the corporation’s taxable income.

- Line 31: If the corporation has a Net Operating Loss (NOL) carryover from a previous year, enter it here.

- Line 34: Compute the total tax by applying the corporate tax rate to taxable income. Check if any additional taxes apply, such as for Personal Holding Company Tax or Alternative Minimum Tax (AMT).

- Line 35: List any tax credits that the corporation is eligible to claim. Attach the relevant forms for any credits.

- Line 36: Subtract the total credits (Line 35) from the total tax (Line 34) to calculate the tax after credits.

- Line 37: List any estimated tax payments, extension payments, or overpayments applied from the previous year. This will give the total amount of payments.

Step 7: Calculate amount owed or overpayment (Lines 38-41)

- Line 38: Subtract the total tax (Line 36) from total payments (Line 37). If the total tax is greater than the payments, the result is the amount owed.

- Line 40: If payments exceed the total tax, the result is an overpayment. Indicate whether you want the overpayment credited to next year’s estimated tax or refunded.

Step 8: Complete Schedule C (Dividends, Inclusions, a Special Deductions)**

- If the corporation received dividends from domestic or foreign corporations, complete Schedule C to calculate the Dividends Received Deduction (DRD).

Step 9: Complete Schedule J (Tax Computation and Payments)

- Schedule J is used to compute the total tax, including any other taxes such as the Alternative Minimum Tax (AMT). It also provides space to list payments and refundable credits.

Step 10: Complete Schedule K (Other Information)

- Answer the questions regarding the corporation’s accounting method, business activities, ownership, foreign transactions, foreign ownership, etc. These questions help the IRS understand the corporation’s operations and identify any potential red flags. Startups with international connections should pay special attention to this section

.

Step 11: Complete Schedule L (Balance Sheets per Books)

- Report the corporation’s balance sheet at the beginning and end of the tax year. Ensure these numbers align with the company’s financial statements.

Step 12: Complete Schedule M-1 (Reconciliation of Income)

- Use Schedule M-1 to reconcile the corporation’s book income (financial statement income) with its taxable income reported on Line 30.

Step 13: Complete Schedule M-2 (Analysis of Unappropriat Retained Earnings per Books)**

- Schedule M-2 provides a reconciliation of the corporation’s retained earnings at the beginning and end of the tax year.

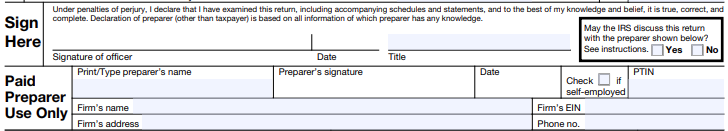

Step 14: Review and sign Form 1120

- Review the entire form for accuracy, completeness, and consistency. Make sure all schedules are properly attached.

- An officer of the corporation must sign and date the form. A paid preparer, if used, must also sign and provide their information.

- E-signatures are now accepted for e-filed returns.

Step 15: File Form 1120 and pay any taxes due

- Mail Form 1120 to the IRS or file it electronically using the IRS e-File system or an authorized e-File provider. Be sure to pay any taxes due by the deadline, typically the 15th day of the fourth month following the end of the corporation’s tax year.

Tips for startups

- Consider professional help. Startups may want to consider consulting a CPA or tax professional to ensure compliance and maximize deductions.

- Stay organized. Keeping organized records throughout the year will make tax preparation smoother.

- Be aware of deadlines. Late filings can result in penalties. Keep track of filing and payment deadlines.

- Remember the R&D Tax Credit. Startups should track and document any research and development expenses, since these can help the company claim valuable tax credits.

While startups can follow these Form 1120 instructions, it’s a good idea to work with tax professionals who understand the unique needs and requirements of early-stage companies, since there are specific considerations and opportunities (like the R&D Tax Credit) for startups.

Tips for Companies Getting Their Tax Returns Done

Here are some tips for companies trying to prepare their federal tax return:

- Review Financials: Ensure that all financial records are accurate and up-to-date. Try to answer any open questions and clean up any uncategorized expenses.

- Know Your Tax Deadlines: Check with your tax preparer regarding which filings they will handle and when they should be submitted.

- Update Business Information: If your business moved, changed its name or fiscal year, ensure your tax preparer is aware.

- Consider R&D Tax Credits: If you’re investing in research and development, you could qualify for R&D tax credits. These need to be estimated and supported with proper documentation.

- Prepare Foreign Subsidiaries’ Financials: If you’ve foreign subsidiaries, their financials need to be ready for reporting on your tax return.

- NOLs (Net Operating Losses): If your startup is running at a loss, make sure this is properly accounted so it could be applied as a ‘credit’ in profitable future years. Read our article on NOLs to learn more.

- Explore Other Tax Credits: Depending on the state and industry, you may be eligible for additional tax credits. Consult with a specialist who understands early-stage start-ups to ensure you do not miss any potential savings. Here is our list of the top 20 tax credits for startups in the US.

Remember to work with a trusted tax advisor who specializes in startups to make sure all criteria are met and potential tax incentives aren’t missed.