Understanding IRS Schedule M-1

Schedule M-1 is an important part of IRS Form 1120, the annual tax form that corporations file with the IRS.

Bridge the gap between your accounting records and IRS requirements, simplify your book-to-tax reconciliation with Kruze’s Startup Tax Services.

Schedule M-1 helps explain the differences between a company’s financial records and its taxable income reported to the IRS. This form aligns the net income or loss on the company’s books, calculated according to GAAP, and the taxable income reported on the tax return.

By listing all the items that account for this difference, Schedule M-1 gives the IRS a clear view of how the company arrived at its taxable income. This transparency allows the IRS to verify that the corporation’s taxable income has been calculated accurately and complies with tax regulations.

What Is The Purpose of Schedule M-1

A company’s profit or loss in its accounting records often doesn’t match what it reports on its tax return, mainly because tax laws don’t always follow standard accounting rules. These differences can be temporary—based on timing—or permanent, meaning some items are handled differently for taxes than they are in the books. For example, a company might have income that’s taxable but hasn’t shown up in its financial records yet, or it might record certain expenses in its books that aren’t deductible on this year’s tax return.

This might sound a little ominous - your tax books don’t match your accounting books! But, it’s actually quite normal.

To address these differences, most corporations file Schedule M-1, along with their annual tax return. This form matches up the income reported in the company’s books with what’s reported to the IRS, making it clear where and why the numbers don’t align. While not every corporation is required to file Schedule M-1, many do because it helps explain these adjustments and adds an extra layer of transparency.

Schedule M-1 often highlights key book-to-tax differences such as depreciation methods, bad debt expenses, business meal deductions over 50%, and specific benefit plan expenses. Schedule M-1 documents these adjustments, giving the IRS a clear picture of how the company calculated its taxable income. This helps ensure that tax reporting is accurate and compliant.

Who Has To Complete Schedule M-1

With Schedule M-1, a corporation’s asset and receipt levels determine the requirements.

Corporations with total receipts and year-end assets under $250,000 can skip Schedules L, M-1, and M-2 if they’ve checked “Yes” on Schedule K, question 13.

For those with $10 million or more in assets at the end of the year, the rule is to file Schedule M-3 (Form 1120) instead of Schedule M-1. Even if a corporation isn’t required to file Schedule M-3, it still has the option to use it voluntarily, following the instructions provided in Schedule M-3’s guidelines.

Corporations that file Schedule M-3, either by requirement or choice, have two options: they can complete Schedule M-3 fully or fill out only Part I of M-3 and then use Schedule M-1 instead of Parts II and III. If they choose this path, the amount on Schedule M-1, line 1, should match the total on Schedule M-3, Part I, line 11.

Even for smaller corporations, it’s often wise to file Schedule M-1, as it reconciles any differences between book and tax income. This can be especially useful if the corporation’s books reflect a loss but its tax return shows income, or if there are other significant discrepancies.

But keep in mind, do not file Schedules M-1 and M-2 (Form 1120-F) if the corporation’s total assets at the end of the tax year are less than $25,000 (as shown on line 17, column (d) of Schedule L).

Schedule M-1 Instructions

We strongly recommend working with an experienced tax preparer for personalized advice on filling out Schedule M-1, which is just one part of the corporate income tax return, Form 1120. While Form 1120 is due April 15, it can be extended until Oct. 15 by filing Form 7004.

You can also visit our C-Corporation tax deadlines calendar to see the current year deadlines.

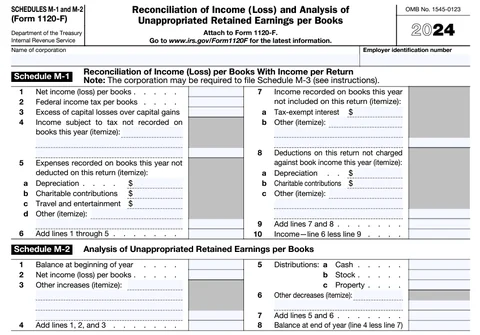

Here are high-level instructions on filling out Schedule M-1.

Schedule M-1 captures differences in items that are recorded for book purposes but not for tax purposes, or vice versa.

- Net income (loss) per books: Report the corporation’s net income or loss as it appears in the financial records (as listed on Schedule L). This is the starting figure for reconciliation.

- Federal income tax per books: Enter the amount of federal income tax expense recorded in the books, which is not deductible for tax purposes.

- Excess of capital losses over capital gains: Record any excess capital losses that surpass capital gains; these are not fully deductible for tax purposes.

- Income subject to tax not recorded on books this year: Itemize any income that is taxable but was not recorded in the financial books for the year, such as income recognized for tax purposes earlier than in book accounting.

-

Expenses recorded on books not deducted on this return: Itemize expenses that were recorded in the books but are not deductible on the tax return. Include the following subcategories:

- Depreciation: List depreciation recorded for books but not allowed for tax purposes.

- Charitable contributions: Enter any charitable contributions that exceed deductible limits.

-

Travel and entertainment: Include nondeductible travel and entertainment expenses, such as:

- Non-deductible entertainment costs under section 274(a).

- Meal expenses exceeding deductible limits under section 274(n).

- Costs associated with entertainment facilities.

- The portion of business gifts over $25.

- Excess expenses on cruise conventions and luxury travel.

- Non-deductible educational travel costs.

- Other: Include any other expenses that were recorded for book purposes but are not tax deductible.

- Add lines 1 through 5: Add the amounts from lines 1 through 5 to calculate the total income adjustments per the books.

-

Income recorded on books this year not included on this return: Itemize income items recorded in the books but exempt from tax, including:

- Tax-exempt interest: Enter any tax-exempt interest, including exempt-interest dividends from mutual funds or regulated investment companies. This should also be reported on Form 1120-F, page 2, item P.

- Other: List any other income items that are not taxable.

-

Deductions on this return not charged against book income this year: Itemize deductions that were claimed on the tax return but not recorded in the books, such as:

- Depreciation: Deduct depreciation allowed for tax that wasn’t included in book records.

- Charitable contributions: Include contributions that are deductible for tax but not recorded in the books.

- Other: Include any additional deductible items not recorded in book income.

- Add lines 7 and 8: Sum lines 7 and 8 to get the total adjustments for tax-exempt and non-booked deductions.

- Income - Income reconciliation: Subtract line 9 from line 6 to arrive at the final taxable income or loss per the tax return. This line ensures the net income per books aligns with the reported taxable income, completing the reconciliation process.

Take full advantage of tax benefits for your startup

If you need help with startup tax planning, including general business credits, Form 1120, and whether you need to file a tax return at all, reach out to Kruze Consulting for help. We are experts at tax credits for startups.