Your startup’s runway is the number of months you can continue to operate before you run out of funding.

Use the lightweight startup runway calculator to estimate your company’s cash runway. Or, use one of our financial model templates (below) to do a more detailed calculation.

What is runway?

Your runway is a VERY important part of your budgeting and planning process. It shows how fast you’re spending your cash, and shows you if you need to adjust your plans. Probably most importantly, your runway lets you know when you need to raise venture capital. Runway is measured in months, so having detail on monthly spend (historical and projected) is helpful in creating an accurate forecast.

How to calculate your startup’s runway

There are several methods of creating a runway projection – we outline several below. The simplest uses recent historical metrics, and divides the company’s current cash position by the recent cash burn rate. A more sophisticated method involved using a financial model to create a financial plan for the startup. The best founders use both – they know how much cash is on hand and understand what will happen if the company maintains its current run rate. They also know what will happen if the company grows revenue, hiring, expenses, etc. according to plan.

Step 1: Calculate your burn rate

The first piece of information you need is your burn rate. That’s the amount of cash your startup spends each month. There are a number of different ways to calculate this metric, including:

- Comparing monthly cash positions. Using your monthly bank account balances, you can estimate how quickly dollars are leaving the business. Don’t forget other cash accounts, like savings accounts, payment processing accounts, etc.

- Using your income statement. One way to determine how much cash you are using monthly is to simply look at the net income each month on your income statement. Remember your income statement will include accruals and capitalization, so that may not show the exact amount of cash you are using every month.

- Using your cash flow statement. Another way to calculate burn is by using your cash flow statement, which indicates the exact amount of money that your startup spends and collects during a specific period.

- Gross burn rate is the total amount of money you spend each money, without considering any income you might earn, and it’s the most conservative way to look at this metric. It helps you estimate how much money you could outflow if revenue stopped.

- Net burn rate factors in any income your startup may generate.

We recommend looking at burn from different perspectives as you conduct your financial planning. Whatever method you use, you’ll need to average your monthly spending over a period of time to get a burn rate. At Kruze, we have clients who use three-month and six-month averages.

Example: You want to calculate a three-month average burn using the cash flow method. From your cash flow statement, you can see you spent $740,000 in January, $820,000 in February, and $910,000 in March. Your burn rate is (740,000+820,000+910,000)/3 = $823,333.

Step 2: Divide your current cash balance by your burn run rate

Once you’ve got your burn, you can calculate the number of months your startup can operate if your expenses and income remain consistent. Just take your current cash balance and divide it by your burn rate to see how many months you have before reaching your zero cash date.

Example: Your startup has a $15,000,000 cash balance. So using the three-month burn rate we calculated in Step 1, we can calculate your runway: 15,000,000/823,333 = 18 months.

Startup financing and runway

Should newly raised funds be included in a startups runway calculation? The answer is yes, but not necessarily in the manner that some founder think. Cash in the bank, even newly raised funds, should influence the numerator of the runway calculation. So if your startup raises an extra $250,000, your cash balance should go up in the runway calculation, therefore increasing the runway calculation.

However, cash from financing should not be included in the numerator of the runway calculation. The numerator, as mentioned above, is the burn rate. This is the company’s operational burn, not including financing, since financing is usually a one off event. If a startup anticipates raising a similar amount of funding every month for the foreseeable future, then it may make sense to include this in the calc, but this is usually not the case for most startups.

Startup runway

Leading into 2024, the average and median runway statistics for startups are at historically healthy levels. The average startup has close to 22 months of runway, while the median startup has almost a full year of runway. The overall metrics are strong, although there are a number of startups with under 6 months of runway. But first, the average and median runway:

Average and median startup runway

There are a number of factors that are contributing to the decline in startup runway. The most significant factor is the difficult fundraising environment. Investors are becoming more demanding of a startup’s progress and metrics before investing, and also want lower valuations. This is making it more difficult for startups to raise the capital they need to grow, as they don’t have the numbers to unlock the next round, or are trying to wait as long as possible to either grow into their previous valuation (to avoid a down round) or on the hopes that economic situation improves and pulls up valuations.

Another factor that is contributing to the decline in startup runway is the rising cost of doing business. Inflation has hit the startup community, and the cost of rent, salaries, and marketing is all on the rise. This is making it more difficult for startups to move towards being more lean, and it is forcing them to burn through their cash reserves more quickly. We are seeing signs that salaries are moderating (we see it starting with founder and CEO salaries).

Let’s dig into the metrics to see how different groups of companies are performing.

Startup runway - distribution of startups by months of runway

It’s obvious that there is a bifurcation in the market, where some startups were able to raise large amounts of capital and still have over two years of burn, whereas there is a growing percentage that have less than 6 months. In 2019, 42% of startups had less than 6 months of runway. This number decreased to 38% in 2020 and 36% in 2021. However, the number increased to 38% in 2022 and 39% in 2023. We see this percentage spiking, as more companies have difficulty raising, and then cut their expenses to stay within the 6 month mark for much longer than 6 months.

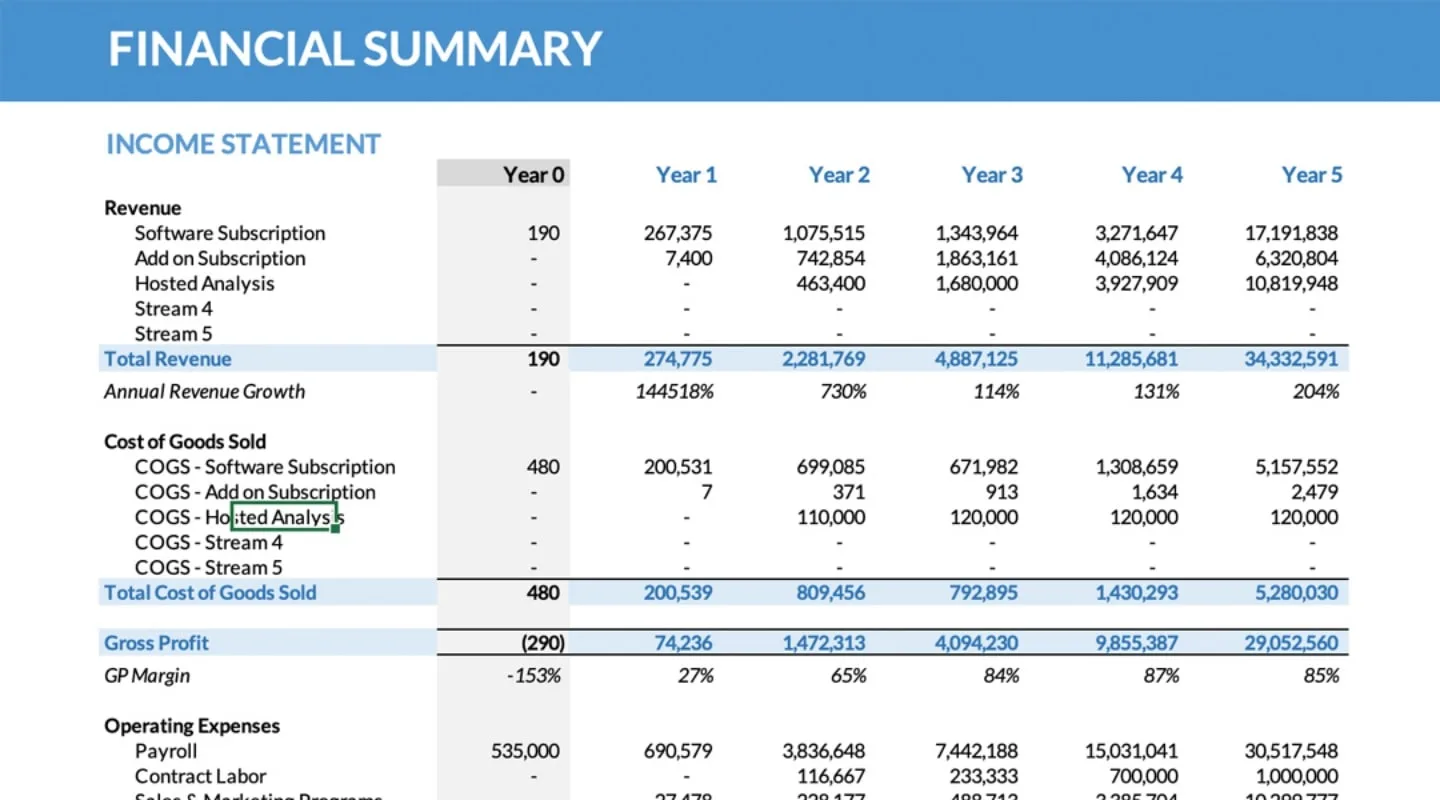

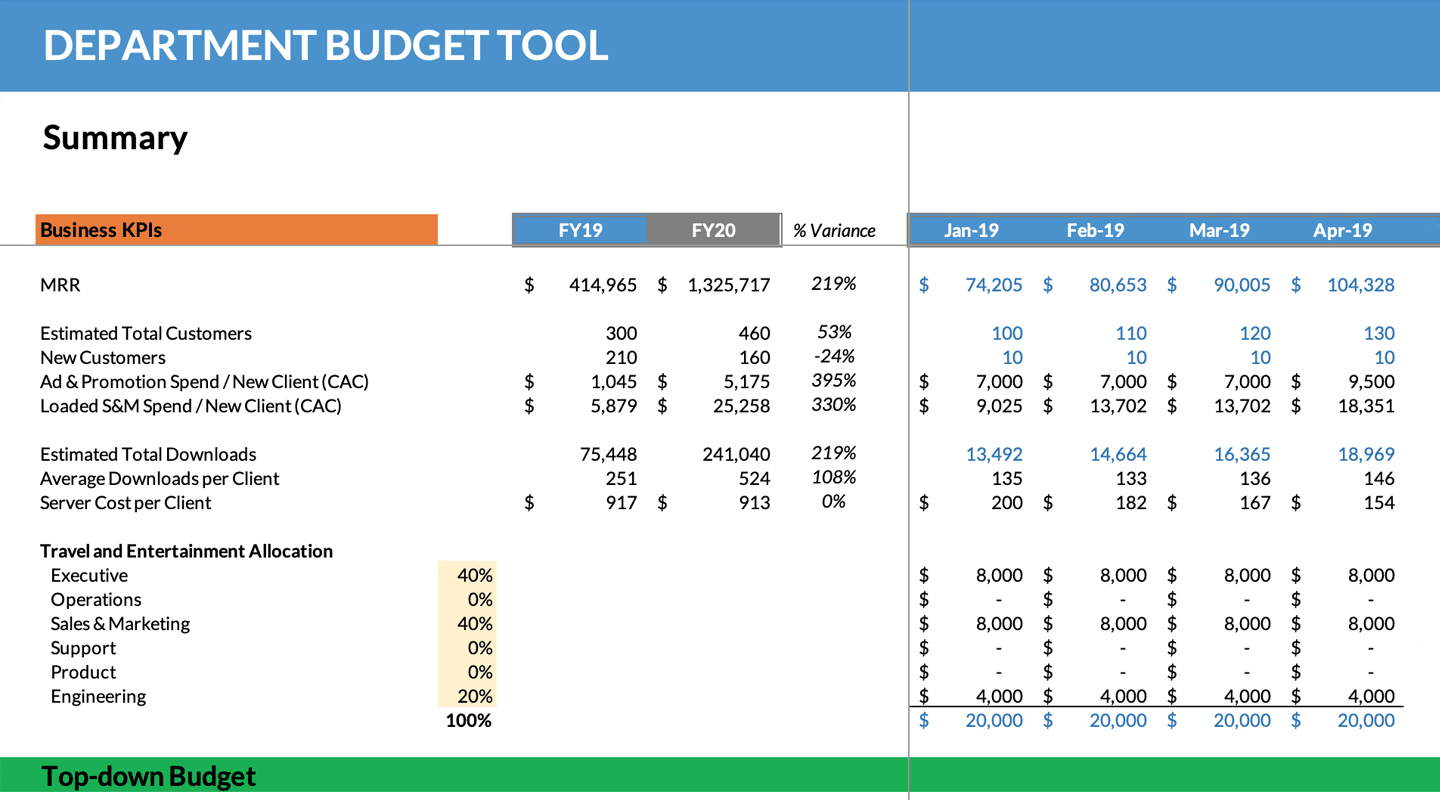

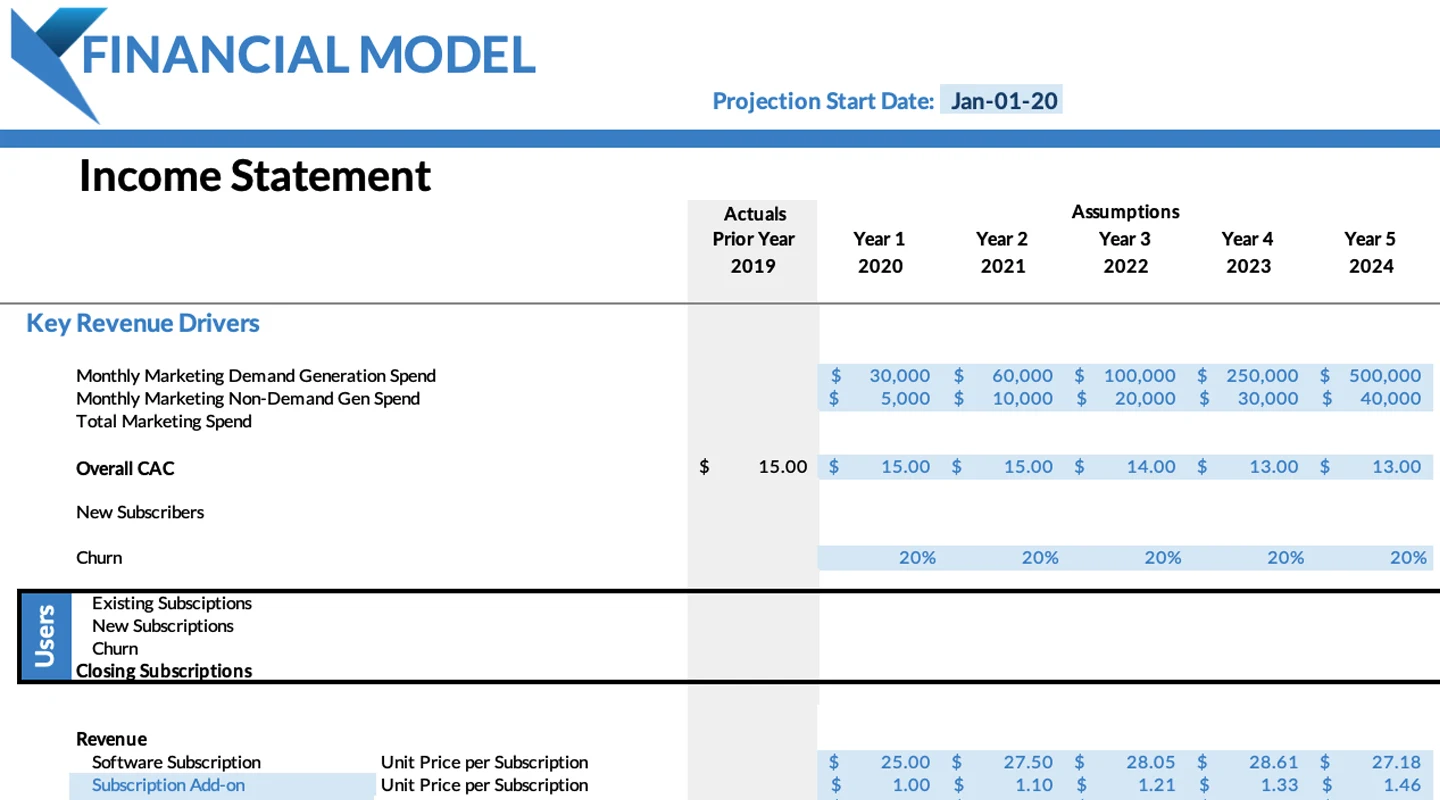

Using a financial model to project runway

The second method that the best founders will use is to have a financial model that projects revenue and expenses (and working capital) for every month. The major advantages of using a detailed monthly financial model to project your cashout date/runway is that it:

- Takes into account projected changes in revenue and revenue growth

- Allows for expense changes such as major marketing expenditures, headcount additions, etc.

- Handles working capital timing

- Allows for expense reductions.

A major advantage of using a budget to project runway is that it allows for you to estimate how your cashout date changes based on expense reductions. Using your historical averages can’t accomplish that, so in a difficult situation where you are doing everything you can to preserve capital and push your cashout date further into the future.

Tips for optimizing your startup runway

For startups, the runway is much more than just a timeline; it’s a lifeline. A longer runway allows startups more time to hit significant milestones, which can lead to a greater likelihood of raising another round, a higher valuation in the next round or even profitability. So how do you ensure that you are maximizing every dollar for the longest runway possible?

- Regularly Re-evaluate Operational Costs: One of the first things startups should consider is trimming the fat. Are there any non-essential expenses that can be eliminated or postponed? These could range from extravagant office spaces to software subscriptions that aren’t being utilized. For many startups, these are recurring software subscriptions that aren’t being used.

- Outsource Instead of Hiring Full-Time: Consider freelancers or agencies for non-core functions. This can extend your startup runway by avoiding long-term financial commitments; it’s easier to cut freelancers or agencies. You’ll have to understand what skills you’ll want to develop inhouse vs. the ones you’ll want to outsource.

- Monitor Your Cash Flow Religiously: Use tools and software to keep a keen eye on your cash inflows and outflows. By actively managing your cash flow, you can predict potential shortfalls and take action before they become problematic. Unexpectedly running out of cash is probably the biggest no-no for a VC-backed founder.

- Get Tax Credits: There are some tax credits for startups, like the R&D tax credit, that can help founders. Most tax credits are designed for profitable companies that are paying income tax, but there are a few that can actually help companies that are burning cash.

- Consider Alternative Funding Sources: Beyond venture capital, consider options like venture debt or crowdfunding.

- Get Customers to Prepay: For non-VC backed startups, customers are the number one source of financing. Why not take a play out of the bootstrapped founders’ playbook and have your customers prepay for your product?

- Offer Services: Offering professional services can be a way to extend runway - although it’s a dangerous plan. Because services can take away from developing a product that drives enterprise value, founders need to be very, very careful about offering services to make sure that they don’t miss out on building a fundable business by building a services one.

- Educate Your Team: Ensure that every member of your team understands the concept of the startup runway. When everyone is aligned with the goal of extending the runway, collective efforts can lead to significant savings.

Your startup runway is a measure of a company’s lifeline. By being proactive, constantly revisiting and reassessing financial strategies, and leveraging the above tips, startups can optimize their runway, giving themselves the best shot at long-term success.

Kruze financial models

Use your startup runway for operational planning

How much runway should you have? The length of the runway your startup needs depends on the stage of your company. Early-stage companies (seed or series A) should plan to have 18 months of runway at a minimum, considering the current fundraising environment. That gives you time to make progress toward your milestones, and can also let you plan for:

- Cash management. If you’ve raised cash you won’t need to spend for several months, you should look at treasury management strategies to earn a better yield on the funds, while keeping them liquid and safe.

- Expense management. Make sure you’ve got a solid expense management system in place to control spending. Controlling spending is the best way to extend your runway.

- Fundraising. When you’ve got 12 months left in your runway, you need to start planning your next fundraise. That gives you time to prepare your pitch and start scheduling meetings. If you’ve got less than six months of runway left, you need to be very close to securing your next funding round or have other options in place.

- Venture debt. Venture debt can help a startup “bridge” to their next funding round, but it’s important to set up a venture debt loan early in your runway, while you still have significant funding available.

Understanding your runway is crucial to your success

The biggest reason startups fail is running out of funding, which underscored the importance of knowing exactly how much money you have and where you are on your runway. If you’ve got questions about how to calculate your runway, please contact us.