For startups that are Delaware C-Corps, the federal annual corporate income tax return, Form 1120, can be extended by filing Form 7004 by April 15.

This six-month extension pushes the due date/deadline to October 15, giving founders and their tax professionals crucial additional time to prepare accurate returns.

However, it’s important to note that this extension applies only to filing the return, not to paying any taxes owed. Startups must still estimate and pay their tax liability by the original April 15 deadline to avoid penalties and interest; we strongly encourage you to work with a qualified tax advisor for this!

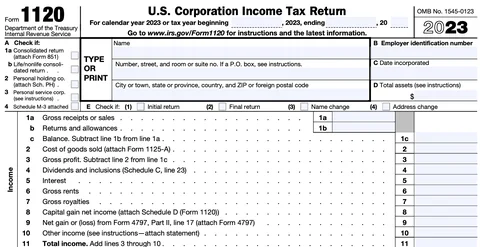

What is Form 1120 and why might you need an extension?

Form 1120 is the standard federal income tax return for C-corporations. It’s used to report income, gains, losses, deductions, credits, and to calculate the tax liability for corporate entities. For many startups, especially those structured as Delaware C-corps, this form is a critical part of their annual tax compliance. Kruze regularly prepares hundreds of Form 1120’s every year, and we recommend filing an extension to the vast, vast majority of our clients.

There are several reasons why a startup might need to file for an extension:

- Founder’s time is better spent working on the business vs. rushing to gather information

- Zero due companies don’t need to rush to calculate income tax due

- Having more time to put together an R&D tax credit report can save the client payroll taxes

- Incomplete financial records

- Pending tax-related decisions

- Complex transactions requiring additional analysis

- Changes in tax laws or regulations

- Staffing or resource constraints

How to file an extension for Form 1120

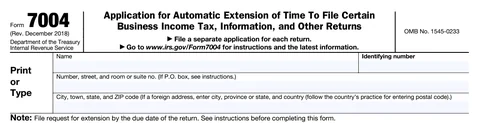

To extend the filing deadline for Form 1120, startups need to file Form 7004, “Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns.” Note that this guidance is focused on Delaware C-Corps, and is not for LLCs or other entity types. And remember to always work with a qualified tax CPA; this stuff is compliance and the IRS can levy fines and penalties if you get it wrong. Here’s a step-by-step extension guide:

- Obtain Form 7004 from the IRS website or through your tax preparation software.

- Fill out the form with your company’s information, including the EIN.

- Estimate your total tax liability for the year.

- Calculate any payment due with the extension.

- File Form 7004 by the original due date of your Form 1120.

It’s crucial to note that Form 7004 must be filed by midnight local time on the normal due date of the return. For Form 1120, this is typically the 15th day of the fourth month after the end of the tax year. An accepted Form 7004 provides a six-month extension of time to file the return.

Filing Form 7004 for an Automatic Extension

For startups structured as Delaware C-Corps, filing Form 7004 is how you’ll get a six-month extension on your Form 1120 filing deadline. This extension, outlined in Part I and Part II of Form 7004, allows you to extend your corporate tax return due date from April 15 to October 15 if you are a calendar-year filer. Remember, other types of entities, including sole proprietors and LLCs, may have different forms and deadlines. We’ve written some notes on these toward the end of this article, but again, we strongly recommend that you work with a tax advisor as every company’s situation is unique.

When completing Form 7004, ensure that all company information, including the EIN and estimated tax liability, is accurately entered to avoid IRS rejection. It’s important to file the extension by the 15th day of the fourth month after the end of your tax year. Remember, this extension only applies to the filing of the return, not the payment of any taxes due. Therefore, timely filing and accurate estimation are essential to avoid penalties and interest.

Key deadlines for Form 1120 extension

Understanding the deadlines associated with Form 1120 and its extension is crucial for timely compliance. Here are the key dates to remember:

- Original Form 1120 due date: 15th day of the fourth month after the end of the tax year

- Form 7004 (extension) due date: Same as the original Form 1120 due date

- Extended Form 1120 due date: Six months after the original due date

For calendar year filers, these dates typically translate to:

- Original Form 1120 due date: April 15

- Form 7004 (extension) due date: April 15

- Extended Form 1120 due date: October 15

Remember, if any of these dates fall on a weekend or federal holiday, the deadline is extended to the next business day. The IRS will also sometimes extend the deadline for filers in areas that have been impacted by natural disasters; you should consult with your tax CPA to make sure you know the correct date for your specific situation.

E-filing your Form 1120 extension

Electronic filing (e-filing) is the preferred method for submitting Form 7004. It’s faster, more secure, and provides immediate confirmation of receipt. Here are some tips for e-filing your extension:

- Use IRS-approved tax preparation software or work with a tax professional who has e-file capabilities.

- Submit your e-filed Form 7004 several hours before the deadline to ensure timely filing.

- Keep the acknowledgement you receive from the IRS as proof of timely filing.

If you encounter any issues with e-filing, such as an IRS rejection, you have a 5-day grace period to correct and resubmit your form while still being considered “timely filed.”

Important considerations for startups filing Form 1120 extensions

While filing for an extension can provide valuable additional time, there are several important factors that startups should keep in mind:

- Extension of time to file, not to pay: An extension gives you more time to file your return, but it does not extend the time to pay any tax due. You must estimate your tax liability and pay any amount due with Form 7004 to avoid penalties and interest.

- State tax extensions: Remember that Form 7004 only extends your federal tax return. You may need to file separate extensions for state corporate tax returns.

- Estimated tax payments: Even with an extension, make sure you’re making quarterly estimated tax payments if required to avoid underpayment penalties.

- C-Corporation tax deadlines: Be aware of other tax deadlines throughout the year, as an extension for Form 1120 doesn’t affect these other obligations.

- Short-period returns: If you’re filing a short-period return (for less than 12 months), different rules may apply. Consult with a tax professional in these cases.

- Extends other schedules: When you extend your tax return, you also get an extension on other IRS documents like the IRS Form Schedule K (not to be confused with K-1s, which C Corps don’t usually have.

Common mistakes to avoid when filing Form 1120 extensions

To ensure a smooth extension process, avoid these common pitfalls:

- Missing the deadline: Remember, Form 7004 must be filed by the original due date of Form 1120.

- Incorrect payment: Underestimating your tax liability can result in penalties and interest.

- Forgetting to file the actual return: An extension gives you more time, but don’t forget to file your complete Form 1120 by the extended deadline.

- Ignoring state requirements: Many states require separate extension filings.

- Not keeping proof of filing: Always retain your IRS acknowledgment as proof of timely filing.

- Not using the time to prepare an R&D tax credit study.

Conclusion: Maximizing the benefits of your Form 1120 extension

Filing for an extension on Form 1120 can provide startups with valuable additional time to ensure accurate and complete tax reporting. However, it’s crucial to understand the process, meet all deadlines, and fulfill all payment obligations to avoid penalties.

For VC-backed startups navigating the complexities of corporate taxation, working with experienced professionals can be invaluable. At Kruze Consulting, we specialize in helping startups manage their tax obligations efficiently and effectively. From timely extensions to comprehensive startup tax planning, we’re here to support your company’s financial health and compliance.

Remember, while extensions can be helpful, the goal should be to build robust financial systems and processes that allow for timely filing without the need for extensions. This approach not only ensures compliance but also provides founders and investors with timely insights into the company’s financial performance.

Sidenote: Other Entity Types

Our CPA firm is focused on C-Corps, so we don’t really work with other entity types. Here is some information on the deadlines and how to file extensions for other entities, such as LLCs or sole proprietorships - however, this information is for information purposes only, and we strongly recommend that you always work with a tax professional who is qualified to file returns for your entity type. Other business entities, such as S corporations, partnerships, and LLCs, have different tax filing deadlines and extension procedures:

- S corporations: File Form 1120-S, due March 15 for calendar year filers. Use Form 7004 for a 6-month extension to September 15.

- Partnerships: File Form 1065, due March 15 for calendar year filers. Use Form 7004 for a 6-month extension to September 15.

- Single-member LLCs: Report on owner’s Form 1040, due April 15. Use Form 4868 for a 6-month extension to October 15.

- Multi-member LLCs: File as partnerships unless electing to be taxed as a corporation.

- Sole proprietorships: Report on owner’s Form 1040, due April 15. Use Form 4868 for extension.

Each entity type has unique requirements, so consulting with a tax professional is advisable to ensure compliance with all applicable deadlines and extension procedures.

Guide To Filling Out Form 1120 Extension (Form 7004)

You can e-file Form 7004, or you can download a PDF that you can fill out, print, and then paper file. We always recommend working with an experienced tax preparer, since filing a Form 1120 Extension is just the first step in startup tax planning, and requires an estimate of how much you will owe in taxes.

Here are high-level instructions on how to fill out Form 7004.

Step 1: Business Details

Enter the name and identifying number (such as your EIN or SSN) exactly as they appeared on your previous tax return. If your name has changed since your last return, use the previous name to avoid mismatches with the IRS database.

Include your full address, including any suite, room, or unit number. For P.O. box users, list the box number instead of the street address. For foreign addresses, list city, province or state, country, and postal code in that order, without abbreviating the country. If your address has changed since your last filing, use Form 8822 (or 8822-B for businesses) to update your IRS records, as any new address entered on Form 7004 will not automatically update their database.

Be sure to enter at least the essential details—name, address, city, state, zip code, and EIN—on screen 1 before submitting.

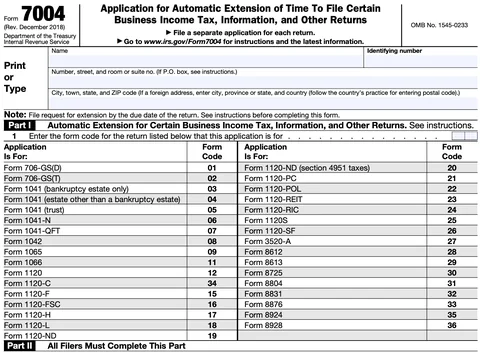

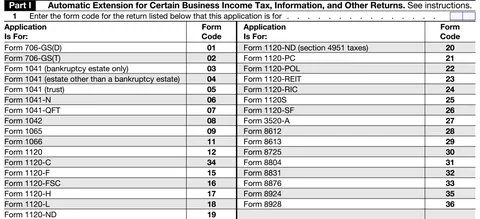

Step 2: Automatic Extension for Certain Business Income Tax, Information, and Other Returns.

In Part I of Form 7004, enter the correct form code, based on the type of return for which they’re requesting an extension.

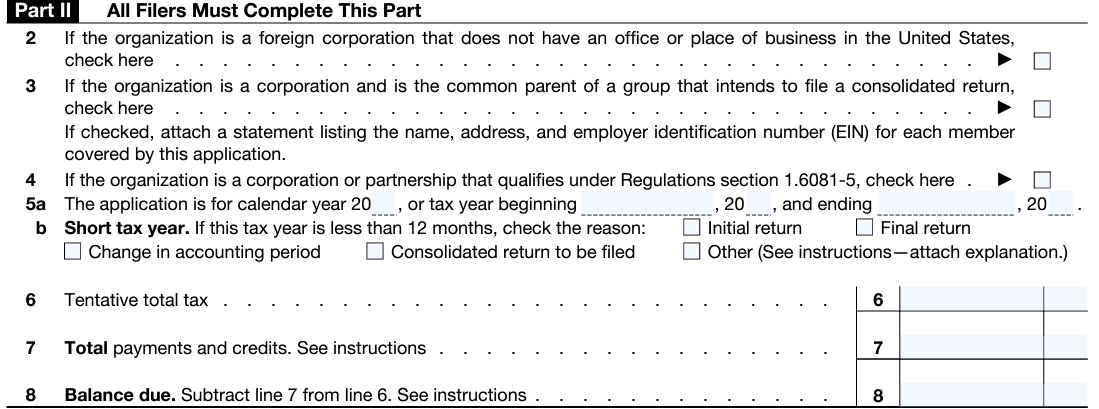

Step 3: All Filers Must Complete This Part

Part II of Form 7004 requires all filers to complete lines 2 through 8, providing basic details like business information, the year for the requested extension, estimated total tax, payments, credits, and any balance due.

Foreign corporations without a U.S. office should check the box on line 2 to extend their filing deadline, while consolidated groups can only request an extension through their common parent or agent, who must also list all group members’ names, addresses, and EINs.

Although group members typically follow the parent’s tax year, any member filing separately for a short period needs to submit their own Form 7004 for that timeframe.

How to get Form 1120 Extension help

If you need help with startup tax planning, including general business credits, Form 1120, and whether you need to file a tax return at all, reach out to Kruze Consulting for help. We are experts at tax credits for startups.

7004

| Application Is For: | Form Code |

|---|---|

| Form 706-GS(D) | 01 |

| Form 706-GS(T) | 02 |

| Form 1041 (bankruptcy estate only) | 03 |

| Form 1041 (estate other than a bankruptcy estate) | 04 |

| Form 1041 (trust) | 05 |

| Form 1041-N | 06 |

| Form 1041-QFT | 07 |

| Form 1042 | 08 |

| Form 1065 | 09 |

| Form 1066 | 11 |

| Form 1120 | 12 |

| Form 1120-C | 34 |

| Form 1120-F | 15 |

| Form 1120-FSC | 16 |

| Form 1120-H | 17 |

| Form 1120-L | 18 |

| Form 1120-ND | 19 |

| Application Is For: | Form Code |

|---|---|

| Form 1120-ND (section 4951 taxes) | 20 |

| Form 1120-PC | 21 |

| Form 1120-POL | 22 |

| Form 1120-REIT | 23 |

| Form 1120-RIC | 24 |

| Form 1120S | 25 |

| Form 1120-SF | 26 |

| Form 3520-A | 27 |

| Form 8612 | 28 |

| Form 8613 | 29 |

| Form 8725 | 30 |

| Form 8804 | 31 |

| Form 8831 | 32 |

| Form 8876 | 33 |

| Form 8924 | 35 |

| Form 8928 | 36 |

Warning: This information is for informational purposes only and should not be used for official tax matters. Use the official Form 1120 Extension and instructions, generally found at: https://www.irs.gov/forms-instructions. Rely on this information at your own risk. Visit https://www.irs.gov/forms-instructions for official IRS information. Consult with a tax professional.