Kruze Consulting’s hardware clients have raised over one billion dollars in VC funding.

Our CPAs and CFOs share our learnings on the best way to do accounting for hardware startups.

When Should a Hardware Startup Start Doing Accounting?

If you haven’t been keeping track of your books by the time you raise money from your first investor, you need to get your books in order.

Venture-backed hardware startups should use accounting software as soon as possible, since it will help create a record of the company’s financial transactions and help communicate with investors where the company’s money is being spent. The right time to do this is when the company is closing its first round of capital.

- Got a bank account for the startup? This is the right moment to start doing bookkeeping.

- Connect your bank account to an accounting software like QuickBooks Online (QBO). Choose a software that suits your early-stage hardware company’s specific needs and can scale with your business. We have an entire article on the best accounting systems for startups.

- As transactions from your bank account flow into your accounting software, make sure to categorize them properly. Hardware startups often have unique expenses, such as tooling and equipment costs that should be capitalized, and inventory expenses that may need to be recognized over multiple months. Consult with an accountant familiar with companies in the hardware space to ensure accurate categorization.

- Consider getting a business credit card that is not tied to your personal credit (look for cards that don’t require a personal guarantee). Link this card directly to your business bank account, so the transactions flow directly into your accounting software. This not only simplifies your personal finances but also ensures cleaner and more accurate books for your startup.

- Keep track of your research and development (R&D) expenses, as these often make up a significant portion of a hardware startup’s costs. Ensure that these expenses are accounted for correctly, including capitalization and amortization when appropriate.

- If your hardware company relies on contract manufacturers or multiple suppliers, make sure your accounting system can handle purchase orders, invoicing, and payment terms to streamline your supply chain management.

By setting up proper accounting practices early on, hardware startups can ensure accurate financial reporting, better decision-making, and smoother operations as the company grows.

Unique Issues with Hardware Accounting - Tips and Tricks

Accounting for hardware startups has several unique aspects compared to accounting for other types of businesses:

- Inventory management: Hardware companies often deal with physical inventory, including raw materials, work-in-progress, and finished goods. Accurate inventory tracking and valuation are crucial for financial reporting and decision-making. And cash flow management requires understanding when to make inventory purchasing decisions.

- Cost of goods sold (COGS): Calculating the cost of goods sold is more complex in hardware businesses, as it involves direct materials, direct labor, and manufacturing overhead costs. Since material costs may vary over time, understanding how to allocate these costs can significantly impact the cost of goods sold.

- Research and development (R&D) expenses: Hardware startups often invest heavily in R&D to develop new products or improve existing ones. (Make sure to take advantage of the R&D tax credit!)

- Tooling and equipment: Hardware companies may require significant investments in tooling and equipment for production. Most of these will be accounted for as assets, and booked to the balance sheet (and then depreciated). Following accrual based accounting rules can be complicated for large equipment purchases.

- Inventory financing: As hardware startups often require substantial working capital to finance inventory, they may need to secure inventory financing or revolving credit facilities. Accounting for these financing arrangements is crucial for managing cash flow and financial obligations, and these lenders will require very specific accounting reports so that they can monitor the health of the business.

- Revenue recognition: Hardware businesses must adhere to revenue recognition principles, ensuring that revenue is recognized when earned and all related costs are matched with the revenue generated. This is particularly important for hardware as a service companies; we have a number of these as clients.

- Supply chain management: Hardware startups often deal with complex supply chains, including multiple suppliers and contract manufacturers. Accounting for these relationships, including purchase orders, invoicing, and payment terms, requires careful management. Since many suppliers will offer discounts for larger purchases, working with a fractional CFO can help founders understand the cash implications of pre purchases and bulk purchases.

- Warranty and returns: Hardware products may be subject to warranties and returns, which require accounting for potential liabilities and establishing appropriate reserves.

Accounting for hardware businesses requires a deep understanding of the unique financial aspects of the industry and the ability to adapt to the changing needs of the growing business.

What Financial Statements do Hardware Startups Need?

Hardware startups should create three essential financial statements: the Income Statement, Cash Flow Statement, and Balance Sheet. In addition to these, they may have other financial and operational metrics that they should monitor to effectively manage the business - and that they may need to report to their board or investors. These include headcount, projected expenses, inventory levels, inventory aging, receivable metrics like DSOs, and progress toward product development and manufacturing milestones.

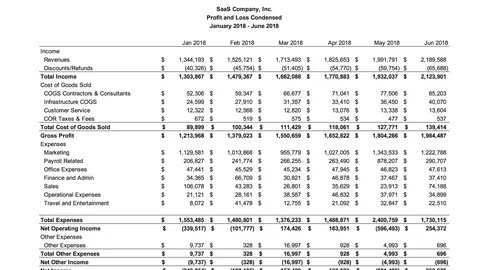

The income statement provides insights into the company’s:

- Revenue (crucial for early-stage hardware companies, especially as they start selling products)

- Cost of Goods Sold (COGS) and Gross Profit (essential for understanding profitability)

- Operating Expenses (often categorized into R&D, sales and marketing, and general and administrative expenses)

- Net Profit

As hardware businesses begin generating revenue and managing production costs, the income statement becomes increasingly important for assessing their financial performance.

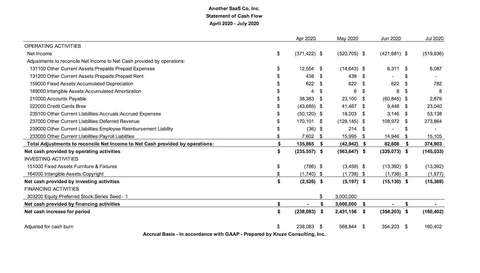

The cash flow statement reveals the startup’s:

- Changes in working capital (such as fluctuations in inventory and payables)

- Operating cash flow

- Investments in tooling and equipment (vital for hardware startups)

- Capital raises and loan repayments

- Net cash flow / change in cash position

Unlike software startups, hardware companies heavily rely on the cash flow statement to monitor their cash position and identify potential cash flow challenges related to inventory management and capital expenditures.

The balance sheet presents:

- Assets

- Cash

- Inventory (raw materials, work-in-progress, and finished goods)

- Tooling and equipment

- Other assets like buildings, labs, etc.

- Liabilities

- Accounts Payable

- Credit Card liabilities

- Loans and inventory financing

- Equity

- Invested equity

- Retained earnings

The balance sheet of a hardware startup often differs from that of a software startup or a traditional business. Hardware companies typically have substantial assets in the form of inventory, tooling, and equipment, as well as unique liabilities related to inventory financing or loans for purchasing production equipment. Precise tracking and reporting of these items on the balance sheet are very important for founders so that they can understand the company’s financial position and make well-informed decisions.

Organizing Your Books

We recommend that founders use a specialized chart of accounts (COA) for their hardware startups. A chart of accounts is a framework that maps expenses, assets, liabilities, and other financial elements into your accounting software. By developing a COA tailored to the unique needs of hardware startups, you can make it easier to deal with the sector’s distinct accounting requirements, such as tracking costs associated with inventory management, tooling and equipment maintenance, and product development.

For example, a well-structured COA for hardware startups might include categories for:

- Inventory costs (raw materials, work-in-progress, and finished goods)

- Tooling and equipment expenses (purchase, maintenance, and depreciation)

- Research and development (R&D) expenses

- Manufacturing and assembly costs

- Shipping and logistics expenses

- Warranty and returns management

While it may not be necessary to implement a fully customized COA from day one, making the commitment to develop a tailored framework as your startup grows will pay dividends in the long run. A hardware-specific COA will help you better understand your company’s financial performance, make informed decisions, and communicate effectively with investors and stakeholders. And, eventually, when your company is audited, you’ll make it easier for the auditors to follow your transactions.

Tactics for Hardware Founders Raising Funding

Since Kruze only works with companies that raise venture funding, we have some specific advice for hardware founders who are raising outside funding. Here are some tips that will help you interact with VCs.

- Make sure you are talking to investors who actually invest in hardware - many VCs only invest in software, so focus on the right ones to save yourself time.

- Look for introductions to those VCs from other founders who they have backed. We suggest cold emailing or contacting them on LinkedIn founders and asking them for advice. If you do a good job, ask if they can introduce you to their investors.

- Your BOM is going to be a big part of due diligence. Since most hardware companies have a much higher build of materials early in their lifecycle, you’ll want to be able to mathematically explain how your BOM will improve over time.

- Be transparent about your startup’s challenges, risks, and weaknesses. Be open to feedback and willing to adapt your strategy based on investor input.

- Follow up and stay engaged with potential investors. Send short updates highlighting your startup’s traction. Ask for tips or advice to build trust.

- Really understand how much capital you’ll need to first release your product. We usually recommend trying to raise 20% more at least, since building a physical product is always difficult.

Kruze is a Leading Accounting Provider to VC-backed Hardware Startups

Through our work with funded hardware startups that have collectively raised over 1 billion in venture funding, we understand that founders need to accurately project their future spending. To help with this, we offer our bookkeeping services at a fixed, recurring monthly rate. This allows our clients to predict their basic accounting costs each month. Experienced startup founders know the importance of forecasting expenses for the coming months, and having set accounting expenses is a crucial step towards effective cash management. Kruze also has a large, in-house tax team dedicated to helping startups take advantage of tax credits, keep on top of sales tax and more.

What to Look For in a Good Hardware Accountant

Your hardware startup’s accounting partner should be well-versed in the unique challenges of working with a business that deals with inventory, manufacturing, and R&D. This includes not only basic bookkeeping but also navigating the complex tax incentives available to hardware businesses.

At Kruze, we combine automated software with experienced controllers and CPAs. Our custom-built, highly automated bookkeeping software integrates seamlessly with QuickBooks Online. This automation helps reduce your monthly accounting expenses while ensuring that your transactions and supporting details are securely stored in the industry-leading accounting software. Our accounting team brings an average of over 11 years of experience to the table.

Want to learn more about our expertise?

The Best Hardware Startup Accountants Know Tax Credits for Hardware Companies

Several tax credits can help unprofitable, R&D-focused hardware startups reduce their burn rate. Work with an accountant who can assist you with both bookkeeping and tax work to maximize your government incentives!

Some of the best tax credits for hardware startups in the research stage include the R&D tax credit (calculate your credit here) and various state credits such as the California Sales Tax Exemption, the Massachusetts Sales Tax Exemption, and some states have manufacturing tax credits - although most of these will not help an unprofitable startup. The most valuable of these, which should apply to most hardware startups conducting research in the USA, is the R&D tax credit.

Crucial Dates for Hardware Startups

-

Review monthly financial statements

-

Close January books

-

Update financial model with January results

-

Hold leadership team meetings

-

Hold all-hands meetings

-

Delaware Annual Franchise Report filing deadline. Your Founder startup will pay a minimum of $400, which increases if you have significant funding.