Understanding IRS Form 1120 Schedule k

Schedule K is a key component of IRS Form 1120, the annual tax form corporations file with the IRS.

Schedule K is designed to provide important details about the corporation filing the return. It uses a straightforward “Yes/No” format to collect information, including ownership details and investments in other companies.

The goal is to ensure everything reported matches the company’s official records, helping maintain accuracy and compliance with tax requirements.

Who Has To Complete Form 1120 Schedule K

Schedule K is an important part of the annual tax return for C-Corporations that owe U.S. corporate income tax. This requirement applies to both U.S.-based corporations and foreign corporations doing business in the United States if they meet the filing rules.

Schedule K helps ensure the corporation provides the IRS with clear and accurate information about its activities and obligations.

Form 1120 Schedule K vs K-1

The primary difference between Form 1120 Schedule K and Schedule K-1 lies in who is reporting the information and the type of entity involved:

- Form 1120 Schedule K is filed by a C-Corporation as part of its tax return. This schedule is for reporting the corporation’s financial activities, income, deductions, and tax credits at the corporate level. Schedule K is a summary of these items, primarily for informational purposes and to ensure that the corporation is complying with U.S. tax laws.

- Schedule K-1 is filed for S-Corporations, Partnerships, and Estates/Trusts. Schedule K-1 provides information on each shareholder’s share of the reporting company’s income, deductions, and credits.

While Form 1120 Schedule K reports the tax information for the entire corporation (C-Corps), Schedule K-1 breaks down the tax information for individual shareholders of S-Corps, Partnerships, and Estates/Trusts.

Form 1120 Schedule K Instructions

We strongly recommend working with an experienced tax preparer for personalized advice on filling out Schedule K, which is just one part of the corporate income tax return, Form 1120. While Form 1120 is due April 15, it can be extended until Oct. 15 by filing Form 7004.

You can also visit our C-Corporation tax deadlines calendar to see the current year deadlines.

Here are high-level instructions on filling out Form 1120 Schedule K.

The “Other Information” section of Schedule K provides a variety of important details about the corporation filing the form. While it doesn’t go into extreme detail, it helps the corporation determine if additional forms or schedules might be needed along with their Form 1120.

This section is organized in a clear, line-item format, making it easier to navigate and ensure all necessary information is accounted for.

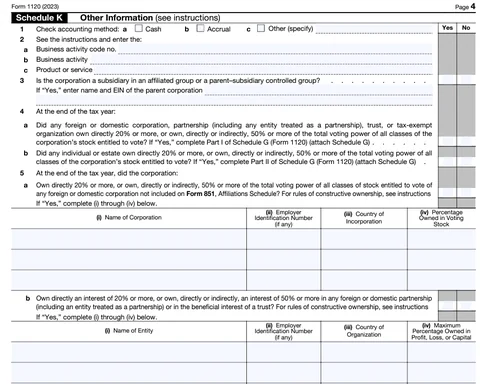

Schedule K: Lines 1-5

Line 1: Select your overall method of accounting as either cash, accrual, or other—if your method has changed since last year, you request the IRS to change it on Form 3115.

Line 2: Enter your business activity, product or service, and business activity code – how the business operates.

Line 3 through Line 5: This portion of Schedule K focuses on the ownership of the corporation – both individuals and other entities.

(More details on Line 3 through Line 5):

Line 3: If the corporation is owned 80% or more by another corporation but chooses to file a separate return instead of being included in a consolidated return, then mark yes and enter the name of the corporation with 80% or more ownership.

Line 4: This line asks if anyone owns 20% or more of the corporation. If so, attach Form 1120 Schedule G and answer yes to either line 4a or 4b depending on the type of owner:

- Answer yes to Line 4a if the 20% owner is a corporation, partnership, trust, or tax-exempt entity and then attach Schedule G.

- Answer yes to Line 4b if the 20% owner is an individual or estate.

Line 5: Gathers information about any entities for which this corporation owns directly 20% or more, or indirectly through related parties 50% or more.

- Line 5a: Answer yes and provide a list of any corporations owned.

- Line 5b: Answer yes and provide a list of any partnerships owned or trusts with a beneficial interest.

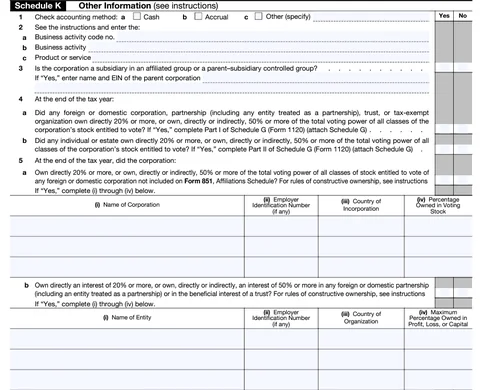

Schedule K: Lines 6-12

Line 6 through Line 9: Generally ask if the reporting corporation has distributions to any shareholders, whether the corporation issued public debt, and any tax-exempt interest received from certain bonds.

(More details on Line 6 through Line 9)

Line 6: Answer yes if you paid shareholder distributions in excess of earnings and profits, which are similar to retained earnings but calculated with some tax adjustments. These excess distributions are generally treated as capital distributions instead of dividend income to the shareholder.

Line 7: If the corporation was owned 25% or more by a foreign person, then answer yes and provide the percentage owned and owner’s country.

Line 8: Check this box if the corporation issued public debt with an original issue discount (OID).

Line 9: Enter any tax-exempt interest that was received. This is usually interest received on municipal bonds. Note that interest received on most federal bonds and treasury notes are not tax-exempt and must be reported as taxable on page 1.

Line 10: Enter the number of shareholders at the end of the year (if less than 100).

Line 11 and Line 12: Ask about any losses being reported by the corporation in the current year, and amounts being carried forward.

(More details on Line 11 and Line 12)

Line 11: If you are reporting a loss for the year, check this box if you want to carry the loss forward to future years rather than carry it back to previous years.

Line 12: If you have a loss being carried forward from prior years, enter the amount here. You should also enter the amount of the NOL being used to offset current-year income on page 1, line 29a.

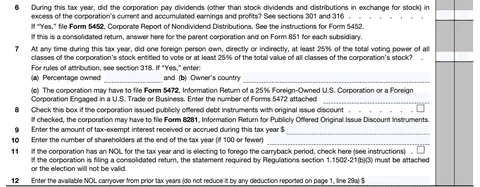

Schedule K: Lines 13-21

Line 13: Answer yes if the corporation had less than $250,000 in gross receipts (page 1, line 1a) and less than $250,000 in total assets at the end of 2023. If yes, then also disclose the number of distributions made on the line provided.

Line 14: Mark yes if you’re claiming an uncertain tax position in this tax return.

Line 15: Answer yes if the corporation made payments during the year that were required to be reported on Form 1099. If you answered yes to line a, be sure to file the form as required and mark yes to line b.

Line 16 through Line 20: Generally ask questions about ownership changes during the year, asset disposals or assets received for stock options. These lines also refer to payments to foreign persons that are part of the US income of the corporation, related parties, and whether the corporation is a CO-OP.

(More details on Line 16 through Line 21)

Line 16: Answer yes if the corporation had an 80% change in ownership during the year.

Line 17: If you disposed of more than 65% of your assets during the year answer yes to line 17.

Line 18: A section 351 transfer is when a corporation receives assets from a new or current shareholder in exchange for issuing that shareholder stock. It is most common when an existing business is transferred into a corporation. Mark yes to this line if you received property worth $1 million or more in exchange for stock.

Line 19: If you made payments to foreign persons that represent US source income to that person, you must file Form 1042 or Form 1042-S and mark yes to this question.

Line 20: If the corporation is being operated as a cooperative, mark yes to line 20.

Line 21: If you made interest payments to related parties during the year, you might be unable to deduct the interest—unless the related party reports the interest as taxable income. If your related party interest is nondeductible, then answer yes and provide the amount in the space provided.

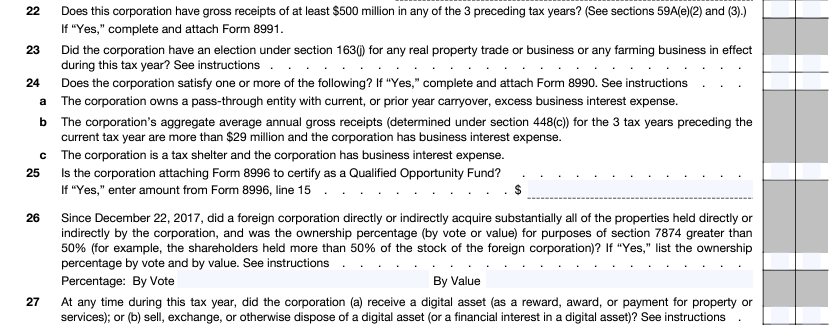

Schedule K: Lines 22-27

Line 22 through Line 26: Ask about the company’s total gross receipts within the prior years, along with moving assets offshore to foreign corporations.

(More details on Line 22 through Line 26)

Line 22: Only mark yes if you have gross receipts of at least $500 million in any of the prior three years.

Line 23: The section 163(j) election is not applicable to corporations with average annual gross receipts of less than $29 million over the prior 3 years, so small businesses can answer no to this question.

Line 24: This line determines if a corporation is subject to the limitation on interest expense. Most small businesses with average annual gross receipts of less than $29 million over the prior three years can answer no to this question.

Line 25: Answer yes if you are applying for certification as a Qualified Opportunity Fund.

Line 26: This line asks if you’ve moved your company’s assets offshore by selling substantially all the assets to a related foreign corporation.

Line 27: If the corporation received or disposed of digital assets—most commonly cryptocurrency—during the year, then mark yes. Paying expenses with digital assets qualifies as disposing of them.

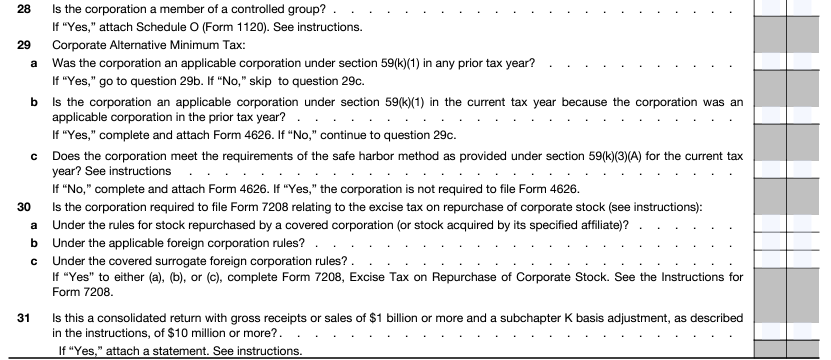

Schedule K: Lines 28-31

Line 28 through Line 31: Ask questions about if the corporation is part of a controlled group and whether the company is publicly traded.

(More details on Line 28 through Line 31)

Line 28: If this corporation is a member of a controlled group, answer yes and complete Schedule O where you’ll need to show how certain tax benefits will be split among members of the group.

Line 29: This line determines if the Corporate Alternative Minimum Tax applies to this corporation; if you’re a small business, then it does not. Answer no to all the questions for line 29 unless you’ve ever had a three-year period with adjusted financial statement income of over $1 billion.

Line 30: Answer no unless you are a publicly traded company and repurchased shares during the year.

Line 31: Answer no if the corporation’s gross receipts for the year are less than $1 billion.

Take full advantage of tax benefits for your startup

If you need help with startup tax planning, including general business credits, Form 1120, and whether you need to file a tax return at all, reach out to Kruze Consulting for help. We are experts at tax credits for startups.